Vasta Gets Bought Out? Why Cogna’s $5 Offer Is Shaking Up Edtech!

Vasta Platform Limited (NASDAQ:VSTA) has officially entered the spotlight after Cogna Educação S.A. (BOVESPA:COGN3) announced its intent to acquire the remaining minority stake in the Nasdaq-listed education platform. On September 15, 2025, Cogna proposed a cash tender offer of $5 per share to absorb Vasta, with plans to delist the Class A shares from Nasdaq and deregister with the SEC. The deal—still pending regulatory approval, SEC authorization, and necessary corporate resolutions—marks a strategic pivot for Cogna as it consolidates assets in a highly competitive and rapidly digitizing education market. Here the key element that needs to be understood is – what exactly did Vasta bring to the table that made it a solid acquisition target for Cogna. Let us find out!

Solid Core Subscription Momentum With Predictable Cash Flows

Vasta’s recurring and resilient core revenue model, which continues to scale profitably, is likely the key driver behind Cogna’s interest in acquiring the remaining stake. In the 2025 commercial cycle to date, Vasta recorded BRL 1.340 billion in subscription revenue, a 16% increase year-over-year. This accounted for over 90% of the company’s total revenue base. What makes this core segment particularly attractive is not just its double-digit growth, but the predictability it offers via contractual relationships with private K-12 schools in Brazil. Vasta’s focus on academic content distribution and licensing generates stable revenue streams that are both non-cyclical and cash-generative. In a market where volatility in B2G contracts and seasonal book deliveries can skew financial results, the subscription segment provides a foundation for forecasting, budgeting, and planning at the group level. Additionally, the high retention rate observed in contract renewals, as highlighted during the Q2 2025 earnings call, supports long-term customer lifetime value and reduces churn-related risks. From Cogna’s perspective, fully integrating Vasta would mean greater control over a profitable business line that cushions other, more cyclical segments of the broader education portfolio. Importantly, Vasta’s free cash flow of BRL 224 million in the current cycle—a 147% jump—combined with strong EBITDA margins of 31.1% illustrates an underlying business engine that is already delivering return on capital. Given Cogna’s past capital structure optimization efforts, absorbing a cash-flow-generative asset like Vasta provides not just earnings accretion but also flexibility for debt repayment, dividend payouts, or reinvestment in adjacent verticals.

Expanding Complementary Solutions With High TAM Penetration

Vasta’s complementary solutions business—spanning bilingual education, social-emotional learning, maker labs, and pre-university courses—grew 24% cycle-to-date, outpacing the growth in its core segment. This expansion is being driven by rising demand for holistic learning solutions among private school networks, as well as strategic investments into the Start-Anglo bilingual school network. With over 50 franchise contracts signed and 7 operating units already live, Vasta’s school-based offering provides Cogna with exposure to a fast-scaling asset in an adjacent high-margin vertical. The Start-Anglo brand operates both on a franchise and flagship model, offering tuition-based revenue streams that diversify the otherwise largely B2B content sales structure. Moreover, the Anglo prep courses, which saw a 21% increase in student enrollments, signal a widening user base for non-subscription services that complement core offerings. For Cogna, which has long invested in content but had less control over distribution and user engagement beyond schools, integrating these complementary verticals deepens the customer relationship while increasing wallet share. Cross-selling between content and services not only enhances customer stickiness but also provides a competitive moat as Vasta embeds itself deeper into institutional workflows. From a revenue mix standpoint, non-subscription revenue now accounts for nearly BRL 98 million annually—up 11% year-over-year. By folding this high-growth, product-adjacent segment fully into its operations, Cogna can leverage group-wide distribution, marketing, and infrastructure capabilities to accelerate penetration further. For a diversified education holding company, this synergy translates into margin uplift and a broader strategic position in the evolving Brazilian education ecosystem.

Resilient B2G Performance Despite Contract Concentration

Although Vasta’s B2G (business-to-government) segment has historically been dominated by a large contract with the state of Pará, recent strategic shifts suggest the company is proactively diversifying its public sector exposure. While 2024’s sales cycle saw a one-time BRL 69 million booking from Pará, 2025 performance thus far includes BRL 14 million from 10 new municipal customers—spread across smaller contracts with lower single-client dependency. During the Q2 earnings call, management indicated ongoing fulfillment of Pará’s second-semester orders and a realistic target of onboarding at least one new state by year-end. For Cogna, which has broader relationships and bargaining power across federal and municipal education networks, acquiring full control over Vasta opens the door to integrating this niche B2G footprint into its existing ecosystem. Moreover, B2G revenues—though lumpy—carry higher unit economics and are supported by long procurement cycles that, once won, deliver multi-period stability. Vasta has also begun introducing new tools like SAEB preparatory products and recovery education initiatives, aligning with public mandates. In an election year, while procurement volatility might be a concern, it also creates a window for new contracts with incoming administrations. Cogna's acquisition could consolidate contract management, reduce administrative overlap, and bring in centralized oversight on B2G compliance and risk mitigation. The ability to normalize Vasta’s public sector exposure across a wider portfolio, rather than viewing it as a standalone risk, could improve overall margin predictability while still preserving upside from government-funded education initiatives.

Operational Efficiencies, Deleveraging, & Cash Discipline

Another compelling reason for Cogna to absorb the rest of Vasta lies in the latter’s sharply improving operational metrics, especially in terms of cash flow discipline, working capital management, and deleveraging. In the 2025 cycle, Vasta’s free cash flow reached BRL 224 million, translating to a 57.7% conversion from adjusted EBITDA—a material improvement over the prior year’s 41.8%. This outperformance was supported by automation in receivables collections, centralized supplier payment scheduling, renegotiation of terms, and early collection cycles. At the same time, net debt has declined to BRL 917 million, resulting in a net debt/EBITDA ratio of 1.9x compared to 2.28x a year ago. For Cogna, which operates under a broader capital efficiency mandate, absorbing Vasta allows it to consolidate cash flows, reduce overlapping treasury operations, and optimize debt structure across entities. Additionally, cost synergies from joint procurement, shared IT systems, and rationalized marketing spend could materially improve group-level margins. G&A expenses at Vasta have already improved by 0.5 percentage points due to workforce optimization and budgeting discipline, showcasing readiness for integration. Beyond that, Cogna could also centralize financing activities, especially for school-based infrastructure expansion under the Start-Anglo banner, using its own balance sheet strength to reduce cost of capital. All of these factors point to back-office consolidation and group-wide financial engineering as key acquisition drivers. With such fundamentals, the asset becomes less about standalone earnings and more about cash flow accretion and scale advantages when integrated into a larger platform.

Final Thoughts

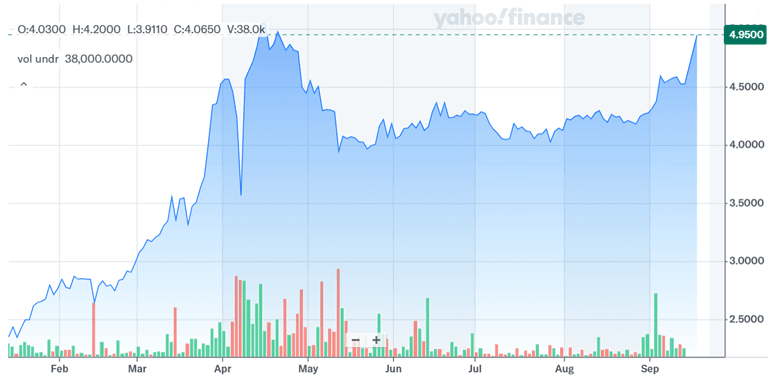

Source: Yahoo Finance

We can see Vasta’s stock price rising close to the $5 acquisition price level over the past couple of days but the stock has risen more than 20% in a month’s time. This goes to show the importance of tracking reasonably valued small-caps especially rumored acquisition targets, from the point of view of opportunistic investors. Vasta trades at relatively modest valuation multiples, with LTM EV/EBITDA at 8.55x and LTM P/S at 1.26x which also indicates that Cogna seems to have got a very good deal. Overall, we believe that the Cogna-Vasta combination appears to be a meaningful strategic fit, provided regulatory and market risks are properly managed.