Immersion And Google, Take Two – Immersion Corporation (NASDAQ:IMMR)

[ad_1]

Background

On January third, Immersion Corporation (IMMR) announced a multi-yr settlement with Google aimed “at exploring alternatives to collaborate on incorporating haptics in Google’s (GOOG) subsequent-technology {hardware} merchandise”.

This first a part of the press launch appears to trace, probably, at future developments within the mobility and Virtual Reality [VR] house, an space the place Immersion has developed various key, foundational haptic patents.

However, over the quick time period, the second a part of IMMR press launch could also be of extra curiosity for buyers.

This settlement additionally gives Google with a license to Immersion’s patent portfolio for Google’s current Pixel line of telephones and “other Google hardware”.

Let’s dig a bit deeper into what this (renewed) settlement could imply for Immersion’s buyers.

Motorola’s 2012 settlement for primary haptics opened the door to Immersion’s first settlement with Google.

In November 2012, because of its patent infringement lawsuit introduced towards Motorola, owned by Google at the moment, Immersion Corporation announced a settlement and license settlement with Google, resolving “certain issues with respect to Google-branded smartphones containing Basic Haptics”.

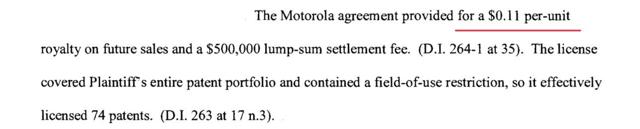

Diving deeper into court docket paperwork associated to Immersion’s lawsuit towards HTC, we learn that the 2012 settlement supplied for a ‘per unit’ royalty price of $0.11 for every Motorola gadget offered and incorporating IMMR primary haptics:

Edited for readability, emphasis added. Source at this link.

We could fairly assume {that a} related royalty price was agreed for Google’s personal gadgets, clearly based mostly on the identical Android’s working system utilized by Motorola, though the press launch doesn’t come very clear on the matter.

Limited revenues from Google’s current Pixel line of telephones and “other hardware”, however a robust validation of Immersion’s I.P.

In spite of being the developer of the Android working system [OS], utilized by most smartphone and tablets OEMs, Google has by no means represented a reputable {hardware} producer.

According to BGR.com, estimated gross sales of Google’s personal Pixar telephones have been hardly noticeable throughout the largest Android market:

We know that Google has by no means managed to promote very many Pixel telephones in comparison with the competitors, and the Pixel 3 isn’t possible to assist.

Google will need to have offered nicely over 2 million Pixel and Pixel 2 items mixed.

Even optimistically assuming that Google can obtain gross sales of 3 to 5 million Pixel 3 gadgets per yr, and an $0.11 per-unit royalty price paid to Immersion, this settlement appears so as to add a comparatively restricted quantity of revenues to IMMR, within the quick time period.

The key take-away from the press launch, nevertheless, appears to be concerning the validation of Immersion’s I.P. and patent portfolio within the Android and VR markets by a key participant like Google.

If Google, the developer of the Android OS, feels the necessity to license Immersion’s patents for its personal gadgets, we will fairly assume that different Android OEMs will really feel further strain to come back to an settlement with IMMR in addition to we will presume that Immersion’s administration will attempt to use this argument to leverage its place in court docket.

Negotiations with Samsung nonetheless ongoing.

While we assume that this renewed Google settlement will deliver comparatively little revenues to Immersion, at the least within the quick time period, we see an attention-grabbing timing on this press launch.

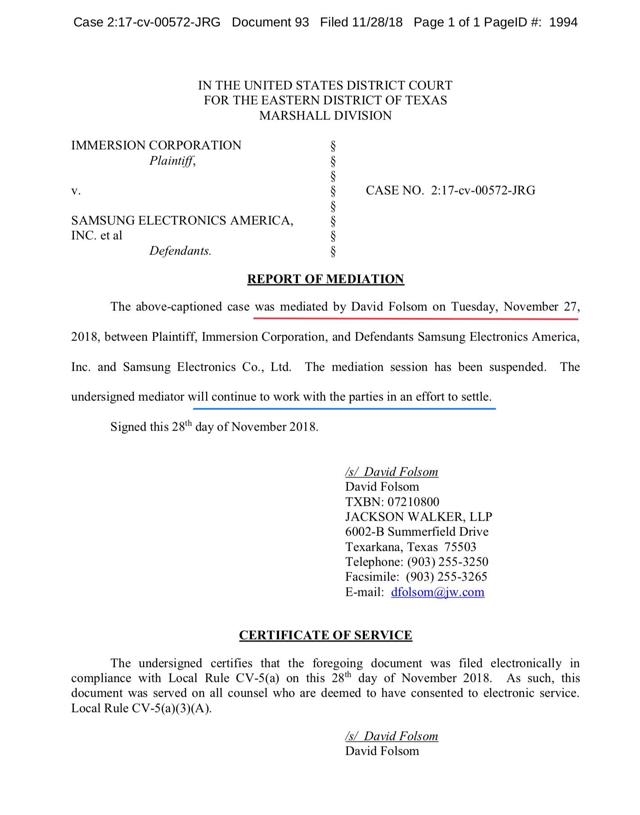

On November 27th, Immersion and Samsung failed to achieve an settlement that might have ended the continuing lawsuit within the Eastern district of Texas court docket.

The mediator, nonetheless, will proceed to work with the events in an effort to settle the dispute:

Emphasis added. Source at this link.

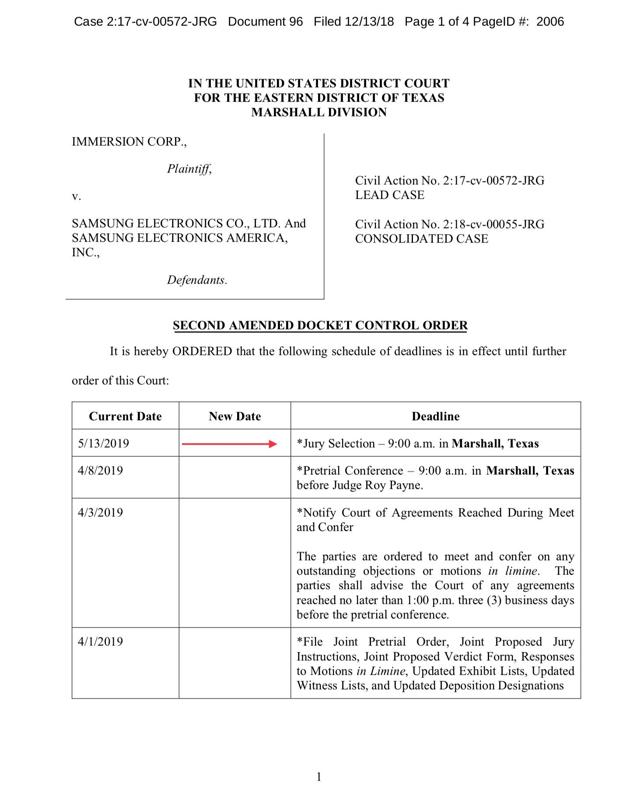

If the 2 firms is not going to attain an settlement, the jury choice for the trial is scheduled for May 2019:

Emphasis added. Source at this link.

We nonetheless see an out-of-court docket settlement because the probably consequence of this dispute.

During the Markman hearing, the court docket dominated 3 times out of 4 in favor of Immersion’s declare development, which can be deciphered as constructive for IMMR.

We clearly hope this press launch could add some strength to Immersion’s negotiating place.

Conclusion

A license with a small Android OEM wouldn’t even deserve a press launch from Immersion – there is no such thing as a doubt that it might be immaterial to its revenues.

A license with Google, the developer of probably the most used OS, Android, is actually price extra attention than its comparatively small quick time period monetary impression may recommend.

The timing of the press launch, a couple of months away from a key court docket deadline, nonetheless with the likelihood to come back to a mediation, can also be attention-grabbing.

As a reminder, Samsung was beforehand paying a set payment within the $20 million per yr vary to Immersion.

A constructive settlement with Samsung will definitely push IMMR shares increased, in related strategy to what occurred after the Sony or Apple agreements – buyers with urge for food for danger each for the end result and the timing of this potential occasion can also contemplate shopping for put choices.

Over the long run, the press launch can also be interpreted as a constructive signal for IMMR efforts within the VR market, whose dimension remains to be too quickly to be estimated.

Disclosure: I’m/we’re lengthy IMMR. I wrote this text myself, and it expresses my very own opinions. I’m not receiving compensation for it (apart from from Seeking Alpha). I’ve no enterprise relationship with any firm whose stock is talked about on this article.

Additional disclosure: Long February name choices

[ad_2]