Jeff Miller Positions For 2019: Focus On Earnings, The Economy, And Financials

[ad_1]

Welcome as soon as once more to the Seeking Alpha positioning collection.

Thanks. I all the time take pleasure in it and discover it very helpful. There are many nice contributor concepts, and the feedback are useful as effectively.

You have written that buyers are getting a real-time lesson in economics. What do you imply by that? And is it nonetheless occurring?

Yes, and it supplies a superb funding alternative. The key points for markets are financial — the consequences of tariffs, what causes recessions, and Fed coverage. Most of the punditry has little talent or expertise on these subjects, however they communicate an essential language: Pop Economics. There is a crucial, wrong-headed viewpoint on every of those subjects.

Getting the financial story proper supplies a fantastic alternative for 2019. The alternative comes with the problem of discovering the very best sources and evaluation.

What do you count on to be the important thing driver of stock market efficiency in 2019?

The most essential issue will probably be continued earnings progress within the context of an inexpensive financial system. This yr noticed shares decrease regardless of glorious earnings will increase. The skeptical market reacted by punishing firms with any flaw of their reviews and just about ignoring those who did effectively. The consequence was a compression of PE multiples – a traditional signal of detrimental sentiment.

As we strategy 2019, are you bullish or bearish on U.S. shares.

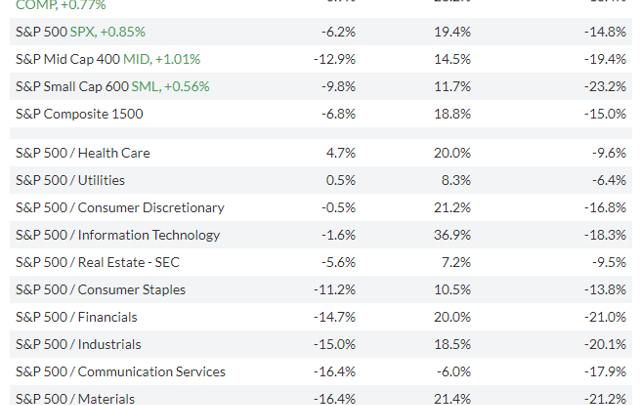

I’m bullish on some and bearish on others. It is dependent upon the stock and sector. Sectors that have been out of favor final yr ought to do very effectively. Those that rose as a result of buyers have been blindly reaching for yield or perceived security could not sustain. This desk from MarketWatch illustrates the distinction. It is just like the previous Dogs of the Dow principle on steroids.

Investors who emphasised what labored final yr will miss a pleasant alternative.

Which home/international problem is more than likely to adversely have an effect on U.S. markets within the coming yr?

In this setting a yr is a very long time!

In my Weighing the Week Ahead Series I embrace updates on what I’m extra and fewer nervous about. My issues change fairly often, as they need to for any cautious, skilled observer. Those who continually beat the identical drum (or swap to a brand new instrument when an issue is resolved) should not actually paying attention.

How does the political local weather have an effect on the dangers and alternatives for subsequent yr?

This is one other glorious query which defies a very good reply. Compromise is the essence of efficient policy-making and stays briefly provide. Years of gerrymandering and the character of major elections have elevated polarization. Bipartisan settlement goes to require a compelling mutual curiosity or efficient horse-trading.

The Mueller investigation is an extra complication. President Trump has warned that it is a menace to compromise. Democrats, now with management of the House, will definitely develop investigations and use subpoena energy.

At the very least, this local weather creates distraction and uncertainty. The particular dangers to the financial system or public companies are tough to find out.

Do you count on the yield curve to proceed flattening in 2019, and if that’s the case what impacts will which have on the fairness market and the financial system generally?

The funding world “discovered” the yield curve in 2018 and now now we have a plethora of recent “experts.” Many have a mission to advertise the concept of a potential recession, despite the fact that they haven’t any confirmed analytical report.

The yield curve flattening displays a number of results on the lengthy finish of the curve – the persistently low yield on the ten-year be aware.

- Extremely low ranges of anticipated inflation, one other issue I monitor in my weekly collection. If inflation expectations improve, then the yield demanded will as effectively.

- Arbitrage with European bonds. If you’ll be able to borrow in Europe paying nearly nothing in curiosity and get a 2 ½ to 3% return, then use eight- or ten-times leverage, you may get a superb return. The greatest danger is a weaker greenback, however that was not an issue in 2018.

An inverted yield curve is one a part of the very best strategies of recession forecasting, however not the one aspect. A flatter yield curve doesn’t essentially sign an incipient recession. Even after an inversion there’s a warning of a few yr. And lastly, the inverted yield curve is an indicator, not a reason behind a potential recessions.

That was lots of myth-busting packed into a few paragraphs. Leading financial cycle knowledgeable Dr. Robert Dieli warns that you shouldn’t “forecast the forecast.”

In phrases of asset allocation, how are you positioned heading into the New Year?

Our buying and selling accounts have excessive money ranges, since market circumstances are particularly tough for buying and selling in a timeframe of quite a lot of seconds. Our funding accounts are nearly absolutely invested. Some shoppers have chosen to rebalance by switching extra property into the funding applications, benefiting from present costs.

What ‘surprise’ do you see within the market that isn’t at present getting ample investor attention?

NAFTA 2.0, now known as USMCA, has gotten little attention. It has been signed by the leaders of the US, Canada, and Mexico, however now requires ratification. There will in all probability be some changes, however I count on it to be authorized. Stocks that may profit from this settlement have actually not moved for the reason that signing and will take pleasure in outsized beneficial properties.

What function will the Fed play within the coming yr?

The function of whipping boy. Fed coverage is just not more likely to have a lot impact. Perceptions of Fed coverage and bogus warnings will trigger emotional swings. Can the Fed enhance communications? Certainly, however that doesn’t appear to be a precedence for them. They have been dedicated to sharing lots of info, however that doesn’t work. Traders, algorithms, and the media look ahead to a code phrase or two after which pounce. The that means will get exaggerated.

What problem is receiving an excessive amount of investor attention and/or already priced in?

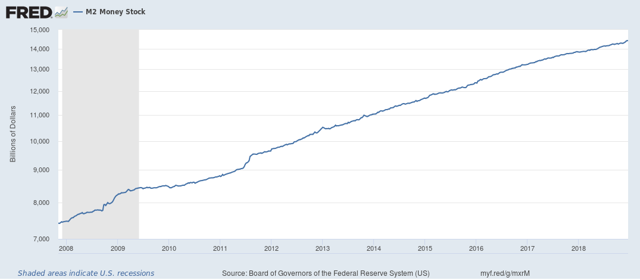

The Fed stability sheet. Those who have been unsuitable in regards to the lengthy rally needed to have an excuse, in order that they pointed to the Fed. The rationalization of the stability sheet impact was all the time obscure. The Fed was in a roundabout way shopping for property apart from Treasuries and mortgage securities. The impression of this, over all the QE historical past, was about 1% on the ten-year be aware. The stability sheet improve offered extra reserves, which banks used to deleverage a bit. As former Dallas Fed President Bob McTeer wrote, there was clearly a requirement from banks to construct and preserve extra reserves within the post-crisis interval. M2 elevated at a standard tempo.

QE did help shares by way of rising confidence and a modestly lowering rates of interest. The particular results turned a matter of buying and selling lore and a self-fulfilling prophecy on days of pre-announced open-market operations. The error and mythology of the QE interval is resulting in the alternative mistake because the stability sheet is unwound.

An oft-repeated assertion, based mostly upon lazy causal reasoning, is that for the reason that market went up throughout QE, we must always count on it to say no throughout “QT.” The pundits concentrate on the entire Fed stability sheet, not the pace of the unwind. The $50 billion per 30 days quantity to about 0.5% of daily trading volume in Treasuries (not even counting futures). At that tempo a big place might be constructed or liquidated with little footprint.

No surprise the Fed thinks that this very sluggish tempo might be placed on “autopilot.” This is a crucial instance of how Fed communication misses the mark even after they may be proper.

Is there anything affecting your positioning?

Yes. The lengthy checklist of issues that dominate monetary media of all sorts. I like it! Markets thrive on well-publicized worries and issues.

Most folks make two errors:

- They haven’t any methodology for figuring out actual dangers, and objectively assessing the magnitude. I publish a quantitative danger evaluation every week, utilizing unchanging metrics.

- They can’t think about potential options.

The second level is very essential. Let’s illustrate it with the commerce problem. The market calls for a particular plan and a firm deadline. They see contentious contributors and count on the worst. To some extent this displays an idealized idea of how their very own enterprise works.

It is each extra correct and extra worthwhile to be extra versatile in your considering. The central tendency in win/win conditions is to discover a answer. Let’s apply that concept to rising tariffs. Everyone around the globe is worse off from a commerce conflict. They could not have understood that when it started, however the proof is mounting.

We don’t have to know the precise ultimate answer, however the incentive is there. GOP partisans really feel the warmth from farmers and enterprise folks paying extra for uncooked supplies. The Koch brothers are a giant supply of GOP marketing campaign financing and have in depth enterprise pursuits on the receiving finish of the commerce conflict.

One chance is that Trump extends the self-imposed deadline if a bit of extra time is required. Concessions are made by the Chinese on varied fronts, together with one thing on mental property. Both sides declare victory.

This is how compromise is cast. You can’t guess precisely what it will likely be prematurely, and it doesn’t appear to be a plan. That illustrates why options are sometimes tough to see.

Major progress on the commerce problem would spark a 15% pop within the stock market and possibly double that in case you held the proper shares and sectors.

And commerce is barely one of many present pervasive worries.

Long-term buyers ought to embrace worries and the accompanying volatility.

Disclosure: I/now we have no positions in any shares talked about, and no plans to provoke any positions throughout the subsequent 72 hours. I wrote this text myself, and it expresses my very own opinions. I’m not receiving compensation for it (apart from from Seeking Alpha). I’ve no enterprise relationship with any firm whose stock is talked about on this article.

Additional disclosure: I’ve positions in all the themes talked about, each personally and for shoppers.

[ad_2]