Is Now A Good Time To Buy Cisco For Its Dividends? – Cisco Systems, Inc. (NASDAQ:CSCO)

I’ve by no means been bearish on community tools and repair supplier Cisco (CSCO). But since shares hit the mid-to-excessive $40s, I’ve turn out to be much more cautious about shopping for the stock at a excessive teen ahead earnings valuation.

Now, CSCO has pulled again a bit to commerce at a present-12 months P/E of about 14x. Perhaps extra importantly to revenue-looking for buyers, the trailing yield has moved up and breached 3%. Given what appears to me like a extra engaging entry level at present ranges, I ask myself: is now an excellent time to tug the set off on CSCO as a compelling dividend play?

To try to reply this query, I take a look at a couple of components to find out whether or not the dividend is nicely protected by sturdy money era, a strong stability sheet and strong enterprise prospects. I then problem my verdict on whether or not CSCO is a dividend-paying stock price contemplating.

The yield and dividend historical past

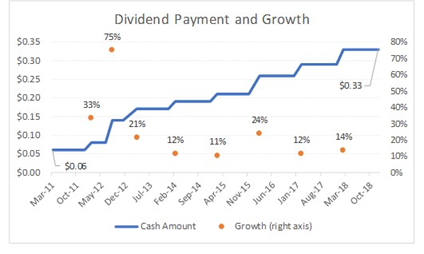

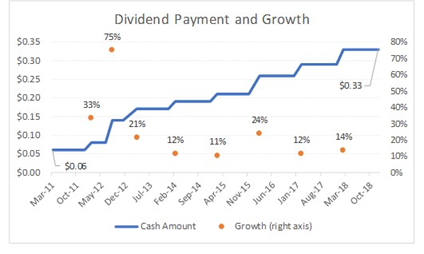

Cisco, maybe the most well liked massive tech identify of the pre-dot com bubble period, has been a dividend payer for less than eight years. The firm, subsequently, is way from reaching dividend aristocrat standing. Yet, Cisco did an excellent job ramping up its dividend funds since then, at a CAGR of 28%, because it transitioned from a development story to the money cow that it has turn out to be. See graph under depicting the dividend development pattern since 2011.

Source: DM Martins Research, utilizing knowledge from firm’s IR page

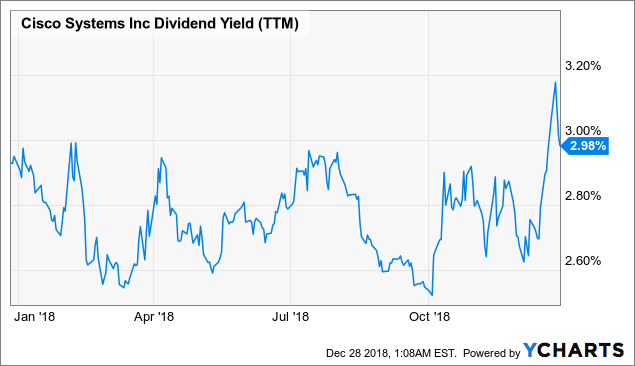

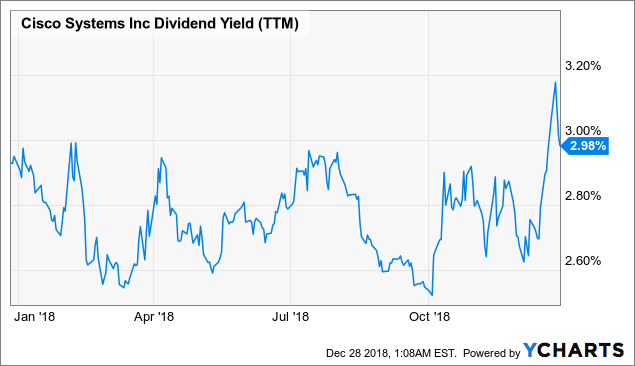

On a trailing foundation, CSCO at the moment yields about 3%, probably the most up to now 12 months (see graph under). Traditionally, Cisco has introduced dividend raises throughout the first calendar quarter of every 12 months, suggesting that the following bump ought to be made public within the subsequent few weeks. Assuming the dividend will increase at the same tempo of 14% that’s in line with the latest pattern (see extra on dividend development issues within the part under), the stock at the moment boasts a projected yield of 3.5% – which, on the floor, I discover extremely engaging.

Dividend protection

The yield alone is nearly by no means sufficient to justify a purchase. More particularly, money movement protection of the dividend funds is an important issue to think about.

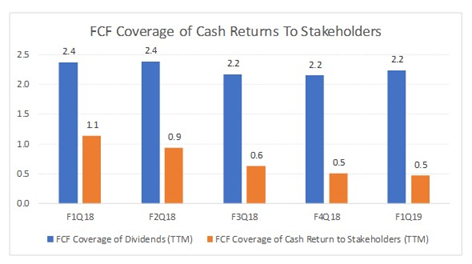

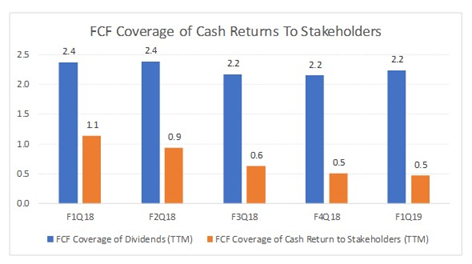

In the case of Cisco, FCF has remained healthy all through at the very least the previous 5 quarters to assist the dividend disbursements to fairness house owners, by no means falling under 2.2x since fiscal 1Q18 on a trailing-twelve month foundation. However, as soon as all money returns to stakeholders are taken under consideration (i.e., dividends, share repurchases and curiosity funds), FCF protection has been dipping at a quick tempo. See graph under and see the clear, unfavourable pattern depicted by the orange bars.

Source: DM Martins Research, utilizing knowledge from firm’s IR page

I imagine, subsequently, that Cisco may quickly have to both cut back on the expansion fee of its dividend funds or offset the money bleed elsewhere, perhaps by revisiting its beneficiant share buyback program. It is necessary to note that, traditionally, the corporate has additionally invested heavily in acquisitions (15 in whole for the reason that start of calendar 2017 alone), and an excellent chunk of money is prone to maintain getting used for this function.

As a end result, I feel {that a} extra conservative strategy to dividend development is likely to be needed within the not-so-distant future to keep away from placing in danger the corporate’s necessary inorganic development momentum.

Balance sheet

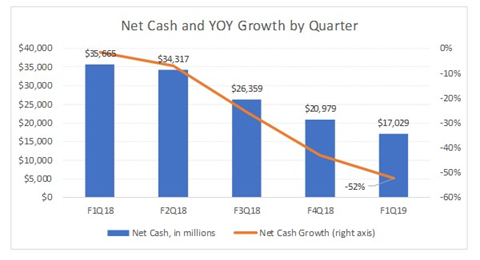

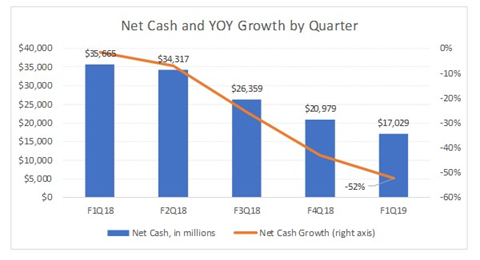

Fortunately for Cisco, the unfavorable money movement protection pattern mentioned above has been much less of a priority as a result of the San Jose-based firm had been sitting on a pile of money. As of fiscal 1Q18, a big web money place of $35.7 billion represented roughly one-fourth of whole belongings. With the 2017 tax reform permitting Cisco to faucet into its international reserves extra affordably, the money stability dropped to lower than half YOY by fiscal 1Q19. See graph under.

Source: DM Martins Research, utilizing knowledge from firm’s IR page

Again, that is one more indication, in my opinion, that Cisco will in the end want to consider tapping the brakes on dividend development, further share repurchases, investments in capital and acquisitions, or a balanced mixture of all of the above. Still, it’s arduous to be too pessimistic about an organization’s capacity to return money to shareholders given a stability sheet that appears as strong because it does at the moment.

Business prospects

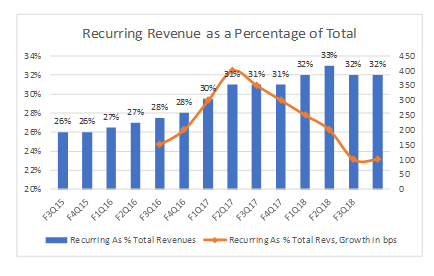

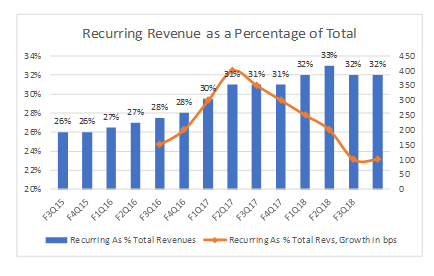

In what pertains to Cisco’s enterprise prospects, I stay cautiously optimistic that the corporate will turn out to be an much more related, ahead-wanting supplier of community options. Key product classes and enterprise segments proceed to develop at a average tempo. I’m significantly bullish on Cisco’s paced, even when sluggish, transition in direction of software program and recurring income stream (on the latter, see graph under).

Source: DM Martins Research, utilizing knowledge from earnings transcripts

Cisco’s fiscal 1Q19, one of the best that I’ve seen lately, additional unveiled encouraging tendencies in gross margins and opex administration. Next 12 months’s EPS is expected to extend by almost 10% YOY (even with none increase from the tax reform), which I discover outstanding for a corporation that had skilled uninspiring top- and backside-line development for fairly numerous quarters, not very way back.

The verdict

CSCO has turn out to be, for my part, a extra engaging proposition for dividend-looking for buyers. The yield has surpassed the 3% mark and, absent a robust stock market rally within the subsequent month and a half, ought to strategy 3.5% by February. Those looking for dividend development, nonetheless, may wish to swap their focus of attention from historic tendencies to money movement protection, which has been deteriorating these days.

Otherwise, the tech firm appears nicely geared up to assist its pretty wealthy dividend coverage. I additionally suppose that, for additional yield increase, this stock is likely to be a first-rate candidate for a purchase-write technique much like the one which I discussed recently, given the corporate’s strong fundamentals that I imagine ought to shield shares from sizable market worth losses.

Note from the creator: I host the Storm-Resistant Growth premium neighborhood on Seeking Alpha, a service wherein I share my threat-diversified strategy to producing market-like returns with decrease threat. In the early a part of 2019, I’ll launch “The 10% Yielder” portfolio as a part of this service. I’ll present and debate different names like CSCO that would present buyers with a hefty and periodic influx of money by means of dividends and name possibility premiums. To turn out to be a member of this neighborhood at 2018 costs and additional discover these funding alternatives, click on this link and benefit from the 14-day free trial at this time.

Disclosure: I/we now have no positions in any shares talked about, however might provoke an extended place in CSCO over the following 72 hours. I wrote this text myself, and it expresses my very own opinions. I’m not receiving compensation for it (apart from from Seeking Alpha). I’ve no enterprise relationship with any firm whose stock is talked about on this article.