Avantor Faces Activist Fire: Why Engine Capital Wants It Sold Now!

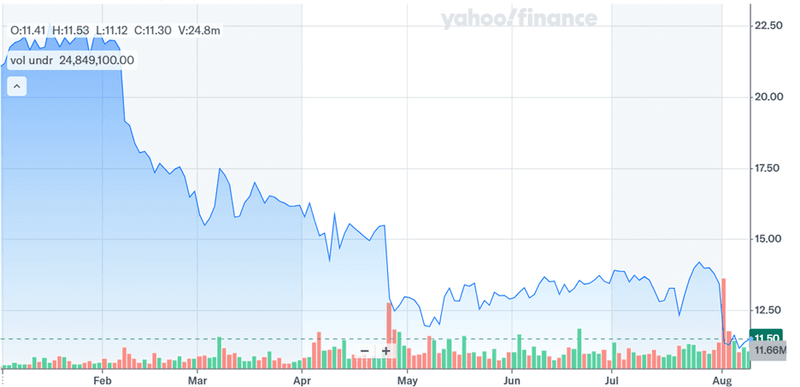

Avantor Inc. (NYSE:AVTR) has landed squarely in the sights of Engine Capital, which has built a roughly 3% stake and is now pressing the $7.8 billion life sciences supplier to either sell itself or execute a major strategic overhaul. The activist move follows a 50% year-to-date share price collapse, driven by contracting demand in government and education sectors after research funding cuts, as well as leadership uncertainty after the April departure of longtime CEO Michael Stubblefield. Incoming CEO Emmanuel Ligner takes the reins in mid-August, inheriting a business that, while globally scaled, is trading at its lowest valuation multiples since going public in 2019. Engine believes a sale could command $17–$19 per share, while a self-directed turnaround could push the stock toward $26 by 2027. With LTM EV/EBITDA at just 10.91x and EV/Revenue at 1.75x, the activist is betting the market has over-discounted Avantor’s operational headwinds. But is it true? Let us find out!

Depressed Multiples Create An Acquisition Window

Avantor’s current trading profile is well below sector norms, creating an opportunity for strategic acquirers and private equity sponsors to acquire a scaled global supplier at a discount. The company’s LTM EV/EBITDA multiple has compressed from 16.04x a year ago to 10.91x, while LTM EV/Revenue has fallen from 2.84x to 1.75x. This is despite Avantor’s entrenched market position across biopharma, healthcare, education, and industrial end markets, and its vertically integrated model combining proprietary manufacturing with global distribution. In a sale scenario, buyers could target immediate cost and procurement synergies, leverage Avantor’s global logistics infrastructure, and extend product penetration across the combined customer base. With life sciences M&A activity picking up, particularly in lab and bioprocessing supply, Engine’s thesis is that strategic buyers could justify paying a meaningful premium over the current $11.50 share price while still achieving post-deal returns above their hurdle rates.

Internal Overhaul Could Re-Rate Shares Without A Sale

If the board resists a near-term sale, Engine is advocating for an aggressive self-help strategy to close the valuation gap. Avantor is mid-way through a $400 million cost transformation program targeting supply chain, manufacturing, and SG&A efficiencies by 2027. Early wins in Lab Solutions include more than $100 million in customer share gains and contract extensions, including a five-year renewal with BIO Business Solutions, the company’s largest consortium customer. Pricing optimization tools, digital ordering upgrades, and service-level improvements are beginning to offset competitive pressures. Deleveraging from 3.2x net leverage toward a sub-3x target should also improve financial flexibility and support incremental buybacks. Engine estimates these measures, if executed without disruption, could lift EPS and EBITDA enough to push the stock toward $26 by 2027—essentially doubling from current levels without relying on a takeout bid.

Platform Appeal In A Consolidating Market

Avantor’s diversified footprint and integrated supply capabilities make it an attractive bolt-on or platform acquisition for larger industry players or PE buyers seeking scale in life sciences consumables and distribution. The company serves a fragmented customer base that includes top-tier pharmaceutical companies, biotech firms, academic institutions, and industrial labs, reducing reliance on any single vertical. Its global reach, established supplier relationships, and category breadth could enable an acquirer to consolidate share in a market where scale drives margin expansion. While bioprocessing has been pressured by customer-specific disruptions, the segment remains exposed to long-term secular demand from biologics, cell therapy, and other advanced modalities. Engine’s position suggests it believes Avantor’s platform value is obscured by near-term execution issues—issues that a buyer with deeper resources could resolve more rapidly under private ownership.

Leadership Transition & Market Risks Could Delay Action

Despite activist pressure, a transaction is not guaranteed in the near term. Emmanuel Ligner’s arrival as CEO introduces a period of operational assessment, during which the board may prioritize giving management time to stabilize performance before entertaining strategic alternatives. Persistent bioprocessing headwinds, maintenance-related production disruptions, and pricing pressure in Lab Solutions could weigh on financial results and reduce deal valuation leverage. Broader market uncertainties—including capital markets volatility, shifting research funding priorities, and geopolitical risks affecting supply chains—may also temper buyer enthusiasm or elongate negotiations. For private equity, rising financing costs could impact deal structuring, while strategic buyers may prefer to monitor early results under new leadership before making a move.

Final Thoughts

Source: Yahoo Finance

Engine Capital’s view regarding Avantor may seem justified especially given the stock’s downward trajectory and the company’s current valuation—LTM EV/EBITDA of 10.91x, EV/Revenue of 1.75x, and P/S of 1.18x—seemingly disconnected from its strategic value and earnings potential. The activist’s dual-path thesis is straightforward: sell the company now at a premium to capitalize on depressed multiples and M&A momentum, or execute an accelerated cost and growth plan to re-rate the stock over the next two years. The sale case hinges on unlocking synergy value and leveraging Avantor’s platform appeal to a strategic or financial buyer, while the self-help case depends on disciplined execution, margin recovery, and capital allocation discipline. Both routes carry execution risk, and the outcome will ultimately depend on the board’s appetite for immediate monetization versus longer-term operational recovery.