Turning Points For The Week Of December 17-21

[ad_1]

The objective of the Turning Points Newsletter is to have a look at the long-leading, main, and coincidental financial indicators to find out if the financial trajectory has modified from growth to contraction – to see if we have reached an financial turning level.

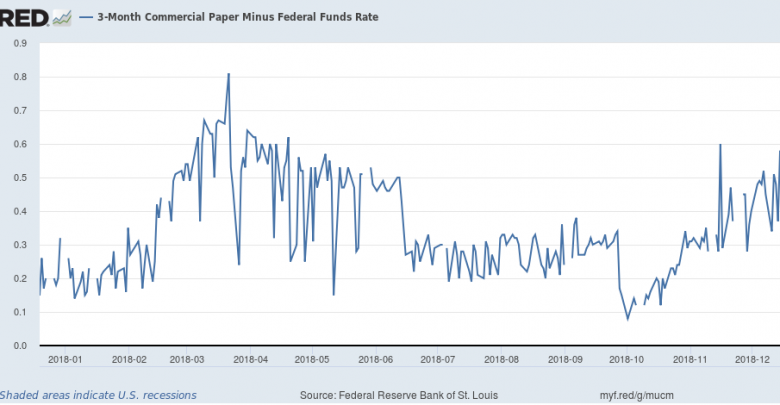

Let’s start with the credit score markets, beginning with the quick finish of the company market:

Once once more, business paper is rising relative to the FF fee. It’s again at ranges we noticed in mid-2018. This is a web destructive.

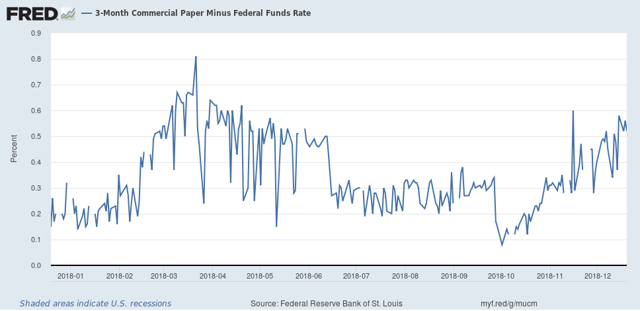

Other segments of the company market are widening:

CCCs proceed to maneuver larger at a pointy fee. The tempo should not be stunning; this a part of the bond market normally trades a bit extra like equities than bonds.

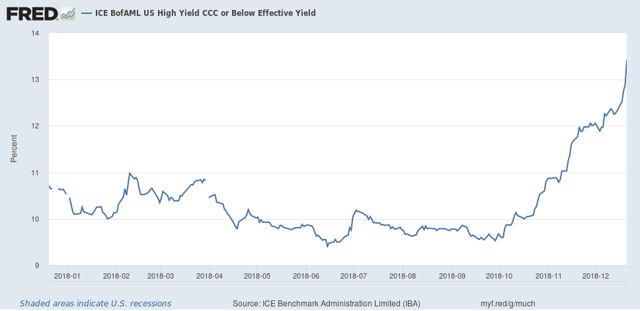

The prime chart exhibits that absolute Baa yields are coming in a bit, which is optimistic. But relative to the 10-year, this phase of the company market is widening.

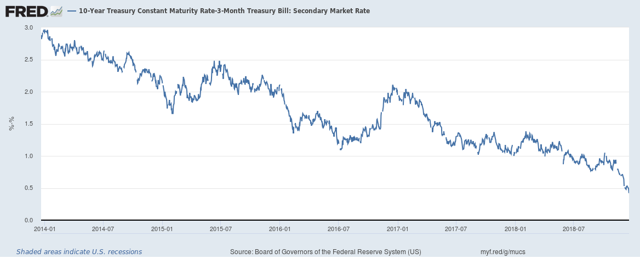

And the Treasury curve continues to slim:

As for different monetary markets, the S&P 500 continues to right:

The sum/whole of the monetary markets is bearish. Riskier segments of the company market proceed to widen. Baa’s are larger relative to the Treasury market. Commercial paper is widening as nicely. And the S&P 500 is in a transparent correction.

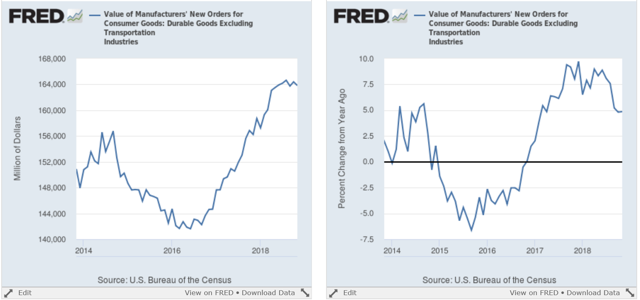

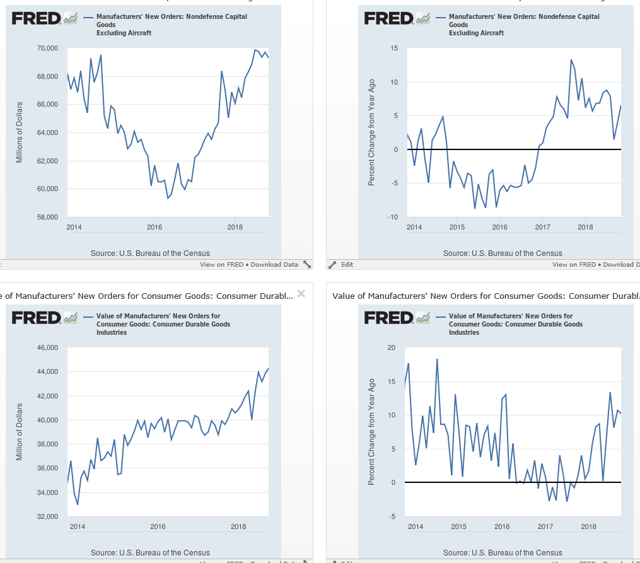

This week, we obtained new information on two different main indicators: sturdy items and constructing permits. Let’s start with the previous. The headline number was a optimistic .8% M/M achieve. But the ex-transport quantity was -.3% – the second decline in three months. This quantity has been proper on the 164,000/month stage for many of this 12 months. The Y/Y tempo (right-hand chart) is declining, however it’s nonetheless at a healthy 5%. Two different key sub-categories of knowledge are additionally optimistic:

The Y/Y tempo (right-hand chart) is declining, however it’s nonetheless at a healthy 5%. Two different key sub-categories of knowledge are additionally optimistic:

The prime two charts present non-defense capital items ex-aircraft. The absolute quantity (left) has in all probability peaked this cycle; it has been simply south of 70,000/month for the latter half of 2018. The proper chart exhibits that the Y/Y tempo is declining, however remains to be at a stable 5% plus. The backside two charts present the identical information for sturdy shopper items orders, that are at a 5-year absolute excessive within the newest report. The Y/Y tempo is true round 10%.

These numbers are in keeping with the latest ISM PMI, which has been printing within the upper-50s/lower-60s for the final 12 months. Overall, manufacturing is in fine condition.

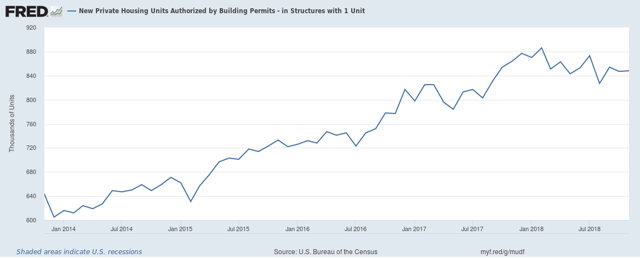

Housing, nevertheless, continues to soften (emphasis added):

Privately‐owned housing items approved by constructing permits in November have been at a seasonally adjusted annual fee of 1,328,000. This is 5.0 % (±1.6 %) above the revised October fee of 1,265,000 and is 0.4 % (±1.7 %)* above the November 2017 fee of 1,323,000. Single‐household authorizations in November have been at a fee of 848,000; that is 0.1 % (±1.4 %)* above the revised October determine of 847,000. Authorizations of items in buildings with 5 items or extra have been at a fee of 441,000 in November

Let’s start with the general quantity:

This quantity had been trending decrease for many of the 12 months. The newest studying was goosed larger by an enormous improve (15%) in residence permits within the South. The 5-unit quantity had been trending decrease for the final 11 months, which implies this improve might be a one-off quantity.

Apartments are vital, however particular person homes are extra related to the financial cycle. Here is a chart of the info:

They have not cratered by any stretch of the creativeness. But the tempo is clearly slowing.

I’m holding my recession chance within the subsequent 18-24 months at 30%. The credit score markets are actually in a traditional pre-recession orientation. Lower-rate paper is promoting off; business paper spreads are widening; and the yield curve continues to flatten. The stock market sell-off is sharp. Housing is softening. These are all indicators of a possible recession. It’s not imminent, however there is a greater than small chance it might occur.

Disclosure: I/we now have no positions in any shares talked about, and no plans to provoke any positions throughout the subsequent 72 hours. I wrote this text myself, and it expresses my very own opinions. I’m not receiving compensation for it (aside from from Seeking Alpha). I’ve no enterprise relationship with any firm whose stock is talked about on this article.

[ad_2]