4% Alpha Remains In Morgan Stanley Asia-Pacific Fund Reorganization – Morgan Stanley Asia-Pacific Fund (NYSE:APF)

[ad_1]

In our newest CEF Weekly Roundup, we launched the information that Morgan Stanley Asia-Pacific Fund, Inc. (APF) is ready to reorganize into an open-ended mutual fund construction.

From the press launch:

Morgan Stanley Asia-Pacific Fund, Inc. Announces Reorganization into Morgan Stanley Institutional Fund, Inc. – Emerging Markets Portfolio

December 06, 2018 08:30 AM Eastern Standard Time

NEW YORK–(BUSINESS WIRE)–Morgan Stanley Asia-Pacific Fund, Inc. (NYSE: APF) (the “Fund”) introduced that, after contemplating the advice of the Fund’s funding adviser, Morgan Stanley Investment Management Inc., the Board of Directors of the Fund decided that it might be in one of the best curiosity of stockholders of the Fund to approve an Agreement and Plan of Reorganization by and between the Fund and Morgan Stanley Institutional Fund, Inc., on behalf of its sequence Emerging Markets Portfolio (“MSIF Emerging Markets”), pursuant to which considerably all the belongings and liabilities of the Fund could be transferred to MSIF Emerging Markets and stockholders of the Fund would turn out to be stockholders of MSIF Emerging Markets, receiving shares of widespread stock of MSIF Emerging Markets equal to the worth of their holdings within the Fund (the “Reorganization”). Upon execution of the Reorganization, shares of the Fund would stop to commerce on the New York Stock Exchange; nonetheless, after the Reorganization, shares of MSIF Emerging Markets could also be bought and redeemed on the possibility of stockholders at web asset worth on a daily foundation, topic to the phrases described within the registration assertion for MSIF Emerging Markets.

The Reorganization is topic to sure circumstances, together with stockholder approval and customary closing circumstances such because the efficiency of sure obligations contained within the Agreement and Plan of Reorganization. The Reorganization of the Fund can be submitted for stockholder approval at a particular assembly of stockholders (the “Meeting”) scheduled to be held on March 8, 2019, and any adjournments or postponements thereof, to stockholders of document on January 14, 2019. Further details about the Reorganization can be included in a proxy assertion/prospectus anticipated to be mailed to stockholders within the first quarter of 2019.

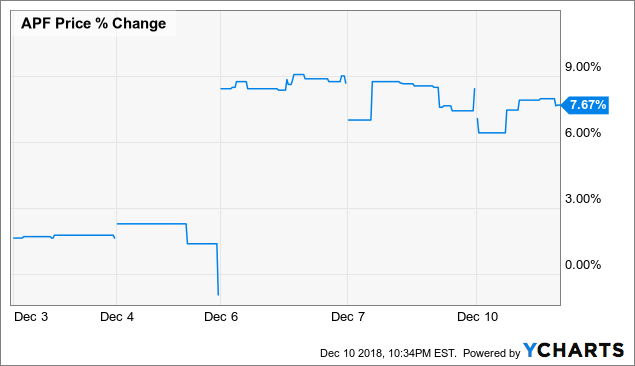

The share worth jumped up by +9.40% upon the announcement because the low cost narrowed from -15.00% to -4.60% in a single day (!).

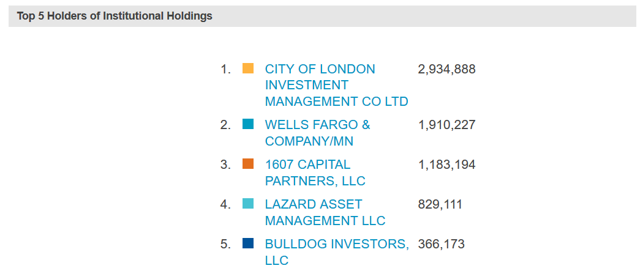

This is one other success for City of London Investment Management Company, which owns 22% of the stock alone. The announcement pop within the share worth would have netted City of London over $4 million in capital features in a single day, which isn’t too shabby in any respect.

Technically, the reorganization of the fund nonetheless must be authorized by stockholders, who will vote at a particular assembly scheduled to be held on March 8, 2019. However, with 64% of the fund institutionally owned (together with 22% by City alone), my guess is that the proposal will sail by means of with out problem.

The present low cost is -3.93% so there’s nonetheless a good bit of alpha to be gained from buyers who do not thoughts holding a portfolio of Asian and Pacific securities (the highest holdings are Tencent (OTCPK:TCEHY) (OTCPK:TCTZF), Taiwan Semiconductor Manufacturing (TSM), Samsung Electronics (OTC:SSNLF) (OTC:SSNNF) (OTC:SSDIY), China Construction Bank (OTCPK:CICHY) (OTCPK:CICHF) and Alibaba (BABA).

(Source: Morgan Stanley)

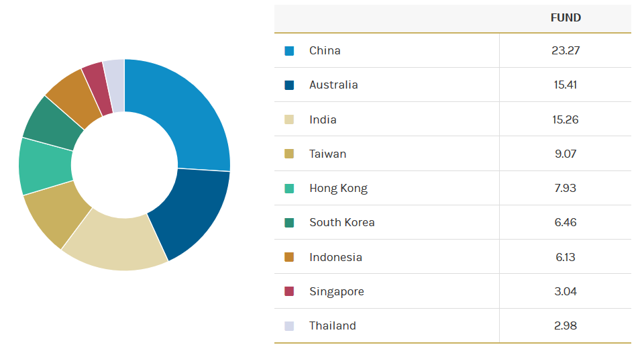

The main nations that APF invests in are China (23.27%), Australia (15.41%), India (15.26%), Taiwan (9.07%) and Hong Kong (7.93%).

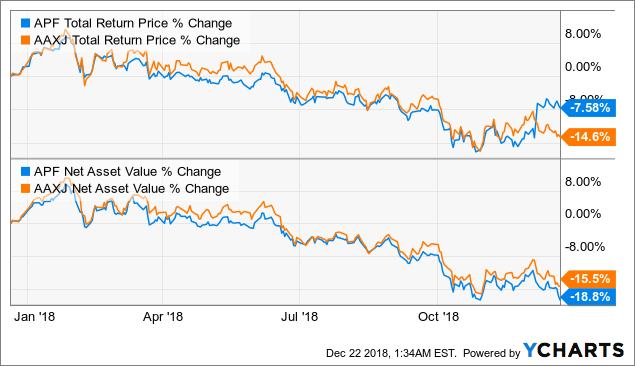

More superior arbitrageurs could contemplate hedging an extended APF place with a brief place in iShares MSCI All Country Asia ex-Japan ETF (AAXJ) with the intention to scale back market threat, though it ought to be famous that the latter doesn’t have any allocation to Australia. The two funds’ NAVs have moved intently collectively up to now yr, though AAXJ does outperform over longer time durations which ought to be borne in thoughts by somebody executing the pairs technique.

APF Total Return Price knowledge by YCharts

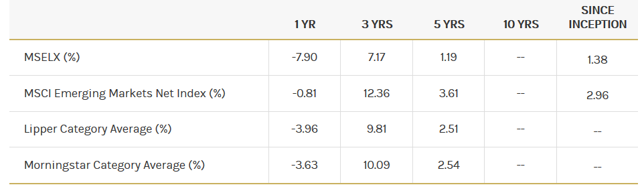

APF Total Return Price knowledge by YChartsIf APF stockholders vote for the reorganization, their monies can be invested within the Morgan Stanley Emerging Markets Portfolio (MSELX).

MSELX Total Return Price knowledge by YCharts

MSELX Total Return Price knowledge by YChartsHowever, MSELX hasn’t accomplished all that properly over the current time durations and I’m not an enormous fan of its 2.54% gross expense ratio both. If I ended proudly owning MSELX, I’d most likely promote it and moderately exchange one other rising market fund.

(Source: Morgan Stanley)

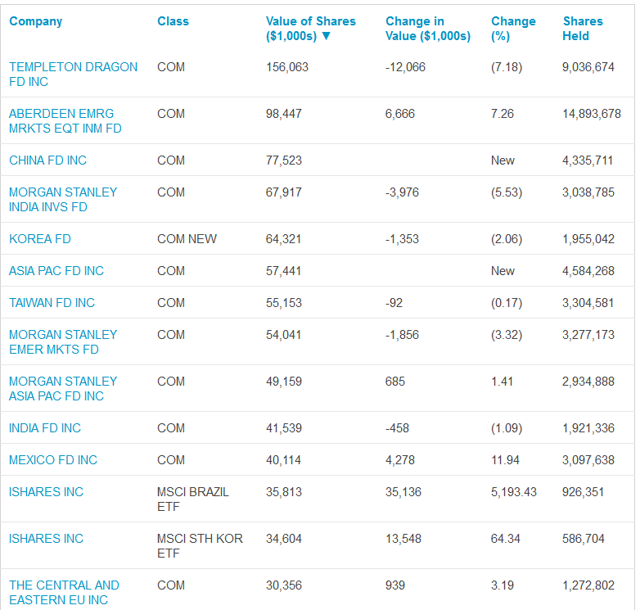

Which CEF focused by City of London would possibly turn out to be reorganized or liquidated subsequent? Here’s the record of funds that City has invested presently in. The prime holding, Templeton Dragon Fund (TDF), a Greater China equities fund, could be a superb guess. City owns $156 million of the stock, or about 26% of all whole shares, and the fund nonetheless trades at a large low cost of -13.36%. However, notice that excessive endurance is required for these wishing to piggy-again on City of London’s success (this additionally signifies that one should both be keen to carry rising markets equities publicity for lengthy durations, or alternatively, to hedge with an acceptable ETF). For occasion, with the aforementioned APF, City had started accumulating the CEF all the way in which again in August of 2014!

(Source: NASDAQ)

The different two funds that City has invested in are Aberdeen Emerging Markets Equity Income Fund (AEF), China Fund (CHN), Morgan Stanley India Investment Fund (IIF), Korea Fund (KF) and Taiwan Fund (TWN).

We’re presently providing a restricted time solely free trial for the CEF/ETF Income Laboratory with a 20% low cost for first-time subscribers. Members obtain an early have a look at all public content material along with unique and actionable commentary on particular funds. We additionally provide managed closed-finish fund (CEF) and alternate-traded fund (ETF) portfolios concentrating on ~8% yield. The sale has been EXTENDED for 1 extra week solely, so please contemplate becoming a member of us by clicking on the next link: CEF/ETF Income Laboratory.

Disclosure: I/we’ve no positions in any shares talked about, and no plans to provoke any positions throughout the subsequent 72 hours. I wrote this text myself, and it expresses my very own opinions. I’m not receiving compensation for it (apart from from Seeking Alpha). I’ve no enterprise relationship with any firm whose stock is talked about on this article.

Additional disclosure: Please notice: This article was first launched to members of CEF/ETF Income Laboratory 2 weeks in the past, so knowledge could also be old-fashioned. Please test newest knowledge earlier than making funding choices.

[ad_2]