Is McKesson Stock A Lifeline in the Tariff Storm? An Analysis Of The Ultimate Defensive Play

As investors scramble to reposition portfolios in the wake of fresh tariffs imposed on imports from Mexico and Canada, one name has quietly emerged as a safe harbor in a stormy market—McKesson Corporation (NYSE:MCK). While broader indices have been rattled by renewed trade tensions and inflationary concerns, McKesson has performed well in 2025, benefitting from a rotation into defensive healthcare stocks. The company's core competency—delivering life-saving drugs across the U.S.—remains largely insulated from tariff shocks due to its highly diversified supply chain and minimal dependence on any single country. In fact, McKesson executives confirmed that the exposure to Mexico and Canada is “immaterial,” shielding the business from the ripple effects seen elsewhere in the market. This makes McKesson not just a healthcare logistics powerhouse but also a resilient choice for investors seeking downside protection in turbulent macroeconomic conditions. With predictable revenue streams and sectoral tailwinds from specialty drugs and GLP-1 therapies, McKesson has emerged as a compelling defensive play.

Highly Diversified Supply Chain Limits Tariff Exposure

McKesson’s defensive attributes begin with its robust and globally diversified supply chain, a feature that has taken center stage in light of the U.S. government’s renewed imposition of tariffs on Mexican and Canadian imports. While many companies are now reeling from supply disruptions or facing increased input costs, McKesson’s leadership confirmed during the TD Cowen Healthcare Conference that there is “no one country” that constitutes a material portion of its supplier base. Over the past several years, the company has proactively diversified sourcing not just for cost optimization but to ensure quality and regulatory compliance. This approach has insulated McKesson from concentrated geopolitical risk and enabled it to maintain a steady flow of pharmaceuticals and medical supplies. For products sourced from countries affected by tariffs, the company has mechanisms in place to pass incremental costs on to customers, which may result in minor patient-level price hikes but protects operating margins. Crucially, McKesson’s dual mandate—to provide the lowest cost and highest availability of supply—has allowed it to thrive in both stable and uncertain times. While the broader logistics and healthcare ecosystem is adjusting to global trade volatility, McKesson’s strategy to decentralize sourcing and prioritize high-availability supply chains places it in a rare category of companies that remain operationally unaffected by macroeconomic trade shifts. This allows McKesson to continue serving its critical role in U.S. healthcare infrastructure with minimal disruption, maintaining investor confidence in a highly defensive model.

Essential Healthcare Demand Offers Recession Immunity

Healthcare is traditionally considered recession-proof, and McKesson is a quintessential example of why. In periods of economic contraction, consumer spending typically slows across discretionary sectors, but demand for medication remains stable or even rises due to demographic and chronic disease trends. McKesson, as the largest pharmaceutical distributor in the U.S., directly benefits from this trend, supplying drugs to retail pharmacies, hospitals, and healthcare providers. Its business model is tied to prescription volume rather than discretionary consumer habits, making its revenue base highly predictable even during downturns. During the current economic uncertainty spurred by trade disruptions and inflationary pressures, McKesson’s consistent revenue growth and operating margin resilience have reinforced its profile as a defensive stock. The company’s broad exposure to essential medications, GLP-1 therapies, and oncology drugs—areas less likely to see demand contraction—adds another layer of protection. Furthermore, its historical performance through multiple economic cycles supports the argument for McKesson’s durability. It has outperformed the S&P 500 and the Health Care Select Sector SPDR ETF over 1-, 5-, 10-, and 20-year periods. Its low beta of 0.6 reflects lower volatility, and even with thin industry-wide profit margins (hovering around 1%), McKesson has built scale advantages that support stable earnings. As long as Americans require life-saving drugs, McKesson’s core business remains largely immune to economic turbulence, supporting its position as a cornerstone of defensive equity allocations.

Specialty Drug Expansion & Platform Building Enhance Margin Stability

Another factor reinforcing McKesson’s recession-resistant profile is its ongoing transition toward high-margin specialty drugs and value-added service platforms. Specialty medications now make up an increasingly large portion of U.S. drug spend, and McKesson has aligned its strategy accordingly. It has expanded its oncology business through long-term investments in drug distribution, GPO services, and clinical trial data infrastructure, including partnerships like Sarah Cannon Research. The company recently acquired PRISM Vision to build a similar specialty platform in retina and ophthalmology, targeting fields with high drug innovation and growing clinical trial potential. These platforms offer not only drug distribution revenues but also higher-margin ancillary services such as practice management, electronic medical record systems, and pharma data monetization. Additionally, McKesson is positioned to benefit from biosimilars, which offer higher margins than branded drugs, particularly in oncology—a space where McKesson already commands distribution dominance. Unlike generics, which face pricing compression, biosimilars offer a structurally more favorable pricing environment, especially when distributed through channels that McKesson controls. In oncology and retina, McKesson isn’t merely moving drugs; it is building infrastructure that integrates clinical research, data services, and supply chain solutions. This strategy helps mitigate the impact of pricing pressure or deflation in traditional generics, giving McKesson durable earnings power even if macroeconomic challenges persist. By continuously enhancing its value proposition beyond distribution, McKesson has structurally improved its margin profile—an important characteristic for a stock positioned as defensive.

Technology-Driven Prior Authorization & Affordability Services Provide Non-Cyclical Growth

Beyond drug distribution, McKesson is also generating high-margin, tech-enabled revenue through its Prescription Technology Solutions (RxTS) segment, which includes services from its CoverMyMeds platform. This business focuses on helping providers and pharmacies manage prior authorizations and affordability programs for patients. In the case of high-demand drug categories like GLP-1 therapies for diabetes and weight loss, McKesson provides automated prior authorization services across over 900,000 providers and 50,000 pharmacies. These services are sticky, difficult to replicate, and generate recurring high-margin revenue independent of broader macroeconomic cycles. McKesson also offers affordability programs such as e-vouchers and discount services, which helped patients save $9 billion last year. This segment represents approximately 50% of RxTS revenue and contributes disproportionately to operating profit due to its technology-driven model. As employers and insurers look to manage rising drug costs, the demand for prior authorization and affordability services is likely to grow—especially in categories like GLP-1s that remain under reimbursement scrutiny. McKesson is also seeing differentiated frequency trends for prior auths depending on whether the drug is for diabetes or weight loss, highlighting its nuanced approach to service customization. These capabilities not only provide counter-cyclical revenue streams but also deepen the company's relationship with both pharma manufacturers and providers. In a market increasingly driven by value-based care and cost containment, McKesson’s embedded technology platforms offer sustainable, non-cyclical growth, reinforcing its profile as a recession-resistant investment.

Final Thoughts

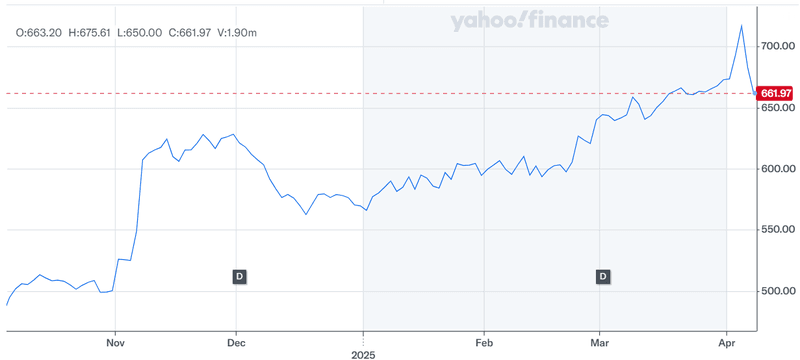

Source: Yahoo Finance

We can clearly see that McKesson has outperformed broader indices in the past couple of months in a market fraught with geopolitical uncertainty, inflation, and new trade tariffs. The company presents a rare combination of operational resilience, essential-service exposure, and forward-looking platform expansion. Its diversified supply chain minimizes the direct impact of tariffs, while the nature of its business—delivering critical medications—insulates it from economic cycles. McKesson’s push into specialty drugs, biosimilars, and tech-enabled services adds margin durability and incremental growth avenues that are less tied to macro conditions. However, it’s important for investors to weigh these positives against potential regulatory risks, sector-wide pricing pressures, and the long-term evolution of healthcare reimbursement models. McKesson’s defensive profile is supported by historical outperformance and stable fundamentals which is why we consider it a solid investment opportunity in the current markets.