Is Amphenol’s $10.5 Billion Commscope Play The Next AI Goldmine—Or A Risky Gamble?

Amphenol (NYSE:APH) has reignited Wall Street chatter by reportedly edging toward a $10.5 billion deal for CommScope’s CCS broadband connectivity and cable unit, marking what could be the company’s largest acquisition ever. Fresh off a stellar Q2 that delivered $5.65 billion in sales (up 57 % YoY) and an industry-leading 25.6 % adjusted operating margin, Amphenol is hunting scale—and fiber-optic heft—to feed surging AI data-center demand. CommScope, burdened by heavy debt, seeks to monetize its biggest division (CCS generated $2.8 billion in 2024 sales) and refocus on core wireless assets. If consummated, this marriage could marry Amphenol’s world-class interconnect and antenna engineering with CCS’s deep expertise in fiber-optic and copper cable systems for residential broadband, cable TV, and enterprise networks. Let us dive deeper and try to analyze exactly what would be the ramifications of the deal.

Enhanced AI & Data-Center Acceleration

Amphenol’s Q2 report highlighted that the IT datacom segment—its largest end market at 36 % of revenues—grew a blistering 133 % YoY, driven by fiber-optic and high-speed interconnect orders tied to artificial-intelligence workloads. By folding in CCS’s $2.8 billion of annual net sales across fiber-optic and copper broadband cables, Amphenol could dramatically increase its addressable market in hyperscale and edge-data centers. CCS brings deep relationships with cloud providers, telecom operators, and cable-MSOs that Amphenol can leverage to upsell its best-in-class fiber connectors, RF components, and specialty cables, capturing more per-rack spend. Moreover, Amphenol’s proven ability to integrate past acquisitions—accelerating margin expansion after buying Carlisle Interconnect Technologies and CommScope’s ANDREW business—suggests a playbook for rapidly combining R&D roadmaps, standardizing fiber-testing platforms, and cross-training engineering teams. This could shrink product development cycles for next-gen optical interconnects, enabling bundled offerings that deliver higher throughput and lower latency for AI clusters. And because Amphenol generated a record $1.417 billion in operating cash flow and $1.122 billion in free cash flow in Q2, the company has firepower to fund targeted capacity expansions—potentially snapping up incremental AI demand that customers had forecast for Q3. In aggregate, the CCS acquisition could turbocharge Amphenol’s penetration into the fastest-growing slice of the data-center market, translating surging fiber-optic cable deployments directly into top-line and margin gains.

Fiber-Optic & Connectivity Portfolio Fusion

CommScope’s CCS division is a market leader in end-to-end broadband connectivity solutions—spanning fiber-optic trunks, drop cables, and copper infrastructures for residential, enterprise, and cable-TV applications. Integrating this offering with Amphenol’s world-class interconnect, antenna, and sensor portfolio provides a unique opportunity to create one of the industry’s broadest connectivity platforms. Amphenol can leverage CCS’s cable-management expertise to develop turnkey fiber harness assemblies that splice Amphenol’s high-speed connectors and ruggedized enclosures, targeting emerging 5G-and-beyond wireline backhaul and smart-infrastructure projects. Unified supply agreements for specialty fiber materials and polymer sheathing could deliver substantial procurement savings, while joint R&D investments can accelerate emerging technologies—such as low-loss ribbon fibers and bend-insensitive cables—for next-generation edge nodes. On the commercial front, Amphenol’s global sales organization can upsell its RF and optical products to CCS’s established customer base, reducing procurement complexity for service providers that traditionally cobbled together components from multiple vendors. Equally, CCS’s distribution channels in residential broadband rollouts pave a path for Amphenol to introduce new connector families and hybrid cable assemblies into the fiber-to-the-home boom. Cross-selling bundled hardware-plus-service packages—leveraging CCS’s network-design and field-installation capabilities—could create sticky, recurring-revenue streams. Together, this integrated fiber-optic and connectivity portfolio may redefine the competitive landscape, enabling Amphenol to capture share in both traditional telecom builds and emerging enterprise-network architectures.

Operational Scale-Up & Supply-Chain Leverage

Amphenol’s record Q2 adjusted operating margin of 25.6 %—up 430 bps YoY—reflects disciplined cost management and strong operating leverage on higher volumes. The CCS acquisition, with its complementary manufacturing footprint and supplier relationships, promises further scale benefits. By consolidating raw-material sourcing—covering fiber-optic preforms, copper conductors, and precision-machined metal housings—Amphenol can negotiate deeper volume discounts and streamline inbound logistics. Centralizing quality-assurance processes and lean-manufacturing methodologies across combined plants will reduce variability and scrap rates, while harmonizing ERP systems can eliminate redundant administrative overhead. The enlarged revenue base (Amphenol’s annualized $22.6 billion run rate plus CCS’s $2.8 billion) allows fixed costs—such as utilities, depreciation, and facility maintenance—to be spread more thinly, potentially lifting incremental EBITDA margins. Working-capital efficiency should improve as well: Amphenol already converted 103 % of net income into free cash flow in Q2 and maintained net leverage of just 0.9× debt/EBITDA. Deploying CCS’s established distribution network and regional inventory hubs can shorten lead times and reduce on-hand stock levels without sacrificing service, preserving liquidity even as combined sales climb. Over time, these operational synergies could underpin sustained margin expansion—provided integration stays on schedule and supply-chain disruptions are contained.

End-Market Diversification & Cross-Sell Expansion

Acquiring CCS broadens Amphenol’s end-market footprint into high-volume residential broadband and cable-MSO segments—areas where Amphenol historically held limited share. This diversification reduces exposure to cyclicality in aerospace, automotive, and industrial end markets (which collectively contributed 38 % of Q2 revenues) by adding a steady stream of broadband infrastructure projects tied to fiber-to-the-home buildouts and DOCSIS 4.0 upgrades. Amphenol’s veteran sales teams can cross-sell high-margin interconnect systems—like hybrid fiber-power assemblies and active RF modules—into CCS’s customer base, capturing upstream value in multi-component network deployments. Simultaneously, CCS’s field-installation and network-design services open new service-contract revenue models, enhancing recurring cash flows beyond hardware sales. Geographic diversification also improves resilience: fiber-broadband spending trends often diverge from OEM and defense budgets, smoothing revenue across macroeconomic cycles. Moreover, integrated solutions that bundle cable, connectors, and on-site support could raise customer switching costs, creating a competitive moat. This end-market expansion, combined with Amphenol’s existing strengths in defense (9 % of Q2 sales), industrial (19 %), automotive (14 %), and mobile devices (6 %), advances the company’s stated goal of a balanced, low-volatility portfolio—potentially boosting investor confidence in its long-term growth narrative.

Final Thoughts

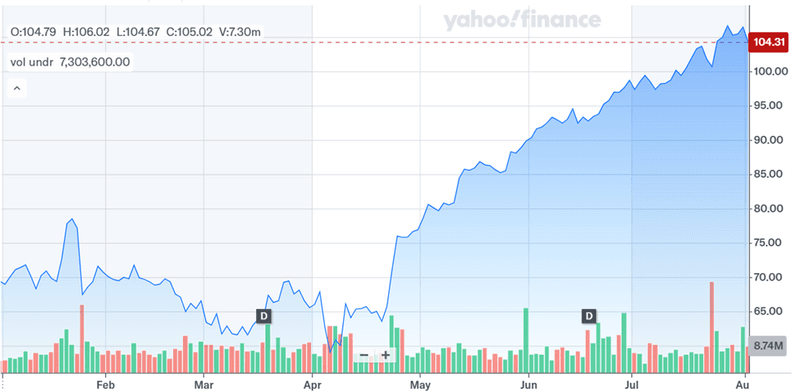

Source: Yahoo Finance

Amphenol’s stock has had a terrific runup in the past 6 months and this acquisition could add to the upside. The slightly worrying aspect is that Amphenol’s valuation already trades at roughly 7.03× LTM EV/Revenue and 25.35× LTM EV/EBITDA—multiples that leave little margin for missteps. While the deal could enhance cash-flow conversion and cement Amphenol’s leadership in broadband infrastructure, execution risk and balance-sheet leverage may temper long-term returns. Ultimately, this strategic move could prove a double-edged sword: unlocking growth in the AI and fiber-optic arenas but demanding disciplined integration to preserve the premium valuation Amphenol commands.