Pasithea Therapeutics: An Emerging Biotech Player With An Immediate Revenue Generation Upside

Investing in development stage biotechnology companies can be scary. For months together, these companies do not have revenues and require constant fundraising which results in increased dilution of investors’ stake. Moreover, there is always a heavy risk of failure with respect to the regulatory approval of the drug that the company may be developing. However, investors are generally much more comfortable with investing in biotech companies that have a parallel revenue stream and a profitable business line generating sufficient cash flows to finance the drug research. Our small cap pick of the day for our readers is one such recently listed biotech player within the mental health domain that has a huge upside potential not just from its drug development but also from its ketamine infusion business – Pasithea Therapeutics (NASDAQ:KTTA) (NASDAQ:KTTAW).

What does Pasithea Therapeutics do?

Pasithea Therapeutics is a biotechnology company focused on the research and development of treatments catering to psychiatric and neurological disorders. Its biotech operations are focused on developing drugs that target the pathophysiology underlying such disorders and it is working towards developing novel pharmacological agents that have an increased level of effectiveness on patients suffering from illnesses such as depression, PTSD (post-traumatic stress disorder), schizophrenia, and so on. The company is currently building its drug development pipeline and will be going through the standard IND (Investigational New Drug) application process and should take a couple of years year to commercialize its first set of therapies. However, the company has a simultaneous revenue stream launching shortly, in the form of intravenous ketamine infusion related business support services to registered mental health clinics for which the company has already established partnerships in locations across Los Angeles, New York City and London.

Services To Anti-Depression Clinics

Pasithea’s near-term revenues are expected to commence through its operation of providing business support services to mental health clinics in the UK and the US. These business support services will include enabling registered healthcare providers to assess patients and administer intravenous infusions of ketamine in order to help the patients deal with a wide variety of psychiatric issues. The company intends on keeping these operations lean and with a minimal investment in any kind of fixed costs which is why it intends to operate through partnerships with healthcare companies. Its 2 key partners are expected to be Zen Healthcare and The IV Doc. It is worth noting that the company will be supporting existing healthcare providers and mental health clinics which means no heavy investments required in setting up its own leasing clinics and also no licensing issues with respect to ketamine. Its UK operations will be taking place through its fully-owned subsidiary, Pasithea Therapeutics Limited which has partnered with Zen Healthcare, a general practice group with two clinics in London located on Knightsbridge and Baker Street. It is worth highlighting that Zen Healthcare has a base of approximately 30,000 patients which provides Pasithea with an excellent start in terms of revenues in the UK. Also, this is the first time that this treatment will be available anywhere in London. With the partnership expected to kick off from the last quarter of 2021, we expect Pasithea to generate a positive top-line for the company quickly.

Strong Macro For Ketamine Infusion

Ketamine was initially introduced to the medical community as a surgical anesthetic over 5 decades ago but has found a strong application in the antidepressants industry. It is known to have the property of blocking N-methyl-D-aspartate, a receptor in the brain that is activated by glutamate, a neurotransmitter which can have a potentially rapid and potent antidepressant effect on the human mind. This is why it has emerged as a wonderful form of alternative antidepressant therapy across the globe. As per FutureWise Research, the global resistant depression treatment market is expected to be valued over $1 billion by the end of 2026 with an expected CAGR of 3% from 2019 to 2026. The increasing cases of depressive disorder among young population is indicative of a global need for innovative depression treatments such as ketamine which is why intravenous ketamine infusion as a treatment for depression and PTSD has become increasingly popular. Ketamine is also receiving increased backing from the US FDA and it is evident that Pasithea should have a large base of ketamine-administering clinics to cater to, in the coming years.

Drug Development Progress

This is a long-term upside with respect to Pasithea but it is worth highlighting that the company is working towards building three drug candidates focused on the neurobiology of psychiatric and neurological disorders with commercial potential. The company has been highly conservative and has not disclosed names or details of its pipeline yet but there is definitely something exciting brewing here. All of its candidates are expected to be novel drugs and not any kind of repurposed medication. The management intends to put its candidate compounds through a hit to lead stage, a stage in early drug discovery where small molecule hits from a high throughput screen are evaluated and undergo limited optimization to identify promising lead compounds. This stage will include chemistry characterization, compound metabolism, pharmacokinetics, in vitro pharmacology, in vivo pharmacology, and safety assays. After they are cleared in this stage, they will go through preclinical models of psychiatric and neurological disorders such as PTSD and schizophrenia. The managements experience and track-record in the space is what really makesobtaining the regulatory approvals to bring this to market realistic, and establishes the a healthy long-term upside for shareholders.

Final thoughts

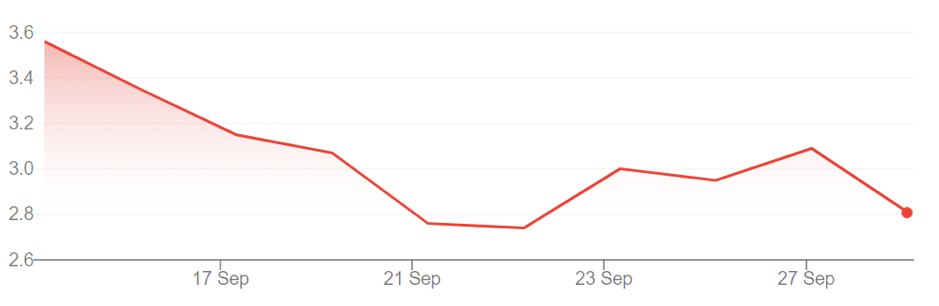

In its recent IPO, Pasithea offered 4.8 million shares at around $5 per share raising close to $24 million in net proceeds. However, like any typical biotech company, its price fell upon listing and it is currently trading below the $3 mark. This is an excellent opportunity to enter the stock as most of the market is perceiving Pasithea as a run-of-the-mill zero-revenue biotech company. The huge revenue potential of its ketamine infusion related business is certainly not factored into this stock price and we believe that it could be an excellent entry point for investors. Long term investors enjoy significant upside related to the company’s drug development pipeline and even those with a 1-2 year holding period can benefit from a sharp revenue growth in the company’s ketamine business.

Disclaimer

No Positions