Alphabet’s Legal Nightmare: Will Google Chrome Become The DOJ’s First Target?

Alphabet (NASDAQ:GOOGL) has recently found itself under intensifying scrutiny as U.S. regulators pursue drastic antitrust remedies following its most recent court battles. The Department of Justice has advanced a landmark antitrust case against the tech giant, arguing that Google has unlawfully maintained its monopoly in Search by locking in Chrome and Android users through exclusionary contracts. This comes just as whispers emerge that Alphabet may be compelled to divest one of its crown jewels—the Chrome browser—as part of a structural remedy. This scenario echoes the latest legal and competitive developments following a high-profile trial where the DOJ argued that Google’s bundling of Chrome, Search, and Android creates a self-reinforcing feedback loop, giving it illegal dominance over how consumers access the internet. The idea of Chrome being spun off into a separate entity is no longer theoretical—it’s now a credible possibility being discussed behind closed doors, with legal analysts viewing it as the most enforceable and clear-cut structural remedy.

Strong Consumer Loyalty Anchors Search Dominance

Alphabet’s grip on the search market is fundamentally underpinned by Chrome’s widespread usage and the broader consumer loyalty it commands across platforms. According to recent earnings commentary, Google Search continues to drive double-digit revenue growth, with over 2 billion users engaging with AI Overviews globally. The power of default status—such as being the embedded search engine on Chrome—cannot be understated. Even where users are free to choose alternatives, the inertia created by years of habitual use ensures that Google remains the default for most. Chrome, installed on billions of devices and often shipped pre-installed with Android, offers seamless Google account integration and superior syncing across desktop and mobile. These network effects deepen user reliance and reinforce Google’s ability to harvest rich data, further improving its advertising products. Even Google's competitors recognize that consumer preference for its search results remains strong, with surveys and behavioral data showing minimal switching even when alternatives are made available. This entrenched loyalty is what makes the DOJ's remedy proposals so bold—stripping Chrome from Alphabet might dilute this deep integration, but it would also test whether consumer loyalty to Search is truly product-driven or largely a function of enforced defaults.

Diversified Innovation Across Products Diminishes Risk

Alphabet’s exposure is partially mitigated by its wide-ranging innovation and diversified product base. The company is not solely reliant on Search revenues but benefits from significant growth in YouTube, Google Cloud, and AI infrastructure. Q2 results showed that YouTube Shorts now generates 200 billion daily views, and Cloud crossed a $50 billion annual run rate—underscoring Alphabet’s capability to monetize beyond its flagship product. The company is also rolling out deeply integrated AI features across its ecosystem: Google Meet, Docs, Gmail, and Drive now incorporate Gemini-powered agents and productivity tools. Over 450 million users are actively engaging with the Gemini app, and AI usage across Workspace and Photos continues to scale rapidly. Google’s recent infrastructure upgrades—particularly the introduction of the Veo 3 video generation model and AI accelerators like TPUs—are enabling the company to maintain leadership in AI tools even as regulatory pressure mounts on its core advertising business. Additionally, strategic partnerships with enterprise giants such as Salesforce, BBVA, and PayPal validate Google Cloud’s enterprise credibility. These innovation vectors reduce Alphabet’s risk profile and allow it to maintain strong growth trajectories even if its Search monopoly is curtailed by legal remedies or structural divestments like Chrome.

AI Market Shift Threatens Core Revenue Streams

Alphabet’s aggressive push into AI presents both opportunity and exposure. Its Gemini 2.5 models now serve over 9 million developers, and the AI-driven search enhancements like AI Mode and Deep Search are catalyzing higher engagement, especially among younger demographics. However, this shift also challenges traditional monetization models. With AI-generated results often reducing the need for multiple queries or click-throughs, Alphabet risks cannibalizing its existing advertising revenue streams, particularly if users bypass conventional search listings. The company claims that AI Overviews are driving 10% more global queries in relevant segments, but this increase may not necessarily translate to a proportional rise in ad revenue. Furthermore, regulators are beginning to examine whether Alphabet’s use of AI itself represents a new form of monopolistic behavior—by leveraging unmatched compute resources and data access, Google could reinforce its dominance in AI search the same way it did in traditional search. This arms race in AI has also led to skyrocketing CapEx—$85 billion is now planned for 2025, up from $75 billion—which will pressure margins if monetization lags. As Alphabet integrates Gemini deeper into Android and Chrome, the DOJ could argue that such bundling replicates the very behavior currently under legal scrutiny. Hence, while AI promises a new growth frontier, it also intensifies the regulatory spotlight and risks invalidating Alphabet’s claims of competitive fairness.

Structural Remedies Could Include Chrome Divestiture

The antitrust trial’s most impactful consequence may be the forced divestiture of Chrome, which has been identified by U.S. regulators as a central node in Alphabet’s alleged monopoly web. Prosecutors argue that Chrome’s integration with Google Search and Android functions as a distribution bottleneck, enabling Alphabet to default users into its services and stifle competition. This “feedback loop” strategy—where Search finances Chrome, Chrome captures users for Android, and Android reinforces Search’s market share—was presented as evidence of monopolistic abuse. Legal analysts suggest that a breakup remedy, specifically separating Chrome from Google, would be the cleanest and most enforceable way to disrupt this loop. The DOJ’s remedies expert has proposed divestitures as preferable to behavioral changes, which are harder to monitor and enforce. The risks for Alphabet are substantial: Chrome accounts for over 60% of global browser market share, and a divestiture could lead to interface changes, defaults being reset, and rival search engines gaining entry. Furthermore, the loss of Chrome would undermine Alphabet’s ability to conduct closed-loop data tracking across web traffic, device usage, and advertising performance. Such a remedy would also set a precedent for future antitrust enforcement against large tech firms, emboldening regulatory bodies both in the U.S. and abroad. While Alphabet is likely to challenge any such remedy legally, the threat is now concrete and tied to a broader regulatory momentum that has already begun to alter the rules of platform dominance and vertical integration in digital ecosystems.

Final Thoughts

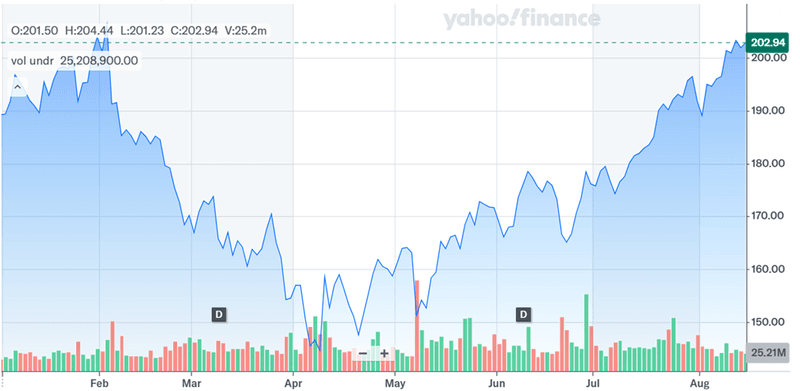

Source: Yahoo Finance

Alphabet’s stock performance has been solid especially after the recent result and the company remains a dominant force in global technology with strong financials. However, the mounting regulatory pressure—culminating in potential structural remedies such as the divestiture of Chrome—adds a layer of strategic risk that investors cannot ignore. A forced separation of Chrome would erode the seamless integration that has long underpinned Alphabet’s ecosystem dominance and could introduce friction in user experience and data continuity. Meanwhile, the company's aggressive CapEx ramp-up to $85 billion in 2025, largely driven by AI infrastructure demands, places considerable pressure on its capital efficiency. As of August 2025, Alphabet trades at an LTM P/E of 21.63x, with an EV/EBIT of 19.44x and a Free Cash Flow multiple of 33.16x—valuations that reflect market confidence but offer little buffer against execution missteps or regulatory disruptions. The balance between innovation-led growth and the regulatory threat of structural disintegration will define Alphabet's trajectory in the coming quarters.