Vail Resorts Stock Has Been On A Slippery Slope—But Is The Trail About To Flatten?

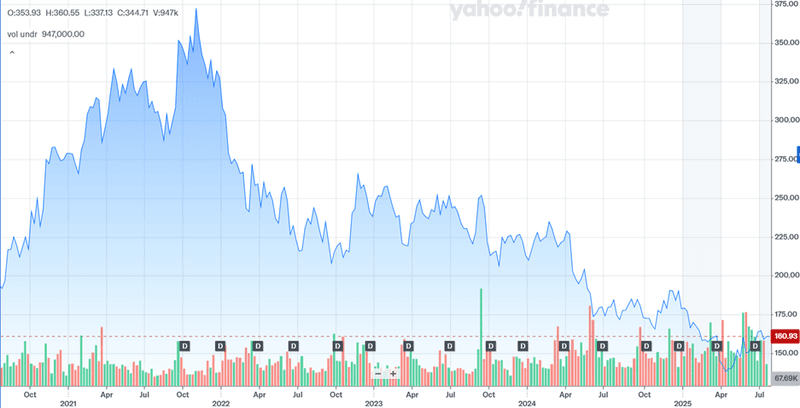

Vail Resorts (NYSE:MTN), the dominant name in North American ski tourism, has seen its stock tumble nearly 50% from its 2021 highs, leaving investors wondering whether the drop is a long-term correction or a temporary skid. The company, known for its sprawling portfolio of 42 world-class resorts and its transformative Epic Pass program, has struggled in the post-pandemic landscape despite the skiing boom of 2020–2021. Recent labor strikes, soft lift ticket sales, and shifting consumer behavior have weighed heavily on performance. However, new leadership under returning CEO Rob Katz, alongside a strategic shift in cost efficiency, digital innovation, and product refinement, may reposition Vail for a steadier climb. With a robust dividend yield nearing 6%, strong liquidity, and disciplined capital deployment, Vail Resorts is not standing still. Let us analyze the bbiggest reasons behind the stock’s decline and identify the strategies the company is deploying to reinvigorate growth and regain investor confidence.

Declining Visitation & Uncommitted Guest Fatigue

One of the central reasons for Vail Resorts’ stock drop has been the noticeable decline in skier visitation, especially from uncommitted guests who do not purchase season passes. While the company’s advance commitment model (anchored by its Epic Pass) continues to perform reasonably well, uncommitted lift ticket sales have consistently fallen short of expectations in recent ski seasons. In the 2024–2025 North American ski season, visitation declined by 3% year-over-year, even as the broader industry posted modest growth. Vail’s management cited factors such as underwhelming snowfall in critical geographies, shifting guest visitation patterns, and lingering friction points in the customer experience, particularly at Park City. The 13-day ski patrol strike at that location in early 2025 served as a flashpoint, highlighting broader labor tensions and operational inconsistency. CEO Rob Katz acknowledged that while most resorts reported strong guest satisfaction, the inconsistency in delivery at high-profile locations has contributed to a deteriorating public narrative. As weather volatility and macroeconomic uncertainty continue to impact vacation decision-making, Vail's model, which heavily depends on high guest engagement at premium destinations, has become more vulnerable. The company is attempting to address this by enhancing its guest engagement efforts and refining its product offerings to bring back lapsed skiers and convert them into passholders. However, the slow recovery in lift ticket sales and the broader saturation of the high-end ski market have combined to make visitation metrics a challenging headwind to overcome in the short term.

Margin Pressures & Cost Escalation Post-Pandemic

The second major drag on Vail Resorts’ stock performance has been margin compression due to rising labor and operational costs. Between 2022 and 2025, the company grappled with higher wages, supply chain disruptions, and frontline labor shortages that impacted service quality and operating leverage. Despite a growing season pass base and robust ancillary spending in areas such as ski schools and dining, profitability has not kept pace. The resort EBITDA margin for fiscal 2025 is expected to come in at approximately 28.4%, well below the pre-pandemic average of 31% and 2022’s peak of 33.1%. Compounding the challenge is the structural seasonality of the business, with the majority of revenues concentrated in just four months of the year. To mitigate cost pressures, the company launched a two-year Resource Efficiency Transformation Plan aimed at unlocking $100 million in annualized cost efficiencies by fiscal 2026. Through workforce management optimization, global shared services, and scaled operations, Vail has accelerated $8 million of savings into the current fiscal year, with $35 million projected in total for FY25. While this plan may help lift margins gradually, the company must simultaneously continue investing in employee satisfaction and guest services to maintain brand equity. Labor relations remain sensitive, especially after the Park City labor dispute, and any misstep could jeopardize future operational continuity. Vail’s leadership has indicated that there is no need for a grand reset of costs, but the delicate balancing act between fiscal discipline and maintaining a premium resort experience will remain a source of tension in the investment narrative.

Marketing Gaps & Erosion Of Brand Connection

A third contributing factor to the company’s downturn has been a misalignment between its marketing strategies and evolving guest expectations. Rob Katz, in his return as CEO, emphasized that Vail Resorts had become less effective at communicating its brand value and engaging potential guests in recent years. Despite having access to vast guest data and advanced CRM tools, the company admitted to missing the mark in some key areas of consumer outreach. The narrative surrounding Vail as a large, publicly traded ski conglomerate has also led to perceived disconnects with the community and customers, some of whom view the company’s growth model as being at odds with the spirit of the ski culture. The inability to properly convey the value of the Epic Pass and ancillary offerings—such as My Epic Gear and My Epic App—has further weakened guest loyalty and brand equity. Vail is now focused on revamping its marketing and communications to align with newer digital trends and better target uncommitted or first-time skiers. This includes enhanced personalization, clearer messaging on product tiers, and more transparent articulation of what the company stands for. Marketing innovation is also being tied to new product initiatives like dynamic pricing strategies and more granular pass 0 segmentation. These efforts, however, will take time to bear fruit and involve trial and error. In a competitive environment with alternatives like the Ikon Pass from Alterra Mountain Company, Vail must work harder to differentiate its value proposition and win back market share—especially among younger, cost-conscious travelers.

Strategic Uncertainty In International Expansion & M&A

Lastly, investor confidence in Vail Resorts has been affected by ambiguity around its international strategy and M&A discipline. While the company continues to express preference for owning and operating resorts rather than relying solely on partnerships, its recent moves in Europe have been largely limited to collaborations rather than acquisitions. The addition of six new partners in Austria was seen as a potential precursor to broader ambitions, yet Vail has not announced a unified European pass product or significant cross-border integration strategy. This restraint may be prudent given regional complexities and cultural differences, but it also limits the company’s immediate growth visibility. In the U.S., organic growth is approaching maturity, and Vail’s ability to expand its addressable market hinges partly on developing a strong international flywheel akin to the Epic Pass network in North America. On the M&A front, CEO Katz reaffirmed that the company will remain disciplined and opportunistic, looking only for assets that are additive and synergistic. However, with fewer high-quality resorts available at attractive valuations, the window for accretive acquisitions appears to be narrowing. Meanwhile, the capital budget of around $250 million for calendar 2025 prioritizes lift upgrades, terrain enhancements, and digital experience improvements, but lacks a blockbuster initiative that might reframe investor expectations. The longer Vail remains in a strategic holding pattern abroad and constrained in M&A execution, the more likely it is that long-term investors will demand clearer signals about the company’s global growth potential.

Final Thoughts

Source: Yahoo Finance

Vail Resorts’ roughly 50% decline since 2021 underscores the seriousness of investor concerns about its growth trajectory and structural headwinds. Despite ongoing investments in guest experience, technology, and cost efficiencies, Vail’s LTM valuation multiples—such as 10.44x EV/EBITDA, 2.02x P/S, and 20.83x P/E—suggest that the market remains cautious. While a 5.6% dividend yield and buyback authorization provide support, upside will likely depend on how effectively the company executes on its operational transformation, stabilizes lift ticket demand, and innovates its pass offerings. For now, Vail’s investment profile is a mix of dependable cash flow with limited near-term growth visibility, making it suitable for income-focused investors but less compelling for those seeking aggressive capital appreciation.