MRC Global: Will Engine Capital’s Push For A Sale Help In Unlocking Hidden Value?

MRC Global (NYSE:MRC), a renowned distributor of pipes, valves, and fittings, has recently found itself in the spotlight, and the attention it is receiving from activist investor Engine Capital is turning heads. As the stock price of MRC Global saw an uptick, news broke that Engine Capital is pushing the company to explore a sale, citing the stock as "deeply undervalued" in its Q3 letter to investors. Engine Capital, holding a significant 4% stake in MRC Global, envisions the company's potential to fetch anywhere between $14 and $18 per share in a sale, according to a Bloomberg report. In this article, we will delve into the factors at play and evaluate whether MRC Global is indeed a promising prospect for investors in search of untapped value in the market.

What Does MRC Global Do?

MRC Global Inc., operating through its subsidiaries, specializes in the distribution of a wide range of infrastructure products and services, including pipes, valves, fittings, and more, catering to diverse markets such as gas utilities, energy, and industrial sectors across the United States, Canada, and internationally. The company's extensive product portfolio encompasses various valve types (such as ball, butterfly, gate, globe, check, diaphragm, needle, and plug valves), lined corrosion-resistant piping systems, control valves, valve automation, and measurement, steam, and instrumentation products. Additionally, MRC Global offers carbon steel fittings and flanges, stainless steel and alloy pipes, tubing, fittings, and flanges, carbon line pipes, natural gas distribution products (like risers, meters, polyethylene pipes, and fittings), oilfield and industrial supplies, including high-density polyethylene pipes and specialized production equipment like tanks and separators. The company also provides a range of services, from product testing, manufacturer assessments, and technical support to just-in-time delivery, order consolidation, and valve inspection and repair services. MRC Global's products find application in demanding operating conditions, including those with high pressure, extreme temperatures, and corrosive or abrasive environments.

Sector Performance & Diversification

MRC Global's performance is significantly influenced by the performance of its sectors, namely Production and Transmission Infrastructure (PTI), Gas Utilities, and Downstream, Industrial, and Energy Transition (DIET). In the coming years, a key driver for the company's stock will be the growth and stability of these sectors. PTI has shown robust performance, especially in the Permian Basin, while DIET experiences fluctuations due to project and turnaround activity. The company expects high single-digit growth in DIET and double-digit growth in PTI. Furthermore, the company's diversification strategy, with approximately two-thirds of its revenue generated outside the traditional oil field, contributes to its overall resilience. The ongoing strength and growth in these sectors, coupled with diversification, will be pivotal in driving MRC Global's future stock performance.

Margin Improvement

MRC Global's ability to maintain and enhance its gross margins is a crucial factor for its future performance. The company's adjusted gross margins stood at a robust 21.5% in the second quarter, benefiting from a higher-margin product mix, improved contract terms, and international segment revenue. Despite supply chain fluctuations and inflation stabilization, the company expects its average adjusted gross margins to remain around 21%, well above pre-pandemic levels. Maintaining these margins reflects efficiency and profitability, making it a key driver for shareholder value creation.

Cash Flow Generation & Liquidity

Cash flow generation is another vital driver for MRC Global's business. The company aims to generate strong cash flow from operations, with an emphasis on reducing inventory levels for the remainder of the year. In the second quarter, MRC Global generated $20 million in cash from operations, and this is expected to accelerate in the latter part of the year. Strong cash flow indicates the company's ability to manage its working capital efficiently and supports its financial stability. Additionally, the company's solid liquidity position, with $630 million in total liquidity, ensures it has the flexibility to address future financial needs, including refinancing its term loan. This stability and flexibility contribute to the stock's attractiveness for investors.

Final Thoughts

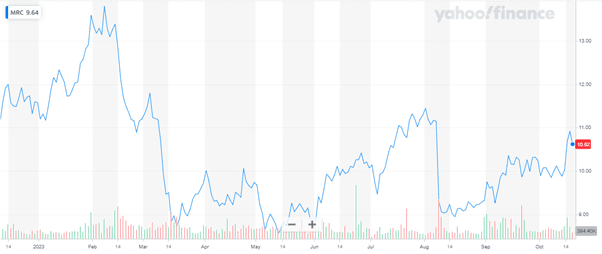

Source: Yahoo Finance

We can see the spike in MRC Global’s stock price after the push from Engine Capital. As the situation unfolds and MRC Global gears up to report its Q3 results on November 7, investors are left pondering whether an acquisition will go through or not. The company is currently valued cheaply at an Enterprise Value/ Revenue of 0.51x and an Enterprise Value/ EBITDA of 15.69x which means there is a good chance of acquisition taking place. MRC Global's future performance in the coming years is expected to be driven by the growth and stability of its sectors, particularly PTI and DIET, along with its diversification strategy. Overall, we believe that Engine Capital's push for a sale of MRC Global has the potential to unlock the hidden value of the stock, making it an enticing opportunity.