Splash Beverage: The Small Cap Beverage Company Who Continues to Exhibit Stellar Growth and an Ever-Increasing Supply Chain

We last covered Splash Beverage Group (Nasdaq:SBEV) in what feels like a lifetime ago, yet in reality was only a few short months ago in December 2021. Since then, the financial world (and actual world for that matter) has changed significantly. Markets in 2022 have seen extreme volatility as investors not only weigh the incoming interest rate hikes, rising inflation, but also, the recent Russian invasion of Ukraine.

When we last evaluated Splash their business model of seeking out undervalued beverage companies with strong brand awareness, acquiring them, and then substantially scaling their operations was firing on all cylinders. Their current portfolio of popular sports drink TapouT, deliciously flavored tequila brand Salt, refreshing sangria drink Pulpoloco, and premier wine Copa di Vino have been gaining market share rapidly, and so far, are proving to be phenomenal acquisitions with large growth still ahead.

As well, back in December Splash had recently signed a new partnership with AB One, a large distributor giving Splash access to large markets including New York, Boston, and Los Angeles. This partnership significantly expanded the reach of Splash and assisted the company in improving their already impressive margins through generating further economies of scale.

And to top it off, Splash had also recently released impressive third quarter earnings, showing revenue increase by 308%, and revenue to date increasing by an even better 578%. The company was (and continues to be) in great financial health with over $8 million in cash and just $5 million in debt.

Overall, Splash has done an incredible job in building out their supply chain, as well as identifying lucrative acquisition targets or joint venture opportunities.

Splash Beverage Expands Distribution Through Key Partnerships

More recently, Splash has continued to expand their distribution network, announcing a partnership with Suncoast Beverage which significantly increases their reach in southwest Florida. More specifically, this announcement further builds upon their current partnership, but will now include Splash’s Salt Tequila brand and sports performance drink TapouT. This news reinforces the company’s growth strategy and signals that large distributors are beginning to further trust Splash and their associated brands.

Splash also announced, through their existing partnership with Central Distribution Arkansas, their sports drink TapouT would be distributed throughout Walmart in Arkansas. Initially, this expansion into Walmart will include 125 different locations with the opportunity to further expand on positive performance. Plus, Splash has also moved TapouT into 47 Walmart’s throughout Florida with the expectation this number will increase in the near future.

Their expansion doesn’t stop with Arkansas or Walmart however, Splash has also moved their products into Ralph’s Grocery (owned by Kroger) which has 187 stores throughout southern California. As well as signing a deal with New York-based D. Bertoline & Sons to distribute their brands within the Hudson Valley Area. And Finally, Splash is also partnering with California-based Distributor Heimark Distributing to supply TapouT, Copa di Vino, and Pulpoloco.

This windstorm of new partnerships and expansions to old ones shows the savvy of the management team and the beginning of a strong moat. As the company continues to improve their distribution model, while simultaneously expanding their portfolio of beverage companies, Splash is developing a powerful network effect and the ability to take a small-scale brand to a national level extremely quickly. As well, with an ever-growing supply chain comes improved margins, and as their brands continue to sell, will further strengthen the relationship with distributors adding further growth to an already fast-growing business model.

Splash Prepares for Further Growth with Successful Capital Raise

In mid-February Splash closed a share offering of 2.3 million shares, with total proceeds reaching $9.2 million. This substantially boosted the company’s cash position and allows them to pursue attractive acquisition or joint venture opportunities.

Splash’s growth strategy is showing it has some serious legs and a long runway to continue. The company now has an impressive cash balance, as well as a distribution network that continues to expand into new markets. They have built strong relationships with multiple large distributors which has led to strong trust and the ability for Splash to grow new acquisitions quickly. All this points to Splash preparing for a record breaking 2022, as they execute further acquisitions and scale faster than they were previously capable of. Their past success proves their strategy works, and with as simple business model as they have, has great scalability and further room for growth.

Key Takeaway

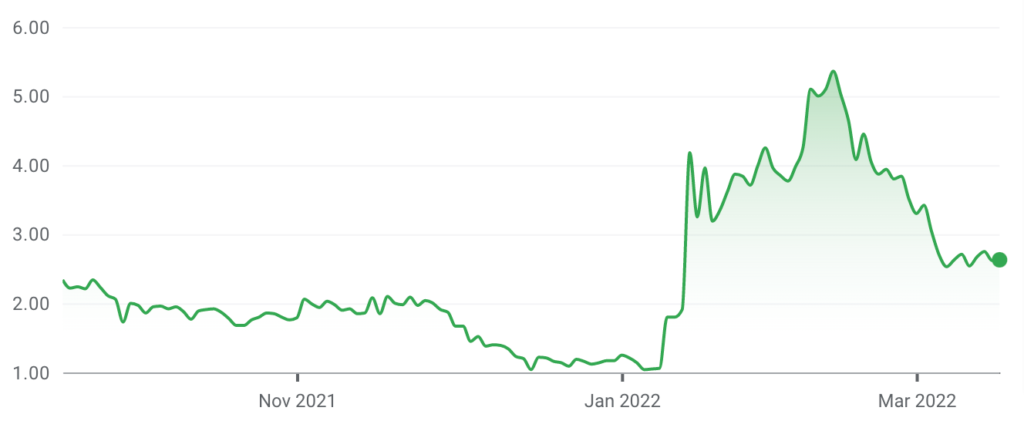

Despite the barrage of good news coming from Splash, macroeconomic headwinds continue to supress the company’s share price. Interest rates, inflation, and now the beginning of war in Europe has led many investors to choose a risk off approach. This however is a mistake. In the long run, the market rewards companies who continually post strong growth, improve margins, and show investors a compelling investment thesis. Splash Beverage Group has checked all these boxes for some time now, and when looking at the recent news, shows no signs of changing. Splash has a current market cap of $139 million, which could well prove to be a steep discount as they continue to make acquisitions and expand their distribution channels. This is a company that has immense shareholder value and could handsomely reward investors who look past these temporary headwinds and focus more on the fundamentals and growth prospects of the company.