Pros & Cons + (2018 Bonus Offer)

Have you ever wished that you simply had a robotic to do issues like clear your own home or stroll your canine?

ALSO READ: 4 Future Materials to Consider Investing In

After all, it’s 2018 and life might be a lot simpler if we had extra robots.

If you agree…

…you’ll probably see the good thing about a robo-advisor, which is mainly a robotic that invests cash for you.

Robo-advisors present automated, algorithm-driven monetary planning software program to construct and handle your funding portfolio.

The expertise collects data like your monetary scenario and future objectives, by a web-based survey, and gives recommendation and makes funding selections primarily based on that data.

Robo-advisors can prevent time by automating complicated, time-consuming actions like rebalancing and tax optimization.

This kind of investing may prevent cash since you cash as a result of robots are cheaper than people!

Robo-advisors weigh your private preferences in opposition to unpredictable occasions to tailor a portfolio to your particular wants. Personal preferences and unpredictable occasions embrace the next:

Personal Preferences

- Time Horizon

- Financial Goals

- Risk Tolerance

Unpredictable Events

- Asset class efficiency

- Market Volatility

- Market Conditions

Robo-advisors are nice as a result of they require minimal human interplay and might do the identical factor that people do.

And, since there are low prices and low (or no minimal funding), robo-advisors can get you started rapidly.

But generally traders want a human’s contact to information them by such a sophisticated subject.

You have many robo-advisor choices at your disposal – so which one do you have to select?

Preferably one that’s low cost, useful, and simple to make use of.

This article goals to take a look at Wealthsimple, one in every of our prime picks for greatest robo-advisors in 2018.

Wealthsimple Review Overview

Wealthsimple gives the good thing about investing with robo-advisors and people.

Founded in 2014, Wealthsimple is Canada’s largest robo-advisor with over 100,000 shoppers. And, Wealthsimple has been newly launched to the United States.

Wealthsimple has world-class monetary specialists and top-talent from Silicon Valley working for you.

Additionally, the corporate’s staff of software program engineers, designers, and information scientists are from corporations like Amazon, Google, and Apple.

Wealthsimple supplies you with world-class, long-term funding administration…

…with out the excessive charges and account minimums!

Even higher, the corporate helps you earn the very best return and might decrease your tax invoice.

But you might be questioning…

What is the purpose of Wealthsimple?

The main purpose of Wealthsimple is to make “investing easier for millennials.”

Because, as we all know, most millennials are clueless about cash.

So, how does Wealthsimple offer you a hassle-free funding expertise?

The firm places your investments on autopilot by making a diversified portfolio made up of ETF indexes.

To put it merely, Wealthsimple’s low-cost, automated funding portfolios may help you attain your long-term funding objectives.

So, aside from millennials, who’s Wealthsimple greatest for?

Beginner traders

There isn’t any minimal deposit required, and you may have your funds managed whatever the quantity.

Advanced traders

Investors with over $100,000 to speculate additionally obtain quite a few further advantages. These advantages embrace decrease charges and tax advantages.

Socially accountable and Islamic traders

This robo-advisor offers you the power to make cash whereas staying in step with your values.

That’s proper – Wealthsimple is nice for almost all people – though that largely depends upon your particular person objectives. Learn extra about Socially Responsible Investing.

How Wealthsimple works

Wealthsimple is surprisingly straightforward to make use of. The firm makes use of the Nobel Prize-winning Modern Portfolio Theory. The firm goals to diversify your portfolio by investing in a broad vary of property.

Here is how a robo-advisor works in FIVE steps…

- Complete a temporary questionnaire to evaluate your funding wants.

- The robo-advisor creates a portfolio of Exchange-Traded Funds (ETFs).

- Experts’ monitor market exercise and underlying investments to rebalance your portfolio.

- Speak with Certified Financial Planning professionals to replace and enhance your plan.

- Log in to your accounts to trace progress, make changes, and transfer nearer to your objectives.

Wealthsimple works simply as some other robo-advisor. You can start your on-line utility by deciding on the “Start Investing” button on the web site.

Signing up for the service is a breeze, to finish your sign-up, you could…

- Get started Here

- Answer a couple of questions.

- E-sign the funding administration settlement.

- Upload a financial institution assertion, a screenshot of a checking account, or a void test.

If you expertise any hassle signing up, you’ll be able to contact Wealthsimple at +1 (855) 782-3559 or e-mail help@wealthsimple.com

Wealthsimple gives a number of account sorts, together with particular person and taxable accounts…

- Personal: Build long-term wealth alongside your 401(ok) and IRA.

- Traditional IRA: Save for retirement and decrease your taxes.

- Roth IRA: Save for retirement and withdraw cash tax-free.

- SEP IRA: Save for retirement in case you are self-employed.

- Joint: For accounts with a number of homeowners.

- Trust: Hold property for a beneficiary.

- Smart Savings: Stash your money for the short-term.

They additionally present 4 sorts of funding accounts:

- Wealthsimple Basic

- Wealthsimple Black

- Wealthsimple Socially Responsible Investing

- Wealthsimple Halal Investing

We have the small print on every of those accounts under.

Wealthsimple Basic

The Wealthsimple Basic portfolio is the most typical possibility.

This account is for account balances between $0 – $100,000. The administration price is 0.50% yearly and manages your first $5,000 invested without spending a dime.

This portfolio gives the next providers…

- Automatic deposits and account rebalancing

- Tax-loss harvesting

- Dividend reinvesting

- Personalized portfolios

- Expert monetary recommendation

From there, you’ve gotten three decisions in your portfolio:

- Conservative: 65% bonds and 35% shares

- Balanced: 50% bonds and 50% shares

- Growth: 80% shares and 20% bonds

Your ‘risk setting’ determines whether or not it’s best to go along with a conservative, balanced, or development portfolio. The solutions that you simply present in your questionnaire will decide your danger setting (however you’ll be able to override this).

Each portfolio is made up of ten totally different ETFs (six stock funds and 4 bond funds).

Wealthsimple Black

This account is for account balances over $100,000+ and gives each characteristic included within the Basic account, plus:

- Lower charges: Management price of 0.4%

- Goal-based planning: Get a monetary planning session with an knowledgeable monetary adviser.

- VIP airline lounge entry: Global entry to 1,000+ airline loungers in over 400 cities with a complimentary Priority Pass membership for you plus one journey companion.

Otherwise, the portfolio choices are just like that of the Basic account.

Wealthsimple Socially Responsible Investing (SRI)

Wealthsimple additionally offers you the chance to put money into good causes.

The SRI accounts concentrate on corporations that help:

- Low carbon emissions

- Gender variety

- Affordable housing

You can see for your self which ETFs you’re investing in and what causes they help.

Here are the six funds provided with the SRI portfolio:

- iShares MSCI ACWI Low Carbon Target (CRBN)

- EnergyShares Cleantech Portfolio (PZD)

- iShares MSCI KLD 400 Social Index Fund (DSI)

- SPDR Gender Diversity (SHE)

- EnergyShares Build America Bond Portfolio (BAB)

- iShares GNMA BD ETF (GNMA)

SRI portfolios do carry barely larger prices related to retaining your investments “socially responsible.” Otherwise, the SRI portfolio gives the identical price construction and asset allocation because the Basic and Black accounts. The main distinction includes the ETFs that you may be invested in.

P.s. If you’re actually thinking about Socially accountable investing, you must also check out Swell Investing.

Wealthsimple U.S. Halal Investing

Wealthsimple has additionally created a portfolio possibility that makes investing straightforward for Islamic individuals. The Halal portfolio doesn’t embrace bonds, which works in opposition to Islamic legislation that stops taking advantage of debt.

These portfolios should not tailor-made to particular person traders for the reason that shares on this portfolio should adjust to Sharia legislation.

Complying with Islamic legislation means no funding in corporations that revenue from tobacco, playing, or different restricted industries.

The prime ten holdings within the Halal portfolio embrace:

- Johnson & Johnson (JNJ)

- Novartis AG-Sponsored ADR (NVS)

- Exxon Mobil Corp (XOM)

- SAP SE-Sponsored ADR (SAP)

- Procter & Gamble (PG)

- Canon Inc.-Sponsored ADR (CAJ)

- Total SA-Sponsored ADR (TOT)

- Pfizer Inc. (PZE)

- Alibaba Group Holding-Sponsored ADR (BABA)

- Unilever N V-NY Shares (UN)

Wealthsimple Tools

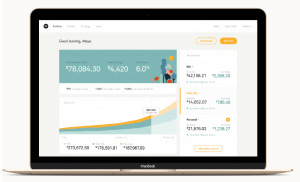

Wealthsimple gives a easy, easy-to-use web site with out many extras.

You may obtain Wealthsimple’s app (obtainable on Android and iOS), which is similar to the performance on the positioning.

You can use the app for:

- Viewing your portfolio

- Tracking account exercise

- Making deposits

- Updating your profile

This makes accessing your investments very straightforward, which was an vital characteristic for us.

Wealthsimple additionally gives academic supplies and instruments to provide you a greater understanding of how your investments are doing.

Our favourite device that you need to use it known as Wealthsimple Roundup. This characteristic rounds up the “change” in your purchases.

For instance, if you are going to buy a $3.75 espresso that buy might be rounded as much as $4.00. Once per week your cash might be mixed and invested. Talk a couple of fully-automated strategy to make investments.

And, imagine us – that cash can actually add up!

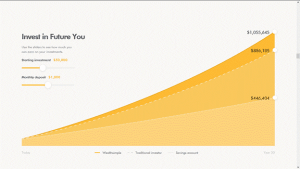

Another device we like is the compound curiosity calculator that you simply exhibits you your investments potential over time.

Seeing your funding potential can encourage you to get started – today!

You may be taught extra about your investments typically in with firm’s academic supplies.

Here is an instance of that with the corporate’s clarification of an ETF:

This data is easy and straight to the purpose.

If you want further data, there’s a wealth of it that may be discovered anyplace on the web.

Wealthsimple Customer Service

This service permits robots to do your investing, however…

…Wealthsimple gives customer support that may help you in opening your portfolio, particular investments, making a monetary plan, and extra.

You can attain buyer help…

You may entry licensed monetary planners and chartered funding managers. This entry is a formidable alternative that MOST robo-advisors don’t supply.

Despite its low-cost choices, Wealthsimple doesn’t skimp on customer support {and professional} funding recommendation.

This profit ensures that your investments will get, and keep, heading in the right direction.

Bonus supply: Open an account at this time and get your first $5,000 invested for FREE. Click Here

* this supply gained’t final eternally

Wealthsimple Fees

I do know what you’re pondering…

…that is nice, however how a lot is it going to value me?

There aren’t any upkeep, buying and selling, rebalancing or switch charges.

The price construction of this firm is easy. Wealthsimple costs a flat share for all account balances. There are two annual price tiers…

- Wealthsimple Basic: 0.5% annual price on account balances $0 – $100,000.

- Wealthsimple Black: 0.4% annual price on accounts balances over $100,000.

In addition to those charges, you have to to pay the expense ratios associated to the ETFs in your portfolio.

These charges are barely larger in comparison with different robo-advisors, however signify a fraction of what you’d pay a human monetary advisor or massive establishment!

These charges are normal inside the business, and there are no hidden charges.

What we love from this Wealthsimple Review

Account choices

Your choices embrace: particular person and joint taxable accounts; trusts; conventional, Roth, and SEP IRA accounts.

Access to monetary planners

Automation is the primary advantage of robo-advisors, however generally you want human interplay.

Wealthsimple offers all clients the power to get customized assist from one of many firm’s licensed monetary planners or chartered funding managers.

Wealthsimple Basic shoppers obtain a 15-minute telephone name to ask inquiries to a monetary planner. These questions might embrace…

- How ought to I be saving?

- Which account is greatest for me?

- How will my investments be taxed?

Wealthsimple Black shoppers get extra options with their plan. These options cowl considerations like…

- Will I manage to pay for to retire?

- Which accounts ought to I withdraw cash from?

- How can I enhance my plan?

Having entry to funding professionals is extraordinarily vital and that is the place Wealthsimple stands out in comparison with different robo-advisors.

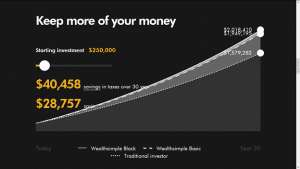

Free tax-loss harvesting

Tax-loss harvesting lowers an investor’s taxes by offsetting revenue with any funding losses. This service is often a paid add-on service or solely obtainable for very rich funding shoppers.

However, any Wealthsimple buyer can have a portfolio analyst evaluation their accounts for tax-loss alternatives.

This free profit will be vital and can pay-off the primary time you file your taxes.

Minimum preliminary funding

There is a $0 account minimal for the Wealthsimple Basic portfolio. This service consists of free automated deposits, automated rebalancing, and dividend reinvestment.

This makes investing with a robo-advisor simpler than ever!

Account charges

Wealthsimple costs no charges for transfers, buying and selling, or tax-loss harvesting. You simply pay an annual price in your account steadiness.

Socially accountable funding choices

You don’t have to fund massive firms to speculate.

You can put money into corporations focusing on issues like clear expertise innovation, efforts to decrease carbon publicity, and supporting variety in management roles.

You can put your cash to work and do some good!

Shariah-compliant portfolio choices

You can put money into a halal portfolio, which is a portfolio that complies with Islamic legislation.

Wealthsimple gives a portfolio containing round 50 particular person shares which are reviewed by a third-party committee of Shariah students.

What we don’t love about Wealthsimple

Account administration charges

Wealthsimple costs a 0.5% administration price on account balances lower than $100,000. And 0.4% on balances over $100,000.

In distinction, quite a few different robo-advisors cost between 0.25 – 0.35% administration charges.

SRI fund administration charges

It will not be at all times low cost to speculate responsibly.

Socially accountable investments usually come at the next value in comparison with different funding choices. SRI portfolios can cost round 0.25% administration charges whereas non-SRI portfolios are roughly 0.1%.

Is Wealthsimple for you?

Most robo-advisors are comparatively related in funding format and price construction.

So, how have you learnt which robo-advisor is best for you? Let’s take a look at the ultimate particulars…

You can open an account with just $1, so these portfolios can be found to any investor. Also, you’ll not pay a dime in your first $5,000 invested.

Wealthsimple does cost larger charges than most robo-advisors – and you might find yourself paying 0.10 – 0.25% extra, per yr. But once more, these charges are meager in comparison with paying a human funding skilled.

Also, one key profit that may be troublesome to measure is the entry to funding professionals.

Depending in your familiarity with investments, this profit might show to be invaluable and effectively definitely worth the larger price.

Also, Wealthsimple gives methods so that you can make investments which are constant together with your values. Robo-advisors are usually restricted in specialty portfolios, however Wealthsimple will not be.

If you want to attempt a robo-advisor, Wealthsimple is a logical place to start as a result of attempting their product is basically risk-free.

Overall, we extremely advocate Wealthsimple and advocate that you simply give them a shot.

Have you ever used a robo-advisor to speculate? What was your expertise?

Let us know your ideas with a remark under!

P.s. If you enroll at this time, you’ll get the primary $5,000 invested for FREE. Sign up here

Wealthsimple

Pros

- No administration price for first $5,000

- Tax-loss harvesting

- No minimal steadiness necessities

- Option for bigger traders

- User-friendly web site

Cons

- Higher charges in contrast competitors

- Limited accounts sorts