An Interview With ‘The Bear’

[ad_1]

Well, that occurred quick.

It looks as if simply yesterweek indexes have been buying and selling at all-time highs and confidence within the international economic system and stock markets have been ebullient. Okay, it was truly since October. But ever since, the market endured a pointy descent like a runway skiier contemporary off a chairlift within the Rockies. The NASDAQ (QQQ) Composite closed down greater than 20% from its all-time excessive, waking the bear from its typical slumber in the course of the annual Santa Rally.

It was tough to lock down the Bear for an interview since he was booked fairly stable with televised appearances, however I used to be capable of safe a couple of minutes to sit down down and choose his mind about his sudden and sudden arrival. Below is the transcript from our dialogue:

Source: Image

Me: Thanks for becoming a member of us at this time, Bear. We weren’t anticipating you so quickly. Many economists forecasted your arrival late next year or early 2020. What offers?

Bear: Me and Rodney Dangerfield. We cannot get no respect. Even a 10-year absence would not make the center develop fonder, eh? I made such a splash in 2008 that individuals tremble at even the considered me. You assume I wish to be right here? I’m presupposed to be hibernating…

Me: As a long-term investor, I’m blissful you are right here. The Bull was getting lengthy within the tooth. I’ve been biding my time ready for an opportune time to purchase shares however every thing has been approach too pricy. What is your plan now that you simply’re right here? Do you plan to stay round for awhile?

Bear: I’ll say. Bull, bull, bull, that is all I’ve been listening to on my Spotify podcasts month after month in my cave. And heck, Spotify didn’t even exist once I took my newest sabbatical. What a bunch of bull. Let me present you one thing.

(Bear pauses and pulls out a 10-year chart of the NASDAQ depicted under)

Source: Charles Schwab

Bear (continued): What about this appears sustainable to you? People shopping for the NASDAQ above 8k? Are these the identical people shopping for oceanfront property in Phoenix? They solely have themselves in charge. The reply is sure, I intend to stay round for 6-12 months.

Me: That ought to give us loads of time to purchase. But my actual query is why are you right here? Why now?

Bear: Why now? Why not now!? Look let me present you one thing else.

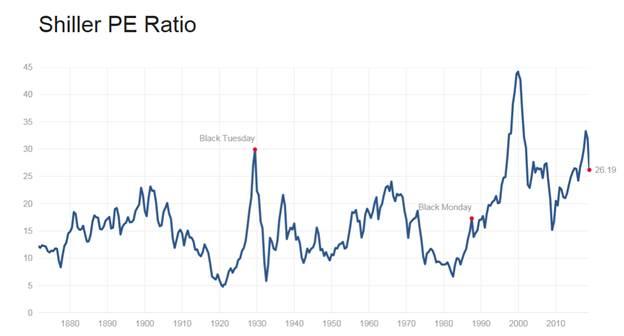

(Bear pulls out one other chart. This time of the Shiller PE Ratio)

Source: Shiller PE Ratio

Bear (continued): Look, I’m offering a public service. I’m saving people from themselves. I would not have such a nasty popularity if people might simply dial again a few of their greed and cease pouring cash into an already overheated market. Let me present among the causes I’m right here:

1) The period of low cost cash by way of accommodative financial coverage is coming to an in depth. And it is lengthy overdue. Let me let you know one thing, TINA labored for a very long time however TINA has aged and fairly frankly, she ain’t as cute as she was. The Fed has been gradual to maneuver however they’re doing the fitting factor normalizing coverage.

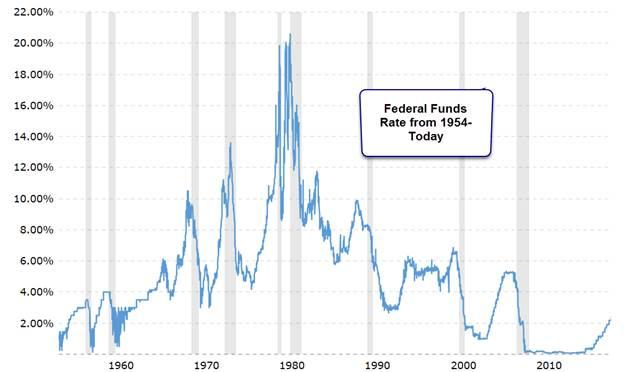

Me: Let me cease you there. I agree. There’s a whole lot of political animosity directed towards the Fed however individuals neglect that rates of interest stay traditionally low. It’s my flip to share a chart. Take a take a look at this:

Source: MacroTrends

Bear: (nodding). That’s motive primary. The second motive I’m right here, is because of all this protectionism nonsense. Trade wars aren’t conducive for strategic planning for companies. Take the U.Ok for instance. There’s a lot ambiguity on the subject of Brexit that corporations are fleeing by the day. The similar issues apply domestically within the United States. Think about corporations buying and selling on the NASDAQ: Facebook (FB), Netflix (NFLX), Apple (AAPL), and Alphabet (GOOGL). These guys have super worldwide publicity; what they acquire in a single place could be misplaced in one other within the occasion of a commerce battle. But it is a momentary setback, as soon as globalism is out of the bag, it is exhausting to bottle it again in. It’s sort of like this present I despatched to my ol’ pal Bull for Christmas. Happy Holidays outdated pal!

Source: Image

Source: Image

Me: I’m certain he is thrilled. Any different causes?

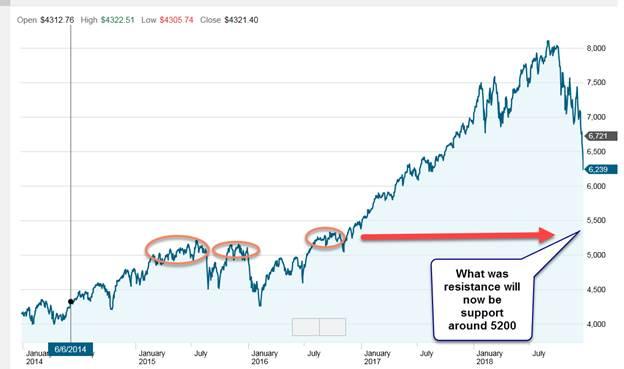

Bear: Some people have alleged tax-loss harvesting and a blended Congress come January, however neither of these have any enamel. No canines at the least — tertiary causes at finest. Then there’s depressed oil costs, however that is truly a boon for many sectors as we noticed from 2014-2018. The fundamental motive I’m right here is merely to let some air out of the ballooned market and restore somewhat sanity. Technically, I will not overstay my welcome. Speaking of technically, let me present you some key technical ranges the place shares will probably backside out:

Source: Charles Schwab

Bear (continued): Same factor applies to the S&P 500.

Source: Charles Schwab

Source: Charles Schwab

Bear (continued): You see, I’m just like the Fed. I’m virtually telegraphing my strikes.

Me: Well thanks for that. So no motive for 2008-level panic? We’re not gonna see a full-fledged market meltdown coupled with a painful recession?

Bear: Fat probability. Or is it slim probability? I by no means did determine that one out. No. I’m no Silicon Valley techie right here to disrupt the peace. Just a fast slap to the face after which it is again to mattress for a number of years. The economic system stays sturdy and cooler heads will prevail relating to tariffs. The Fed could be very attuned and average and income will proceed to roll in. No motive for pandemonium.

Me: That’s a reduction. Do you ever surprise why so many buyers dislike you?

Bear: Isn’t it apparent? Michael Jordan was a bull. The bears had Jay Cutler and Rex Grossman. Even I am unable to blame ’em.

Me: Well thanks once more in your time.

That was our chat and the bear shuffled off to his subsequent appointment. This market pullback that manifested right into a bear market is lengthy overdue and buyers ought to embrace this chance to seek out the gems battered down throughout the indiscriminate promoting. I’m in no rush, however I’m excited to be again to being an energetic purchaser once more. As the bear mentioned, that is almost certainly a benign and generic pullback and never the second coming of the Great Recession.

In my estimation, the underside is inside 5-10% from right here. It’s virtually time to pounce and be a part of the bear in his vacation revelries.

Disclosure: I’m/we’re lengthy APPL, NFLX, QQQ. I wrote this text myself, and it expresses my very own opinions. I’m not receiving compensation for it (aside from from Seeking Alpha). I’ve no enterprise relationship with any firm whose stock is talked about on this article.

[ad_2]