Tullow Oil Reinstated Dividend. Too Prematurely? – Tullow Oil Plc. (OTCMKTS:TUWLF)

FY18 will probably be exceptional for British upstream firm Tullow Oil (OTCPK:TUWLF, OTCPK:TUWOY), which I covered in October. The London-based hydrocarbon producer and explorer has proven its first revenue since dramatic 2014, and on the finish of the yr declared that dividends postponed because of the monetary misery and lackluster efficiency can be reinstated. Expensive Brent improved earnings and even instilled confidence that choices of the frontier drilling can be sufficiently funded. But as we speak oil is terrifying power buyers, hurting the capital acquire. Moreover, market individuals and pundits voiced issues that recession is on the door with the inverted yield curve because the harbinger. The imprimatur to distribute money amongst shareholders amid the oil market downturn and international financial slowdown may have a look at least complicated. Has the choice been taken too prematurely, or has the firm determined to reward its stock homeowners at an apt time? In my judgment, in the mean time Tullow Oil’s monetary sources aren’t strained, and I shall present supporting proof forward within the article.

Source: Tullow Oil website

The story of plunge and restoration

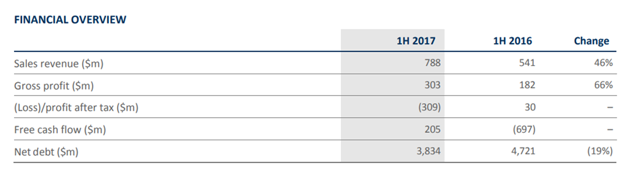

At the second, the FTSE 250 constituent Tullow has misplaced its place within the FTSE 100 Index, the important thing benchmark of the London Stock Exchange that mirrors the efficiency of the highest giant-cap London-listed firms. That occurred due to decreased market capitalization, plummeting on the wave of the oil market promote-off and evaporating shareholder confidence. It is feasible to imagine that index funds that observe the market benchmark closed positions in Tullow, which led to extra distressing share value motion. The occasion was dispiriting and painful. In the center of FY16, the firm was burdened by at first sight insurmountable debt of round $4.7 billion with deeply destructive half-yr FCF of $(697) million. Dividend restoration was distant and blurry.

Source: 1H17 results, p. 1

But the corporate appears to have the ability to deal with all headwinds. The rights challenge in H1 2017 considerably diminished debt however unsurprisingly pushed shares decrease with a 15% lower. However, deleveraged, Tullow elevated EBITDAX and FCF, and the Net debt-to-EBITDAX ratio compressed from 5.1x in 2016 to 3.3x in H1 FY17 and 2x in H1 FY18. The TEN fields and Jubilee subject offshore Ghana largely contributed to the expansion with low-value and excessive-high quality crude.

In truth, an upstream firm’s means to service debt relies upon not solely on the highest line (and therefore, the sentiment of oil merchants and science and artwork of hedging) however on the associated fee administration and recognized working leverage. If the enterprise shouldn’t be in a position to convey the manufacturing value per barrel to the bottom diploma, EBIT will undergo and the solvency will probably be questioned so far as curiosity funds won’t be sufficiently lined. Tullow exerted its muscle mass to chop manufacturing prices and spur working revenue. It canceled costly operations within the North Sea and centered on Ghana. As a outcome, working prices per barrel are anticipated to be under $8 (see p. 37 of the presentation). Hence, a key FCF driver, EBIT, will stay robust. Also, in the course of the presentation was disclosed the EBITDAX steerage of $1.2-1.7 billion. Obviously, this quantity will probably be within the decrease finish due to cheaper oil. According to the consensus estimates (I used Simply Wall St. as a knowledge supply, which makes use of information from S&P Global), FY19 income will probably attain $2.18 billion. That specifies a spectacular FY19 EBITDAX margin of 55%.

Dividend protection and solvency

It was introduced that a minimum of $100 million can be distributed among the many stockholders as annual dividends. On June 30, 2018, Tullow Oil had 1,389.5 million shares. Hence, DPS will quantity to ~0.72 cents. On December 21, 2018, the share value on the London Stock Exchange was GBX 171.60. Using the GBP/USD change price on that date, we will arrive at a $2.18 share value. That specifies a 3.3% potential dividend yield. Importantly, the $100 million quantity shouldn’t be set in stone. The dividend is perhaps elevated, however solely in case of plentiful FCF surplus.

It is value mentioning that Tullow has by no means been an exceptional dividend payer. Its common yearly dividend yield peaked in 2014, reaching 2.41% earlier than an abrupt downward plunge to zero.

Frankly, a firm like Tullow has two choices to revive buyers’ confidence: to faux that the monetary place is strong and reinstate dividends utilizing borrowed cash, or genuinely ignite FCF era and spur the CFFO surplus to cowl DPS not by accounting earnings however by materials money generated by on a regular basis operations. The first path is precarious however not uncommon or atypical, and the second is the Tullow’s means.

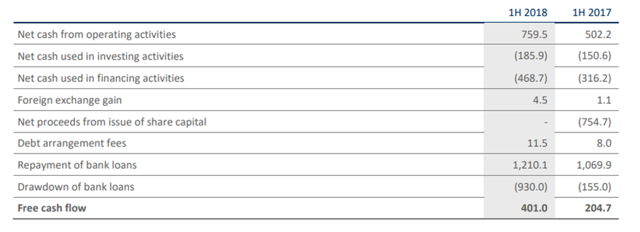

First, it’s value taking into consideration the firm’s most well-liked definition of free money movement. This is defined intimately within the 1H18 report on web page 14:

Source: 2018 half-year results, p. 14. As seen, the determine has virtually doubled in H1 FY18.

According to the November Trading Update, FY18 FCF will probably be ~$700 million. This quantity consists of one-off $200 million influx from the farm-down in Uganda. Consequently, the normalized adjusted FCF will probably be $500 million. This quantity is 5x greater than FY19 dividend.

Tullow’s definition shouldn’t be much like the broadly used one as a result of to reach on the FCF surplus researchers sometimes deduct annualized capital expenditures from internet CFFO (ttm). I assume it’s value making use of a extra standard technique to take a look at the firm’s money era capability from one other aspect:

- On June 30, internet CFFO (ttm) amounted to $1.48 billion. This quantity sufficiently covers annual estimated dividends 1.48 instances.

- Investment in PP&E (ttm) from the IFRS CFS was $335 million. Consequently, the FCF was $1.14 billion.

- Hence, if the quantity stays unchanged in FY19, the firm will use solely 8.8% of its yearly standard FCF to pay dividends, which is sort of affordable and never dangerous.

As disclosed within the Capital Markets Day presentation, FY19 capex is estimated to be ~$570 million. This determine consists of spending on infill wells and manufacturing increase in Ghana and $150 million on exploration. If internet CFFO stays unchanged, FCF will quantity to ~$910 million. This determine specifies a 900% protection of annual dividend. Also, if onerous Brent value actions result in decreased internet CFFO, working money movement even minimize in half will absolutely cowl capex and a $170 million surplus will stay.

Speaking concerning the steadiness sheet and solvency, I ought to say that:

- Current Ratio shouldn’t be a priority. On June 30, 2018, CR was 1.49x, which is protected. That is solely in step with historic figures, however weaker than on the finish of FY17.

- Quick Ratio was weaker, 0.58x is across the lowest stage in 10 years. The final time QR was equal to 0.58x was in 2011.

- All in all, it doesn’t transparently point out that the firm is getting ready to insolvency, and the place is pretty healthy.

- There aren’t any close to-time period debt maturities.

- In the November Trading Update, it was talked about that internet debt stood at $2.8 billion with solely 1.8x gearing. As a reminder, the firm makes use of Net Debt-to-EBITDAX ratio, not a conventional Net debt-to-EBITDA, as an indicator of gearing.

- According to the slide 56 of the presentation, Net Debt-to-EBITDAX will compress to 1x with Brent round $70 per barrel. And if the sentiment on the market shouldn’t be favorable with Brent ~$50, the gearing will stay above 2x, however this stage is appropriate for the upstream.

Summarizing the entire above, I ought to conclude that Tullow Oil has a inflexible steadiness sheet and adequate FCF era functionality, and that the choice to reintroduce the dividend was affordable.

Valuation

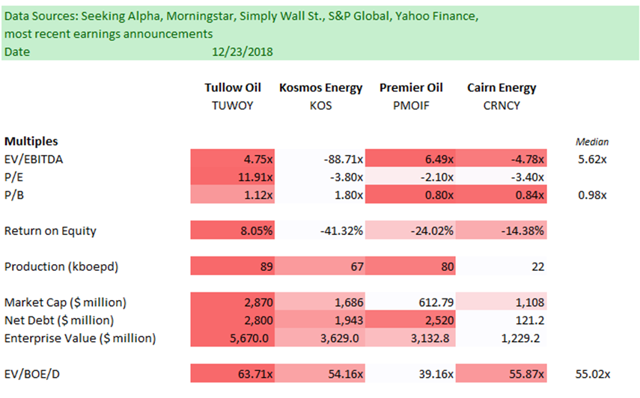

As I’ve identified within the earlier stock protection, the closest friends of Tullow Oil are Kosmos Energy (KOS), Cairn Energy (OTCPK:CRNCY), and Premier Oil (OTCPK:PMOIF). As regards dividends, Tullow compares fairly favorably with the chosen friends:

- Premier Oil postponed dividend funds in 2014 and had not restored it but.

- Kosmos Energy shouldn’t be a dividend payer. The backside line on the firm’s P&L assertion is painted crimson, and the debt is burdensome.

- Cairn Energy has reworked its portfolio and proven the primary income in a couple of years; constructive EPS (ttm) is a matter of time. However, it’s not prepared for dividends.

Hence, Tullow is initially in a extra enticing place relating to shareholders’ rewards.

EV/EBITDA and P/E mixed with Return on Equity may make clear if the firm is undervalued or overvalued amongst its closest friends. Here are the info:

1) Enterprise Value was calculated as a sum of market capitalization and internet debt. 2) Red cells point out the best information factors. 3) Negative multiples had been excluded from the calculations of median figures.

It seems that Tullow is extra enticing than chosen friends with low EV/EBITDA and constructive ROE. It has P/E (ttm) of 11.91x, however it’s not potential to match the ratio with opponents so far as their EPS are nonetheless destructive. However, an 11.91x ratio shouldn’t be uncommon for the E&P and doesn’t point out overvaluation. The P/B ratio is barely greater than the peer median and so is the EV/BOE/D, however the stage of manufacturing in FY19 will probably attain 100 kboepd and the a number of will compress.

It can also be value mentioning that funding banks stay bullish on the stock regardless of trimmed value targets. For occasion, on December 12, Barclays cut its value goal from GBX 315 to GBX 250 with an “Overweight” ranking. That means a ~45.7% upside potential even amid lackluster Brent efficiency.

Catalysts that may probably assist the share value

Analysts and buyers are watching carefully on the 2019 drilling marketing campaign and additional steps in Guyana. The drilling blueprint has been already approved, and in “late May, early June,” the work will start. Interestingly, the drilling sector and the current Exxon Mobil (XOM) and Hess Corp. (HES) Liza discovery are conterminous, and that evokes sure hopes that drillers will encounter commercially viable hydrocarbons.

Tullow shouldn’t be a novice within the South American offshore operations. Previously, in 2013, earlier than the oil disaster, the firm examined waters in French Guiana, partnering with Royal Dutch Shell (RDS.A, RDS.B). However, the properly was dry. As a outcome, Tullow lost 6% of market capitalization in a day.

For Tullow, assisted by French oil business mammoth Total SA (TOT), exploration in Guyana seems to be an essential worth driver. Howbeit, if wells don’t convey prosperous reserves or don’t encounter excessive-high quality promising reservoir, the share value efficiency is perhaps distressing. The announcement of the unsuccessful Cormorant-1 properly offshore Namibia vastly contributed to the promote-off in October, which was adopted by the strain of oil market uncertainty.

Risks and headwinds

- Waste dumping points in Kenya attracted the attention of the federal government.

- Cheaper oil may result in impairments, which have already been burdensome prior to now. For occasion, an enormous portion of H1 FY17 EBIT was worn out by non-money impairment bills.

Conclusion

I ought to conclude that the corporate’s resolution to reinstate dividends, which upon cursory inspection regarded hasty amid the present market situations, is pretty affordable and well timed. Tullow Oil’s administration is circumspect as a result of the board determined to distribute solely a small portion of FCF. Also, it’s crystal clear that the rationale behind the dividend reintroduction is the intention to draw the buyers who shun even enticing shares which at present don’t have any DPS. However, the capital acquire in 2019 largely will depend on the outcomes of the scheduled drilling marketing campaign.

Disclosure: I/we have now no positions in any shares talked about, and no plans to provoke any positions throughout the subsequent 72 hours. I wrote this text myself, and it expresses my very own opinions. I’m not receiving compensation for it (apart from from Seeking Alpha). I’ve no enterprise relationship with any firm whose stock is talked about on this article.