Mawson Infrastructure Group: The Carbon Neutral Cryptocurrency Mining Company Set to Dominate the Market

Investors who are looking for life-changing returns have started to focus their attention on cryptocurrencies, mainly because this industry has outpaced almost all other asset classes by an extremely wide margin despite being barely a decade old. As cryptocurrencies become more widely adopted and accepted in mainstream society, there is without a doubt more shareholder appreciation in store.

A sector that is becoming more important as the adoption of cryptos becomes more popular is the cryptocurrency mining industry. According to Verified Market Research, the global cryptocurrency mining machines market was valued at $11 billion in 2019 and will reach $21 billion by 2027. According to The BlockCrypto, in October 2021 Bitcoin Mining revenue was $1.72BN. Mining processes are becoming more complex day by day, creating the opportunity for companies who can remain operationally flexible while still deploying cutting edge technology, the chance to become the dominant player in the industry. An industry that is likely to experience double digit growth for the foreseeable future.

Company Profile

Mawson Infrastructure Group (Nasdaq: MIGI) is an industry leading digital infrastructure provider, specializing in cryptocurrency mining and other digital assets. The company is operating out of multiple locations that contain modular data centers with specially designed high-performance computing capabilities. The modular adaptability allows for Mawson to scale on demand as the value of digital assets increase. What is truly unique about Mawson’s business model is choosing site facilities where there are stranded or underutilized energy assets that can support the high energy levels associated with digital asset mining. This strategy allows for the company to reduce their energy footprint while still maximizing computational power. Mawson is quickly becoming a major player within the cryptocurrency world and is making great strides towards their goal of bridging the gap between the fast-growing digital asset industry and traditional capital markets.

Currently, Mawson has 4 facilities across the U.S. and Australia, and at the end of November will have 0.8 ExaHash online, generating 4.7 BTC/day according to their latest investor presentation. The company has very ambitious goals for 2022 and beyond. The company is targeting to increase their hash rate to 5 ExaHash (equating to production of 28.5 BTC/day) and doing all this while keeping operations 100% carbon neutral. Mawson has been growing incredibly quickly, and if they are able to deliver on these goals it would position them as one of the top three cryptocurrency mining companies in the world.

Mawson Begins Expansion Journey with New Australian Based Facility

Mawson recently brought their first Australian facility online at the end of October and announced it will be powered by 100% renewable energy sources through partnering with Quinbrook Infrastructure Partners. Quinbrook Infrastructure Partners is a global green energy infrastructure fund, developing 17GW of green energy assets across their portfolio globally. This partnership is the first of its kind amongst the Nasdaq listed Bitcoin Miners. The facility will be in northern New South Wales, Australia and will be home to a next generation Modular Data Center specially designed for Australian environmental conditions.

The successful launch of Mawson’s first facility in Australia puts the company at a strategic advantage and paves the way for additional facilities to become operational in the future. Mawson and Quinbrook have developed a comprehensive list of potential future renewable energy-based sites in which the two companies will be able to develop through joint partnerships.

Through Purchase of 4000 ASIC Bitcoin Miners, Mawson Prepares for Massive Growth on the Horizon

To facilitate the expansion into their new Australian based facility and to increase the capacity of existing facilities, Mawson has purchased 4000 new ASIC bitcoin miners. The order is split evenly between the MicroBT M30S and the Canaan Avalon A1166/124. The company plans on making all 4,000 machines operational by the end of Q4 2021. Mawson recently upgraded guidance from 3.00 Exahash to 3.35 Exahash by Q2 2022, and brought forward its 5 Exahash target to early Q1 2023. As per the company’s Q3 investor presentation, 5 Exahash online is expected to produce approximately $623 million in annualized revenue, at an 80% gross margin.

This announcement further demonstrates to investors how serious Mawson is about becoming one of the top Bitcoin miners in the world and highlights the success of their “infrastructure first” strategy for the deployment and scaling of new and current facilities.

Mawson Announces Blowout Third Quarter Results and Purchases New Batch of Bitcoin Miners

Mawson’s third quarter earnings were nothing short of amazing. The company saw revenue increase to $10.9 million, marking a 1100% increase from last year’s Q3. Gross profit increased handsomely to $8.4 million (compared to $44,000 in 2020) and virtually every other financial metric saw an outstanding improvement when compared to previous results. Mawson not only reported record breaking revenue and gross profit, but they also announced to investors that they had purchased an additional 17,352 bitcoin miners, which will in part be used to outfit their newly announced, brand new 100MW facility located in Pennsylvania. This large increase in bitcoin miners, paired with multiple new facilities under way, means Mawson will effectively increase their hashing power to an impressive 3.35 Exahash by Q2 2022, a 400% increase from November 2021 levels. This represents a significant increase in the amount of hashing power available to Mawson for Bitcoin production. To put this in perspective, currently, all the bitcoin hashing power is around 150 EH/s. Mawson will manage roughly 2.2% of all bitcoin hashing power. At a spot price of 60k USD, by Q2 2022 Mawson could generate over $400 million in bitcoin rewards. That is a massive 4x revenue increase from current levels. This earnings report should signal two things two investors. First, Mawson’s strategy of finding energy efficient facilities is paying off in a big way and is making a major difference to the company’s bottom line. Second, Mawson is scaling up in a major way and is putting their operations on the fast track to quickly become one of the most efficient and largest bitcoin mining operations in the world. The company is going to have a busy 2022, and with no signs of slowing down anytime soon, Mawson is a clear winner and needs to be on your watchlist.

Final Thoughts

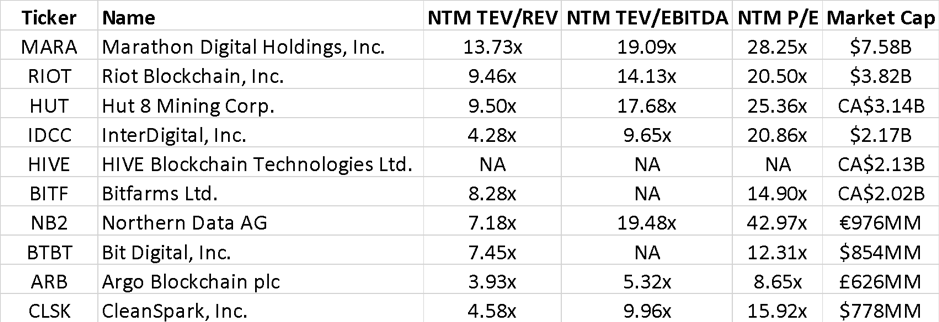

A common way to value bitcoin mining players is their enterprise value as a function of their next twelve-month (NTM) revenues as these companies continuously invest in adding capacity and have a reasonable view of the bitcoin that they are going to mine in a given year. Today, most major bitcoin miners are trading at an average multiple above 9x their forward revenues. Now, let us have a look at Mawson Infrastructure’s valuation.

Based on one sell-side analyst report from August 20, 2021, Mawson is expected to generate revenues of approximately $180 million for fiscal year 2022. Mawson is trading at around 5x in terms of Enterprise Value/NTM Revenues which is below the average multiple of its peer group. Moreover, the company’s low-cost mining infrastructure ensures a higher margin than most of these companies. There is an excellent chance that Mawson’s valuation multiples will move higher as management executes on its plans and more investors become acquainted with the company. Rising bitcoin prices will also attract market attention towards the stock. Investing in bitcoin mining companies is often considered speculative given the volatility of bitcoin’s pricing and network hash rate, the global semiconductor shortage, and other factors. Mawson’s capacity expansion initiatives, low-cost mining infrastructure, and high margin of safety with respect to bitcoin price fluctuations makes the company a solid investment proposition for small cap investors.

Key Takeaway

The cryptocurrency industry as a whole has seen exponential returns for the last decade, creating an incredible level of wealth for investors who saw the potential early on. We believe the industry is in the early stages of its growth, with lots of upside still available to companies and investors. Mawson Infrastructure has positioned itself to be an industry leading, carbon neutral Bitcoin mining company. Mawson is currently sporting a market cap of approximately $800 million, with a strong cash position. Mawson has the balance sheet, infrastructure, and growth plans to not only attain but exceed their incredibly ambitious growth plans. Investors would be wise to keep Mawson at the top of their watchlists.

Disclaimer

No Positions.