MannKind: Afrezza Scripts Down, Sharecount Up, And Shareholders Have Questions – MannKind Corporation (NASDAQ:MNKD)

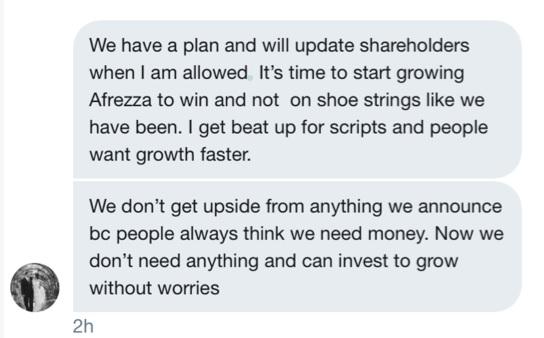

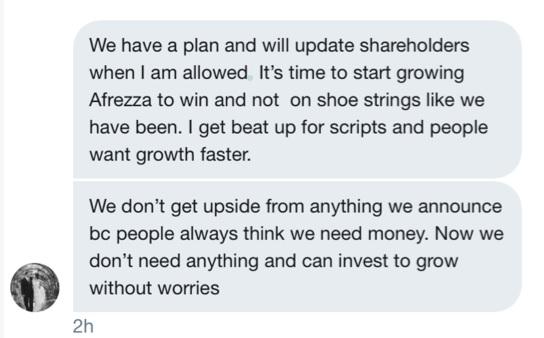

MannKind (MNKD) buyers have had a fairly unhealthy week. Scripts have been down, the stock value is down, and the share depend is about to rise. Just every week after the CEO tweeted, “It can only go up from here” and deleted the tweet the next day, we see the one factor that has gone up is the share depend.

Hindsight is 20/20. Leerink Partners is doing the providing, and HC Wainwright was an advisor to MannKind. Leerink was on the Q3 quarterly name in the course of the query and reply session, and Wainwright has been advising MannKind for fairly a while. It would seem that MannKind has been procuring a capital increase for fairly a while. If that’s not fascinating sufficient, we’ve got this communication from the CEO on the day the providing was introduced.

Ironically, that message would appear to tie in fairly effectively with the considerations I’ve had in regards to the firm for fairly a while. I’ve lengthy acknowledged that Afrezza development just isn’t quick sufficient, and have lengthy acknowledged that the funds MannKind has don’t enable it to alter the state of affairs. The remark about not needing something is a bit misguided, in my view. The $40 million that this providing will increase buys about 20 weeks of operations beneath the present technique of doing issues. If the corporate goes to spend extra to market, then that 20 weeks could turn into someplace between 10 and 15 weeks.

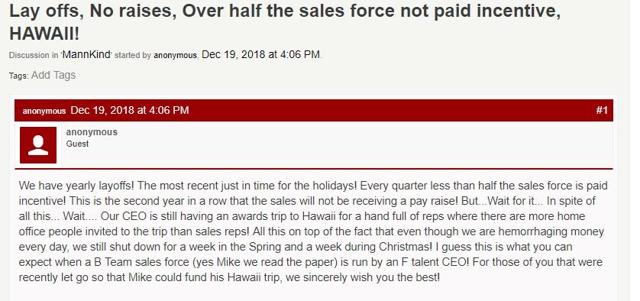

Now issues get actually fascinating. A person who’s allegedly a gross sales rep for MannKind posted this:

(Post on CafePharma)

It is alleged on this put up that there are a number of members of administration on this journey, together with the CEO. In equity, journeys to incentivize gross sales reps are widespread and even essential. What just isn’t essential is a number of members of the administration crew occurring the identical journey. The optics of this, if true, are outright horrible. Shareholders see the stock drop from $1.60 per share to about $1.00 per share, whereas administration asks for extra money while amassing the solar rays in Hawaii. A administration in tune with the optics right here would have stepped away from the holiday and easily despatched the reps who earned it by means of their efforts in the course of the yr.

As many readers know, I’ve lengthy touted warning with regard to MannKind’s money state of affairs. I used to be warning way back that the corporate would nonetheless want additional cash, and additional stating that the corporate would doubtless want to hunt a further share authorization. MannKind received some money, and it has just about exhausted the 140 million shares that have been licensed solely a yr in the past. This providing primarily exhausts your complete licensed share depend of 280 million shares.

Lastly, the providing introduced the stock value down close to $1.00. If the stock closes beneath $1.00, the corporate will likely be out of compliance with Nasdaq itemizing necessities. The course of is lengthy, however primarily, the stock can get de-listed in some unspecified time in the future if it doesn’t regain compliance. De-listing shouldn’t be a significant concern of buyers. Being out of compliance is the priority, and right here is why. Companies outdoors compliance discover it harder to get any financing achieved. The similar situation may be a detraction to potential companions, particularly those who may contemplate a purchase-in. If MannKind can’t stack collectively some strikes that bolster the share value, it might discover itself in a troublesome state of affairs with regard to the itemizing situation.

My situation with this transfer could be summarized within the following method:

- There are some very unhealthy optics to this transfer.

- The transfer raises some money, however MannKind remains to be a good distance away from being totally funded.

- The amount of money raised is not going to enable rising advertising and marketing efforts on Afrezza, in addition to transferring the pipeline in a significant method. This is sufficient money to do one or the opposite.

- Warrants are poisonous and put a ceiling on the stock.

- The acknowledged use of funds is so extensive {that a} bus, train, and aircraft might undergo it.

- The transfer wipes out primarily all shares on the shelf.

Afrezza Scripts

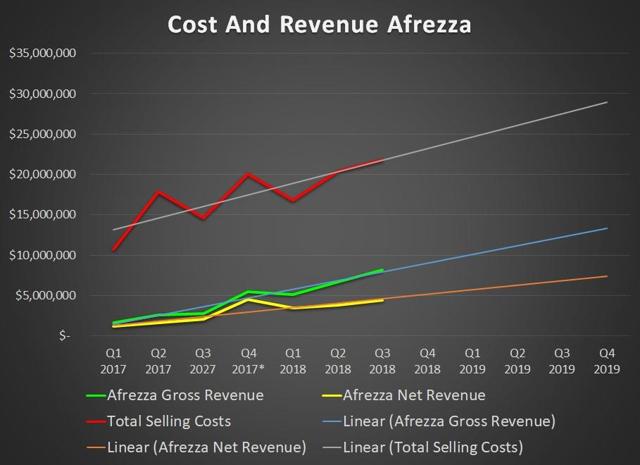

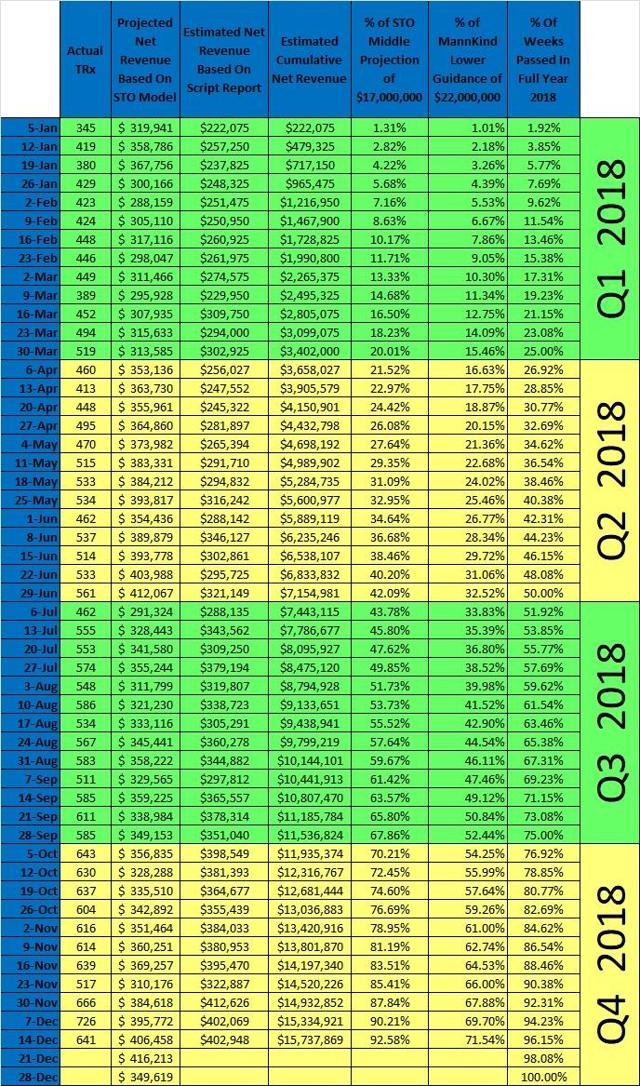

I might enterprise to say that the corporate lacking its gross sales steering by a number of miles is presently not the chief dialogue level with many buyers. That being mentioned, it ought to be. Afrezza’s internet income in 2018 will are available at lower than $17 million. MannKind initially guided to internet Afrezza income of between $25 million and $30 million. It then lowered steering to between $22 million and $25 million. Needless to say, the corporate will miss. Now, as we enter 2019, what’s the Street alleged to anticipate? Management has primarily acknowledged that it needs it by no means gave steering.

Will the corporate step as much as the plate and provide practical steering for 2019? The hazard in that’s easy. Realistic steering can be for internet income of between $30 million and $35 million. Ironically, $30 million was a part of the preliminary steering for 2018. The Street can be very fast to be aware of that. It can be a quantity that’s lower than spectacular to the Street when the corporate is already in a money crunch. Meanwhile, MannKind is seeing the hole between what it spends bringing Afrezza to the market versus what it retains. In different phrases, internet income development is being outpaced with the bills of development.

Chart Source – Spencer Osborne

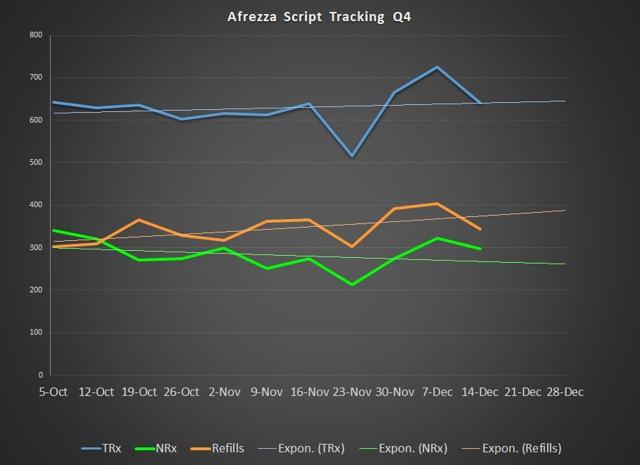

For the week ending December 14th, Afrezza scripts got here in at 641. This was a 12% drop from the week prior, and main holidays at the moment are upon us. More regarding is the info in This autumn, which reveals a really destructive trajectory on new scripts. Seeing new scripts fall off just isn’t good at this stage within the Afrezza story.

Chart Source – Spencer Osborne (based mostly partly on Symphony information)

I’m projecting that 2018 internet gross sales will are available at about $16.5 million. As acknowledged earlier, this can be a very massive miss when in comparison with firm steering. That is much more true given MannKind acknowledged simply 4 months in the past that it was assured about assembly its steering.

Chart Source – Spencer Osborne

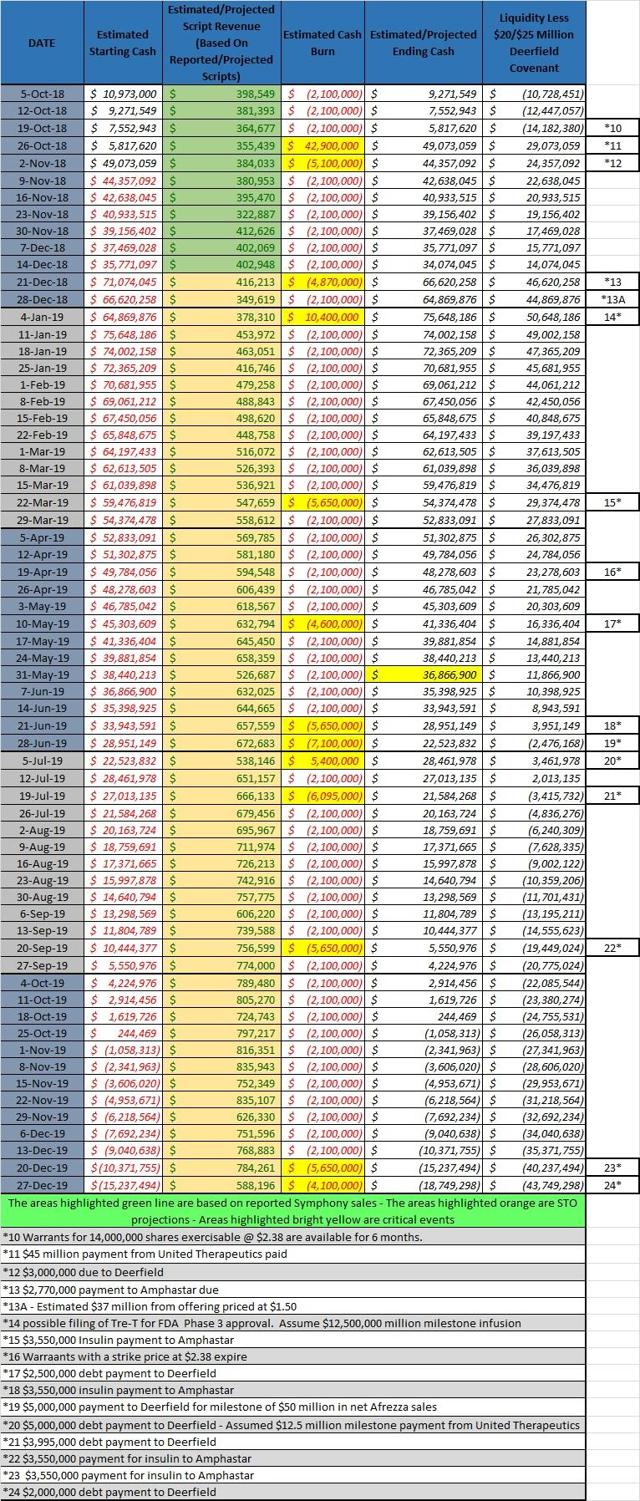

Cash

The money state of affairs at MannKind stays a sizzling matter. With the belief that the corporate places $37 million into its coffers on December 26th, it is going to end the yr with about $65 million. This will enable MannKind to presumably get by means of Q2 of 2019 while remaining in compliance with Deerfield covenants. It permits for the corporate to get by means of Q3 of 2019 earlier than the checking account runs dry. This is with an enormous assumption that money burn doesn’t enhance, nor do analysis & growth bills. If the corporate spends extra on advertising and marketing Afrezza or analysis & growth, then the money runs out extra shortly.

The new warrants might come into play and ship some a lot-wanted money, however that may be a double-edged sword for buyers due to the poisonous properties of warrants and convertibles. My chart assumes $25 million in milestones from United Therapeutics (NASDAQ:UTHR) in 2019, however doesn’t but contemplate another molecules being chosen by United or partnered with others. If loads of issues go proper, MannKind can get by means of 2019. If some issues don’t pan out, then the corporate will want money as soon as once more.

Simply acknowledged, the money state of affairs has now improved (on the expense of current shareholders) however remains to be not preferrred.

Chart Source – Spencer Osborne

Summary

This stock nonetheless stays on the benefit of energetic merchants. A brand new buying and selling vary is being established with an undefined backside however a prime at round $2.00. The backside of that buying and selling vary will doubtless turn into extra evident within the subsequent 3 weeks. Management states that it’ll replace shareholders, and I totally anticipate it to sing a great track. The query at this stage is whether or not shareholders are uninterested in what appears to be lip service and whether or not administration will lay out a practical plan for 2019. Over the previous couple of years there have been two constants – shareholders have all the time given the good thing about the doubt, and administration has but to perform with Afrezza what it thinks it may well do. Something has received to provide, and it ought to start with administration. It must be clear, be concise, be clear, and in addition wants to provide practical steering. Stay tuned!

Disclosure: I/we’ve got no positions in any shares talked about, and no plans to provoke any positions throughout the subsequent 72 hours. I wrote this text myself, and it expresses my very own opinions. I’m not receiving compensation for it (apart from from Seeking Alpha). I’ve no enterprise relationship with any firm whose stock is talked about on this article.