Make Money and be Socially Responsible (2018)

[ad_1]

Have you heard the newest in investing?

ALSO READ: How to become a stockbroker: How-to guide with examples

“Robo-advisors” are all the fashion for buyers in 2018 – 2019.

But which one is finest for you?

There is Wealthsimple that means that you can make investments as a lot, or as little, as you need.

There is M1 Finance with no administration or buying and selling charges. (Yup, FREE)

And don’t neglect Acorns, Stash, and the myriad of different choices thrown at you.

All of those choices can be considerably overwhelming.

But, if you’re ready for me to inform you which one to decide on…

…it ain’t gonna occur!

That is for YOU to resolve

Since no two robo-advisors are created equal, that you must educate your self on not less than just a few choices.

But as an alternative of scouring the World Wide Web…

…you might be in luck as a result of class is in session!

We have spent hours analyzing and reviewing quite a few robo-advisors for you.

But to avoid wasting you the difficulty of studying an article that doesn’t go well with you…

…please, take a second to reply the questionnaire beneath:

- Do you need to earn money whereas doing nothing?

- Do you care about our planet?

- Do you hate Ebola, Mad Cow Disease, and the Bird Flu?

- Do you get pleasure from some high-quality H2O, every so often?

- Do you wish to disgrace your morally-inferior pals and household?

All executed? Good as a result of that was a TEST cleverly disguised a questionnaire.

Give your self 1-point for every query through which you answered “Yes.”

And here’s what your rating means:

- 3, 4, or 5: This could be the robo-advisor for you!

- 2 or beneath: You can cease studying now.

Today we’re going to have a look at a robo-advisor known as Swell Investing that specialised in affect investing.

But what’s affect investing, anyway?

Impact Investing

To perceive the funding platform that we’re protecting, that you must perceive affect investing.

We have heard all of it earlier than…

…that you must make investments for a affluent future.

But what about the way forward for our planet and fellow people?! Impact investing addresses this concern.

Impact investing also can be known as ‘sustainable investing’ or ‘socially-responsible investing.’

Call it what you need, however this investing provides you the facility to create essential social modifications.

Investors that search to make such change achieve this by investing in corporations that set the next customary for environmental and social actions.

The better part is…

…you do not want to decide on between cash and creating change.

You can do each!

You can earn substantial returns in your investments and profit folks all over the world.

That is exactly what Swell Investing will help you accomplish.

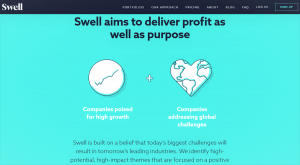

Swell Investing Overview

The firm started with ONE easy query:

“How can we create a better investment option for people who care about where their money goes and what it supports?”

Does that sound Swell to you?

Swell Investing is an SEC-registered funding advisor created by Pacific Life.

These guys (and gals) are a small robo-advisor with simply over $25 million below administration.

So, if you’re something like me…

…you need to make a optimistic affect and earn money.

The key phrase is “AND” in that sentence.

Because investing in one thing optimistic mustn’t come on the expense of your wealth.

Swell creates themed portfolios of particular person shares.

The corporations that make up every portfolio come from socially accountable industries.

If you have an interest in investing in socially accountable securities, that’s Swell’s specialty.

Currently, Swell supplies its shoppers with six funding themes:

- Green Tech

- Renewable Energy

- Zero Waste

- Clean Water

- Healthy Living

- Disease Eradication

Swell can put your cash to work in methods that may profit thousands and thousands of individuals.

But you’ll by no means fulfill your objectives giving your life-savings to charity.

So, with out additional ado…

…does it make monetary sense to speculate with Swell?

That is what you might be about to find!

How Swell Works

If you’ve got seen one robo-advisors, you’ve got seen all of them, proper?

Not precisely.

This part goals to give attention to how Swell differentiates itself from different robo-advisors.

Swell permits its customers to select from pre-packaged portfolios which can be managed by the corporate.

Users have the liberty to decide on which portfolios to put money into and to resolve the asset allocation in every.

Each portfolio comprises between 40 and 70 particular person shares, and customers can select to swap-out as much as three securities at their discretion.

Impact investing is nothing new…

…however the best way Swell helps buyers discover the perfect shares and make investments on the lowest value is new.

The platform locates revolutionary corporations that match the affect investing mould and makes use of them to fill every portfolio.

Sign-Up for Swell

The sign-up course of for Swell is simple, easy, and shorter in comparison with different robo-advisors.

You should be a U.S. citizen or resident alien and not less than 18 years of age.

Select Go to Site, then click on Sign Up.

Create your username by coming into your e-mail and make a password.

Just enter your figuring out info (e.g., title, date of beginning, employment standing) and reply just a few questions.

These questions cowl info like:

- Your present property

- Your desired timeline

- Your threat tolerance

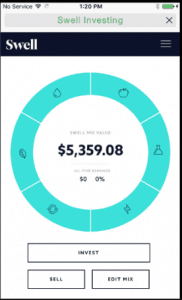

Fund Your Swell Account

Once the sign-up course of is full, you’ll link your checking or financial savings account (accepts most banks) to the brokerage account and start investing!

Swell will make investments your funds as quickly as they hit your account.

And, it’s also possible to set-up recurring deposits to automate the financial savings course of.

The complete course of from set-up to funding your account takes about 20 minutes to finish.

Once you’ve got efficiently signed-up, it’s time to select your portfolio!

Swell Portfolios

Since Swell goes to be managing your cash…

…wouldn’t you wish to understand how the corporate chooses its investments?

The firm makes use of a rule-based method to optimize affect and efficiency.

Here is the three-step course of that goes into making a Swell portfolio:

- Swell screens every firm for his or her dedication to optimistic affect.

- Swell researches every firm to see how they derive income.

- Swell analyzes every firm’s monetary health, stock valuation, and liquidity.

With this course of, you might be getting shares that make an affect socially and financially.

You can put money into one in every of Swell’s socially accountable portfolios for as little as $50.

This low-investment threshold is spectacular for SRI because it used to value buyers severe money up-front simply to get started.

There are six portfolios to select from, every with a special mission.

Each Swell portfolio consists of 40 to 60 shares from corporations that align with every class.

You can select particular person taxable accounts and Traditional, Roth, and SEP IRAs.

Green Tech

Summary: A portfolio of corporations constructing merchandise and companies that cut back our pull on the vitality infrastructure. Think of electrical vehicles and LED lights.

Top 5 Holdings: Tesla Motors 4.63% | Analog Devices 4.23% | ABB LTD. 4.14% | Arista Networks 4.06% | Johnson Controls International 4.04%

Clean Water

Summary: A portfolio of corporations conserving water, cleansing it up, and streamlining our programs. Think of water filters and pipe repairs.

Top 5 Holdings: Aqua America 4.15% | EcoLab 4.05% | Waters Corp 4.04% | Xylem 4.02% | Pentair PLC 4.0%

Zero Waste

Summary: A portfolio of corporations cleansing up our planet and assembly rising world demand. Think of recycling and repurposing.

Top 5 Holdings: Westerlock Co Com 4.06% | RPM 4.04% | Trimble 4.04% | Tetra Tech 4.03% | Ball Corporation 4.03%

Renewable Energy

Summary: A portfolio of corporations which can be harnessing pure assets to energy our world. Think of generators and photo voltaic panels.

Top 5 Holdings: PPL Corp 4.1% | Edison International 4.1% | National Grid Transco 4.05% | Digital Realty TR 4.01% | Eaton Corp 4.01%

Disease Eradication

Summary: A portfolio of corporations engaged on pharmaceutical and biotech options to fight main health challenges. Think of Immunizations and analysis.

Top 5 Holdings: Incyte Corp 4.26% | Shire PLC 4.22% | Bristol-Myers Squibb 4.2% | Medtronic PLC 4.06% | Biogen 4.05%

Swell holds 0.25% of your portfolio in money to cowl advisory charges.

The money held in your portfolio is FDIC insured and positioned into an interest-bearing account.

Healthy Living

Summary: A portfolio of corporations that allow extra of us to stay longer, more healthy lives by food, fitness, and know-how. Think of nutritious meals and health facilities.

Top 5 Holdings: Lululemon Athletica 4.08% | Align Technology 4.07% | Dexcom 4.03% | Unilever 4.03%| Abiomed 4.03%

Impact 400

Summary: A portfolio of corporations that derive income from actions aligned with the 17 United Nations Sustainable Development objectives. The most impactful corporations within the market.

Top 5 Holdings: Tesla Motors 2.68% | Novartis A G ADR 2.32% | Apple 2.16% | Roche Holdings LTD ADR 2.1% | Nextera Energy 2.03%

Swell Fees

Swell fees a 0.75% annual payment on all balances.

Given that Swell is a distinct segment service larger charges ought to be anticipated in comparison with different robo-advisors.

So, should you make investments $500, it’s going to value you $3.75 per yr.

Or, as Swell would say, “The price of 3 fancy coffees.”

The firm doesn’t have:

- Trading charges

- Price Tiers

- Expense Ratios

Swell’s all-inclusive payment is refreshing as a result of you understand what you’ll be able to anticipate to pay upfront.

Many robo-advisors promote one payment if you are signing up…

…solely to cost buying and selling charges and expense ratios after you’ve got invested your cash with them!

With Swell, you do not want to fret about that taking place.

Key Features

Swell supplies a number of worthwhile options you can profit you.

Here are just a few key advantages that come together with this funding platform:

Tax Optimization. This function sells your most substantial losses and beneficial properties final to scale back your taxable earnings.

Automatic Deposits. You can set-up recurring deposits to repeatedly save and make investments.

Customizable Portfolios. You can take away corporations out of your funding combine whether or not they’re underperforming, don’t align along with your beliefs, or for another purpose.

We wish to see extra options from Swell, akin to academic supplies, as the corporate continues to develop.

But for now, these options are helpful and will help take advantage of out of your investments.

Customer Service

Swell makes use of e-mail as its major methodology of communication with customers.

There isn’t any stay customer support contact or direct hyperlinks on the corporate’s web site.

However, if Swell can not remedy your downside by way of e-mail, the corporate vows to be in contact to resolve your challenge.

Additionally, there is a superb FAQ Support Center web site that may reply your questions on:

- Sign Up Process

- Funding My Account

- Account Types

- Portfolios

- Deposits & Withdrawals

- Closing Your Account

- Taxes & Fees

We have discovered Swell customer support to be dependable however missing in comparison with bigger robo-advisors.

Who Swell Can Benefit

We at all times suggest that new buyers check the waters with a robo-advisor.

Investing $50 with Swell is an effective way to get started and check out the markets.

For extra skilled buyers, Swell is superb for:

- Socially Responsible Investing. Make a distinction on the planet!

- Hands-Off Investing. Let your robo-advisor do the work!

- Young Generations. Because you might be tech-savvy!

Swell’s target market is millennials that need to make a distinction on the planet.

Small and massive investments can be used to vary how the world works.

Swell optimizes your portfolio for threat and anticipated returns.

Your portfolio is re-balanced quarterly to take away underperforming corporations.

What We Love About Swell

Socially Responsible Investing. If you might be in search of socially accountable investing – look no additional.

Swell is a novel robo-advisor in the best way that the corporate facilities round SRI-themed portfolios.

Customizable Portfolios. Swell can also be distinctive as a result of the corporate provides buyers the flexibility to decide on particular person securities.

Most robo-advisors make investments primarily in exchange-traded funds (ETFs) which limits your capability to choose and select the shares that you really want.

Swell buyers can select to swap out as much as three shares of their portfolio.

Individual and Retirement Accounts. Swell is an choice for buyers with long- and short-term objectives.

Whether you might be saving for a house or retirement, there may be an account for you.

All-Inclusive Fee. The simplicity of Swell’s pricing is what we wish to see.

You don’t want to fret about buying and selling commissions or expense ratios.

To put it merely, what you see is what you get.

Low account balances. You solely want $50 to start investing with Swell.

This minimal stability requirement could be very low so far as SRI-themed portfolios go.

What We Don’t Love About Swell

High Fees. This “all-in” pricing mannequin is easy however not the perfect deal for buyers.

This payment construction can be notably dangerous to buyers with massive account balances.

Other robo-advisors sometimes cost charges between 0.25% and 0.50%.

Professional Guidance. Swell presents customer support by e-mail and telephone throughout common enterprise hours.

Robo-advisors usually take a “hands-off” method to investing, and some achieve this greater than others.

Investors searching for customized service ought to search one other robo-advisor (or neglect robo-advisors altogether!).

Portfolio Management Tools. Swell lacks monetary planning instruments like calculators and different gadgets used to know your funds and investments.

The firm does provide weekly market evaluation and a device that buyers can use to assessment U.N. Sustainable Development Goals.

The lack of instruments is a minor setback given the convenience of accessing them elsewhere on the internet.

Ready to Start Investing?

Have you made up your thoughts, but?

If you are ready to speculate for revenue and affect…

…click on right here to go over to Swell Investing and open your account immediately!

Swell Investing Review Summary

Swell goals to assist buyers construct a optimistic monetary future and assist peace and prosperity.

Hard to argue with that!

If you agree with the corporate’s mission, this might be the robo-advisor for you!

You can put money into the whole lot from sustainable vitality to healthy dwelling.

But in all seriousness, it’s extra vital to decide on investments that instill confidence.

If social duty will not be one in every of your objectives, there are higher robo-advisor choices for you.

But, whether or not you’re a newbie or seasoned investor, Swell is an effective choice for each.

The low-minimum funding makes this platform extremely accessible to anybody.

Plus, the upper charges for this area of interest service won’t majorly affect your funding efficiency.

You can use a monetary advisor to set-up an affect funding portfolio…

…however Swell Investing makes the whole lot a lot simpler!

If you have an interest in making a living and a distinction, we extremely suggest testing our pals at Swell Investing.

Are you ready for an invite?

Go and set-up your account today!

Swell Investing

Pros

- Socially Responsible Investing made straightforward

- Choose between six completely different “themed” portfolios

- Portfolio customization choice

- Invest with as little as $50

- Automatic portfolio rebalancing

Cons

- High charges in comparison with different robo-advisors

- Lack {of professional} steering

[ad_2]