National CineMedia Wants a Bigger Audience—Here’s How It’s Getting One

National CineMedia (NASDAQ:NCMI), the small-cap cinema advertising company you have probably encountered every time you show up early for a movie, just made a pretty interesting move. The company announced in mid-November 2025 that it’s buying Spotlight Cinema Networks—a group best known for advertising inside luxury boutique theaters. In simple terms, NCM is expanding into trendier, higher-end cinemas that pull in audiences with more disposable income, stronger brand loyalty, and a love for premium experiences. By bringing Spotlight under its wing, NCM expects to boost its national market share by around 6% and grow its presence in the huge New York and Los Angeles markets by about 30%. With Spotlight valued at just 4.5x pro forma EBITDA, well below NCM’s own trailing valuation, many investors are now asking what this deal might really mean for NCM’s future.

Expanded Luxury Audience & Geographic Reach

Spotlight Cinema Networks’ core strength lies in its presence within luxury boutique theaters—venues known for upscale customer experiences and premium environments. These locations typically attract high-income, culturally engaged consumers who are difficult to reach through traditional mass-market advertising channels. For NCM, this means an immediate upgrade in audience quality and the ability to offer brands highly targeted campaigns in curated environments. Critically, Spotlight adds significant presence in the New York and Los Angeles markets—two of the most advertiser-coveted DMAs in the U.S.—where NCM previously had weaker penetration. With a 30% increase in theater presence in these metro areas, NCM’s media buying footprint becomes far more competitive against streaming and digital alternatives that already dominate urban consumer attention. Moreover, luxury cinema-goers tend to be less price-sensitive and more engaged with the cinematic experience, enabling higher CPMs and stronger brand recall—metrics already supported by NCM’s 89% ad recall on premium placements like the Platinum Spot. The geographic synergy is also critical when integrated with NCM’s growing local and Programmatic platforms, allowing for localized, high-ROI campaigns that are both demographically precise and geographically optimized. As advertisers increasingly demand both scale and precision, the Spotlight acquisition directly addresses this dual imperative by blending reach with refinement—factors that could prove particularly effective in attracting higher-margin luxury, travel, automotive, and tech brands.

Boost To Programmatic Inventory & Yield

National CineMedia has made significant progress in diversifying its sales channels, particularly through Programmatic advertising. In Q3 2025, Programmatic revenue quadrupled year-over-year and grew 82% sequentially, with the majority of demand coming from new advertisers. However, one persistent constraint has been inventory depth, especially in premium urban theaters that perform well with digital buyers seeking high-intent audiences. The Spotlight acquisition directly alleviates this bottleneck by introducing additional upscale screens into NCM’s digital buying stack, boosting the total Programmatic-eligible inventory pool. As a result, NCM will be better positioned to fulfill large-scale, automated buys from agencies and DSPs that increasingly prioritize premium, brand-safe, and viewable environments—criteria Spotlight theaters naturally meet. This infusion of high-quality impressions could increase bid density and CPMs within NCM’s real-time bidding ecosystem, particularly as advertisers double down on first-party data and contextual relevance. With national CPMs softening in Q3 due to scatter market fluctuations, having differentiated, premium inventory becomes essential for maintaining pricing power and optimizing yield. In addition, by layering Spotlight screens into its NCMX data and Bullseye geotargeting products, NCM can create new addressable audience segments for Programmatic campaigns—blending the prestige of luxury locations with the scale of automated delivery. This synergy not only monetizes the new footprint more effectively but also provides a strong hedge against cyclical ad budget shifts by anchoring NCM’s Programmatic offering in high-performance, high-recall settings.

Strategic Leverage For Self-Serve & Local Sales Channels

While Programmatic garners the headlines, NCM is also scaling up its self-serve and local sales capabilities to better engage mid-market and regional advertisers. Q3 saw self-serve revenues jump 23% quarter-over-quarter, driven by CRM-based lead generation and predictive AI models that identify high-value prospects. Spotlight’s luxury exhibitors represent an ideal channel expansion opportunity for this segment. Upscale venues often host community events, film festivals, and bespoke programming that aligns well with local businesses and lifestyle brands looking to reach affluent, experience-driven consumers. Integrating Spotlight’s screens into NCM’s self-serve portal will offer these advertisers a more diverse set of options tailored to premium environments, helping to increase conversion rates and campaign retention. On the local side, NCM has been adding senior sales talent with regional expertise to deepen relationships across key territories. With the Spotlight acquisition bringing new local inventory in Tier 1 markets, this upgraded salesforce can pitch location-specific campaigns that balance national reach with community relevance. Additionally, NCM’s Bullseye and Boost products—both designed for geo-triggered engagement—can be deployed more effectively across Spotlight’s boutique network, enabling granular campaign tracking and precise audience targeting. These tools have already demonstrated strong performance, including a 110% lift in verified store visits for a recent wireless campaign. With Spotlight’s luxury footprint in the mix, the local & self-serve engines become even more differentiated, potentially reducing advertiser churn and opening up new monetization pathways.

Enhanced Platform Stickiness & Brand Positioning

National CineMedia is not just trying to sell ads—it’s positioning itself as a performance-driven media platform that blends cinematic impact with measurable outcomes. The Spotlight acquisition enhances this value proposition by reinforcing NCM’s premium narrative. Advertisers increasingly want high-engagement environments that deliver both emotional resonance and verifiable results, and cinema remains one of the few formats that reliably delivers both. Spotlight theaters, with their elevated ambiance and attentive audiences, extend this value proposition further, allowing NCM to command a premium brand position in the media marketplace. The recent success of NCM’s Platinum Spot—with 89% ad recall—and 4DX format—driving 85% ad recall—shows how vital immersive experiences are to brand lift. By adding Spotlight into its inventory suite, NCM gains not only additional screens but also a more refined storytelling environment that aligns with experiential marketing trends. This could help NCM better compete with premium digital formats such as YouTube Select or streaming pre-rolls. Moreover, the integration of Spotlight venues into attribution platforms like iSpot—where cinema is now benchmarked alongside linear and streaming TV—allows advertisers to quantify cinema’s contribution to the marketing funnel. Early case studies, such as a travel brand seeing 3x faster conversions than TV, underscore how stickiness is no longer just about screen time but about attributable ROI. In this context, Spotlight becomes a lever to enhance NCM’s platform economics and elevate its perceived media value—especially critical for a small-cap player seeking to punch above its weight.

Final Thoughts

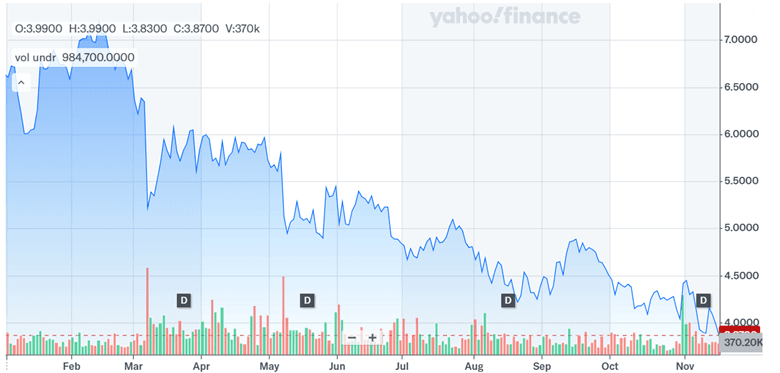

Source: Yahoo Finance

National CineMedia’s stock has been on the downslide for the past year and the purchase of Spotlight Cinema Networks has done little to change that. With its LTM valuation multiples landing around 17.76x EV/EBITDA and 1.47x EV/Revenue, the company is priced as a small-cap that still has something to prove but also room to run. Spotlight’s low 4.5x purchase multiple looks attractive, but like most deals, the real impact will depend on how smoothly NCM blends the two businesses and how well the combined platform performs over time. It is a situation with genuine potential—but also real execution questions—so it is worth watching without assuming anything is guaranteed.