Walmart Just Lost $22 Billion in Value — Here’s What No One’s Telling You About the Consumer Confidence Crisis!

As 2025 unfolds, troubling signs are emerging for Walmart (NYSE:WMT) and the broader retail sector, with consumer confidence plummeting to its lowest point in over a decade. On March 26, 2025, the Conference Board reported a steep decline in its consumer confidence index, falling to 92.9, the fourth consecutive monthly drop and the lowest since January 2021. The expectations index, which captures consumer sentiment about income, business, and job market conditions over the next six months, fell to just 65.2—its lowest level in 12 years and significantly below the 80-point threshold that historically signals a potential recession. Almost immediately, Walmart saw $22 billion wiped off its market cap as shares dipped nearly 3%. The timing was particularly concerning: just weeks earlier, Walmart CEO Doug McMillon had expressed concerns over stressed consumer behavior. Let us delve into the biggest reasons why investors should adopt a cautious stance on Walmart and the U.S. retail landscape amid declining consumer sentiment.

12-Year Low In Consumer Confidence Threatens Spending Trends

The sharp decline in consumer confidence is more than just a psychological metric—it has real implications for future consumer behavior and retail earnings. The Conference Board’s latest data shows a particularly alarming drop in the expectations index to 65.2, a level not seen in 12 years and one that falls significantly below the 80-point recessionary warning threshold. This deterioration in outlook is tied closely to concerns about persistent inflation, new tariffs on imports from countries like China, Mexico, and Canada, and waning optimism about income growth. Walmart, with its significant exposure to the U.S. consumer, is already seeing the impact. CEO Doug McMillon recently highlighted that many shoppers are exhibiting "budget-stressed behaviors," such as purchasing smaller pack sizes toward the end of the month—a clear sign of deteriorating purchasing power. The problem is compounded by external economic variables that are squeezing household budgets, such as elevated food inflation in items like ground beef and eggs, and the anticipation of higher prices due to tariffs. Although Walmart has traditionally been resilient in down cycles due to its value-driven proposition, the current environment is uniquely challenging. Consumers are not only cutting back but are also increasingly pessimistic about their financial futures, which can suppress discretionary spending. With consumer spending accounting for nearly two-thirds of U.S. GDP, these trends have wide-reaching consequences not just for Walmart but also for the retail sector at large. This underlying fragility makes it hard to ignore the risks posed by softening consumer sentiment, especially for a volume-driven business like Walmart.

Retail Pressure Evident In Guidance & Corporate Caution

Despite posting strong quarterly results, Walmart has guided cautiously for fiscal 2026, indicating that even the world’s largest retailer is preparing for a potentially difficult year. During its most recent earnings call, Walmart projected consolidated net sales growth of just 3% to 4% and operating income growth of 3.5% to 5.5%, with management noting the presence of numerous macroeconomic uncertainties including consumer behavior shifts and geopolitical instability. Additionally, CFO John David Rainey acknowledged that approximately 150 basis points of headwinds to operating income growth could arise from factors such as the integration of Vizio and the leap year comparison. Notably, Walmart has also flagged a 100 basis point currency headwind to sales growth. These aren’t isolated comments; they represent a pattern of measured expectations that suggest the company is deliberately tempering investor sentiment. Even within its core U.S. operations, the margin improvements in Q4 were attributed partly to fewer markdowns and tighter inventory management—strategies that are not infinitely scalable and may not cushion against a broader demand downturn. While management highlighted ongoing investments in supply chain automation and e-commerce efficiencies, those benefits may be outweighed in the near term by the pressures of subdued consumer activity. What’s more, SG&A expenses have deleveraged, partially due to increased tech spending and higher variable pay, adding to profitability concerns. In sum, Walmart’s reserved outlook and cost headwinds underscore the likelihood of a more volatile year ahead, a sentiment that aligns uncomfortably well with broader consumer apprehensions.

Digital Innovation Is Impressive—But May Not Offset Macro Headwinds

Walmart has been doubling down on its technological infrastructure, touting major advances in generative AI deployment, developer productivity tools, and supply chain automation. EVP Sravana Karnati, at the Morgan Stanley TMT Conference in March 2025, detailed how Walmart’s investments have resulted in over 4 million developer hours saved and led to a more unified global tech platform rolled out across countries like Mexico, Chile, and Canada. Moreover, innovations such as the "Wally" AI agent for merchants and frictionless checkout experiences at Sam’s Club demonstrate Walmart’s ambition to evolve into a tech-enabled retail powerhouse. However, while these investments are critical for long-term competitiveness, they may not be sufficient to counteract short-term macroeconomic challenges. Consumer behavior ultimately drives sales, and with confidence waning and spending becoming more conservative, even the most sophisticated technology can only do so much to maintain revenue momentum. Furthermore, Walmart’s diversification into high-margin digital businesses like advertising and data ventures—while encouraging—is still a relatively small part of its overall operating income. For instance, advertising contributed around $4.4 billion in revenue last year, and membership income totaled $3.8 billion. These figures, though impressive in isolation, remain modest when compared to Walmart’s $680+ billion valuation and indicate that the core retail engine must continue to perform. Additionally, the growth of new digital initiatives often requires significant upfront capital investments, and as the company acknowledged in its earnings call, integration costs and increased CapEx will remain a drag on near-term margins. Thus, while digital transformation offers long-term upside, it may not materially offset the risks posed by deteriorating consumer sentiment in the immediate future.

Tariff Uncertainty & Category Mix Shift Add To Structural Risks

One of the less predictable but highly impactful risks facing Walmart is the reemergence of tariffs under the current U.S. administration. CEO Doug McMillon has downplayed the issue by emphasizing Walmart’s historical experience in managing tariffs, but CFO John David Rainey was more circumspect, noting that these duties could become a headwind depending on their scope and implementation. Already, retailers like Target and Best Buy have warned of “meaningful pressure” on profits due to new tariffs, particularly those impacting goods from China, Mexico, and Canada. For Walmart, a significant importer of general merchandise, this adds yet another layer of complexity to pricing strategies and inventory management. Compounding this concern is a persistent shift in category mix away from higher-margin general merchandise and toward lower-margin essentials like groceries and health products. Over the past year, general merchandise mix fell by roughly 100 basis points, and Walmart has only forecast a partial rebound for FY2026. While the company is attempting to offset this mix drag through its growing marketplace platform—where categories like automotive and toys are showing over 20% growth—the impact may not be immediate or sufficient. Moreover, the anticipated increase in unit sales does not necessarily translate into higher dollar value sales, especially in a deflationary environment for consumables. These structural shifts may limit Walmart’s ability to leverage pricing power, especially if consumers continue to delay or downsize their purchases due to inflation fatigue and price sensitivity. In a business so dependent on volume and scale, these risks could become material constraints on future growth and profitability.

Final Thoughts

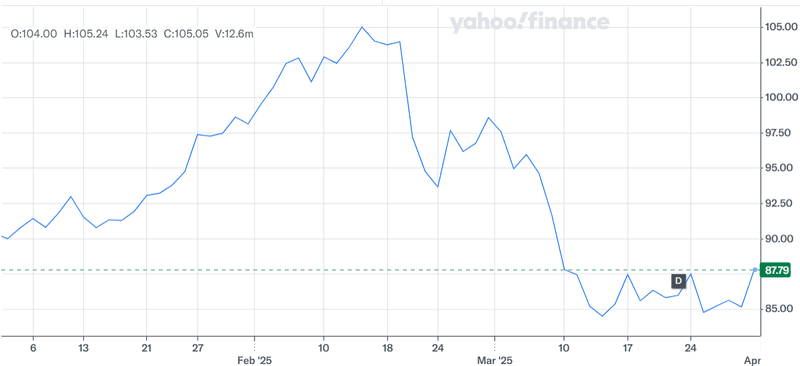

Source: Yahoo Finance

In the above chart, we can see the sharp decline in Walmart’s stock price over the past few weeks. While retail behemoth continues to show resilience through strong operational execution, technological innovation, and diversified revenue streams, the backdrop of falling consumer confidence and economic uncertainty cannot be ignored. From margin pressures and cautious guidance to the risks associated with tariffs and shifting product mix, the road ahead appears challenging. The near-term headwinds tied to consumer sentiment and macroeconomic volatility cannot be ignored which is we believe that given the current environment, an investment Walmart—and the retail sector as a whole—should be avoided in the current scenario.