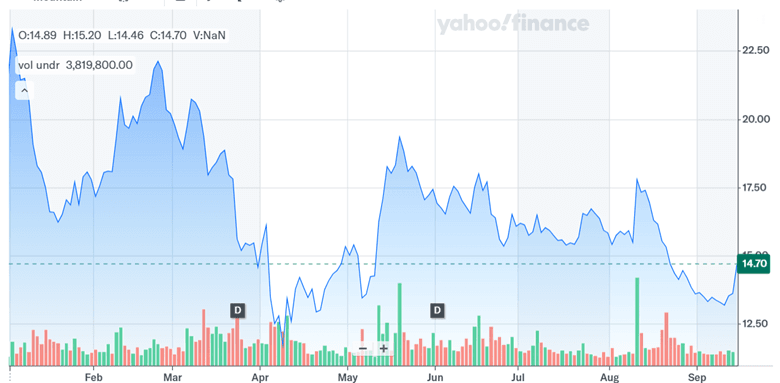

ZIM Integrated’s Board Rejects A $20 Per Share Offer — Could Moller-Maersk Step In?

ZIM Integrated Shipping Services (NYSE:ZIM) is the latest small-cap that has been in the news that is about to become an acquisition target. The company saw its shares spike 6.6% after reports revealed that its board is actively exploring potential acquisition offers from external buyers. This follows an earlier report from Israeli outlet Calcalist that CEO Eli Glickman, along with five senior executives and shipping magnate Rami Ungar, was aiming to take the company private. While that group was said to be proposing a $20 per share offer, ZIM’s board appears unconvinced by the valuation and has since hired Evercore to canvass other strategic and financial suitors. Among the parties reportedly contacted is Danish shipping giant Moller-Maersk. Notably, Glickman has yet to submit a formal proposal. With ZIM trading at historically low valuation multiples, it is interesting to see what value is being seen in the company by all these potential suitors.

Buyout Premium Looks Increasingly Likely

ZIM’s discounted trading profile has made it a ripe candidate for a takeover premium, and the board’s rejection of the internal offer around $20 per share reflects a belief that the company’s fair value is well above that level. As of September 2025, ZIM trades at a trailing EV/Revenue multiple of just 0.68x and a Price/Sales ratio of 0.19x—well below sector averages. Its EV/EBITDA ratio stands at only 2.19x, indicating that acquirers could potentially extract substantial value through synergies or a normalized freight rate environment. These depressed multiples make the company attractive to both strategics and financial sponsors, especially in a sector where consolidation has become a recurring theme. The board’s openness to external bids suggests that it views the internal offer as merely a floor—and not a particularly compelling one at that. A strategic buyer, particularly one with overlapping networks or cost advantages, may be able to justify a significantly higher offer price. Even infrastructure-focused private equity firms could find the asset appealing given ZIM’s free cash flow potential and relatively capital-light model. Investors are responding to this asymmetric setup, where downside appears somewhat anchored and the upside remains undefined, but potentially substantial, depending on how competitive the bidding becomes.

Potential Bidding War Could Reshape The Outcome

What started as a low-profile internal buyout attempt has quickly escalated into a potential bidding war. The involvement of investment bank Evercore to reach out to third parties signals that the board is serious about running a structured process. Reports that Moller-Maersk has been approached amplify the stakes significantly. If other strategic buyers or private equity firms enter the mix, the prospect of a competitive auction becomes real. ZIM’s global shipping routes, operational footprint, and scalable model make it an attractive target for established industry players looking to expand capacity or eliminate redundancy. In a fragmented and cyclical sector, scale is often the difference between margin expansion and profit erosion. However, regulatory headwinds cannot be discounted. A merger with another major player could invite scrutiny from antitrust authorities, especially if it reduces competition in critical shipping lanes. Nonetheless, if multiple suitors come forward, ZIM’s valuation dynamics could be reshaped very quickly. A broader sale process also benefits minority shareholders, ensuring that the company’s value is discovered in the open market and not simply through a management-led transaction. As this process unfolds, the risk-reward around ZIM will likely remain tied to the credibility and financial strength of any new bidders that emerge.

Management's Involvement Signals Belief In Undervalued Assets

That ZIM’s CEO Eli Glickman is personally involved in efforts to take the company private is an important signal of insider confidence. Management buyouts are typically launched when executives feel the market is mispricing the company’s long-term potential or undervaluing its assets. Glickman’s bid—though not yet formalized—suggests a belief that ZIM’s future cash flow generation or strategic positioning is not being adequately reflected in its stock price. However, the board’s subsequent rejection of the early terms points to internal disagreement on what constitutes a fair valuation. This divergence could complicate the process. While a management-backed bid can be attractive to some buyers looking for continuity and operational familiarity, it also introduces potential conflicts of interest that could deter third-party interest if not handled transparently. Moreover, with no firm offer submitted by Glickman’s group to date, credibility questions arise. Is the internal group serious? Do they have financing in place? The board’s choice to engage Evercore and look outward indicates a lack of full confidence in the internal path. Still, management’s interest is a clear indicator that ZIM has value that insiders believe can be unlocked—just perhaps under a different ownership structure. That belief is now being tested in the open market.

Key Takeaway – Uncertainty Clouds The Final Outcome

Source: Yahoo Finance

Despite the recent stock rally and increased investor attention, the path toward a completed transaction remains uncertain. There is no formal bid on the table from Glickman, and it is unclear whether any external bidders will submit a binding offer. The shipping industry remains volatile, with freight rates under pressure and global trade flows susceptible to macro disruptions. Even though ZIM appears cheap by most valuation metrics, its earnings have been highly cyclical, and trailing twelve-month earnings are negative—reflected in an LTM P/E ratio of 0.82x. While metrics like a 2.19x EV/EBITDA and a 60% levered free cash flow yield suggest financial strength, they are based on volatile underlying earnings. If ZIM does attract formal bids, they may come with conditions, financing hurdles, or regulatory risks—especially if large strategic acquirers are involved. There is also a risk that this strategic review ends with no deal, leaving ZIM to operate independently with its current capital structure. Investors must weigh the prospect of a near-term liquidity event against the possibility that management and the board are unable to agree on terms with any suitor. Until a formal offer is disclosed, uncertainty remains high and will likely drive volatility in the stock.