Stellantis In A Tailspin? Trump’s Tariffs Trigger Factory Closures, Rating Cuts & Strategic Rethinks!

Stellantis NV (NYSE:STLA), the maker of Jeep, Dodge, and Fiat vehicles, is grappling with one of its most turbulent quarters since its formation in 2021. The company is facing mounting challenges from the ripple effects of U.S. President Donald Trump’s newly imposed 25% tariffs on imported vehicles. Within days of the tariff implementation, Stellantis was forced to halt operations at key plants in Canada and Mexico, temporarily laying off hundreds of workers and triggering supply chain disruptions across the U.S. powertrain network. Credit rating agencies reacted swiftly, with Fitch downgrading the company to BBB, citing cost pressures and diminished headroom for shock absorption. The crisis has exposed Stellantis’ heavy reliance on cross-border manufacturing, as nearly 40% of the vehicles it sells in the U.S. are imported. Despite the turmoil, management is aggressively rolling out mitigation strategies, from supplier support programs to strategic partnerships, while emphasizing regional empowerment and an ambitious new product pipeline.

Tariff Shock Forces Stellantis Into Operational Retrenchment

The imposition of the 25% U.S. tariff on imported vehicles triggered an immediate reaction from Stellantis. The company paused production at its Windsor plant in Ontario for two weeks and indefinitely suspended operations at its Mexico facilities. These closures disrupted a critical segment of Stellantis’ supply chain, including U.S.-based stamping and powertrain plants that support these locations. The tariff’s impact was amplified by the company’s dependence on cross-border trade, with approximately 40% of its U.S. sales comprised of imported vehicles. This exposed Stellantis to a more pronounced cost shock than its peers. In response, management began recalibrating production schedules and evaluating the feasibility of shifting operations back to the U.S. However, such realignments require significant capital investment and time—potentially up to two years—rendering them ineffective as near-term fixes. Meanwhile, the temporary layoffs of roughly 900 workers and the stock’s sharp decline of more than 8% reflect how swiftly investor confidence was shaken. As the industry anticipates broader supply chain disturbances, Stellantis finds itself at the epicenter of geopolitical and economic policy crossfire, facing structural decisions that could define its North American strategy for the foreseeable future. While the company voiced support for U.S. manufacturing initiatives and Trump’s “America First” policy, it also highlighted the importance of honoring USMCA provisions, indicating that some of its cross-border operations may still be tariff-exempt. However, with ambiguity surrounding enforcement and potential loopholes, Stellantis’ operational outlook remains clouded in uncertainty as it navigates an increasingly protectionist trade environment.

Credit Ratings Downgraded Amid Profit Compression & Cash Flow Woes

Stellantis’ financial posture weakened significantly under the pressure of the new trade regime. Fitch Ratings downgraded the company to BBB, just two notches above junk, citing elevated cost structures and reduced flexibility to absorb short-term operational shocks. The downgrade followed an equally bearish outlook from S&P Global, while Moody’s remains marginally more optimistic with a Baa1 rating. The rationale for these downgrades stems from a sharp contraction in profitability—2024 adjusted operating income plummeted 64% year-over-year to €8.6 billion, and earnings per share fell 61% to €2.48. Simultaneously, industrial free cash flow registered a negative €6 billion for the year, strained by €5 billion in working capital buildup and €1.6 billion in increased capital expenditures. The revenue drop of 17% was primarily attributed to a 12% decline in vehicle shipments and unfavorable regional mix, particularly in North America. Despite aggressive inventory correction, U.S. dealer stock was still running at 304,000 units by year-end, underscoring the challenge of restoring supply-demand equilibrium. Stellantis had to amplify incentives and reduce production to tackle bloated inventories, further eroding margins. The company expects a gradual recovery in 2025, but has cautioned that the bulk of improvements in revenue, margin, and cash flow will materialize only in the second half. Management also confirmed that share buybacks are suspended for the first half of 2025, with future distributions contingent on income stability. The downgrade signals that Stellantis’ balance sheet, once seen as a pillar of strength, is now under heightened scrutiny as the automaker recalibrates its global strategy amid intensifying external pressures.

Strategic Supplier Support & McKinsey Engagement Offer Tactical Relief

In a proactive move to prevent wider supply chain disruptions, Stellantis introduced a supplier assistance program aimed at easing the burden of tariff-related costs. Recognizing that many suppliers are financially stretched after over-investing in EV production, the company offered to partially fund monthly tariff payments for eligible vendors, rather than renegotiating component prices. This initiative, while limited in scope and still evolving, illustrates Stellantis’ attempt to sustain its ecosystem and avoid cascading failures among its Tier 1 and Tier 2 partners. The company is also consulting McKinsey & Co. to advise on strategic options for underperforming luxury brands Maserati and Alfa Romeo, both of which rely entirely on imports into the U.S. and are severely exposed to tariffs. Options under consideration include joint ventures with Asian manufacturers or even a potential spin-off of Maserati. Maserati posted a €260 million adjusted operating loss last year, with U.S. customers accounting for up to 40% of its demand. Meanwhile, Stellantis is also reassessing production localization for these brands in Italy, as part of its broader effort to appease political stakeholders and optimize its European manufacturing footprint. The McKinsey review marks a turning point in Stellantis’ willingness to structurally reconfigure its brand portfolio, with regional empowerment and modular production strategies taking precedence. While none of these actions guarantee relief in the near term, they suggest that Stellantis is pursuing a multi-pronged path to shore up resilience—through financial assistance, strategic partnerships, and long-term portfolio rationalization.

Q1 Italy Output Collapse Underscores Deeper Structural Challenges

The fallout from the tariffs and global demand shifts manifested sharply in Italy, where Stellantis’ Q1 2025 vehicle production plummeted 36% year-over-year to just under 110,000 units—the lowest for that period since 1956. The decline was driven by a mix of weak consumer demand, transition gaps in EV production, and U.S. tariff effects on exported European cars. Italian unions such as FIM-CISL do not expect a recovery this year, citing a “perfect storm” scenario. The company operates several key facilities in Italy, including the historic Fiat site in Turin and Maserati’s luxury plants, which are all running at significantly reduced utilization. Chairman John Elkann reaffirmed Stellantis’ commitment to invest €2 billion in Italy this year but warned that escalating trade barriers and regulatory divergence could offset any intended gains. The company also faces reputational pressure in its home market, with unions criticizing underutilization and the lack of a coherent roadmap for reindustrialization. The structural nature of this production slump highlights Stellantis’ broader challenge—managing 14 global brands across fragmented geographies, each with unique regulatory, economic, and consumer dynamics. While regional empowerment is a core tenet of the company’s turnaround plan, Italy’s continued decline raises questions about how effectively the strategy is being executed. The production cuts also risk affecting supplier morale, labor relations, and political goodwill in one of Stellantis’ foundational markets. As the company scrambles to localize production and diversify exposure, the Italian setback acts as a sobering reminder that its path to recovery may be rockier than anticipated.

Final Thoughts

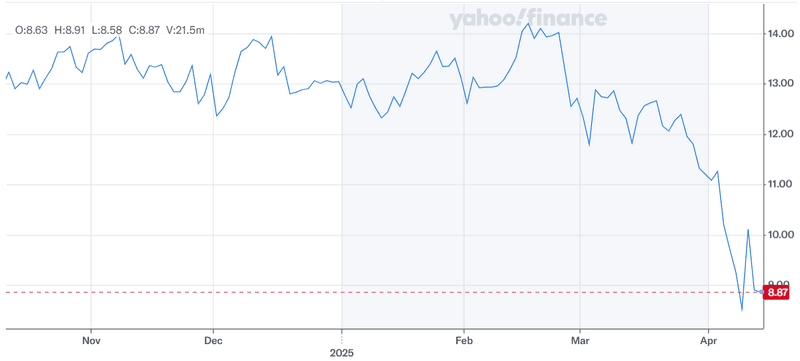

Source: Yahoo Finance

The fall in its stock price clearly indicates Wall Street’s perception that Stellantis is navigating a particularly volatile phase marked by geopolitical disruption, internal restructuring, and the urgent need to regain market relevance in North America and Europe. The company has responded with a mix of tactical cost-sharing initiatives, supplier support programs, and strategic advisory engagements. However, its financial health has taken a hit—evident from rating downgrades, operating losses in key segments, and the suspension of stock buybacks. While management projects a stronger second half of 2025 driven by new product rollouts and market reentry, the margin recovery and cash flow normalization are contingent on many external factors, including tariff resolution, consumer demand stabilization, and competitive pricing discipline. Stellantis’ long-term viability will depend on how successfully it can regionalize operations, consolidate its brand portfolio, and adapt its supply chain in response to a rapidly evolving regulatory and economic landscape. Given the current uncertainty, we believe that Stellantis’ stock is best avoided at current levels.