Is It The Rise Of Clinical Stage Pharma Small Caps? Decoding The Harpoon Therapeutics Acquisition By Merck!

In a recent and potentially game-changing development for the pharmaceutical industry, Harpoon Therapeutics (NASDAQ:HARP) has entered the spotlight with Merck (NYSE:MRK) agreeing to acquire the company for a staggering $680 million. Harpoon Therapeutics is a clinical stage small-cap player whose name has been steadily making waves in the realm of cancer immunotherapy, particularly with its T-cell engager (TCE) platform. The transaction, which values Harpoon at approximately $23 per share, is not just a financial milestone; it represents a significant validation of Harpoon's cutting-edge approaches to cancer treatment, especially in the area of CAR T-cell therapy. This is bound to make us wonder if there are many other such hidden gems in small-cap pharma at the clinical stage that could become potential acquisition targets in the future. Let us take a closer look at the Harpoon Therapeutics case study and find out!

Harpoon Therapeutics – Business Overview

Harpoon Therapeutics, Inc. is a California-based company operating in the clinical-stage immunotherapy landscape of the United States. The company is primarily focused on the creation and advancement of a unique class of T cell engagers, leveraging the body's immune system to confront and treat a variety of cancers and other diseases. Its flagship innovation, the tri-specific T cell activating construct (TriTAC), includes notable product candidates like HPN328, which is currently undergoing Phase I/II clinical trials aimed at treating small cell lung cancer and tumors expressing the Delta-like canonical Notch ligand 3. Additionally, Harpoon Therapeutics is developing HPN217, now in Phase I trials, targeting multiple myeloma treatment. Beyond these, the company is also working on a preclinical stage product, HPN601, designed for addressing multiple solid tumor types. Further extending its reach and capabilities, Harpoon has entered into a significant discovery collaboration and license agreement with AbbVie Biotechnology Ltd., focusing on developing and commercializing products that integrate its proprietary TriTAC platform with soluble T cell receptors, marking a significant stride in its journey towards innovative cancer therapies.

Potential For Best-in-Class Efficacy In Treating Neuroendocrine Neoplasms

One of the primary drivers of Harpoon Therapeutics’ acquisition interest is the potential for best-in-class efficacy of their lead product, HPN328, particularly in treating high-grade neuroendocrine neoplasms (NEN), including small cell lung cancer. These tumor types, characterized by high DLL3 expression, are prevalent across major markets and have notably poor prognoses with limited treatment options. Harpoon’s HPN328 has shown promising clinical activity in these areas, offering a new hope for effective treatment where options were previously scarce. The data presented indicates a significant improvement in response rates in both small cell lung cancer and other neuroendocrine tumors, positioning HPN328 as a potential game-changer in oncology treatment and making Harpoon an attractive acquisition target for companies looking to expand their oncology portfolio.

Innovative T Cell Engager Design & Solid Tumor Penetration

Harpoon’s innovative approach to T cell engagers, focusing on both solid and liquid tumors, has been a key factor in attracting acquisition interest. The company’s HPN328 molecule, designed for better solid tumor penetration, demonstrates a balanced combination of small size and albumin binding. This design not only enhances tumor targeting but also minimizes non-specific activation and avoids Fc receptor engagement, broadening the therapeutic window. The emphasis on safety and efficacy, evident in the thoughtful trial design and detailed evaluation of patient responses, underscores Harpoon’s commitment to creating effective and safe cancer therapies. The successful implementation of this innovative approach has likely played a significant role in making Harpoon Therapeutics an attractive acquisition candidate for major pharmaceutical companies like Merck.

Robust Clinical Trial Data & Progress

Harpoon Therapeutics' acquisition interest is further bolstered by the robust clinical trial data and significant progress made in their trials. The interim update on HPN328 presented at ESMO showcases the drug's potential in various tumor types, supported by strong response data in the 1 milligram priming dose cohorts. The trial’s design, emphasizing safety, PK, and PD, alongside early anti-tumor activity, has provided a strong foundation for Harpoon’s strategic plan. The company’s ability to rapidly escalate doses, manage adverse events effectively, and showcase encouraging response rates, especially in neuroendocrine tumors, illustrates the potential of HPN328 in oncology. This progress not only validates Harpoon’s approach but also positions the company as an attractive target for acquisition by firms eager to expand their oncology portfolios with promising new therapies.

Final Thoughts

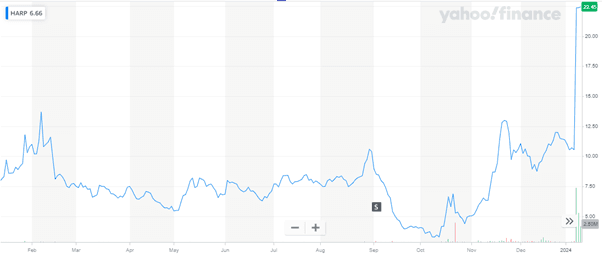

Source: Yahoo Finance

We can clearly see Harpoon Therapeutics' stock price more than doubling after Merck’s announcement to acquire the company. It is worth noting that Harpoon’s remarkable advancements in the development of HPN328 present a compelling case for its acquisition, especially its innovative approach in targeting neuroendocrine neoplasms, including small cell lung cancer, through its novel T cell engagers. The company's strategic focus on solid tumor penetration and robust clinical trial data further strengthens its position as a valuable addition to Merck’s oncology portfolio. Harpoon's progress in oncology research aligns seamlessly with Merck’s mission to lead in this field, potentially bringing transformative treatments to patients with limited options. However, the acquisition carries inherent risks, including the challenges of integrating Harpoon's research into Merck’s broader strategy and the uncertainty of clinical outcomes in later phases of drug development. Despite these risks, we believe that the potential rewards of Harpoon's innovative therapies make it a promising and strategic fit for Merck's expanding oncology pipeline.