United Homes Group Explores Strategic Alternatives Amid Leadership Reshuffle: Can It Become A Buyout Target?

United Homes Group (NASDAQ:UHG) has officially entered the M&A spotlight after announcing a strategic review aimed at maximizing shareholder value, which includes a potential sale, asset sales, or refinancing options. This move, disclosed in mid-May 2025, comes at a pivotal moment for the Southeast-focused homebuilder. As part of the strategic overhaul, UHG appointed John G. Micenko, Jr.—a seasoned real estate capital markets veteran—as CEO, replacing interim chief James M. Pirrello, who will remain on the board. Simultaneously, operational leadership has been bolstered by naming Jeremy Pyle co-Chief Operating Officer alongside Shelton Twine. These shifts suggest a heightened focus on improving execution and profitability to appeal to potential suitors. Vestra Advisors has been engaged as financial advisor and Paul, Weiss, Rifkind, Wharton & Garrison LLP as legal counsel for the review process. While there is no definitive timeline or guarantee of a transaction, the combination of leadership realignment and an active search for strategic alternatives has set the stage for UHG to emerge as a compelling acquisition candidate.

Geographic Strength In High-Growth Southeastern Markets

United Homes Group's strong operational footprint across the Carolinas and Georgia is one of its most attractive assets from an acquirer's standpoint. These regions have consistently demonstrated robust population growth and economic development due to business-friendly regulations, affordable housing relative to other major U.S. markets, and increasing employer migration. The Southeast continues to be a preferred destination for both homebuyers and corporations, bolstering the long-term housing demand in these areas. UHG's focus on these markets positions it as a scalable growth platform for larger national builders or private equity firms seeking to expand in resilient, high-migration areas. Additionally, the company controls approximately 7,500 lots, offering an asset-light land strategy that appeals to risk-averse acquirers seeking capital efficiency. The 28 new communities slated for launch in Q2 and Q3 2025 will feature refreshed product lines with higher-margin designs, creating future revenue visibility. Combined with an improving cycle time and increased presale activity, UHG’s Southeast concentration enhances both margin stability and predictable cash flows. For a potential buyer, the company offers a ready-made operational base in thriving markets with favorable demographic and economic trends, reducing the need for organic market entry. This geographic positioning, coupled with market fundamentals that support sustained growth, makes United Homes Group a strategically valuable bolt-on or standalone asset for companies targeting the U.S. Sunbelt housing corridor.

High-Margin Product Refresh & Presale Strategy

UHG's product and pricing strategy has undergone a major transformation in early 2025, pivoting towards higher-margin presold homes and newly refreshed home designs under its "Fresh Floor" initiative. The new home designs have delivered gross margins of approximately 24%, significantly higher than the company-wide average of 16.2% in Q1 2025. This margin improvement is not theoretical—27 of these new homes were closed in April, and 95 more are in backlog as of mid-May, signaling that the product refresh is already contributing meaningfully to operational metrics. In tandem with design enhancements, UHG is shifting its focus toward presale homes, which carry higher profitability compared to spec inventory that often requires discounting and incentives. This shift is timely, as market conditions increasingly favor buyers who want customizable homes with upgraded options, especially in the move-up segment. Acquirers will note that this strategy provides enhanced margin visibility and reduces working capital needs by decreasing spec inventory exposure. The combination of better product positioning, rising backlog of refreshed homes, and a more balanced inventory model demonstrates a disciplined operational approach that aligns with the long-term return expectations of institutional investors or strategic buyers. The ability to generate and sustain premium gross margins—while still competing effectively on affordability—enhances UHG's overall valuation and attractiveness as a takeover target.

Operational & Financial Discipline Enhancing Returns

United Homes Group has taken tangible steps to position itself as a returns-focused, efficiently managed builder. A key component of this transformation is the cost reduction program already yielding over $3.5 million in identified direct construction savings for homes to be closed in 2025. These savings are being realized through competitive rebidding of subcontractor and supplier agreements and are expected to scale in the coming quarters. Additionally, the company has successfully trimmed 16 days from its average construction cycle time, increasing its ability to turn inventory faster and enhance return on capital. This operational discipline extends to its capital structure as well. In December, UHG refinanced its convertible debt, reducing both total debt and quarterly cash interest expense by $1 million. This effort to clean up the balance sheet strengthens its financial profile, providing a clearer earnings picture and reduced refinancing risk—key factors that acquirers weigh heavily. With $86.9 million in liquidity and a land-light growth model, UHG has positioned itself to weather near-term market volatility while pursuing long-term expansion. The alignment of strategic cost control, balance sheet repair, and execution on new communities creates a framework for consistent earnings growth, making UHG an operationally ready and financially sound target for acquisition.

Margin Pressure From Incentives & Sluggish Start To 2025

Despite its many strengths, United Homes Group is not without headwinds that may concern potential acquirers. The company’s Q1 2025 performance was impacted by a slower-than-expected sales pace in January and early February, partially due to poor weather and broader housing market softness. This led to a 13.7% decline in quarterly revenue and a drop in home closings to 252 units from 311 in the prior year. Compounding these issues, gross margin remained subdued at 16.2%, suppressed by elevated incentive activity and discounting on move-in-ready homes. Financing incentives alone amounted to 4% of the average selling price, eroding profitability. Although the company is actively shifting to higher-margin presales, incentives are expected to remain a necessary tool to compete with resale homes in the current affordability-constrained environment. Adjusted gross margin declined to 18.8% from 20.4% a year ago, reflecting the combined impact of incentives and pricing adjustments. These margin challenges, if prolonged, could deter acquirers seeking more predictable and higher-yielding operations. The pressure to maintain sales volumes in a competitive market may continue to weigh on profitability, adding a layer of uncertainty to the growth trajectory. While the initiatives in place are promising, the time required for full turnaround and the dependency on external housing demand factors could limit immediate buyer interest or compress the acquisition premium.

Key Takeaways

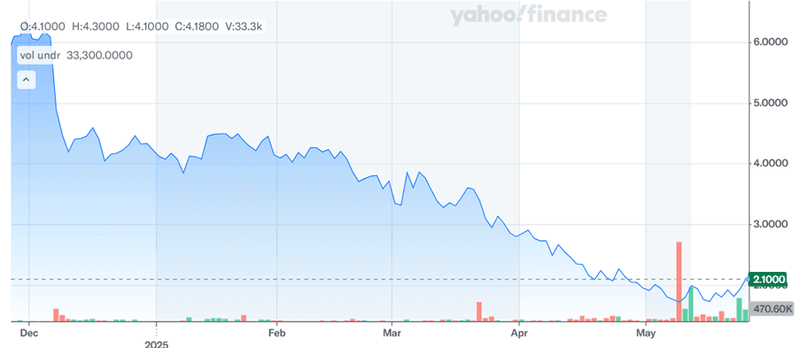

Source: Yahoo Finance

We can see UHG’s stock has taken a beating over the past 6 months and is down to nearly one-third of its levels from end 2025. Its LTM EV/ Revenue valuation is down from 1.03x in March 2024 to hardly 0.49x today making it a cheap buy. We believe that United Homes Group has positioned itself as a credible acquisition target through strategic market focus, improved product margins, and disciplined operational execution. However, short-term profitability pressures and ongoing reliance on incentives may temper acquirer enthusiasm in the near term, which is why we believe that caution is warranted before making investment decisions in the stock.