Mill City Ventures: A True Outperformer In The Specialty Finance Domain

Credit markets have become relatively unstable with tighter lending norms, rising interest rates, and a generally cautious approach from banks with respect to lending to small, high-growth businesses and real estate operators. In this environment, specialty finance companies play a key role in providing the much-needed financing to borrowers with their fast processing speeds albeit at a higher interest rate. Such companies rely on their own analysis of the opportunity rather than making sure that a borrower fits into a conventionally defined credit box, on which many larger financial institutions rely. This gives them the chance to generate alpha returns as they are lending to borrowers who may not qualify for more traditional financing. Today, we will take a deep dive into one such specialty finance company that has rock solid fundamentals and is providing excellent returns on its capital employed – Mill City Ventures III, Ltd. (OTCQB:MCVT). It’s worth noting that Mill City Ventures just filed an S-1 announcing an offering of 666,667 shares of stock and undertake a reverse split and listing of its shares to the Nasdaq Capital Market. The offering will provide additional capital for expanded sales and marketing activities and making additional specialty short-term loans. The Nasdaq listing should enhance the company’s visibility and help make its shares more attractive to investors.

Company Overview

Mill City Ventures III, Ltd. is an investment company that specializes in lending money or other specialty finance options for public and private companies to fund their operations, including start-up, acquisition, and growth. It focuses primarily on lending to privately held and publicly traded businesses. Their objective is to provide above-market returns to their investors while making every effort to lower investor risk. Apart from specialty finance, the company also provides litigation finance, asset-backed loans, title loans, tax anticipation loans, real estate bridge loans, mortgages, and so on. The company is headquartered in Wayzata, Minnesota.

Business Model

Mill City Ventures III started off as a business development company back in 2013 and has transformed into a full-fledged specialty finance company and non-bank lender providing credit to borrowers that might otherwise have trouble getting short-term financing. Borrowers use the money for a range of purposes. In contrast to traditional banks’ more formulaic, ratio-driven approach, Mill City Ventures evaluates each loan request by considering hard data like the borrower’s intention and ability to pay, as well as the asset value of any pledged collateral. The biggest advantage of Mill City Ventures is its fast-processing speed which justifies the higher cost of borrowing for any borrower, and this is one reason why companies flock to them with loan proposals. With fewer reporting requirements, the company has significantly higher flexibility with respect to its investments and lending policy and it has an excellent blend of aggressive lending and robust risk management. This company’s risk management is evident from the fact that it has not reported any non-performing assets to date. It also has a much lower cost of processing proposals given the lower volume of staff and overhead and a much flatter organizational structure than traditional banks, with rapid decision making on loan requests.

Key Metrics & Lending Success Stories

As per its most recent balance sheet, Mill City Ventures III is managing a little less than $19 million if we consider the total debt and equity holdings of the company. On these funds, the company currently generates trailing 12-month revenue of $3.11 million and net income of $1.50 million. It has a solid return on equity of 11% and an overall return on capital employed of 9.4%. Mill City Ventures III has had some noteworthy success stories in the lending business as it looks to seize new lending opportunities in settled claims, asset-based loans, real estate-backed loans, and other specialized lending scenarios. One of their clients, a Minnesota real estate developer, borrowed $3.9 million from the company to carry on with active apartment development projects. The developer’s share of the sale of a different apartment building was expected to bring in $18 million and they were a rock-solid client with a sizable net worth, expected to repay the loan upon completion of the sale of apartments. Mill City Ventures III expected to earn a net interest and closing fee income of $365,000 on this transaction, an ROI of more than 32% which is truly phenomenal. Another example of a successful real estate lending deal was the company lending $3.4 million to an Arizona real estate developer to close on the land and seek final development approvals. The ROI on this transaction was as high as 58.29%. A non-real-estate example would be Mill City Ventures III financing Ammo Inc., the renowned American ammunition and munition components manufacturer, and GunBroker.com, the top online marketplace for the legal sale of firearms. The company is expected to have a solid upside from this transaction as well.

The company’s flexible structure, ability to analyse and quickly process loans puts the company in a position where its growth is constrained only by its access to capital. The current offering will provide additional for the company to supercharge its already impressive growth.

Final thoughts

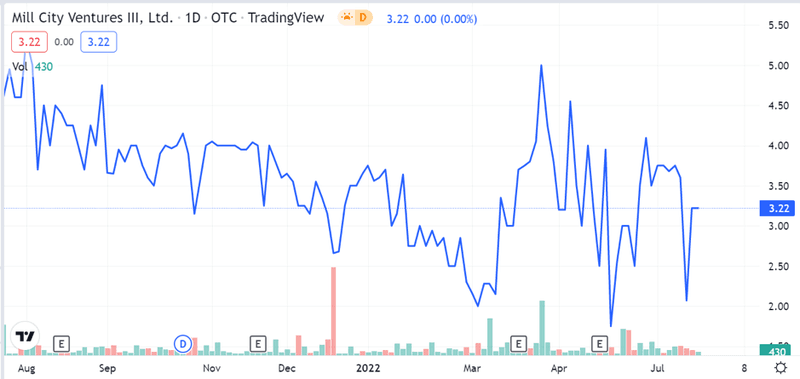

Despite the flat trajectory of the company’s stock, Mill City Ventures III’s fundamentals remain solid. Given its current scale, the company is not subject to many of the regulatory limitations that govern other traditional lenders or institutional competitors. This allows them to be more aggressive in their lending while generating superior returns. With a more aggressive approach come greater risks but management has highly effective risk mitigation measures in place and is continuously focusing on driving blended portfolio returns upwards. They have a greater income statement leverage with its low operating costs and this maximises profitability and the Return on Equity for shareholders. Mill City Ventures also has the opportunity for inorganic growth through complementary and profitable acquisitions of other investment management companies with strong loan books. This company may look like a bank lender, but it generates returns closer to a high-rate equity investor. Overall, we are extremely bullish on Mill City Ventures and we believe that the company is a solid investment proposition for small-cap investors.