Intuit: Unlocking Growth Opportunity Through Xero Acquisition – Intuit Inc. (NASDAQ:INTU)

[ad_1]

Thesis

Through their flagship merchandise resembling TurboTax and QuickBooks, Intuit (INTU) has been the dominant accounting and tax preparation software program suppliers in United States. Xero (OTCMKTS: XROLF), alternatively, started out in New Zealand and Australia as a small enterprise accounting software program supplier in 2008 and expanded into United States in 2011.

We see Intuit as a progress stock. However, as the corporate expects to develop slower within the subsequent 12 months, getting into the rising market may present an affordable option to unlock progress alternative. This is why we consider that Xero can be a strategic takeover goal for Intuit. The potential acquisition will permit Intuit to develop into quick-rising Asia Pacific market, the place Xero is a way more dominant participant. Intuit has grown 12.49% whereas Xero 46.58% YoY on common within the final 3 years. We consider that accounting and tax preparation software program market faces a number of boundaries to entries that may make it troublesome for abroad gamers to enter. For occasion, a excessive diploma of tailoring to a selected accounting or tax software program is required to account for variations in languages and reporting requirements. On that foundation alone, the acquisition supplies essentially the most strategic path to develop into a brand new market and exponential progress.

Asia Pacific market outlook and drivers

Cloud tax preparation and accounting software program adoptions have elevated considerably in rising areas resembling Southeast Asia and a few elements of East Asia.

Some quick-rising areas in Asia Pacific like Southeast Asia have been identified to be very numerous by way of financial improvement and regulatory insurance policies. However, we have seen that the member nations within the area have gotten extra built-in in recent times. Barriers for commerce offers and labor actions amongst its members have considerably lowered. In addition, we have noticed that the much less developed member nations have efficiently revamped their fiscal and different nationwide safety insurance policies to stage the taking part in area. Regulations have gotten considerably stricter, as an illustration, with regards to tax reporting and collections. This more and more stricter insurance policies and extra mature financial developments will drive the adoption for cloud tax preparation and accounting software program.

Based in New Zealand and Australia, Xero is the biggest participant within the area with the closest proximity to the remainder of the quick-rising nations in Asia Pacific. We consider that the areas will reward the early trailblazers. In Southeast Asia, we have seen non-public fairness and main enterprise capital companies like Warburg Pincus and Sequoia Capital main $28.5 million progress stage investments in a tax preparation software company in the region. The firm has reportedly processed over $8 billion of tax returns thus far.

Moving the needle

Much of Intuit’s Q1 2018 – Q1 2019 YoY 12% income progress has been pushed by their Small Business & Self-Employed phase. This phase contributes $908 million of general $1 billion income as of Q1 FY 2019. Some product traces within the phase embody QuickBooks monetary and enterprise administration software program, payroll options, and service provider cost processing options.

92% of Intuit’s general income can also be made up of Small Business & Self-Employed and Consumer segments, each pushed by their Quickbooks and TurboTax merchandise. In their monetary experiences, Intuit solely experiences segments that make-up of at the very least 8% of complete internet income.

Source: Intuit 10-K Filing Aug 31 2018.

International phase, which makes up 5% of the entire internet income, shouldn’t be included. That is the place Intuit has a whole lot of room to develop. Intuit’s Quickbooks on-line product has about 3.4 million subscribers as of at present, or up 43% YoY. But, Xero acquisition would permit Intuit to extend their variety of subscribers by 47% to 5 million and to develop to Asia Pacific market.

Source: Xero presentation slideshow as of August 2018.

Xero has had a really sturdy Q3 efficiency. Besides having grown their variety of subscribers by greater than 30% within the final twelve months, we additionally see that their money circulate era has improved considerably within the final three years.

Valuation

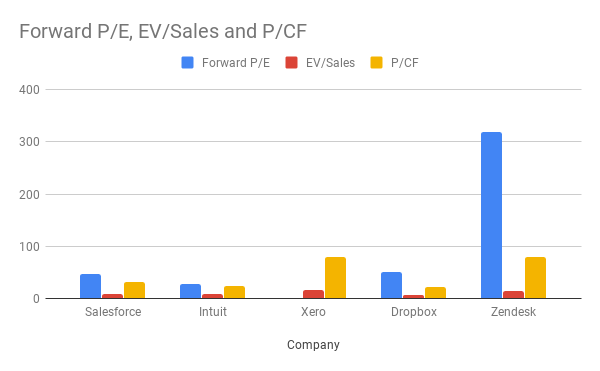

By wanting on the different comparable firms within the cloud software program market, we predict that Xero is pretty valued.

Source: Author. Comparison of relative valuation metrics for Intuit and Xero.

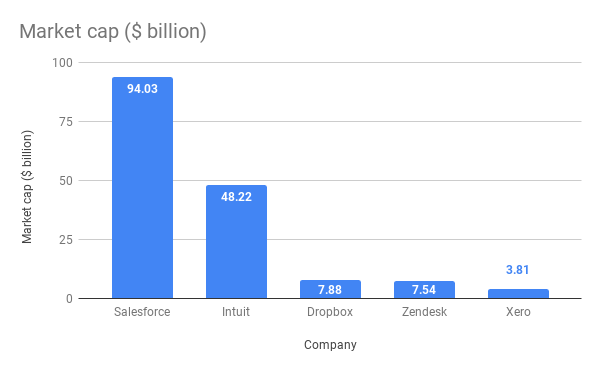

One factor we observed is the similarity between the market valuation for Xero and Zendesk (ZEN), regardless of their apparent distinction in sizes. With $7.5 billion market cap, Zendesk is about twice the scale of Xero. However, Zendesk can also be at an identical stage of progress and earnings to Xero. As it stands, Xero nonetheless has damaging earnings as a consequence of its excessive progress price. Zendesk, alternatively, additionally hasn’t had optimistic earnings till the current quarter as a result of similar motive.

Source: Author. Market cap comparability of all Intuit and Xero comparable firms.

CRM merchandise like Zendesk and Salesforce (CRM) would have a better time to develop throughout geographic with no need a excessive diploma of localization or tailoring on its software program. As we have talked about, this may not be the case for accounting and tax software program suppliers like Intuit and Xero.

This turns into clear once we take a look at the ahead P/E ratio and dimension of Salesforce vs Intuit. Looking on the ahead P/E ratios for each firms, we see that traders have the next expectation of Salesforce rising sooner than Intuit regardless of their dimension. However, the actual alternative lies in the truth that accounting and tax software program has the next switching value than CRM merchandise. With a market worth of $3.81 billion, we predict that Intuit can simply finance the acquisition by debt issuance and money. Servicing the debt will not be a giant problem. Xero has lately had a optimistic working money circulate final quarter. In addition, Intuit’s money circulate era has been very sturdy and remained at 10% progress YoY. Last 12 months, Intuit generated $2.1 billion of money circulate from operations.

Conclusion

We assume Intuit can unlock larger progress alternative by getting into a sooner-rising market like Asia Pacific. In stark distinction to different cloud enterprise software program like CRM, an accounting, tax, and HR software program supplier like Intuit faces a sure problem once they attempt to develop their companies abroad. Due to totally different reporting requirements and nation-particular laws, such software program sometimes requires a excessive diploma of localization by way of options and probably pricing with the intention to achieve adoption in sure abroad markets. Being based mostly within the area already, Xero may present that entry for Intuit for $3.8 billion.

Disclosure: I’m/we’re lengthy VGT. I wrote this text myself, and it expresses my very own opinions. I’m not receiving compensation for it (apart from from Seeking Alpha). I’ve no enterprise relationship with any firm whose stock is talked about on this article.

Editor’s Note: This article discusses a number of securities that don’t commerce on a significant U.S. alternate. Please concentrate on the dangers related to these shares.

[ad_2]