Palantir’s Pentagon Power Play: The Story Behind The $7.1 Billion Backlog & The 600% Rally!

Palantir Technologies (NASDAQ:PLTR) has executed a breathtaking transformation from its early days as a scrappy Silicon Valley analytics upstart into a linchpin of U.S. national security. In Q2 2025, the company surpassed $1 billion in quarterly revenue for the first time, fueled by 68% year-over-year growth in its U.S. business and a record $2.3 billion in total contract bookings. Under CEO Alex Karp’s unapologetically bold vision, Palantir has leveraged its proprietary ontology-based AI platform—Foundry and AIP—to win marquee defense awards, including a consolidated $10 billion, ten-year Army enterprise agreement and a $218 million Space Force delivery order. Its crisis-response prowess has also earned it roles in pandemic vaccine logistics, real-time battlefield intelligence in Ukraine and Israel, and high-stakes immigration-enforcement pilots. Yet as Palantir’s stock has climbed over 600% in the past year, its LTM enterprise-to-revenue multiple now stands at roughly 118×—a valuation premium that demands scrutiny against concentration risks, ethical controversies, and mounting regulatory overhang.

Growth Strategy Powered By AI

Palantir’s AI-driven growth centers on its ontology-first architecture, which layers domain-specific data models atop large language and machine-learning engines. Unlike standalone LLM solutions prone to “jagged intelligence,” Palantir’s ontology concretizes human expertise into software, enabling consistent, auditable, and explainable AI outcomes at scale. Clients re-platform onto AIP—Palantir’s opinionated set of building blocks—because it compresses deployment timelines by up to tenfold compared with unstructured hyperscaler toolkits. TeleTracking’s leadership reported a flood of industry inquiries after publicly embracing AIP, while Nebraska Medicine achieved a 2,100% increase in discharge-lounge utilization—effectively adding capacity equivalent to a new hospital unit—by automating patient-flow analytics. Palantir’s AI FDE layer further accelerates delivery by autonomously generating and debugging data transforms, functions, and applications under human supervision, reducing weeks of development to hours. In manufacturing, Warp Speed has cut production-line balancing from a day to an hour for defense-industrial clients. From speeding Citibank’s KYC checks from nine days to mere seconds, to shrinking Fannie Mae’s mortgage-fraud detection from two months to seconds, Palantir’s ontology-powered approach is touted as the only way to operationalize AI reliably in mission-critical contexts. This unique integration of LLMs, workflows, and structured domain knowledge has propelled Palantir to 48% consolidated revenue growth in Q2 and underpins its aggressive guidance for sustained 50%+ growth into 2026.

Expanding U.S. Government Contract Pipeline

Palantir’s expanding U.S. government backlog reflects its entrenched role across defense, intelligence, and civilian agencies—and secures a multiyear annuity stream fueling valuation support. In Q2 2025, U.S. government revenue grew 53% year-over-year to $426 million, buoyed by a $795 million ceiling increase on the Maven Smart System contract and a $218 million delivery order from the Space Force for synchronized multi-domain operations. The consolidation of 75 Army software agreements into a single, ten-year, up to $10 billion enterprise contract marks a watershed, underscoring the Pentagon’s reliance on Palantir’s AI capabilities. Total remaining deal value climbed to $7.1 billion—up 65% year-over-year—and remaining performance obligations rose 77%, providing clear visibility into revenue streams. Palantir’s lobbying spend has more than quadrupled since 2019, and company alumni have assumed senior federal IT positions, enhancing its policy influence. Its technology underpins vital operations—from vaccine distribution tracking at HHS to real-time battlefield intelligence in Ukraine and Israel—demonstrating that crisis-response agility and institutional trust go hand-in-hand. With the U.S. Department of Defense allocating over $58 billion annually for software, Palantir’s deep institutional footprint positions it to capture follow-on awards and perpetuate high-margin renewals, solidifying government contracts as both a growth driver and a strategic moat.

Accelerated Crisis-Response Capability

Palantir’s reputation for deploying mission-critical software within 24–36 hours in emergent crises distinguishes it from legacy defense contractors and pure-play AI firms. At the pandemic’s outset, Foundry was swiftly reconfigured to oversee viral-spread modeling, vaccine-production coordination, and nationwide distribution logistics—winning high-priority HHS and DoD engagements. In early 2022, CEO Alex Karp personally flew to Kyiv to integrate Palantir’s platforms across multiple Ukrainian agencies, enabling dynamic battlefield mapping, supply-chain management, and intelligence fusion. Following the October 2023 Hamas attacks on Israel, Palantir teams were on the ground in days, supporting both defense operations and humanitarian relief. In the immigration sphere, its data-fusion pilot for ICE aggregated cross-agency records to expedite enforcement actions, spurring debates over civil-liberties safeguards. Beyond U.S. borders, Palantir is pursuing high-stakes AI ventures in the Gulf—modernizing Saudi Arabia’s healthcare system and advancing Neom’s smart-city vision—despite past human-rights concerns. This ability to pivot its ontology-driven stack to diverse theaters—public health, defense, homeland security, and international development—at exceptional speed underpins Palantir’s claim to unmatched operational readiness, and has translated into premium contract awards and swift expansions at existing clients.

High Client Concentration With Ethical Controversy Vulnerability

Palantir’s growth narrative is tempered by risks stemming from customer concentration and ethical controversies that could spur reputational damage or regulatory intervention. The company’s top 20 clients now generate on average $75 million each in trailing-12-month revenue—up 30% year-over-year—highlighting profound account penetration but also potential vulnerability should a marquee client scale back or opt for competitive alternatives. U.S. government contracts represent roughly a quarter of revenues, yet high-profile consolidations like the $10 billion Army agreement magnify single-customer exposure. Ethically, Palantir’s collaboration with ICE on immigration-enforcement tools prompted an open letter from 13 former employees decrying “normalizing authoritarianism,” and its renewed presence in Saudi Arabia’s healthcare and Neom projects signals a departure from its professed commitment to democratic values. Although Palantir insists on comprehensive usage logging and audit trails, ultimate control rests with government agencies, raising concerns that its platforms may facilitate surveillance or rights infringements. As global AI governance frameworks tighten and data-privacy regulations evolve, Palantir’s willingness to pursue any remunerative contract without restrictive use clauses could invite heightened oversight, contract suspensions, or reputational harm—factors that could undermine its valuation and growth trajectory if not proactively managed.

Final Thoughts

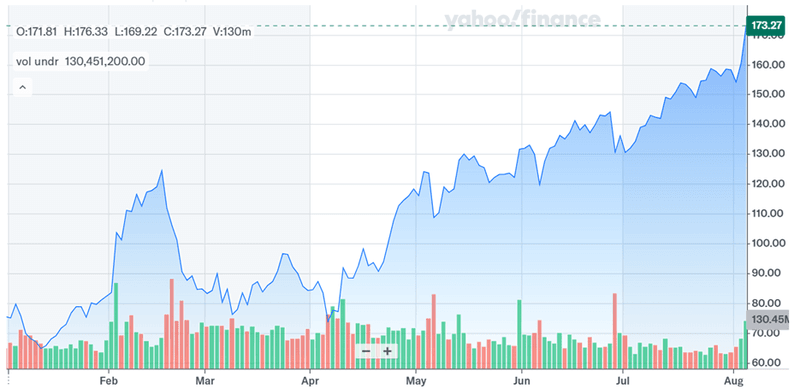

Source: Yahoo Finance

Palantir’s rally has been unreal and the stock has more than doubled in the last 6 months but the big question is whether this is sustainable. The company’s journey—from niche data-analytics pioneer to a dominant national-security AI platform—has been powered by its ontology-driven AI architecture, crisis-response agility, and an ever-expanding U.S. government backlog. These strategic assets have driven record revenue growth and premium contract wins, justifying investor enthusiasm amid 600% stock appreciation. However, its current LTM valuation multiples—approximately 118x enterprise value to revenue and over 678x EV/EBITDA—reflect exceptionally high market expectations and leave limited room for execution missteps. Customer concentration and ethical controversies around immigration enforcement and overseas deployments present real reputational and regulatory risks that could dampen growth if governance frameworks tighten. Balancing these durable strengths against valuation stretch and potential overhang will be crucial for stakeholders seeking to assess whether Palantir’s pioneering role in the AI-security nexus is enough to justify its lofty price tag.