Target Names New CEO — Wall Street Wanted Someone Else!

Target (NYSE:TGT) has been in the news for all the wrong reasons off late. The company’s most recent leadership transition is colliding with investor disappointment and ongoing operational headwinds, raising the stakes for a turnaround at the once-iconic retailer. Target announced that Chief Operating Officer Michael Fiddelke, a 20-year veteran, will succeed Brian Cornell as chief executive on February 1, 2026 whereas Cornell, who has led Target for more than a decade, will move into the role of executive chair. While the decision followed a lengthy succession process that included external candidates, investors reacted negatively, with shares dropping 11% on the news and extending a 22% year-to-date decline. But why the pessimism around the new CEO? Or is it just about the new CEO or are Target’s problems deeper than we can imagine?

Employee Frustration & Organizational Drift

Target’s internal employee sentiment has deteriorated alongside its operational performance. A June survey revealed that about half of employees did not believe the company was making the necessary changes to compete effectively, while 40% expressed a lack of confidence in the company’s long-term future. At headquarters, scores were even lower, suggesting a deep-rooted skepticism about leadership and strategy. Chief Commercial Officer Rick Gomez acknowledged that “we need to do a better job of empowering you to do your best work,” but morale challenges persist as staff grapple with bureaucracy, unclear priorities, and the strain of executing against ambitious but inconsistent initiatives. Leadership turnover has also contributed to instability, with longtime executive Christina Hennington departing earlier this year despite being viewed as a potential CEO candidate. While around 80% of headquarters employees said they intend to remain at the company, retention is not the same as engagement. The risk is that a workforce skeptical of leadership’s ability to deliver change may perpetuate the operational inconsistencies that shoppers have noticed in understaffed stores and uneven execution. Fiddelke’s long tenure may reassure some employees who value continuity, but it also raises doubts about whether he can drive the kind of cultural reset needed to reenergize teams and restore executional discipline.

Weak Sales, Pressured Margins, & Rising Competition

The financial trajectory underscores the urgency of Target’s turnaround. The company has recorded two consecutive years of revenue decline and remains on track for a third, reflecting lost momentum across key categories. In Q2 2025, sales fell 0.9% year over year to $25.2 billion, while comparable sales declined 1.9%. Gross margins were pressured by higher markdowns and tariffs, though disciplined cost management allowed earnings per share of $2.05 to narrowly exceed consensus. For the full year, management maintained guidance for a low-single-digit sales decline and EPS between $7 and $9. Still, competitive pressure is intensifying. Walmart and Costco continue to win on price and efficiency, while Amazon maintains dominance in e-commerce. Target’s historic differentiators in apparel and home goods have eroded, with Bernstein estimating that the company has ceded share in both categories. Shoppers increasingly perceive Target as more expensive than peers, despite management’s investments to cut prices on thousands of items. Operational challenges compound the issue: messy stores, thin staffing, and supply chain inefficiencies have weakened the in-store experience, which remains central to Target’s model. Analysts have also raised concerns about underinvestment in automation and fulfillment, warning that the company faces a difficult trade-off between sales growth and margins. These pressures explain why the market has discounted Target’s shares despite its profitability, as the durability of earnings remains in question.

Brand Erosion Amid Cultural Controversies

Target’s reputational standing has weakened due to a series of cultural controversies that have alienated both customers and employees. In 2023, backlash against Pride merchandise disrupted sales, while in 2024 and 2025, management’s retreat from DEI commitments drew criticism from progressive stakeholders, including descendants of the founding Dayton family. The decision to discontinue DEI terminology and scale back certain programs led to Target being barred as a sponsor of the Minneapolis Pride parade, a symbolic setback in its hometown. Shopper backlash to these shifts weighed on sales, as acknowledged by Cornell. Internally, the reversals created further disillusionment among employees, many of whom felt the company had abandoned core values. For investors, the controversies have underscored a broader identity crisis: Target has struggled to articulate a clear and consistent reason why shoppers should choose it over competitors. This erosion of brand equity is particularly damaging given that Target’s historical success was built on a reputation for affordable style and inclusivity that differentiated it from Walmart’s low-price positioning. Until management can stabilize the brand and reduce self-inflicted reputational risks, the company will face difficulty rebuilding loyalty and market share.

Digital Growth & Merchandising Innovation Provide A Base

Despite the setbacks, Target retains several strategic assets that offer potential levers for recovery. Digital sales grew 4.3% in Q2 and have tripled since 2019, with the digital channel now profitable, unlike many retail peers. Categories such as trading cards, up 70% year-to-date, and electronics, boosted by Nintendo Switch 2, highlight the potential for targeted merchandising wins. The newly formed Enterprise Acceleration Office, overseen by Fiddelke, has delivered early successes, including double-digit growth in children’s home décor, demonstrating that disciplined category focus can reignite momentum. Partnerships remain a differentiator, with Apple, Disney, and Starbucks shop-in-shops reinforcing Target’s ability to create curated in-store experiences. Exclusive brand tie-ins, such as a Taylor Swift book and Kate Spade collaborations, also helped drive sales in select quarters. Target continues to invest approximately $4 billion annually into store remodels, new formats, and technology upgrades, while maintaining a dividend yield of 4.3%. These factors provide some resilience: adjusted earnings have held up better than sales, and the balance sheet supports ongoing capital deployment. While not enough to offset the broader decline in comps, these initiatives suggest the company has levers to re-establish relevance if execution improves.

Final Thoughts

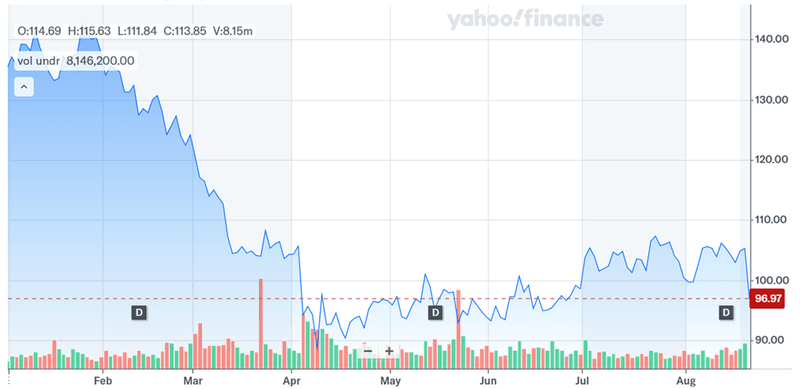

Source: Yahoo Finance

We can see that Target’s stock performance has been reflective of the company’s troubles. The market’s skepticism is evident in its valuation: shares trade at 0.61x LTM EV/Revenue, 7.19x EV/EBITDA, and 11.58x LTM P/E—discounted relative to historical levels, yet not distressed given ongoing profitability. Target’s leadership transition comes at a critical juncture. With Michael Fiddelke set to assume the CEO role in 2026, the company faces the dual challenge of reversing sales declines and restoring investor confidence in a turnaround led by a long-tenured insider. Employee morale is fragile, competitive pressures are intensifying, and cultural controversies have weighed on both reputation and results. At the same time, Target retains valuable assets, including a profitable digital business, differentiated partnerships, and the financial flexibility to continue investing. Fiddelke does benefit from all these factors but he will also have to deal with limited investor patience and must prove that continuity can deliver change in a challenging retail environment.