Y-mAbs’ $412 Million Take-Private Offer From SERB Poised To Upset The Oncology Landscape

Y-mAbs Therapeutics (NASDAQ:YMAB) stunned investors when SERB Pharmaceuticals announced an all-cash bid to take the company private at $8.60 per share, valuing the deal at approximately $412 million—more than a 100 percent premium to Y-mAb’s closing price on August 4, 2025. Trading resumed with a halt in premarket, sparking a more-than doubling of YMAB’s share price as traders assessed the strategic fit. Under the proposal, SERB would fold Y-mAbs’ flagship Danyelza antibody into its oncology portfolio and gain ownership of the company’s novel SADA PRIT radiopharmaceutical platform. The acquisition continues to be subject to tender offer conditions and board approval but the biggest point to analyze here remains SERB’s interest in Y-mAbs and the potential synergies that could transform both companies’ trajectories in pediatric neuroblastoma, precision radiation therapy, and broader oncology R&D.

Danyelza’s Commercial Momentum & Market Expansion

Y-mAbs’ Danyelza is the only FDA-approved anti-GD2 antibody indicated for high-risk, relapsed or refractory neuroblastoma, a rare pediatric cancer with dismal survival rates. In Q1 2025, the drug posted $20.9 million in net product revenues—an 8 percent increase year-over-year—despite competitive and reimbursement headwinds in the U.S. market, reflecting the strength of the company’s focused advocacy and prescriber engagement efforts. Ex-U.S. revenues climbed 816 percent to $7.5 million, driven by named patient programs across Western and Eastern Asia and Latin America. Crucially, Danyelza’s inclusion in the NCCN guidelines for relapsed or refractory neuroblastoma in mid-2025 eradicated a prior market access barrier, opening doors at major pediatric oncology centers and catalyzing investigator-sponsored trials through the Children’s Oncology Group (COG) and New Approaches to Neuroblastoma Treatment Consortium (NANT). SERB can capitalize on this momentum by deploying its established oncology sales force to accelerate U.S. penetration in high-volume treatment centers, align reimbursement strategies around outpatient administration cost savings, and expand patient advocacy initiatives to boost initiation rates. Leveraging cross-selling opportunities within SERB’s global network, the combined entity could optimize channel coverage and generate incremental Danyelza prescriptions in markets where Y-mAbs has limited reach. Moreover, SERB’s deeper payer relationships and manufacturing scale could improve gross margins on Danyelza, reducing the net-price volatility that Y-mAbs has historically managed alone. Integrating Danyelza into SERB’s broader oncology portfolio also enables bundled contracting with health systems, enhancing formulary leverage and driving share gains against competing immunotherapies. In sum, the proven trajectory of Danyelza revenues and its expanded guideline footprint make it a cornerstone asset that SERB can amplify through superior commercial infrastructure and financial muscle.

Breakthrough Radiopharmaceutical SADA PRIT Platform

Y-mAbs has pioneered the Self-Assembling Double-Antibody (SADA) Pretargeted Radioimmunotherapy (PRIT) platform, an innovation that separates tumor targeting from radionuclide delivery to minimize off-tumor radiation exposure. Part A of the GD2-SADA Phase I solid tumor trial has completed dose-finding and safety cohorts, and the first patient has been dosed in the CD38-SADA non-Hodgkin’s lymphoma study. These milestones validate the platform’s robust safety profile and pharmacokinetic behavior, paving the way for optimized linker-chelator constructs that enhance tumor residence time and receptor affinity. SERB stands to gain immediate entry into the high-growth radiopharmaceutical space, leveraging Y-mAbs’ clinical data and integrated radiochemistry capabilities. By consolidating R&D functions, SERB can streamline manufacturing of centralized cGMP-grade antibodies and radionuclide conjugates, reducing per-dose production costs. Regulatory synergies emerge as well: Y-mAbs’ proven track record with SEC-filed clinical disclosures and precision dosing algorithms can be absorbed into SERB’s global filing strategy to accelerate label expansions. Additionally, SERB’s existing collaborations in nuclear medicine imaging provide a natural channel for diagnostic support and post-marketing surveillance of radiopharmaceutical therapies. Cross-training Y-mAbs’ scientific team within SERB’s research organization would foster knowledge transfer, accelerating development timelines for next-generation SADA constructs targeting alternative antigens and solid tumor types. The proprietary linker-chelator technology, once fully validated in bridging studies, can be deployed across multiple radionuclide isotopes, enabling a pipeline of alpha- and beta-emitting therapies. In integrating this platform, SERB can transition from a conventional biologics and small-molecule developer to a leader in precision radiotherapy, capturing high-value niche markets where competition is minimal and therapeutic benefits are transformative.

Complementary Portfolio & R&D Synergies

The strategic rationale for SERB’s interest extends to portfolio diversification and integration of complementary therapeutic modalities. Y-mAbs’ R&D focuses on antibody-drug conjugates, immunocytokines, and radiolabeled antibody platforms targeting GD2, CD38, and other tumor-associated antigens. SERB’s existing pipeline of kinase inhibitors and monoclonal antibodies can be combined with Y-mAbs’ technologies to create novel combination regimens that exploit synergistic mechanisms—such as pairing immune checkpoint inhibitors with Danyelza to enhance antibody-dependent cellular cytotoxicity, or combining kinase blockade with targeted radiation to overcome resistance. Joint clinical development efforts could yield higher overall response rates and prolong progression-free survival across both pediatric and adult oncology indications. Manufacturing and supply chain synergies are significant: SERB can absorb Y-mAbs’ fill-finish operations for complex biologics and radiopharmaceuticals, streamlining procurement of radionuclides and centralized quality control. Shared data analytics platforms will accelerate biomarker discovery and patient stratification, while unified pharmacovigilance systems ensure consistent safety monitoring. Furthermore, Y-mAbs’ seasoned leadership in regulatory affairs and SEC reporting can bolster SERB’s global submissions, expediting approvals in North America, Europe, and Asia. Market access advantages accrue through a harmonized contracting approach—health systems can negotiate bundled pricing for multi-modal regimens, improving reimbursement predictability. Cross-selling across SERB’s commercial territories enhances revenue diversification, mitigating single-product risk. By integrating Y-mAbs’ asset suite under SERB’s R&D umbrella, the combined entity can prioritize high-value targets, allocate resources more efficiently, and accelerate time to market for novel therapies.

Undervalued Valuation Multiples & Financial Levers

Y-mAbs is trading at attractive LTM valuation multiples that understate the value of its assets. As of June 30, 2025, LTM EV/Revenue stood at 1.63×, up to 3.68× by August 5, 2025, while LTM Price/Sales moved from 2.30× to 4.35×—levels below typical metrics for oncology biotech peers, which often command 6×–10× EV/Revenue for differentiated assets. LTM EV/EBITDA and EV/EBIT remain negative (–6.19× and –6.07× respectively as of Q1 2025), reflecting ongoing investment in R&D rather than a lack of commercial potential. SERB’s $412 million bid at $8.60 per share represents a rich premium to recent trading prices, yet still implies upside if Danyelza revenue rebounds in the U.S. and radiopharma milestones are achieved. The transaction can be structured with a mix of debt at current low interest rates and cash, preserving SERB’s capital flexibility. Post-close, the combined company should realize cost synergies by consolidating overlapping SG&A functions—Y-mAbs recorded $13.1 million in SG&A in Q1 2025—and centralizing manufacturing overheads. These efficiencies will drive improved adjusted EBITDA margins and free cash flow, supporting deleveraging and funding of late-stage trials. Moreover, the acquisition’s accretive impact on adjusted EPS and levered free cash flow yield (previously negative 20.8 percent LTM) could enhance SERB’s credit profile. For investors, arbitraging the gap between standalone biotech multiples and a diversified oncology company’s stronger valuation offers compelling financial rationale.

Final Thoughts

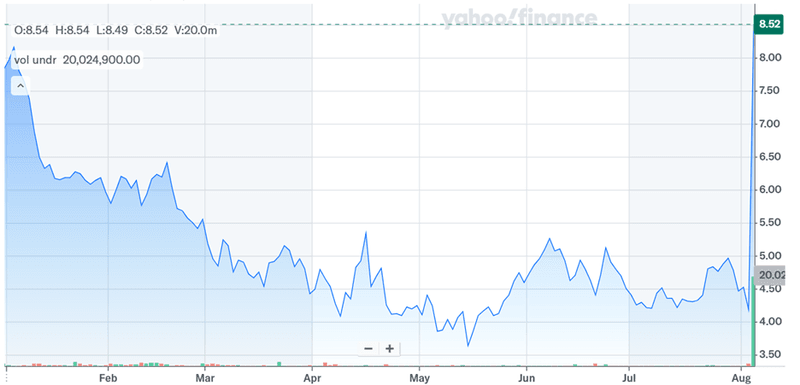

Source: Yahoo Finance

SERB’s proposed acquisition of Y-mAbs resulted in a massive jump in the latter’s stock price. There is no doubt on what Y-mAbs brings to the table given its proven pediatric oncology asset, a pioneering radiopharmaceutical platform, and a complementary R&D pipeline that can be pushed forward aggressively by SERB under a unified oncology strategy. From a valuation standpoint, Y-mAbs is trading at at LTM EV/Revenue of approximately 3.68x and Price/Sales of 4.35x, and its valuation appears extremely modest given its differentiated assets. This implies that SERB is getting an excellent deal. To conclude, we believe that ultimately, the success of the transaction will depend on SERB’s ability to integrate Y-mAbs without diluting focus on core programs, while delivering on the combined entity’s promise to advance patient outcomes across pediatric and adult oncology.