McDonald’s And Starbucks: High-Yield Strategies For Market-Beating Burgers And Lattes – McDonald’s Corporation (NYSE:MCD)

[ad_1]

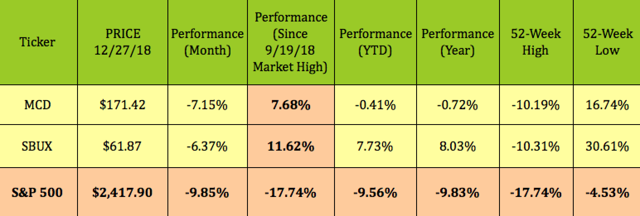

With the market melodrama persevering with this week, we went in search of some massive-cap dividend shares which have outperformed the market for the reason that pullback.

We got here up with two acquainted names – McDonald’s (MCD) and Starbucks (SBUX). Both of those shares have outperformed the market throughout this pullback and still have outperformed it yr-to-date.

Well, that is sensible, would not it? We all have to eat, and who hasn’t had the responsible pleasure of a Big Mac or a latte sooner or later, though it will be a stretch to say these are actually staples of any food plan, except you are speaking about your common highschool or school pupil.

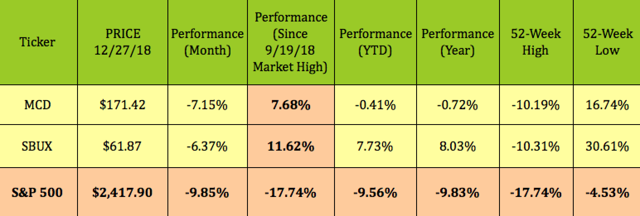

Both shares have obtained a number of upgrades from analysts – MCD has obtained three upgrades and two constructive initiations since October:

Both shares have obtained a number of upgrades from analysts – MCD has obtained three upgrades and two constructive initiations since October:

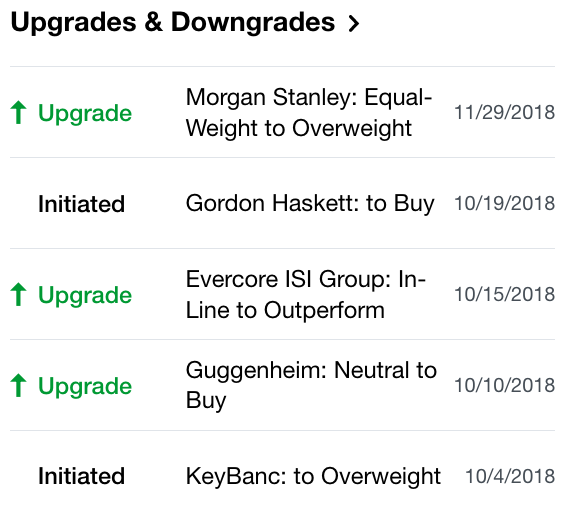

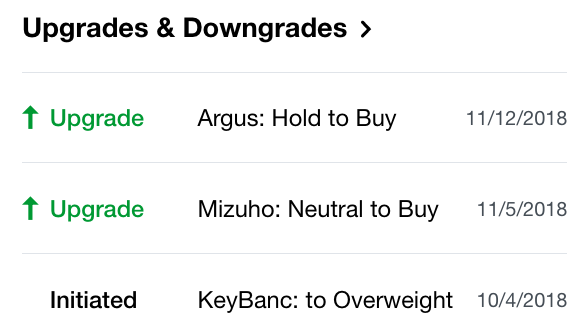

SBUX additionally has had a number of upbeat rankings from analysts:

SBUX additionally has had a number of upbeat rankings from analysts:

(Source: Yahoo Finance)

(Source: Yahoo Finance)

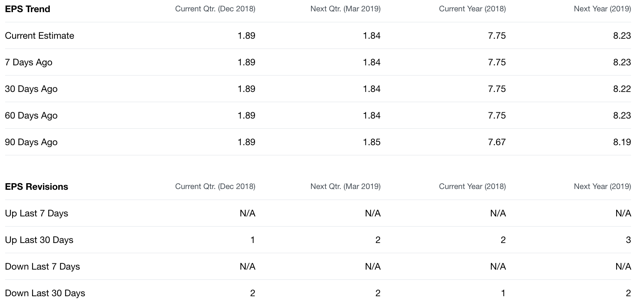

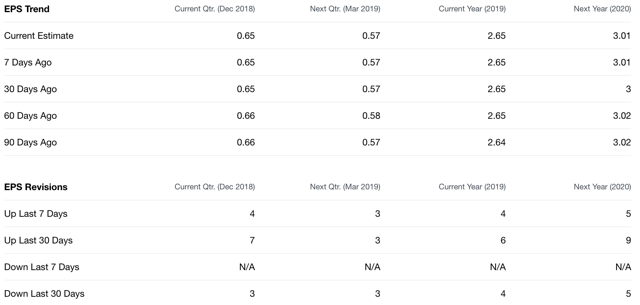

In phrases of earnings estimates although, it has been a blended bag for each of those shares, with upward and downward revisions over the previous month.

MCD is internet constructive for full years 2018 and 2019, however it’s a break up determination for This fall ’18 and Q1 ’19. The consensus EPS estimates are largely flat for This fall ’18, Q1 ’19 and full-yr 2018, however present a 6.2% rise for 2019 vs. 2018:

SBUX’s revisions are leaning far more towards the constructive aspect for This fall ’18, Q1 ’19 and full years 2018 and 2019, though the consensus EPS estimates look largely flat, apart from 2019 vs. 2018, which reveals a 13.5% estimated rise in EPS:

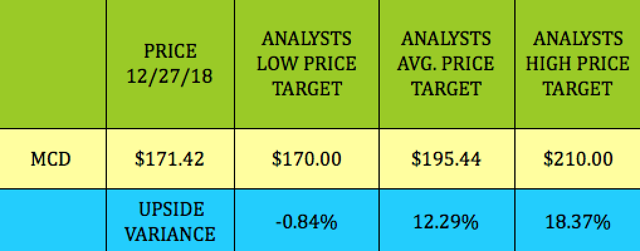

Analyst’s Price Targets – MCD:

At $171.42, MCD is barely larger than analysts’ lowest value goal, however is 12.3% under the common $195.44 value goal.

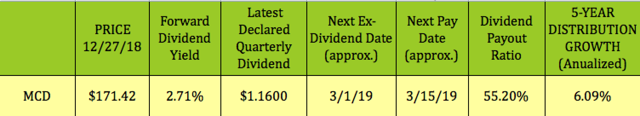

Dividends – MCD:

Dividends – MCD:

MCD’s administration raised its quarterly dividend by ~15% in November, to $1.16. MCD pays in a March/June/Sept/Dec. schedule, and will go ex-dividend once more in early March. It yields ~2.71%, and has a dividend payout ratio of 55.20%, with common 5-yr dividend progress of 6.09%:

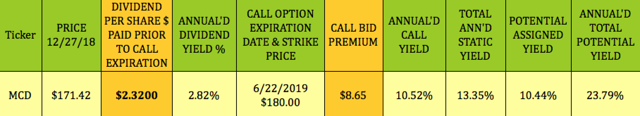

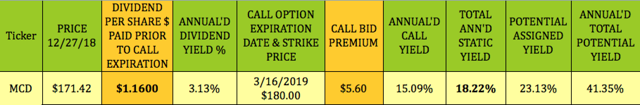

Options – MCD:

Covered Calls:

We added two trades for MCD to our free Covered Calls Table which tracks greater than 30 different trades, and is up to date all through every buying and selling day.

MCD’s March $180.00 name strike pays $5.60, almost 5X the quarterly $1.16 dividend, so, on a brief-time period foundation, you possibly can improve MCD’s fairly considerably. The flip aspect to that’s MCD may blow proper by way of $180.00, however you’d nonetheless solely make $5.60/share on the decision choice.

MCD additionally has a June choice expiration, with a $180.00 strike bid premium of $8.65. This commerce captures two ex-dividend dates for a complete of $2.32 in dividend funds. Since the $180.00 strike is kind of a bit above MCD’s value/share, the potential value achieve could be additionally larger than the $2.32 in dividend payouts, ought to your shares be assigned earlier than the ex-dividend dates.

MCD additionally has a June choice expiration, with a $180.00 strike bid premium of $8.65. This commerce captures two ex-dividend dates for a complete of $2.32 in dividend funds. Since the $180.00 strike is kind of a bit above MCD’s value/share, the potential value achieve could be additionally larger than the $2.32 in dividend payouts, ought to your shares be assigned earlier than the ex-dividend dates.

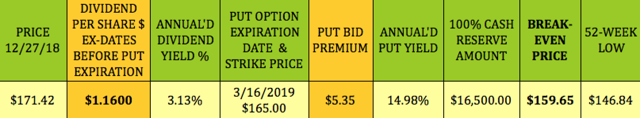

MCD Put Options:

We added these March and June put-promoting trades to our Cash Secured Put Tables. MCD’s March $165.00 put strike pays $5.35, once more, a lot larger than the $1.16 quarterly dividend. This put choice provides you a breakeven of $159.65, which is ~6% under analysts’ lowest value goal of $171.42 for MCD.

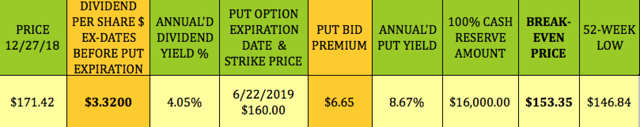

Generally, you may receives a commission extra for promoting choices additional out in time, however you may receives a commission much less the additional out of the cash you promote at. This June $160.00 put strike pays $6.65, nearly two instances the subsequent two dividends, and affords you a breakeven of $153.35, which is 9.8% under MCD’s lowest value goal:

Generally, you may receives a commission extra for promoting choices additional out in time, however you may receives a commission much less the additional out of the cash you promote at. This June $160.00 put strike pays $6.65, nearly two instances the subsequent two dividends, and affords you a breakeven of $153.35, which is 9.8% under MCD’s lowest value goal:

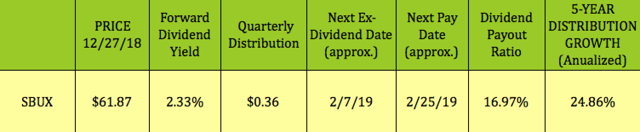

SBUX pays $.36, with a 2.33% yield, and has a really spectacular 5-yr dividend progress common of 24.86%. It pays in a Feb/May/Aug.Nov. cycle, with a really conservative 16.97% dividend payout ratio.

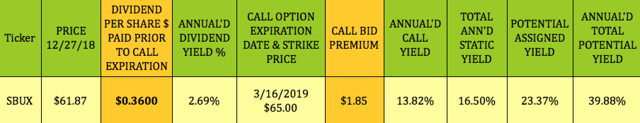

Options – SBUX:

Covered Calls:

If you are seeking to improve your yield on a brief time period foundation, these 2 lined name trades can do the trick. The SBUX March $65.00 name strike pays $1.85, over 5 instances the $.36 dividend.

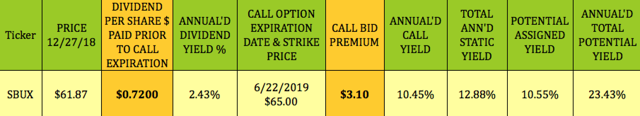

There’s additionally a $65.00 name strike for June, which pays $3.10, over 4 instances SBUX’s two dividends throughout the time period of this ~six-month commerce.

There’s additionally a $65.00 name strike for June, which pays $3.10, over 4 instances SBUX’s two dividends throughout the time period of this ~six-month commerce.

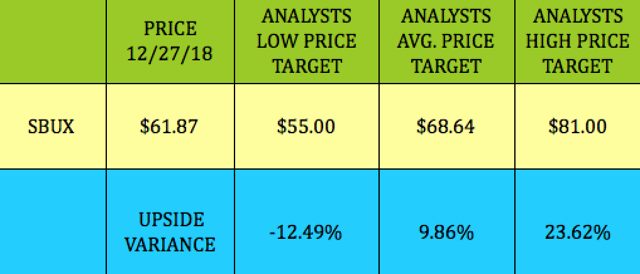

Analyst’s Price Targets – SBUX:

Analyst’s Price Targets – SBUX:

At $61.87, SBUX is 12.5% above analysts’ lowest value goal of $55.00 and 9.9% under the common $68.64 value goal. There’s a 47% unfold between the bottom and highest value targets for SBUX.

Cash Secured Put Options – SBUX:

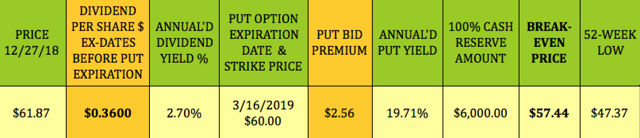

The March ’19 $60.00 put strike pays $2.56, supplying you with a $57.44 breakeven, which is 4.4% above the $55.00 lowest value goal for SBUX.

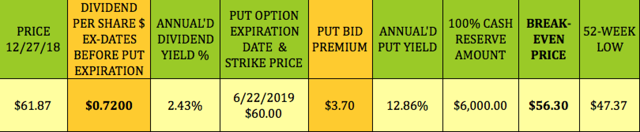

Moving additional out in time, to the June $60.00 put strike, would offer you a $3.70 premium, which is greater than 5 instances the $.72 in dividends for the subsequent two quarters. It provides you a $56.30 breakeven, which is ~2% above the bottom value goal.

Moving additional out in time, to the June $60.00 put strike, would offer you a $3.70 premium, which is greater than 5 instances the $.72 in dividends for the subsequent two quarters. It provides you a $56.30 breakeven, which is ~2% above the bottom value goal.

Note: Put sellers do not obtain dividends, we simply record the dividends in our put tables, so viewers can examine them to the put premiums.

Note: Put sellers do not obtain dividends, we simply record the dividends in our put tables, so viewers can examine them to the put premiums.

You can see extra particulars for these MCD and SBUX put trades, along with over 35 different trades, in our free Cash Secured Puts Table, which is up to date all through every buying and selling day.

If you are new to choices, our Options Glossary explains the phrases you may come throughout utilizing choices-promoting methods.

Summary:

There are many different expirations and strike value ranges for MCD and SBUX. If you need to be extra conservative, you possibly can promote places even additional under their present costs/share, which can supply decrease choice payouts, but additionally offer you a decrease breakeven. Given the upper market volatility, choice premiums are at present providing a lot better yields than we have encountered previously few years.

All tables furnished by DoubleDividendStocks.com, except in any other case famous.

Disclaimer: This article was written for informational functions solely, and isn’t meant as private funding recommendation. Please apply due diligence earlier than investing in any funding automobile talked about on this article.

CLARIFICATION: We have two investing providers. Our legacy service, DoubleDividendStocks.com, has targeted on promoting choices on dividend shares since 2009.

Our Marketplace service, Hidden Dividend Stocks Plus, focuses on undercovered, undervalued earnings automobiles, and particular excessive yield conditions.

We scour the US and world markets to search out stable earnings alternatives with dividend yields starting from 5% to 10%-plus, backed by sturdy earnings.

These shares are sometimes low beta equities that may supply stronger value safety vs. market volatility.

We publish unique articles every week with investing concepts for the HDS+ web site that you just will not see anyplace else.

Disclosure: I/we now have no positions in any shares talked about, however might provoke an extended place in MCD, SBUX over the subsequent 72 hours. I wrote this text myself, and it expresses my very own opinions. I’m not receiving compensation for it (aside from from Seeking Alpha). I’ve no enterprise relationship with any firm whose stock is talked about on this article.

[ad_2]