Signing Off 2018: India Equity Market Performance

[ad_1]

By Mahavir Kaswa, Associate Director, Product Management

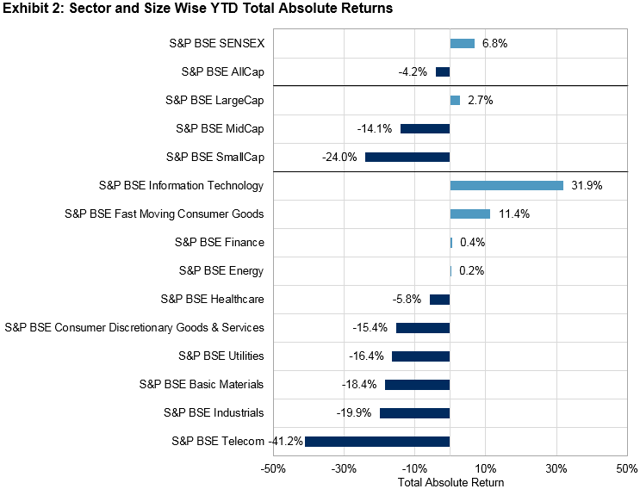

The 2017 calendar 12 months famous vital returns after a few years with almost flat returns. Continuing with the joy from 2017, the 2018 calendar 12 months started with exuberance, because the S&P BSE SENSEX reached extra frequent lifetime highs by way of the top of January 2018. However, it didn’t maintain these highs, as instantly after the price range was handed, the S&P BSE SENSEX and all different main indices skilled a pointy fall. As of Dec. 13, 2018, the S&P BSE SENSEX gained roughly 1,872 factors YTD, up 6.8% by way of whole returns.

Source: Asia Index Private Limited. Data from Dec. 29, 2017, to Dec. 13, 2018. Index efficiency primarily based on whole return in INR. Past efficiency is not any assure of future outcomes. Chart is supplied for illustrative functions.

After witnessing the least risky 12 months throughout 2017 (with an annualized volatility of 8.9%), the Indian market has seen an uptick in volatility throughout 2018, with an annualized volatility of 12.5%. On the worldwide entrance, greater oil costs, the U.S.-China commerce battle, and international financial tightening had been the highest three drivers of volatility. On the home aspect, elements such because the introduction of the long-term capital good points tax on fairness, perceived total greater valuations of Indian equities, growing rates of interest, concern over falling GDP, and these days, the non-banking monetary firm (NBFC) liquidity disaster saved the market risky all year long.

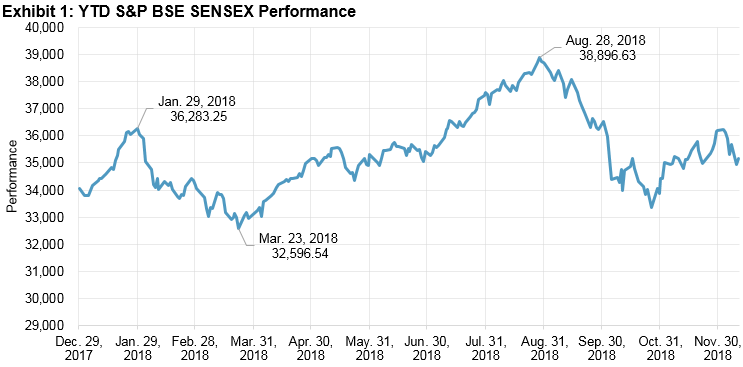

The S&P BSE AllCap, which covers greater than 95% of India’s listed fairness universe by way of whole market capitalization, declined by 4.2%. The declines within the S&P BSE MidCap (-14.1%) and S&P BSE SmallCap (-24.0%), with the simultaneous optimistic returns for the S&P BSE SENSEX (6.8%) and S&P BSE LargeCap (2.7%), could possibly be attributed to a shift in focus of buyers from mid-cap and small-cap shares to comparatively safer bets in large- or mega-cap shares.

On the sectoral entrance, the S&P BSE Information Technology and S&P BSE Fast Moving Consumer Goods famous good points of 31.9% and 11.4%, respectively. The revival in demand and sharp depreciation of the Indian rupee helped the Information Technology sector, whereas Fast Moving Consumer Goods shares famous optimistic whole returns, reflecting India’s consumption story.

Meanwhile, the S&P BSE Finance and S&P BSE Energy ended flat. The S&P BSE Telecom was the worst-performing sector index, with a complete return of -41.2%-not shocking, given that the majority telecommunication providers corporations are usually extremely leveraged and are going through a probably intense value battle.

Source: Asia Index Private Limited. Data from Dec. 29, 2017, to Dec. 13, 2018. Index efficiency primarily based on whole return in INR. Past efficiency is not any assure of future outcomes. Chart is supplied for illustrative functions.

Outlook: With the U.S.-China commerce battle not cooling off, the IMF’s current revision of the worldwide GDP development estimate to 3.7% in 2018 from 3.9%, and the downward bias in India’s GDP development, the Indian fairness market is anticipated to stay risky within the close to future. Market contributors might also be fascinated with seeing how the federal government of India will reply to the current losses in state elections, and the way this will likely have an effect on voter confidence within the upcoming basic elections in 2019.

Disclosure: Copyright © 2018 S&P Dow Jones Indices LLC, a division of S&P Global. All rights reserved. This materials is reproduced with the prior written consent of S&P DJI. For extra data on S&P DJI please go to www.spdji.com. For full phrases of use and disclosures please go to www.spdji.com/terms-of-use.

[ad_2]