Sweetgreen Could Be The Next Big Bite For Wonder Group Inc. – Here’s Why!

Sweetgreen Inc (NYSE:SG), the small-cap health-focused fast-casual restaurant chain, just made a big move that has gotten people talking. The company sold its robotics unit, Spyce, to Wonder Group Inc. for a total of $186 million—$100 million in cash and $86 million in Wonder stock. But here’s where it gets interesting: this wasn’t just a tech sale. Sweetgreen is keeping access to the Infinite Kitchen automation system that Spyce developed, giving it a path forward without carrying the full cost of running that side of the business. And for Wonder, which runs multi-brand food halls and delivery services, it looks like the start of something deeper—perhaps even a step toward acquiring Sweetgreen outright. With both companies set to use this technology more widely in their restaurants, the deal feels like more than just a one-time exchange. Let us explore why Wonder might want to take an even bigger bite out of Sweetgreen.

Technology Synergies & Automation Alignment

Wonder’s acquisition of Spyce from Sweetgreen opens the door for deeper automation integration across both platforms, with substantial long-term synergies. Infinite Kitchen can produce up to 500 meals per hour and has already delivered significant operating benefits to Sweetgreen—including labor savings of 700 basis points and COGS improvement of nearly 100 basis points in locations where it is deployed. For Wonder, whose business model hinges on efficiently operating high-variety food halls, automation is less about labor cost savings and more about executing complex, multi-brand menus with precision. By embedding the Infinite Kitchen across both its virtual restaurant portfolio and in-store offerings, Wonder could dramatically improve consistency, throughput, and food quality while reducing dependency on human labor, especially during late hours or low-volume periods. The ability to scale this technology under a shared R&D and manufacturing roadmap would enable significant cost reductions through economies of scale. Sweetgreen, with its domain experience in deploying and refining automation in a live restaurant environment, provides the operational blueprint Wonder needs to integrate similar systems across its platform. Moreover, Wonder’s plan to install Infinite Kitchens in half of its new locations by 2027 suggests growing dependence on Sweetgreen’s expertise—making a full acquisition a logical next step to consolidate IP, talent, and deployment capabilities under one umbrella.

Market Footprint Expansion & Customer Base Diversification

A potential acquisition of Sweetgreen would provide Wonder with an immediate, strategically located store footprint across key urban markets, particularly the Northeast and Los Angeles—regions that comprise approximately 60% of Sweetgreen’s comp base. Despite current headwinds in those geographies, including softer spending from the 25–35 age cohort, Wonder could use its multi-brand infrastructure and centralized prep facilities to drive operational and financial improvements across Sweetgreen’s base. In return, Wonder would gain exposure to a higher-income, health-conscious demographic that is already habituated to digital ordering and mobile engagement—a major asset as Wonder continues to scale its food hall and virtual restaurant models. Furthermore, Sweetgreen’s restaurant-level tech stack, digital app loyalty programs, and data-driven CRM strategy are highly complementary to Wonder’s ambitions. With approximately 20,000 new activations per week through SG Rewards and high engagement from urban digital-first consumers, Sweetgreen could serve as the tip of the spear for Wonder’s consumer data strategy and offer a playbook to drive lifetime value across its own food brands. An integrated model that leverages Sweetgreen’s in-store engagement with Wonder’s delivery-first scale could accelerate cross-channel innovation, expand addressable markets, and deepen customer insights across both portfolios.

Operational Efficiency & Cost Discipline

Sweetgreen’s current financial discipline initiatives may make it a more appealing acquisition target by minimizing integration overhead. The company is undergoing a strategic transformation under a new leadership team, which includes recently appointed CFO Jamie McConnell. A full review of its restaurant-level expenses and G&A structure is underway, with anticipated $8 million in annual G&A savings from the Spyce divestiture alone. Additionally, Sweetgreen has announced a more measured growth plan for 2026—15 to 20 net new units, half of which will feature Infinite Kitchen units—indicating a pivot toward quality over quantity. This conservative growth stance reduces capex risk and aligns with Wonder’s long-term capital-light approach. Furthermore, restaurant-level margin targets in the 14.5% to 15% range for FY25, despite ongoing inflationary pressures and soft comps, reflect meaningful cost containment. For Wonder, acquiring a partner already executing margin improvement and operational excellence via Project One Best Way, standardized scorecards, and throughput initiatives provides a playbook that can be applied across its portfolio. These improvements are already showing traction: 60% of Sweetgreen stores now meet internal operational standards (up from 33% last quarter), and initiatives such as “Scan to Pay” are improving peak-hour efficiencies. These efficiency gains, coupled with lower SG&A post-Spyce, create operational leverage that could unlock accretive synergies if Wonder integrates Sweetgreen into its own vertically integrated food ecosystem.

Brand Equity, Menu Innovation & Digital Loyalty Flywheel

Sweetgreen’s brand equity, rooted in transparency, food quality, and sustainability, holds strategic value for Wonder, whose portfolio includes a mix of both virtual and real-world brands. Sweetgreen’s positioning as a lifestyle brand with an expanding culinary focus and well-defined customer base offers brand halo potential for Wonder, especially if it wants to move upstream toward more premium, wellness-oriented concepts. With nine protein-rich chef-curated items, new steak-focused SKUs, and a macros calculator now integrated into its app, Sweetgreen is reworking its menu architecture to appeal to both value-conscious and health-driven diners. This diversification increases the relevance of the brand across meal occasions and price tiers, which is crucial for Wonder’s multi-brand platform. Additionally, Sweetgreen’s digital infrastructure—highlighted by its recently launched SG Rewards program, personalization efforts via CRM, and consistent app engagement—offers a rich data ecosystem. As Wonder continues expanding via Blue Apron and Grubhub, integrating a proven digital loyalty platform like Sweetgreen’s could enhance customer retention and cross-brand engagement. Finally, upcoming tests of new handheld products in 2026 and the use of a structured stage-gate innovation pipeline provide optionality for daypart expansion and innovation-led growth, offering another lever of synergy for a diversified food-tech entity like Wonder.

Final Thoughts

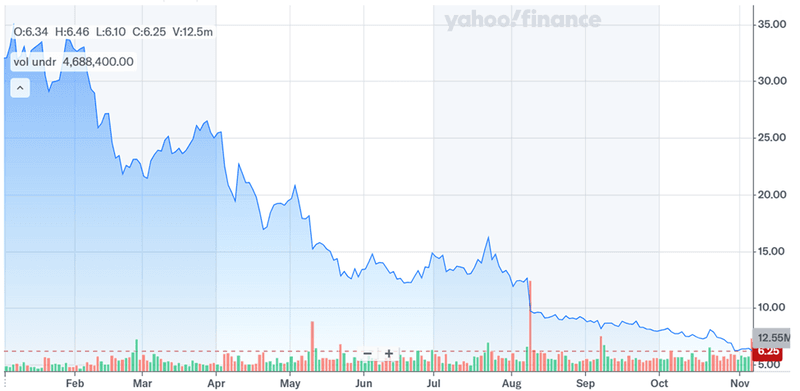

Source: Yahoo Finance

Sweetgreen’s stock performance has been deplorable and has been destroying value for shareholders. Its stock is also trading at much lower levels than previous years, with valuation metrics like an LTM EV/Revenue multiple of just 1.41x showing how far things have come down. That could make it an appealing acquisition option—but also a riskier one. So, where does all this leave us? On one hand, Sweetgreen has a lot going for it: cutting-edge kitchen tech, a fresh brand image, loyal customers, and an expanding presence in key cities. Teaming up even more closely with Wonder could give both companies a real boost, especially as they both explore ways to automate and scale smarter. On the other hand, Sweetgreen is still working through some challenges. Its sales have slowed in major markets, inflation is pinching margins, and the business isn’t yet consistently profitable. For now, Sweetgreen seems focused on getting its own house in order, but this growing partnership with Wonder means there could be more twists ahead. Only time will tell how closely these two companies will really end up working together.