Vimeo’s $1.38 Billion Acquisition By Bending Spoons Isn’t Just A Buyout—It’s A Strategic Power Play!

Video software solutions provider, Vimeo Inc. (NASDAQ:VMEO) has been in the news off late as it is all set to be acquired by Bending Spoons in an all-cash transaction valued at $1.38 billion, or $7.85 per share—a staggering 91% premium over its 60-day volume-weighted average. The timing of this acquisition is notable: Vimeo recently announced a 10% global headcount reduction while navigating a transition marked by AI innovation, platform unification, and profitability improvements. While revenue growth remains muted, the company is reporting momentum in both its self-serve and enterprise segments, supported by recent product launches and AI-driven features. While tech and AI related small-caps and startups are getting acquired every day in a rapidly evolving tech landscape, Vimeo’s acquisition is particularly intriguing and Bending Spoons’ rationale in acquiring the company presents a very interesting case study.

AI-Led Product Innovation with Monetizable Use Cases

Vimeo's investment in AI functionality stands out as one of the most immediate value propositions for Bending Spoons. The company has integrated generative AI and Agentic AI features across its self-serve and enterprise platforms. These tools enable users to search video libraries via natural language, auto-translate entire content catalogs, and embed interactive video into workflows. In Q2 2025, Vimeo began monetizing these AI features—notably in areas like training and customer support, where customers can deliver personalized, indexed content experiences. Products like Workspaces, which provide enhanced access controls and departmental-level security, are scheduled for wider release in Q3 and Q4. These capabilities appeal to heavily regulated verticals and large distributed organizations—two areas where Bending Spoons has limited but growing traction. Vimeo’s enterprise business already serves advanced clients like Spotify, FanDuel, and Jaguar Land Rover, proving the robustness of its infrastructure. Bending Spoons could capitalize on Vimeo’s proprietary AI stack to deepen platform stickiness, introduce tiered monetization, and unify video creation and distribution within its existing suite of creative and productivity apps. The result would be an integrated, AI-powered experience that reduces customer churn and expands average revenue per user (ARPU).

Streamlined Operations and Margin Expansion Potential

Bending Spoons is acquiring a leaner Vimeo than the market remembers. The company has executed a significant operational restructuring, including a reduction in force and platform consolidation that is streamlining over a dozen legacy products into a single codebase. This architecture upgrade is improving both development velocity and product stability. More importantly, it is reducing the cost burden across engineering, support, and infrastructure. Vimeo raised its adjusted EBITDA guidance for 2025 to $35 million, reflecting improved operating leverage. During the Q2 2025 call, management emphasized their ability to achieve higher margins without sacrificing innovation. Additionally, Vimeo's tight rein on R&D and SG&A spending reflects a disciplined capital deployment model. These efficiency gains could prove highly synergistic for Bending Spoons, which has a track record of building high-margin mobile applications. Vimeo’s positive free cash flow profile—alongside its cash reserves—reduces the integration risk and funding requirements for the acquiring firm. As AI features scale and legacy product maintenance winds down, EBITDA margins are likely to expand further. These dynamics allow Bending Spoons to extract value through operational improvements while maintaining investment in core growth initiatives.

Strategic Expansion into Video SaaS and the Creator Economy

The acquisition provides Bending Spoons with an immediate footprint in the high-growth, under-monetized video-first SaaS space. Vimeo’s self-serve segment, which grew bookings by 11% in Q2 2025, represents a critical lever. After updating its pricing and packaging and releasing long-requested features, Vimeo saw customer retention stabilize. Leadership expects this segment to return to sustained double-digit growth by 2026. Additionally, 70% of Vimeo’s enterprise customers are converted from self-serve accounts, illustrating a clear upgrade path within the platform. For Bending Spoons, this customer lifecycle is valuable: it enables high-LTV (lifetime value) user acquisition and predictable upsell opportunities. Vimeo’s brand also holds credibility among marketers, SMBs, and creators—demographics that overlap with Bending Spoons’ core user base. Combining Vimeo’s video hosting, streaming, and analytics capabilities with Bending Spoons’ mobile video editing and wellness applications could create a unique flywheel. New monetization models such as usage-based billing, pay-as-you-publish tiers, and AI-generated content packages could be tested across both ecosystems. As consumer and enterprise demand for visual content accelerates, owning a scalable, end-to-end video stack offers long-term competitive advantages.

Attractive Valuation Entry Point for Scalable Infrastructure

While Vimeo's growth has stabilized, its market valuation remains disconnected from its asset quality. As of September 10, 2025, Vimeo traded at an LTM TEV/Revenue of just 2.38x and LTM P/S of 3.09x. Despite recent improvements in operating metrics, its LTM TEV/EBITDA multiple has ballooned to 89.29x due to temporarily suppressed EBITDA. This makes it difficult for public investors to value the company based on current cash flows. However, for a private buyer with operational expertise, Vimeo presents a strategic asset that can be optimized and scaled. The platform includes robust video infrastructure, secure hosting, real-time collaboration tools, live streaming, and integrations with enterprise platforms like Zoom. Building this stack from scratch would require significant capital and time. Bending Spoons is acquiring a platform with proven reliability, global reach, and monetizable data workflows—especially valuable as video becomes the dominant medium for learning, communication, and commerce. Given Vimeo’s low TEV/GP multiple of 3.06x, Bending Spoons could unlock value not currently reflected in public market expectations, especially if cost synergies and pricing initiatives are successfully implemented.

Final Thoughts

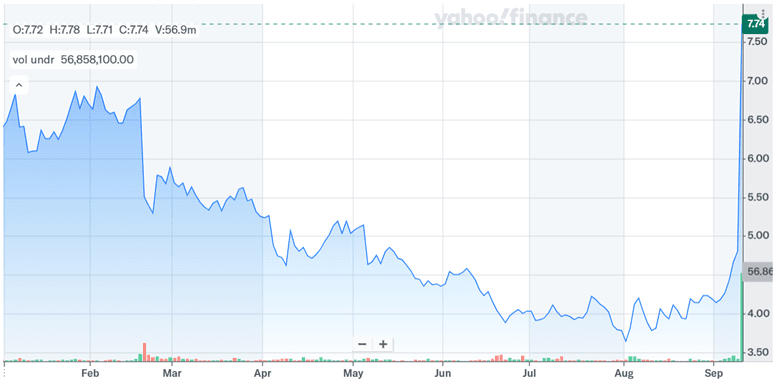

Source: Yahoo Finance

We can see how Vimeo’s stock price nearly doubled after the deal was announced, providing phenomenal returns to its shareholders as well as M&A players who saw this coming. Vimeo getting acquired in the current market is not surprising at all as its AI product evolution, operating discipline, and multi-tier customer funnel provide a foundation for long-term value creation for any acquirer. For Bending Spoons, the acquisition offers scale, infrastructure, and product depth that align with its app-centric, mobile-first strategy. Whether or not the deal ultimately creates outsized returns for Bending Spoons will depend on the management’s ability to enhance distribution, reduce operating drag, and re-accelerate growth in a competitive and fast-evolving market.