Baker Hughes’ $13.6 Billion Chart Industries Play: LNG, Nuclear, & Data Center Powerhouse?

Baker Hughes (NYSE:BKR) is making headlines with its pursuit of a transformative $13.6 billion all-cash acquisition of Chart Industries (NYSE:GTLS), a move that would override the previously announced all-stock merger between Chart and Flowserve. Valuing Chart at $210 per share—a 22% premium to its pre-announcement closing price—the proposed acquisition signals Baker Hughes’ intent to strengthen its presence in liquefied natural gas (LNG), nuclear power, and data center infrastructure. If completed, the acquisition of Chart would give Baker Hughes access to cryogenic technologies and heat transfer systems crucial for LNG production and hydrogen storage, while also solidifying its reach in emerging digital infrastructure markets. Let us dive deeper into this update and analyze the biggest strategic synergies that Baker Hughes could derive from acquiring Chart Industries.

LNG Integration For End-To-End Infrastructure Control

The acquisition of Chart Industries would significantly enhance Baker Hughes’ value proposition in the LNG value chain by integrating Chart’s cryogenic and liquefaction equipment into Baker Hughes’ already robust gas technology portfolio. Chart’s engineered equipment—such as brazed aluminum heat exchangers, cold boxes, and modular LNG systems—complements Baker Hughes’ turbines, compressors, and controls. This merger would enable Baker Hughes to provide more vertically integrated LNG solutions, allowing it to reduce project delivery times, control critical-path components, and capture higher margins across the value chain. Baker Hughes expects 60 MTPA in new LNG project final investment decisions through the next 18 months, and the addition of Chart’s capabilities could enhance bid competitiveness and enable turnkey offerings for customers pursuing mid-scale and modular LNG installations. Moreover, Chart’s global footprint, particularly in North America and Asia, would give Baker Hughes new access points to growing LNG markets and shorter delivery timelines. Beyond capex projects, the merged entity could deepen aftermarket service opportunities by bundling maintenance contracts across turbines, exchangers, and control systems—resulting in recurring revenue synergies. This consolidation may also help mitigate supply chain constraints that have previously delayed LNG projects, as well as align with customer preferences for fewer interfaces and integrated solutions. Overall, the LNG synergy lies not only in complementary product portfolios but also in operational scalability, project execution, and long-term service economics.

Accelerating Growth In Data Center Power Solutions

Chart’s portfolio of cryogenic and industrial gas systems could become a critical asset for Baker Hughes as it expands into the fast-growing data center power market. Baker Hughes has already booked over $650 million in data center orders this year alone—primarily for its NovaLT gas turbines used in behind-the-meter, low-emissions power applications. By acquiring Chart, Baker Hughes gains capabilities in heat transfer, carbon capture integration, and liquefied gas storage, which are increasingly relevant as hyperscale operators shift toward alternative fuels like hydrogen, LNG, and ammonia for power reliability. The pairing of Baker Hughes’ turbines with Chart’s heat exchangers and cryogenic storage creates a unique offering tailored for AI- and compute-intensive data centers grappling with escalating power demands and environmental scrutiny. With data center power consumption expected to double by the end of the decade, this acquisition could strategically position Baker Hughes to serve this need with integrated, clean-energy-compatible infrastructure. Additionally, Chart’s customer base includes industrial players and EPC contractors active in large infrastructure projects, offering cross-sell potential for Baker Hughes’ digital and rotating equipment portfolios. This synergy could help unlock higher-margin, longer-duration contracts with cloud providers and hyperscalers, and diversify Baker Hughes’ IET segment beyond traditional energy verticals. The data center synergy is further underscored by the stickiness of service contracts tied to energy reliability and the repeat nature of modular deployments—both of which align well with Baker Hughes’ pivot toward recurring revenue models.

Hydrogen & Nuclear Scale-Up Through Complementary Technologies

Another synergy emerges from the alignment between Chart’s hydrogen and nuclear capabilities and Baker Hughes’ existing new energy strategies. Chart is a recognized player in hydrogen liquefaction, storage, and distribution, supplying key components for projects involving mobility, blending, and stationary storage. For Baker Hughes, which reported over $1 billion in new energy orders YTD and has targeted hydrogen and carbon capture as growth areas, integrating Chart offers immediate scale and system-level control in these high-growth segments. Particularly, Chart’s vacuum-insulated pipe systems, liquid hydrogen tanks, and compression systems fit directly into Baker Hughes’ energy transition narrative, supporting its goal of delivering full hydrogen value chains from production to utilization. In nuclear, Chart’s heat transfer technologies are already being used in small modular reactor (SMR) and fusion-related projects. This complements Baker Hughes’ turbine and control solutions used in steam cycle systems for nuclear power. By combining engineering resources, Baker Hughes could accelerate commercialization of next-gen SMR solutions and hybrid energy systems where nuclear and hydrogen are co-located. The R&D overlap also offers the potential for joint innovation in cryogenic materials, system integration, and low-carbon fuels. These offerings could appeal to national labs, utility-scale operators, and project developers looking to integrate flexible baseload power and hydrogen infrastructure. This synergy is especially relevant given global policy tailwinds for decarbonization and energy security, positioning the combined firm to serve both private and public sector customers in hydrogen hubs and nuclear modernization initiatives.

Strategic Portfolio Fit & Industrial Customer Leverage

Chart Industries represents a strong portfolio fit with Baker Hughes’ ongoing transformation strategy focused on industrial energy technologies and recurring revenue. Baker Hughes has been divesting its non-core Oilfield Services businesses—such as Surface Pressure Control and PSI—and redeploying capital into high-growth, high-margin verticals. The $3.1 billion in cash and low 0.6x net leverage gives it room to finance a deal of this scale while preserving dividend payments and buybacks. Chart’s exposure to industries such as water treatment, food & beverage, and industrial gases complements Baker Hughes’ industrial turbines, pumps, and digital automation platforms, allowing for deeper penetration into cyclical but diversified end markets. Additionally, both firms share a focus on engineered-to-order systems, modularity, and maintenance contracts—areas ripe for operational streamlining and commercial integration. From a systems architecture perspective, there is potential to unify procurement, engineering, and project management workflows across shared customer bases. Moreover, Chart’s long-standing client relationships could serve as entry points for Baker Hughes’ full portfolio, including Bently Nevada diagnostics, AI-based performance monitoring, and condition-based maintenance platforms. This broader platform appeal also enhances Baker Hughes’ value proposition to EPCs and system integrators looking for fewer vendors and turnkey capabilities. At a time when industrial customers are seeking electrification, emissions reductions, and process efficiency, a combined Baker Hughes–Chart entity could deliver on those imperatives more effectively through integrated offerings and lifecycle service models.

Final Thoughts

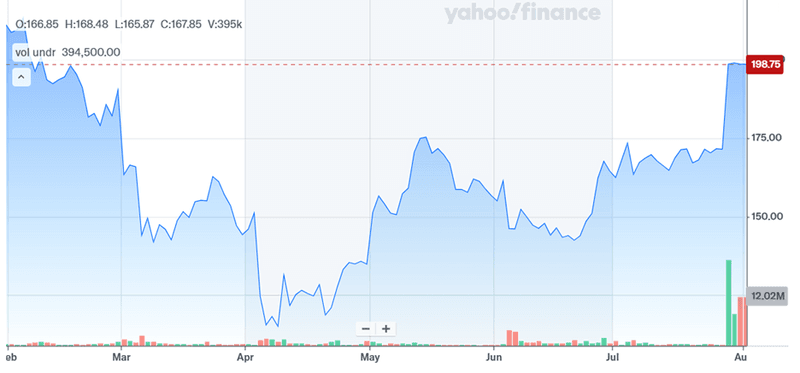

Source: Yahoo Finance

The bid, which values Chart at $210 per share, sparked a 17% post-market surge in its stock price—effectively providing shareholders with a 22% premium over the pre-deal valuation. This interest from Baker Hughes arrives at a time when Chart’s trading multiples have steadily rebounded following a broad correction across the industrial and energy infrastructure sectors. As of August 1, 2025, Chart’s LTM EV/EBITDA stood at 12.68x and EV/Sales at 2.91x—higher than its June 30 levels of 11.45x and 2.64x, respectively, and markedly above the depressed levels observed in late 2024. On a forward basis, Chart trades at 9.84x NTM EV/EBITDA and 2.56x NTM EV/Revenue, which, although elevated, remain modest compared to historical acquisition multiples in the LNG and hydrogen equipment space. The Baker Hughes bid effectively capitalizes on this valuation inflection, offering a liquidity event for shareholders while also potentially insulating Chart from execution risks in large-scale project cycles. That said, a transaction of this scale could curtail Chart’s independence just as it begins to benefit from secular tailwinds in LNG, hydrogen, and clean power. The company has developed a differentiated position across cryogenic systems and modular infrastructure, and its integration into a broader energy conglomerate may dilute its identity and innovation autonomy. Moreover, the all-cash nature of the offer may limit upside participation for long-term holders betting on continued valuation multiple expansion. While the proposal offers near-term value realization and operational scale, Chart’s future—whether as an independent innovator or as part of a larger platform—now hinges on the outcome of these negotiations and the strategic vision ultimately endorsed by its board.