Semiconductor Equipment: An Uptick As Early As Q2 2019

[ad_1]

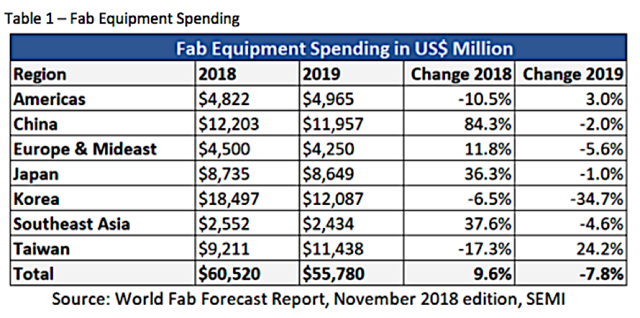

SEMI, the semiconductor tools business consortium, in December 2018 reversed its 2019 forecast, projecting the sector will drop 8%, a reversal from the beforehand anticipated improve of 7%, as proven in Table 1. Three of the foremost modifications for 2019 are related to Korea (-34.7%), China (-2.0% following progress of 84.3% in 2018), and Taiwan (+24.2%).

I mentioned in a December 20, 2018 Seeking Alpha article entitled “Applied Materials And Lam Research Face Strong Headwinds In 1H 2019,” how Applied Materials (AMAT) and Lam Research (LRCX) could be impacted by the change in Korea capex spend as a result of their excessive publicity to DRAM and NAND reminiscence chips. The reminiscence publicity of AMAT and LRCX have been 60% and 77% of whole revenues in 2018.

Positive Signals for Equipment Suppliers Outside Memory Sector

Metrology/Inspection Sector

But there are brighter indicators within the tools market. The first is the Metrology/Inspection phase, which I mentioned in a December 14, 2018 Seeking Alpha article entitled “KLA-Tencor And Metrology/Inspection Competitors To Outperform Overall Equipment Market In 2018.”

I famous that there have been 5 corporations that lead the $5 billion Semiconductor Metrology/Inspection market – KLA-Tencor (KLAC), Hitachi High Tech (OTC:HICTY), Nanometrics (NANO), Nova Measuring Instruments (NVMI), and Rudolph Technologies (RTEC).

But equally vital, I famous:

“Metrology/inspection equipment companies will benefit from the growth of the semiconductors in general, and from the need to increase in chip quality and reliability as the industry moves to 3D logic and memory chips, and more advanced technologies such as EUV lithography become more commonplace.”

Lithography

Lithography represents 20% of the general wafer entrance finish tools market. I famous in a January 23, 2018 Seeking Alpha article entitled “ASML’s Dominance Of The Semiconductor Lithography Sector Has Far-Reaching Implications,” that ASML (ASML) dominates for lithography market, not just for EUV lithography tools, however DUV as nicely.

Despite some EUV pushouts from Intel and GlobalFoundries, ASML will register revised revenues of $2.1 billion in 2018, $3.3 billion in 2019, and $4.7 billion in 2020. The $3.3 billion in revenues represents a 56% progress in 2019 over 2018.

ASML’s income represents whole system gross sales – EUV and DUV. Remember that EUV eliminates most of the deposition and etch steps utilized in a number of processing with DUV immersion lithography. Thus, the extra EUV lithography is utilized in manufacturing, the much less deposition and etch tools is required, creating further headwinds for AMAT and LRCX.

Foundries

TSMC (TSM) is the world’s largest semiconductor foundry. TSMC’s 2017 revenues by node classes, have been 10nm (10% of 2017 income), 16/20nm (25%), 28nm (23%) and >28nm (42%). TSM expects 7nm income contribution to leap to better than 20% in 4Q18 and even larger in 2019; from lower than 1% in 2Q18 and 11% in 3Q18.

Table 2 reveals semiconductor capex spend progress by machine kind for 2018 and 2019. I beforehand detailed NAND and DRAM capex spend in a November 26, 2018 Seeking Alpha article entitled “Applied Materials Is Closer To Losing Dominance In Semiconductor Equipment.” Most importantly, foundry capex spend is forecast to extend 10% in 2019, creating tailwinds for any tools producer promoting to foundries. But there’s a caveat if the tools, primarily an etch or deposition, is abated as EUV lithography ramps.

|

Table 2 – Semiconductor Capex Spend by Device Type – % Change |

||

|

Device Type |

2018 |

2019 |

|

NAND |

8% |

4% |

|

DRAM |

46% |

-33% |

|

Logic |

19% |

-1% |

|

Foundry |

-10% |

10% |

|

Source: The Information Network (www.theinformationnet.com) |

||

Investor Takeaway

SEMI’s forecast of -8% (Table 1) doesn’t point out how the semiconductor tools market will carry out in 2020. The Information Network, in its report entitled “The Global Semiconductor Equipment: Markets, Market Shares, Market Forecasts,” forecasts the market to extend 5% in 2020.

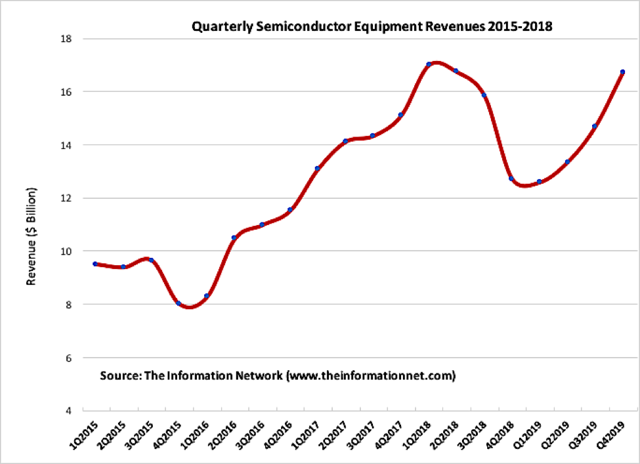

Based on the premise that the semiconductor tools market is forecast to drop 8% in 2019 and improve 5% in 2020, I’ve plotted tools progress by quarter from 2015 via 2019 in Chart 1. Revenues ought to attain its lowest level in Q1 2019 earlier than starting a turnaround via the rest of 2019.

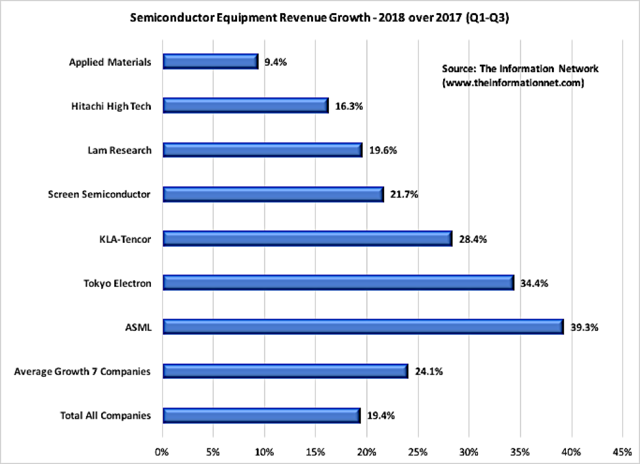

Another vital investor takeaway it how main semiconductor tools corporations will fare in 2018 going into 2019, primarily based on the truth that income will range by provider and its buyer base (e.g., reminiscence vs foundry).

Chart 2 reveals tools income YoY for Q1-Q3 2018 by the highest seven distributors and compares progress to the general tools market, which has grown 19.3% via 3Q 2018. The income progress of the highest seven corporations is 24.1% via 3Q 2018.

Two corporations will face extreme headwinds in 2019 and underperform the general international market – AMAT and LRCX.

- Applied Materials has dramatically underperformed the general market with solely 9.4% progress – solely one-half that of the general market progress and almost one-third of the common progress of the highest seven corporations.

- Lam Research simply barely matched the expansion of the general tools market so far whereas underperforming the common progress of the highest seven corporations.

With the majority of those two corporations revenues coming from reminiscence, forecast to drop considerably in 2019, and a rise in EUV lithography presenting additional headwinds, important market share loses are anticipated.

Disclosure: I/we have now no positions in any shares talked about, and no plans to provoke any positions inside the subsequent 72 hours. I wrote this text myself, and it expresses my very own opinions. I’m not receiving compensation for it (aside from from Seeking Alpha). I’ve no enterprise relationship with any firm whose stock is talked about on this article.

Editor’s Note: This article discusses a number of securities that don’t commerce on a significant U.S. change. Please concentrate on the dangers related to these shares.

[ad_2]