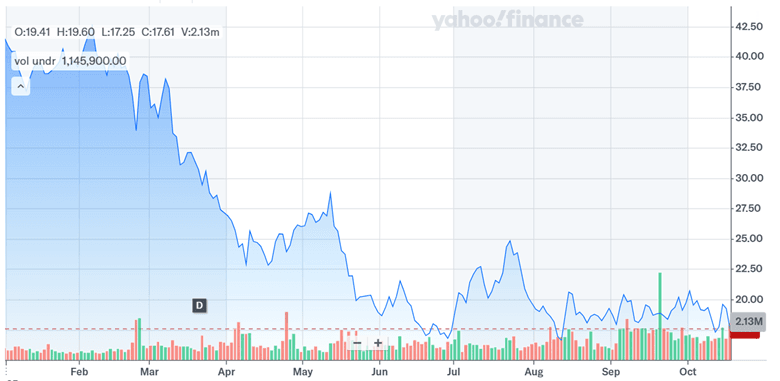

Jack In The Box Stock Tanks After Del Taco Fire Sale – What Investors Need To Know

Jack in the Box (NASDAQ: JACK) stock nosedived nearly 9% following its announcement of the Del Taco divestiture for a deeply discounted $115 million to franchisee Yadav Enterprises—an exit from its $585 million bet made just three years ago. This latest move continues a brutal 2025 for the small-cap fast food chain, which has seen its stock plunge nearly 60% year-to-date, exacerbated by deteriorating margins, weak traffic, and persistent inflationary headwinds. The company’s leadership emphasized that the sale was a strategic decision to “simplify operations” and focus on its core burger business, while the proceeds would be used primarily to pay down debt. Yet, the markdown of over 80% on Del Taco’s original purchase price signals not just poor deal timing, but deeper structural issues facing the company. Amid falling same-store sales, mounting pressure from price-sensitive customers, and a competitive quick-service restaurant (QSR) landscape, the street remains skeptical on the viability of Jack’s turnaround plan. Here are the four key factors driving investor concern.

Fire Sale At The Drive-Thru: Jack & The Box Dumps Del Taco At A Massive Loss

The sale of Del Taco at $115 million marks a staggering 80% markdown from the $585 million paid in 2022—when the QSR sector was bouncing back from the pandemic and consumer demand was rebounding. At that time, Jack in the Box touted the acquisition as a synergistic play, citing scale benefits, digital investments, and shared infrastructure. Fast forward to October 2025, the harsh reality is Del Taco delivered six consecutive quarters of same-store sales declines, with CEO Lance Tucker publicly acknowledging the concept had become a drag on the portfolio. While the chain did make some inroads in new markets like Durham, North Carolina, where it saw strong openings, persistent macroeconomic pressures—including rising input costs, declining low-income consumer spending, and a weakened value proposition—sank its broader performance. The decision to offload Del Taco to Yadav Enterprises, one of its own franchisees, indicates a rushed strategic pivot and limited buyer appetite. Even more telling is the cash-only nature of the transaction, which is set to close in January, suggesting Jack needed liquidity quickly to shore up its balance sheet. The sale also underscores the risk of QSR overexpansion during periods of artificially elevated demand, especially when built on debt-fueled acquisitions. This fire sale not only marks a rare public misstep in capital allocation but also highlights the shrinking optionality for small-cap players struggling to juggle growth with profitability amid tightening financial conditions.

Debt, Declines & Discount Menus: Jack & The Box’s Turnaround Plan Faces Harsh Reality

Jack in the Box is pursuing an aggressive turnaround under its “JACK on Track” initiative, aimed at improving profitability through debt reduction, store closures, and operational restructuring. As of Q3 2025, the company reported $1.7 billion in total debt and a net leverage ratio of 5.7x EBITDA, a level management admits is “well above comfort.” The company’s goal is to deleverage by selling real estate assets worth at least $100 million in the coming fiscal year, cutting dividends, and closing 80–120 underperforming stores—most of which generate negative four-wall EBITDA. The divestiture of Del Taco is part of this broader strategy, but it's only one piece of a fragmented fix. Jack's own same-store sales were down 7.1% in Q3, with traffic falling 6.6% and menu mix contributing an additional 2% decline, partly due to aggressive pricing and promotional fatigue. To address waning traffic, Jack has returned to a barbell menu strategy, reintroducing lower-priced combo meals such as the Bonus Jack and spicy chicken strips, while allocating $5.5 million in incremental Q4 marketing spend. However, these promotional tactics are short-term levers and may not offset structural cost pressures like California wage increases and elevated utility expenses. Moreover, margin erosion remains a concern, with restaurant-level margin declining from 21% to 17.9% year-over-year. The operating model is further strained by a digital transformation push that, while promising, has led to temporary POS downtime and implementation costs. Overall, Jack’s turnaround depends heavily on disciplined execution of multiple levers simultaneously—a high bar given the current environment.

From Combo Meals To Cutbacks: Investors Lose Appetite For Jack & The Box

Investors have become increasingly wary of Jack in the Box’s ability to deliver shareholder value amid a backdrop of declining comps, deteriorating unit economics, and macroeconomic fragility. The company’s franchise-heavy model, once seen as an asset-light growth driver, has become a liability as underperforming units drag down overall performance. Jack’s Q3 restaurant count fell by 15 net locations, including 13 closures directly tied to the JACK on Track plan. Even more concerning is the drop in average unit volume across affected restaurants, which are generating just $1.2 million in annual sales with negative EBITDA margins. At the same time, Jack has halted share buybacks and suspended its dividend to prioritize debt repayment—an ominous signal for income-focused investors. The company’s 2025 adjusted EBITDA guidance of $270–$275 million implies flat to negative earnings growth, despite heightened promotional activity and technology investments. Management’s commentary on the call also revealed unease around their core customer base, particularly among Hispanic and low-income segments, who have materially pulled back on spending. This overexposure has intensified top-line volatility compared to large-cap peers like McDonald’s or Restaurant Brands, which have better geographic and demographic diversification. Meanwhile, investor enthusiasm for small-cap QSR stocks has waned broadly, and JACK’s discounted valuation has not provided support. The stock now trades at just 0.22x LTM price/sales and 11.84x LTM EV/EBITDA, reflecting deteriorating sentiment and heightened risk around execution. Without a clear inflection in comps or margins, the path to multiple expansion remains elusive.

Refocusing For Recovery: Why Jack & The Box’s Del Taco Sale Could Mark A Leaner, Stronger Future

Despite the fire sale optics, the Del Taco divestiture could mark a strategic pivot toward a more focused and operationally disciplined Jack in the Box. CEO Lance Tucker emphasized a renewed commitment to “Jack’s Way,” a company-wide initiative aimed at improving core menu execution, elevating guest experience, and modernizing restaurants. Operationally, this means more stringent accountability at the franchisee level, investments in training, and the return of recognition programs for frontline workers. On the food side, Jack is leaning into nostalgia and brand equity by reviving legacy items and showcasing its 75-year heritage. The company also plans to deploy a multi-year reimaging campaign across 1,000 locations, on top of a prior $50 million reimaging investment that garnered over 1,000 franchisee applications—an encouraging signal of internal buy-in. While these initiatives won’t deliver immediate sales lift, they do lay the groundwork for improved brand consistency and customer retention. On the tech front, Jack is ahead of schedule in its POS rollout and expects to exceed its 20% digital sales mix goal. These efforts, coupled with structural cost actions and deleveraging, suggest the company is trying to position itself as a leaner, more efficient operator. Still, execution risk remains elevated, especially as promotional cadence and commodity costs continue to buffet restaurant-level margins. If Jack can stabilize comps while extracting efficiency gains, the long-term outcome may be a more predictable, albeit smaller, earnings base—a welcome shift for small-cap investors fatigued by volatility.

Final Thoughts

Source: Yahoo Finance

Jack in the Box’s decision to sell Del Taco at a massive markdown highlights the challenges facing small-cap QSR players amid a tough macro environment. The sale provides liquidity and streamlines operations but also underscores past capital allocation missteps. The company’s JACK on Track initiative includes store closures, real estate sales, and value-based menu shifts—all aimed at restoring profitability. However, persistent declines in traffic and margins, coupled with execution complexity, present ongoing risks. On the valuation front, Jack trades at just 0.22x LTM P/S and 11.84x LTM EV/EBITDA—levels that reflect investor skepticism despite improving free cash flow yields and reduced capital returns. Whether the company can reestablish earnings stability and regain investor confidence remains to be seen. Until then, its discounted multiple profile is both a reflection of risk and a potential support level should fundamentals show sustained improvement.