Ranger Energy Expands In The Permian: What The $90.5 Million American Well Services Acquisition Means

If you have been keeping an eye on the oilfield services space, there’s some big news coming out of the Permian Basin. Ranger Energy Services (NYSE:RNGR), a small-cap company known for its well servicing work, just made a bold move by announcing a $90.5 million deal to acquire American Well Services (AWS). This isn’t just any deal—AWS brings 39 active rigs, over 550 workers, and a strong track record across the Permian. The purchase is being paid with a mix of cash, Ranger shares, and a bonus payment if AWS hits certain performance goals. What’s more, the company believes this deal will boost both profits and cash flow right away. Ranger’s leadership says this will push them past $100 million in annual EBITDA for the first time—a big milestone for a company their size. Add in their new hybrid electric rigs and a balance sheet with low debt, and it’s clear Ranger is making some serious moves. So, what exactly can they gain from this acquisition? Let’s dig in.

Scale & Geographic Synergies

The most immediate synergy from acquiring American Well Services comes from the scale and depth it adds to Ranger’s existing Permian Basin operations. AWS is a 100% Permian-focused company with a robust fleet of 39 high-spec rigs and established relationships with major operators. This acquisition increases Ranger’s total rig count by roughly 25%, strengthening its market leadership position in the Lower 48. For a small-cap energy player, scale can be a key differentiator, allowing better cost absorption, higher utilization rates, and improved negotiating leverage with suppliers. The addition of AWS’s assets and workforce gives Ranger access to a broader customer base, including some it previously did not serve, while deepening ties with existing clients. By integrating AWS’s rig operations, Ranger can deploy its proven efficiency playbook used during prior integrations, like that of Basic Energy, to quickly standardize maintenance, logistics, and scheduling processes. The scale benefits also translate into stronger cross-basin optionality; even though both companies are Permian-centric, the larger combined operation allows Ranger to shift assets and crews more dynamically based on customer activity. The sheer density of rigs in the Permian—now the heart of U.S. oil production—provides Ranger with logistical advantages that can improve asset uptime and reduce idle time, a critical factor in margin expansion. Moreover, larger scale enhances Ranger’s ability to pilot and roll out new technologies, such as its ECHO hybrid electric rig, across a broader footprint, enabling faster adoption and more consistent operational data collection.

Diversification Through Complementary Service Lines

Another significant synergy lies in the diversification of Ranger’s service offerings. While Ranger has traditionally excelled in high-spec rig services, AWS brings a suite of complementary businesses that broaden its reach and revenue mix. Roughly 45% of AWS’s revenue stems from services that Ranger previously did not offer—such as tubing, rentals and inspection, chemical sales, and logistics. These additional service lines give Ranger new opportunities for cross-selling within its existing customer base while deepening relationships through bundled solutions. For instance, AWS’s tubing and inspection business naturally aligns with Ranger’s rig work, allowing a single integrated provider to handle more stages of the well servicing process, improving efficiency and customer retention. Additionally, the rental and logistics segments can help smooth revenue through cyclical downturns by providing steady demand even when completion activity slows. For a small-cap company, such diversification is essential to reducing exposure to the volatile drilling cycle. AWS’s ancillary services also provide a more balanced earnings mix—spanning production support, maintenance, and inspection—which can stabilize margins. Beyond financial diversification, these service lines introduce Ranger to new operational competencies and regional customer contracts that may open further expansion opportunities. By leveraging AWS’s established facilities, mixing plants, and logistics network, Ranger can optimize supply chain efficiencies and lower transportation costs in the field. Over time, this broader service portfolio could make Ranger less vulnerable to swings in commodity prices and more competitive against larger, diversified peers.

Operational & Cost Synergies

Ranger expects approximately $4 million in annual cost and revenue synergies from integrating AWS by the end of 2026, but the actual benefits may extend further. The company has historically been disciplined in executing integrations, and its previous success with the Basic Energy asset acquisition offers a template for capturing efficiencies. Operationally, Ranger can consolidate overlapping administrative functions, streamline maintenance and parts procurement, and optimize fleet utilization. Both companies share similar cultures and safety-first philosophies, which should minimize friction and enable faster alignment of processes. In the field, combining AWS’s experienced workforce with Ranger’s technology-enabled systems—particularly its data-driven maintenance and scheduling tools—can drive measurable productivity improvements. Economies of scale in procurement and standardized fleet management could also yield margin uplift. From a financial perspective, the deal structure itself provides leverage efficiency. Ranger financed the acquisition primarily with cash and a modest draw on its revolver, maintaining pro forma leverage below 0.5x EBITDA. This conservative approach ensures that free cash flow, which totaled $25.8 million year-to-date, remains available for debt repayment and shareholder returns. With Ranger’s adjusted EBITDA margin at 13% in the most recent quarter, even modest synergies can produce noticeable accretion. The integration timeline—targeted for completion by Q3 2026—suggests management’s confidence in realizing these efficiencies swiftly. For a small-cap energy firm where every basis point in margin matters, the combination of cost rationalization, improved fleet utilization, and enhanced back-office efficiency could translate into durable operational leverage once the integration is fully complete.

Technology & Innovation Advantages

One of the underappreciated benefits of the AWS deal is how it strengthens Ranger’s platform for technological innovation. Ranger’s ECHO hybrid electric rig program—a first-of-its-kind initiative converting conventional workover rigs into hybrid electric units—represents the company’s most forward-looking bet on emissions reduction, safety, and cost efficiency. By integrating AWS’s Permian-based infrastructure and customer network, Ranger gains a much larger sandbox to scale the ECHO program. The two initial ECHO rigs—one in the Bakken and one in the Permian—are completing final testing, and early customer feedback has been overwhelmingly positive, particularly regarding safety and noise reduction. With AWS’s 39 active rigs and strong customer ties, Ranger can accelerate adoption of hybrid rigs among Permian operators looking to meet ESG commitments and lower operational costs. The AWS acquisition also adds complementary expertise in tubing, chemicals, and logistics—all areas that could benefit from digital tracking and automation under Ranger’s growing technology umbrella. Moreover, the integration enables the company to collect richer performance data across a wider range of assets, helping refine predictive maintenance algorithms and remote monitoring systems. This data-driven approach not only improves uptime and service reliability but also differentiates Ranger from smaller competitors that lack scale to invest in such tools. In an industry gradually shifting toward automation and hybridization, AWS’s footprint offers Ranger the ideal proving ground to validate its technology roadmap while monetizing it faster. For a small-cap company, such innovation-led differentiation could be key to sustaining competitive advantage in a consolidating market.

Final Thoughts

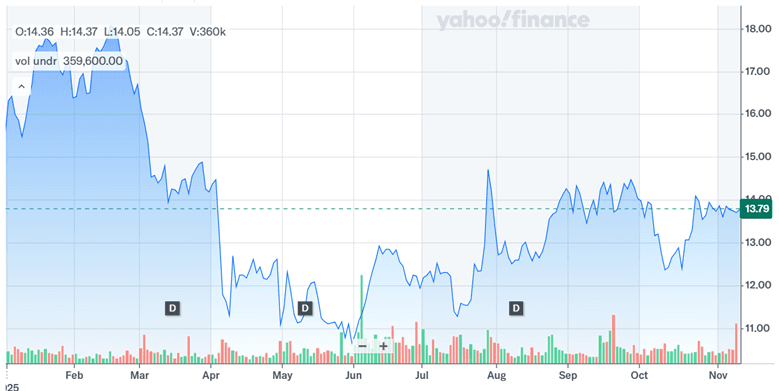

Source: Yahoo Finance

The trajectory of Ranger Energy Services’ stock has been more or less flat over the past few months and the recent acquisition has done little to change it. On valuation grounds, Ranger remains relatively inexpensive versus peers, trading at around 4.4x LTM EV/EBITDA and 0.51x EV/Revenue, which reflects investor caution but also highlights upside potential if synergies materialize. On the one hand, this acquisition could be a game-changer. It gives them more rigs, more services to offer, and a stronger position in the country’s busiest oil region. It also helps them test and roll out new technology like their hybrid rigs a lot faster. On the other hand, let’s be real—merging two companies is never easy. There’s always the challenge of getting teams and operations aligned without missing a beat, especially when market conditions can shift quickly. This deal has a lot of potential upside, but it’ll come down to how smoothly Ranger can execute its plans. For now, the company is in a solid spot financially, and this move could take it to the next level—but only time will tell how it all plays out.