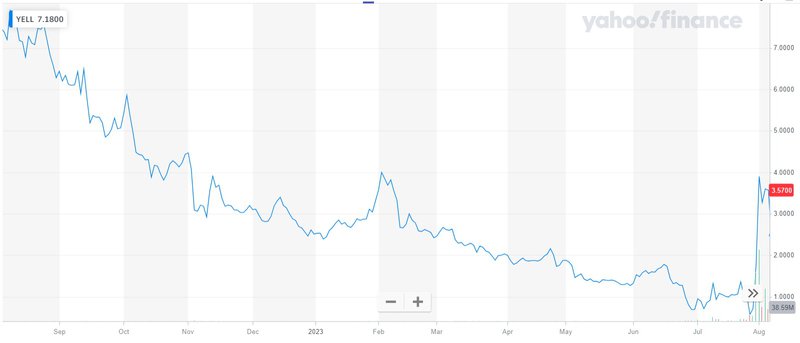

Renowned trucking company Yellow Corp (NASDAQ:YELL), with a near-century history, has recently announced its closure. The company was once prominent in the U.S. trucking landscape but has found itself plagued by debt from a series of mergers and consistent disagreements with the Teamsters union. However, despite declaring bankruptcy, Yellow's stock has unexpectedly witnessed its stock soar.

As we can see in the above chart, although the stock had plummeted to a mere $0.43 the prior week, it skyrocketed in subsequent sessions crossing the $2 mark. This was a result of an unexpected stake by MFN Partners. Now the big question here is: is it worth speculating on Yellow Corp given its latest meme stock status or is it too risky a play?

Yellow's Evolution & Expansion

Tracing its humble beginnings back to 1924, Yellow sprouted as a modest taxi and bus venture in Oklahoma City. The Yellow Cab Transit Company, aptly named for its fleet of yellow Ford Model-Ts and buses, primarily catered to local commuters. Yet, the company's trajectory changed dramatically post its 1951 bankruptcy. George Powell, a Kansas City banker, envisioned a larger dream for Yellow. Capitalizing on the inception of the Interstate Highway System, Powell transformed Yellow into a dominant long-haul operator. The following decades saw Yellow continuously expanding its footprint. Key acquisitions post interstate trucking deregulation in 1980 fortified its position, enabling the company to outlive many contemporaries. By 2003, Yellow's ambitions led to the acquisition of Roadway, another heavyweight in the LTL trucking realm. The merger aimed to enhance competitiveness against non-unionized rivals. However, decisions during these expansion phases sowed the seeds for future challenges.

Challenges, Mergers, and Missteps

Yellow's growth resulted in many complexities. The merger with Roadway, followed by another major acquisition of USF in 2005, was intended to streamline operations. However, instead of merging networks for maximum efficiency, Yellow only combined back-office functions, missing out on broader synergies. This decision would haunt them, especially when the 2008 recession hit, significantly reducing their business with major clients like Walmart. The adverse economic environment amplified the issues inherent in their operational model. Debts accrued from mergers, combined with the intricacies of managing multiple brands, persistently burdened the company. By 2014 and 2020, the specter of bankruptcy loomed again.

As the years rolled on, Yellow's performance metrics began to lag. Their revenue per shipment was substantially lower than competitors, a clear indicator of operational inefficiencies and potential mismanagement. Despite having an annual revenue near $5 billion since 2009, the company struggled to achieve consistent profits, signaling deep-rooted operational challenges.

The Final Straws

The challenges for Yellow were not solely historical. The recent global pandemic further strained the already beleaguered trucking giant. With the shutdown of factories and stores in 2020, the company, rebranded as YRC Worldwide, found itself grappling with debt payments. A controversial $700 million Covid rescue loan from the federal government provided temporary relief, given under the pretext of Yellow's crucial services to the Defense Department. However, even with this aid, internal tensions brewed.

The relationship between Yellow and the Teamsters union became increasingly tumultuous. As Yellow embarked on nationwide operational integration, disagreements with the Teamsters intensified. By June, Yellow was embroiled in a legal suit against the Teamsters and was lagging behind on pension fund payments. These internal conflicts, combined with dwindling cash reserves and mounting debts, led to a cascading effect, pushing Yellow to the brink.

MFN Partners' Unexpected Stake & Creditors Negotiations

Interestingly, the bleak landscape hasn’t deterred Boston’s MFN Partners, a hedge fund known for its significant stakes in competitors like XPO Inc. and RXO Inc. In the past month alone, MFN has shockingly acquired a 42.5% stake in Yellow Corporation. This substantial acquisition has been shrouded in mystery since the hedge fund remains tight-lipped regarding its motives, particularly in light of Yellow’s precarious financial standing. Observers have questioned the logic behind such a move, especially when considering the shift of Yellow’s customer volume to rival firms.

Further complicating matters is Apollo Global Management Inc.'s reported discussions about offering debtor-in-possession (DIP) financing to Yellow. This form of financing could potentially aid the company through its bankruptcy phase. However, such a move would only push more debt ahead of common shareholders, making the situation murkier for equity holders. Historical precedents, like the Luminus Management's misjudged gamble on the financially unstable offshore driller Valaris in 2019, serve as cautionary tales in such scenarios.

Potential Scenarios

Speculation is rife regarding MFN Partners’ endgame. Some market participants believe that the hedge fund might be considering a takeover at Yellow's current $1.6 billion enterprise value. Others suggest potential capital infusion into the beleaguered firm. A subset even theorizes a deal involving XPO Inc., although the involvement of MFN Partners in such a transaction seems unnecessary. A wild theory also hints at MFN possibly attempting to emulate Ryan Cohen’s surprise maneuver with shares of the floundering retailer, Bed, Bath & Beyond.

Final Thoughts: Is It Worth Trying To Monetize This Sinking Ship?

Despite MFN Partners' dramatic entry, the prospects for Yellow Corporation's common shareholders appear dim, especially with Apollo Global Management poised to offer super-senior DIP financing. With operations reportedly halted, any rationale for taking over the ailing firm and its colossal debt seems absent. Not to mention China imports sinking, and wholesale inventories rising sharply…investors might be well-advised to capitalize on the present rally, divest their positions, and look for greener pastures.