Socially Responsible Investing – Can it really work? (updated guide)

[ad_1]

Taking the time to analysis what sort of impression the corporate in query is making is a vital step in investing.

Stay within the know as to what actions the businesses you’ve invested in are making with a view to stay socially accountable.

An index helps traders get a glimpse on the general efficiency of a market. Some of essentially the most well-known indexes are the Dow Jones and the S&P 500.

SRI Indexes

While the DOW and S&P 500 seize the whole broad market, there are additionally a lot of indexes that characterize subsets of the market. This is sweet information for Socially Responsible Investors – there are a selection of indexes designed to offer a snapshot of the whole SR market. Let’s have a look at just a few:

Domini 400 Social Index

This index might be the most well-liked amongst Socially Responsible Investors. These 400 public firms meet the Domini Social Investments’ standards for environmentally and human-pleasant practices. You received’t discover, for instance, makers of weapons, cigarettes, booze, or nuclear energy crops on this index.

This index might be the most well-liked amongst Socially Responsible Investors. These 400 public firms meet the Domini Social Investments’ standards for environmentally and human-pleasant practices. You received’t discover, for instance, makers of weapons, cigarettes, booze, or nuclear energy crops on this index.

FTSE4Good Index

These indices embody firms all through the world which were vetted in line with globally acknowledged company duty requirements. If an organization fails to make the grade alongside the traces of human rights, labor practices, environmental administration, or local weather-change standards, it will get deleted from the index. Recent additions to FTSE4Good embody: LG, Siemens, and Aetna.

These indices embody firms all through the world which were vetted in line with globally acknowledged company duty requirements. If an organization fails to make the grade alongside the traces of human rights, labor practices, environmental administration, or local weather-change standards, it will get deleted from the index. Recent additions to FTSE4Good embody: LG, Siemens, and Aetna.

Dow Jones Sustainability Index

Including massive gamers akin to General Electric and Verizon, the DJSI is a main instance of how socially accountable doesn’t must imply small-entity investing. Companies from any and all sectors are included within the index, as long as they proceed to meet sure sustainability standards and benchmarks.

Including massive gamers akin to General Electric and Verizon, the DJSI is a main instance of how socially accountable doesn’t must imply small-entity investing. Companies from any and all sectors are included within the index, as long as they proceed to meet sure sustainability standards and benchmarks.

The Future of Socially Responsible Investing (SRI)

We’ve discovered what Socially Responsible Investing is, find out how to discover SR firms and find out how to observe the market. Nice work!

Here are some closing ideas:

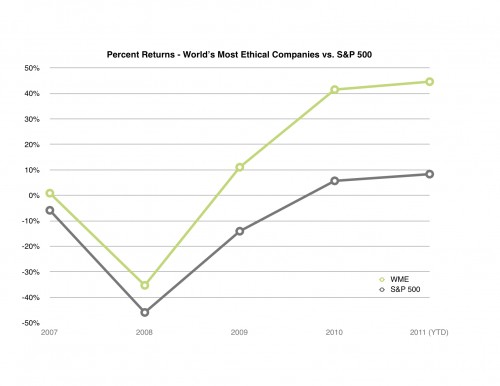

In right now’s economic system, it could be very worthwhile to be a socially accountable investor. In a research by Ethisphere, “ethical” firms have outperformed the S&P 500 since 2007. But that’s not all; the Domini 400 Social Index, the FTSE4Good Index and the Dow Jones Sustainability Index have additionally outperformed the final market.

On the opposite hand, some traders imagine the pendulum might have shifted too far – that firms can justify or write-off losses as social prices.

Some capitalists imagine in income and company effectivity above all else and have been extraordinarily profitable traders. Like many issues in life, the reality most likely lies someplace within the center.

This purpose of this mission wasn’t to show that being a socially accountable investor is healthier than the choice however fairly to show investing in socially accountable firms doesn’t imply sacrificing income.

How are you able to make investments responsibly?

The excellent news is that there are lots of startups and funding firms whose mission is predicated on offering traders with Socially accountable choices. And they work!

Here are the 4 main the cost. (you’ll want to reap the benefits of their provides right now)

[swell]

Wealthsimple – First $5,000 free

Wealthsimple has world-class monetary consultants and prime-expertise from Silicon Valley working for you.

Wealthsimple’s low-price, automated funding portfolios may also help you attain your lengthy-time period funding targets. Simply use this link to create an account and start without cost. Or you will discover out extra data with our in-depth assessment.

(Wealthsimple Review)

[acorns]

Stash – Join tens of millions of latest traders

Stash is greater than an funding app. You’ll have entry to instruments that may provide help to develop into a assured investor. Become an investor in simply two minutes and get $5 free.

From innovation to the surroundings, spend money on what issues to you. With Stash, you possibly can spend money on a collection of shares and ETFs that’s fastidiously curated by our funding group.

Get your FREE $5 NOW. Or learn our full Stash Review.

One last thought

Just as a result of an organization is socially accountable, it doesn’t reduce funding threat. The likelihood of destructive returns is roughly the identical for SR and non-SR firms. Due-diligence and analysis remains to be required!

[ad_2]