Tesla Is Burning More Than Rubber: How Musk’s Politics Is Sparking A Global Meltdown!

Tesla’s (NASDAQ:TSLA) troubles are deepening as a combination of falling deliveries, executive exits, and escalating brand damage begin to chip away at the automaker’s dominance in the electric vehicle market. The company recently reported its weakest quarterly delivery numbers since 2022, triggering another wave of analyst downgrades and confirming that customer backlash tied to Elon Musk’s political affiliations is materially impacting sales. JPMorgan now expects Tesla to earn just $2.30 per share in 2025, down from earlier estimates, and investor confidence has been shaken by the abrupt resignation of longtime software chief David Lau. In parallel, Tesla’s market share has dropped significantly across major geographies like Germany, China, and the United States, with global sales falling despite a broader uptick in EV demand. These setbacks come as the company transitions production lines for its Model Y refresh, further limiting supply while demand continues to deteriorate.

Sharp Global Sales Decline Amid Broad EV Market Growth

While global EV sales surged 24% in 2024 and are projected to rise another 30% in 2025, Tesla’s sales performance has sharply diverged from this trend. Deliveries fell 13% in the first quarter of 2025, marking the worst quarterly output since 2022. In Germany, Tesla’s second-largest market in Europe, vehicle sales dropped 62% through March. In China, shipments from Tesla’s Shanghai plant plunged 49% in February alone. The U.S. market, which accounts for nearly half of Tesla’s revenue, has also shown signs of significant weakness; Kelley Blue Book estimated just 43,650 vehicles were sold in February 2025, well below past monthly peaks. Even as countries like France and Australia posted growth in EV adoption, Tesla's market share has slipped below 50% in the U.S., down from over 75% in 2022. The company's refresh of the Model Y required halts in production across all four global assembly lines, compounding supply issues. But analysts increasingly attribute the demand shortfall not to supply bottlenecks but to a structural shift in consumer sentiment. As competitors like BYD post 58% quarterly growth and offer faster-charging, lower-cost vehicles, Tesla’s over-reliance on an aging product lineup is exacerbating its global sales erosion. Without new volume models or significant pricing breakthroughs, Tesla may continue to lose ground in key growth markets despite favorable macro trends for EVs as a whole.

Brand Damage Driven By Political Controversy & Social Backlash

Tesla is experiencing what analysts are calling “unprecedented brand damage” due to Elon Musk’s growing political profile and ideological realignment. His support for far-right figures in Europe and high-profile role in Donald Trump’s administration have alienated Tesla’s core liberal customer base. The emergence of the decentralized protest movement “Tesla Takedown” and the rise in acts of vandalism at Tesla facilities—including suspected arson in France, Italy, and Germany—illustrate the extent of the backlash. In Germany, 94% of surveyed respondents indicated they would not buy a Tesla, correlating with a 70% sales drop in early 2025. In the U.S., Tesla registrations fell in all four quarters of 2024 in Democratic-leaning California, while customers increasingly report feeling uncomfortable associating with the brand. Embarrassed Tesla owners have gone so far as to modify their vehicles to signal that they bought them before Musk’s political shift. While Musk attempted damage control through a joint appearance with Trump at the White House in March 2025, analysts doubt the company can successfully pivot to a new conservative customer base. Tesla’s traditional market—affluent, environmentally-conscious progressives—is difficult to replace, and the alternative ideological audience may be reluctant to adopt electric vehicles in large numbers. This political entanglement has reshaped Tesla into a symbol of polarization rather than innovation, which has direct consequences for demand elasticity in both consumer and fleet markets.

Leadership Instability & Strategic Uncertainty

The departure of David Lau, Tesla’s Vice President of Software Engineering and one of its longest-tenured executives, adds to concerns about the company's internal stability. Lau’s team managed core systems ranging from in-vehicle software to cloud infrastructure and manufacturing platforms, playing a critical role in Tesla’s digital ecosystem. His resignation follows a period of intense scrutiny over Musk’s split focus between Tesla and his work as a temporary advisor in Trump’s Department of Government Efficiency. While Musk retains formal and informal influence over federal cost-cutting efforts, investors are growing uneasy about the leadership vacuum forming at Tesla. The executive bench has already been under pressure, with previous departures of other key figures exacerbating the perception of volatility in Tesla’s strategic direction. Despite Musk's promotion of autonomous driving and humanoid robots as future revenue sources, there is a lack of near-term clarity on product roadmap execution, especially with Tesla pausing production to update the Model Y. Analysts point out that Tesla's reliance on a narrow product portfolio—with the Model 3 and Y making up over 95% of sales—makes it vulnerable to operational disruptions and innovation fatigue. The recent executive churn, coupled with a thin pipeline of new product launches and limited visibility on the affordability of future models, raises questions about the company’s ability to execute on its next growth phase.

Weak Earnings & Speculative Narratives

JPMorgan now estimates full-year EPS at $2.30, down from $2.70 previously and far below peak expectations from 2023. While some investors continue to back Tesla based on speculative future technologies like robotaxis and Optimus humanoid robots, these initiatives have yet to generate commercial revenue. Meanwhile, competitors such as Alphabet’s Waymo are widely seen as more advanced in autonomous driving and trade at lower valuations. With analysts forecasting a potential second consecutive year of declining sales, Tesla’s “growth stock” premium is increasingly under pressure. The disconnect between fundamentals and valuation raises the risk of further multiple compression, especially if revenue misses continue and high-margin software contributions do not materialize. Additionally, the unclear timeline for affordable EV models and the lack of concrete details around future innovations erode investor confidence in the bull case. If Tesla cannot reaccelerate deliveries or present a credible case for near-term profitability from new initiatives, the market may continue to reprice the stock closer to auto industry norms.

Final Thoughts

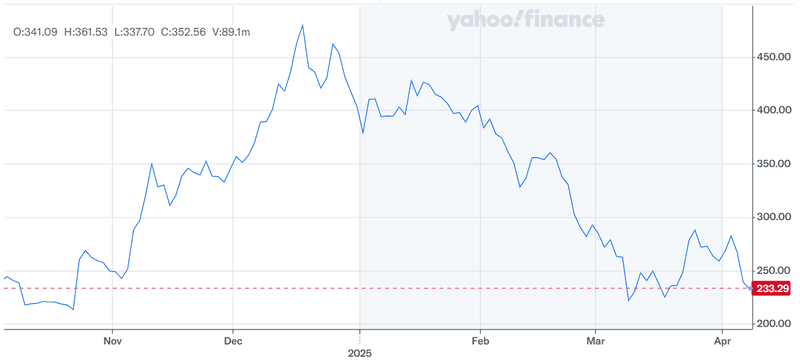

Source: Yahoo Finance

Even after a 44% decline since its December 2024 high, Tesla remains one of the most richly valued auto companies. The stock trades at approximately 89 times projected 2025 earnings, compared to far lower multiples for traditional automakers and tech peers with similar or stronger growth profiles. We believe that the combination of declining global sales, high-profile executive departures, brand degradation linked to political activism, and an overreliance on speculative narratives is reshaping Tesla’s risk-reward profile. With analysts forecasting a potential second consecutive year of revenue contraction and global competition intensifying, caution is warranted, especially for those investors seeing this as a bottom-fishing opportunity.