Waldencast plc: How Long Will The Bloodbath Continue?

The recent news about Waldencast plc has caught the attention of shareholders and potential investors alike and has seen the company’s stock plummeting. The company is now under scrutiny following the announcement from Bragar Eagel & Squire, P.C., a shareholder rights law firm, whose ongoing investigation into Waldencast, alongside Arbor Realty Trust, Inc. and Brooge Energy Limited, raises questions about potential violations of federal securities laws and other questionable business practices. Waldencast's situation became particularly precarious when the company disclosed its inability to file its 2022 annual report punctually. This delay, attributed to a review of the company's year-end 2022 financial statements, specifically pertains to accounting issues related to the sale of certain Obagi products in the Vietnam market. This announcement triggered a significant drop in Waldencast's share value, plummeting approximately 6.20% in a single day. However, we believe that Waldencast’s drop is not just because of the investigation but because of many inherent issues within the company. Let us take a closer look and find out!

What Does Waldencast plc Do?

Waldencast plc is a prominent player in the beauty and wellness industry, focusing on developing, acquiring, accelerating, and scaling a diverse range of brands. The company's portfolio includes a variety of cosmetic, over-the-counter, and prescription products, notably under the Obagi Medical, Obagi Clinical, and Obagi Professional brands. Additionally, Waldencast offers the innovative Skintrinsiq device, designed for facial treatments and widely used in physicians' offices, spas, and by aestheticians. Expanding its reach, the company also caters to the growing demand for clean makeup products through its Milk Makeup brand. Waldencast's distribution strategy encompasses direct sales to dermatologists, plastic surgeons, and other physicians specializing in aesthetic and therapeutic skincare, including those operating in medical spas, alongside partnerships with various distributors, ensuring a broad and effective market presence.

Brand Dilution & Limited Consumer Reach

The ambitious expansion of Obagi, a part of Waldencast's professional skincare segment, into broader consumer markets beyond healthcare professionals, while seemingly strategic, faces significant risks of brand dilution and limited consumer reach. Historically, Obagi has been a respected brand in the physician-dispensed market, but its transition to a more consumer-centric model, including ventures into e-commerce and spa channels, poses substantial challenges. The skincare market is notoriously competitive and saturated, with numerous established and emerging brands vying for consumer attention. Obagi's attempt to redefine its brand identity to appeal to a younger, "skin-tellectual" consumer base, potentially alienates its core, loyal customer base, which has traditionally valued the clinical efficacy and exclusivity of the brand. The introduction of the Skintrinsiq device and the push into Southeast Asian markets through the Obagi Clinical line further stretch the brand's traditional boundaries, risking a loss of focus and brand equity. These efforts, while aiming for diversification, may not effectively penetrate the intended new markets due to fierce competition, consumer skepticism about the authenticity of a medically-oriented brand in a commercial retail setting, and potential misalignment with consumer expectations and preferences. Additionally, the strategic shift may result in operational complexities and increased marketing costs without guaranteeing proportionate revenue growth or market acceptance.

Regulatory & Compliance Challenges

Waldencast's ambitious plans for Obagi in the evolving and highly regulated skincare industry are fraught with significant regulatory and compliance challenges that could severely impede its growth. The skincare and cosmetics industry is subject to rigorous regulatory scrutiny, especially for products claiming medical or therapeutic benefits. Obagi's expansion of product lines, including the move into areas like anti-aging and skin lightening, brings it under the close watch of regulatory authorities like the FDA. The lack of FDA approval for some of its prescription products raises red flags about the potential for future regulatory interventions, which could result in costly legal battles, product recalls, or mandatory reformulations. Additionally, the global expansion strategy, particularly in varied regulatory landscapes like Europe, Asia, and South America, adds layers of complexity in compliance, requiring adaptations to different regulatory standards and potentially leading to delays in product launches or unexpected compliance costs. The entrance into these new markets with differing cultural and regulatory norms might result in missteps that could damage the brand's reputation and financial standing. Furthermore, the reliance on intellectual property and patents, some of which are nearing expiration, exposes the company to risks of increased competition and potential revenue loss as proprietary technologies become open to competitors. These regulatory and IP challenges, coupled with the evolving global regulatory landscape for skincare and cosmetic products, could significantly constrain Obagi's ability to innovate, market, and distribute its products effectively.

Operational & Strategic Execution Risks

Waldencast's strategic initiatives for driving growth through Obagi, including brand and channel expansion, and international growth, are laden with operational and strategic execution risks that could severely undermine the company's performance. The strategy to diversify distribution channels, while theoretically sound, requires significant operational restructuring and investment. Expanding into e-commerce and international markets demands a robust digital infrastructure, effective supply chain management, and a deep understanding of diverse consumer behaviors, all of which are resource-intensive and prone to executional errors. The push into new geographies like Southeast Asia and strategic partnerships for distribution, such as the acquisition of Obagi Vietnam, introduces complexities in market dynamics, cultural nuances, and local regulatory compliance, which could result in misaligned marketing strategies, ineffective distribution models, and potential legal and financial liabilities. The focus on building an omni-channel presence, including a foray into the spa channel, stretches the company’s operational capabilities and could dilute its brand equity. The reliance on a global sales force and international distributors to mirror U.S. success in foreign markets is a gamble, given the stark differences in market dynamics and consumer preferences across regions. Furthermore, the internalization of distribution channels in key markets, such as the restructuring of Obagi Vietnam, adds to the operational burden and risks associated with managing a more extensive and complex organizational structure. This strategic pivot, combined with an aggressive international expansion plan and diversification into new sales channels, presents significant risks of operational inefficiencies, cost overruns, and a potential disconnect between strategy and execution, which could adversely impact Waldencast's financial performance and market standing.

Final Thoughts

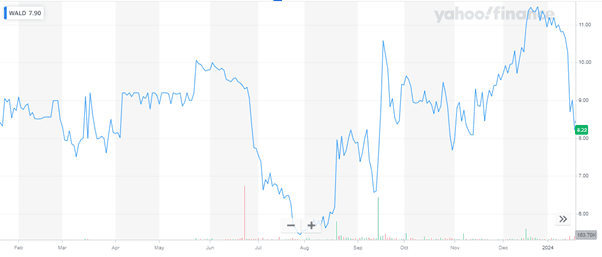

Source: Yahoo Finance

We can see a sharp decline in Waldencast’s stock price whci not only reflects investor uncertainty but also casts a shadow over Waldencast's financial integrity and operational transparency. Given the multitude of risks and challenges facing Waldencast, particularly in its Obagi segment, investors should exercise caution and consider staying away from Waldencast stock at this time. The brand's strategic shift towards consumer markets and e-commerce, while ambitious, is fraught with potential pitfalls in brand dilution, regulatory hurdles, and intense market competition. These factors, combined with the company's ongoing investigation due to delayed SEC filings, paint a picture of a company navigating a tumultuous path with uncertain outcomes. Therefore, it seems prudent for investors to steer clear of Waldencast stock until the company demonstrates a more stable and clear trajectory in its business operations and regulatory compliance.