HomeStreet Bank, a Seattle-based micro-cap lender that focuses on mortgages and commercial real estate loans, is exploring a potential sale. The company has a market capitalization that is around the $180 million mark and is a highly volatile stock making it interesting for traders. The fact that the news related to the exploration of sale was out on Bloomberg a couple of days back means it is now well past the rumor stage and we can expect M&A-focused traders and investors analyzing the company looking for a quick buck to be made in the event that a sale goes through, especially amidst the consolidation in the U.S. banking industry. Let us have a closer look at the company and its recent financial results .

HomeStreet Inc – Company Overview

HomeStreet, Inc was established in 1921 as Continental Mortgage and Loan Company and is headquartered in Seattle, Washington. The company, acting as the holding institution for HomeStreet Bank, has built a comprehensive and diversified portfolio. Primarily serving the Western United States, it has a suite of offerings spans commercial, mortgage, and consumer/retail banking services. With a product range that includes basic checking and savings accounts, interest-bearing and money market accounts, credit cards, insurance, and a vast array of loan portfolios such as commercial real estate loans, multifamily, construction land development loans, owner-occupied real estate loans, commercial business loans, and home equity loans, HomeStreet stands as a multifaceted financial institution.

Recent Q2 Earnings Highlights: Can HomeStreet Combat Unfavorable Interest Rates?

HomeStreet's Q2 earnings report illuminates the company's agility in navigating an adverse interest rate environment, a common challenge in the banking sector. With core earnings reported at $3.2 million, HomeStreet has focused on optimized operational expenses, including trimming non-essential expenditures and adopting a cautious loan origination strategy. By reducing new loan originations and shrinking their loan and securities portfolios, the company managed to offset contracted net interest margins. A two-pronged approach, involving bolstering the deposit base with promotional products and reducing uninsured deposits to 7% of total deposits, has helped maintain stability. Strategic shifts, including funding through the Federal Home Loan Bank and Federal Reserve Bank Term funding program, and expansion into Southern California, further illustrate the company's proactive approach to balance earnings and growth.

However, all of these are future promises. HomeStreet's Q2 financial results uncover some unsettling trends, including an unprecedented spike in short-term interest rates, leading to a decrease in net interest margin to 1.93%. Other challenges include deposit outflows driven by a competitive rate environment, cyclicality of banking operations, and a negative balance of $101 million in the accumulated and other comprehensive income as of June 30, 2023. These factors combine to paint a gloomy picture of HomeStreet's financial health, adding complexity to its investment profile.

Why Is HomeStreet Exploring A Sale? A History of Pressure and Weak Industry Trends

HomeStreet's exploration of a sale joins a broader trend in the industry, where regional lenders are considering mergers and acquisitions in response to low interest rates and rising costs, as evidenced by recent deals like Webster Financial Corp's acquisition of Sterling Bancorp and the BancorpSouth Bank and Cadence Bancorporation merger. Another important fact is that HomeStreet Bank has been under pressure from activist investors in recent years to improve its performance and governance. In 2019, the bank reached a settlement with Blue Lion Capital, which had criticized its strategy and urged it to consider selling itself. As part of the deal, HomeStreet Bank added two new directors and agreed to sell its home loan centers to Homebridge Financial Services Inc. In 2019, the bank faced another proxy fight from Roaring Blue Lion Capital Management LP, which sought to replace two board members and lower the threshold for shareholders to call special meetings. HomeStreet Bank won the vote at its annual meeting. Today, the big question is whether the bank can find a buyer willing to provide any kind of premium over its current market price.

Final thoughts: Is HomeStreet An Investment Trap For M&A Traders?

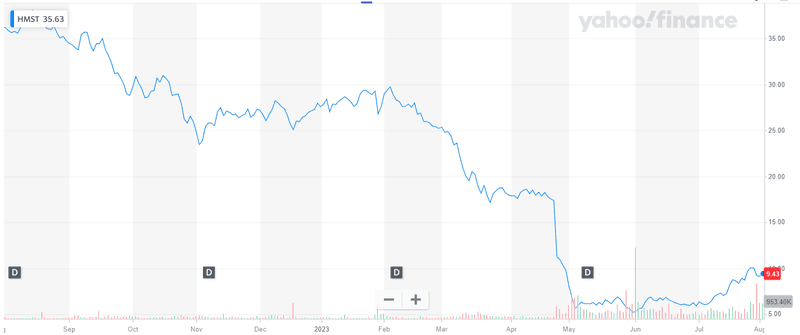

A glaring issue looms in the form of HomeStreet's declining stock price which makes one wonder if the whole news of exploring a sale is simply about getting market participants interested in the stock. Since peaking at $53.44 in January 2022, HomeStreet's stock price has witnessed a freefall, losing a staggering 84% over six months and almost 94% of its value over the past year. The bank has a price-to-book ratio of 0.16 which is low and indicative of the low confidence of the market in its asset quality. While this low price-to-book ratio paints HomeStreet as a ripe target for acquisition, whether by larger competitors or private equity firms, we believe that it could be a highly risky proposition for traders/ investors as we are unaware of what skeletons lie in their books.