Beaten Down ADT Primed For A Bounce – ADT Inc. (NYSE:ADT)

Under our investing method, we search to search out shares which were unfairly overwhelmed down that supply worth, chart assist, and the prospect to see fast-return bounces when the market reprices the stock. Today, we wish you to pay attention to a play we have recently recommended at BAD BEAT Investing. We wish to discuss to you about shares of safety supplier ADT (ADT), which at the moment are down 50% since their IPO simply over a 12 months in the past. The world residence security system market was valued at $45.6 billion in 2018 and is projected to achieve $74.8 billion by 2023, with some estimates placing the market and its related performs at almost $500 billion in mixture income by 2025. There is room for ADT to develop right here, however why is the identify falling? Long story quick, the Street has considerations over competitors from Alphabet (GOOG) (NASDAQ:GOOGL), some cable suppliers, in addition to impartial corporations. Other main gamers are Honeywell (HON) and Johnson Controls (JCI). In addition, the Street is fairly upset, in our opinion, with coming pinched margins and decreased free money circulation because of ADT stepping up its spending to rent and spend money on the corporate.

We are of the opinion that these strikes are exactly what the corporate must reestablish dominance within the area. From a gross sales and earnings perspective, the outlook shouldn’t be all that dangerous. As such, we predict a BAD BEAT alternative is establishing in shares right here at $6.20

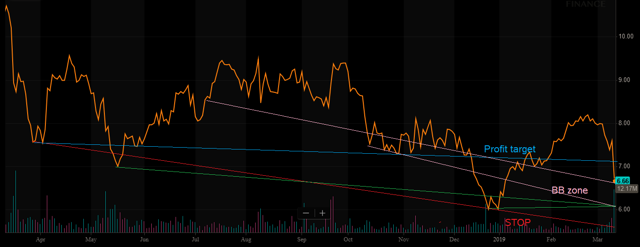

Take a take a look at the motion:

Source: BAD BEAT Investing

As you’ll be able to see, the chart has been lower than stellar. Despite the latest precipitous drop, the stock has but to problem the December lows. We assume you’ll be able to let the stock drop a bit greater than do some shopping for.

The play

Target entry: $6.05-$6.25

Stop loss: $5.85

Target exit: $7.15-$7.50

Discussion

Simple enterprise

The ADT enterprise mannequin is fairly straightforward to know. Basically, ADT offers and installs safety {hardware} after which provides 24-hour per day central monitoring companies for each residential and business clients. The firm sometimes receives an upfront free for set up adopted by recurring month-to-month income over a contracted time frame. The key dangers are competitors and excessive attrition charges.

Performance

So, let’s first discuss in regards to the fourth-quarter loss that missed analysts’ forecasts.

A week in the past, ADT reported a fourth-quarter net loss of $149 million or $0.20 a share vs. web revenue of $638 million or $0.99 a share within the comparable 12 months-ancient times. That clearly harm. On an adjusted foundation, the corporate reported a per share loss of $0.04, nicely under the revenue estimate of $0.12 per share that the Street was searching for. So, that may be a ache, proper?

Well, that’s a part of the rationale for the promoting. But what went into the loss? The web loss was because of the prior 12 months’s revenue tax good thing about $725 million associated to U.S. tax reform and a goodwill impairment loss of $88 million in 2018 because of the underperformance of the corporate’s Canadian enterprise. But it was not all dangerous. Sales had been up properly, pushed by ongoing strength in monitoring and safety revenues.

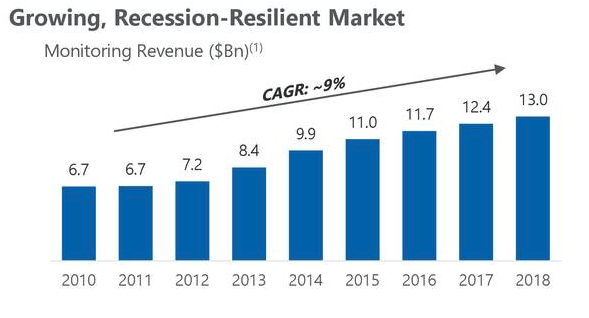

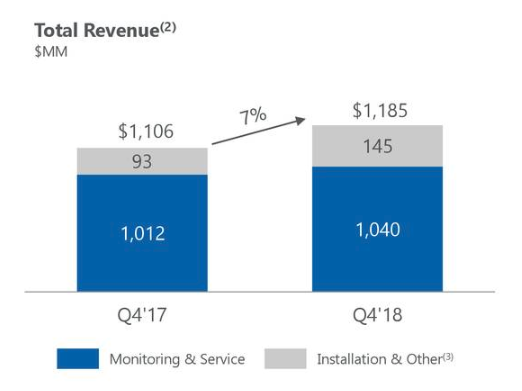

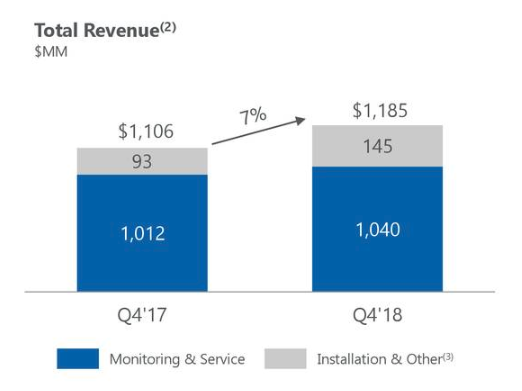

Source: This fall investor presentation

Total income was $1.185 billion, up 7% or $80 million 12 months-over-12 months and consists of incremental income related to latest acquisitions. Monitoring and associated companies income, which comprised $1.040 billion of whole income, was up 3% over the identical interval final 12 months. The development in income was attributable to a rise in month-to-month recurring income, which resulted from the addition of latest clients and enhancements in common pricing, partially offset by buyer attrition. Installation and different income was up by a further $52 million from final 12 months.

Source: This fall investor presentation

Recurring month-to-month income or RMR was the first driver of monitoring and associated companies income. This income grew by 2% by itself or 4% if we embrace Red Hawk’s acquisition in comparison with the 2017 quarter. Net development in core U.S. residential and business operations was offset by a decline in RMR attributable to the Canadian enterprise.

EBITDA seems to be good too. Adjusted EBITDA was $614 million, up 3% or $15 million 12 months-over-12 months. Adjusted EBITDA development was a results of increased monitoring and associated companies income mixed with increased income from transactions by which safety tools is bought outright to clients. There was, nevertheless, a slight uptick in promoting, basic, and administrative bills, in addition to related prices of promoting safety tools.

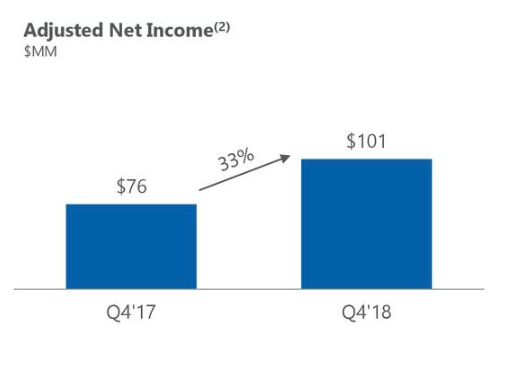

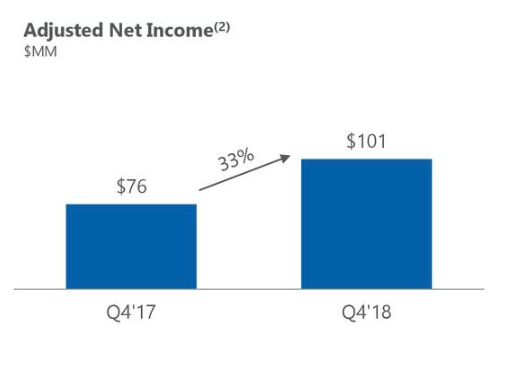

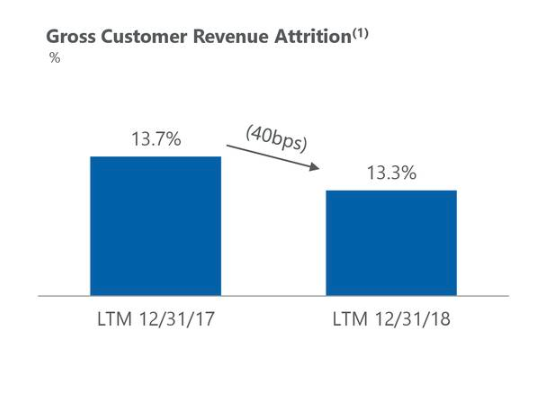

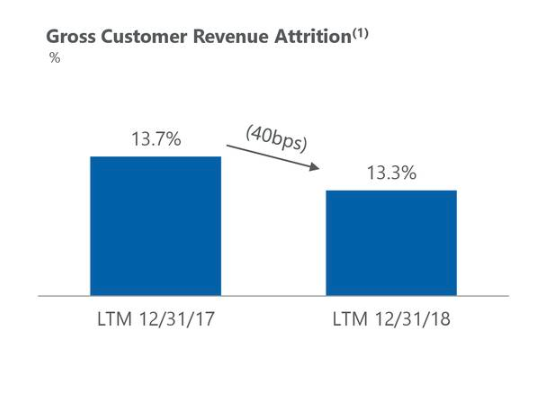

Source: This fall investor presentation

Adjusted web revenue was $101 million versus $76 million in the identical interval final 12 months, a rise of $25 million. The improve in adjusted web revenue was largely pushed by 12 months-over-12 months development in adjusted EBITDA and a lower in money curiosity. We additionally wish to level out that whereas buyer attrition is all the time an issue, the trailing twelve-month gross buyer income attrition improved 40 foundation factors 12 months-over-12 months, ending at 13.3%.

Looking forward

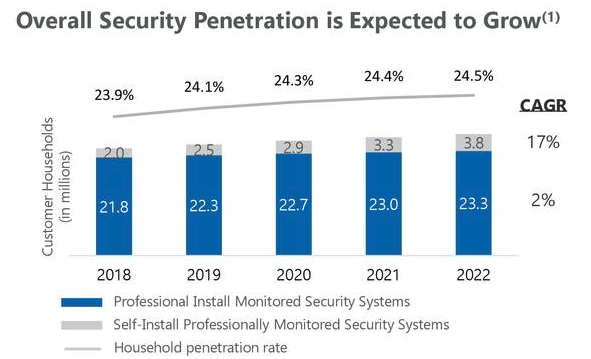

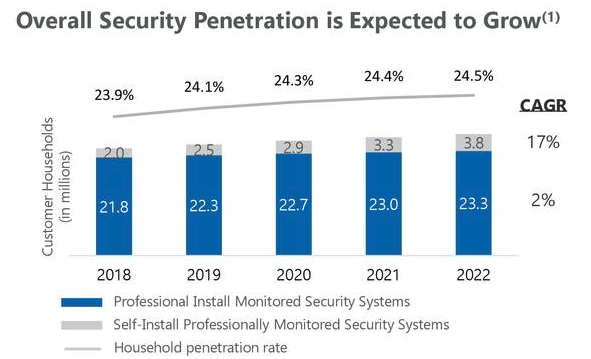

We wish to stress that the corporate shouldn’t be at the moment worthwhile and is very leveraged. However, the market has largely priced in these negatives with shares at a $6 deal with. We additionally assume and has failed to understand that the corporate’s administration is bettering operational efficiency, increasing into the business safety market, and paying down debt. The firm, nevertheless, ought to see its total family penetration develop sizably within the coming years.

Source: This fall investor presentation

The firm has additionally made a sequence of acquisitions to develop its footprint and has guided that it’ll improve spending to solidify its grip on market share. These catalysts are positioning the corporate for rising income and earnings and, subsequently, a better stock value, and we predict the market will value this in finally.

In phrases of ahead efficiency, for 2019, ADT stated it now expects income of $4.9 billion to $5.1 billion vs. consensus forecasts of $4.92 billion. We like that steering. The firm additionally sees adjusted EBITDA of $2.46-2.5 billion, an increase from $2.45 billion in 2018. The small rise has some considerations, however it is because the corporate will likely be targeted on getting buyer attrition underneath 13% for the 12 months 2019.

Source: This fall investor presentation

The firm can also be working arduous to spice up its place by additional strikes within the area and investments within the model. At the identical time, it’s working to spice up shareholder worth.

Shareholder-friendly

We could be remiss if we didn’t point out that the corporate is changing into shareholder-pleasant, in our opinion. The board of administrators declared a money dividend of $0.035 per share for holders of file as of April 2, 2019. This dividend will likely be paid on April 12, 2019. Just two weeks in the past, ADT additionally accredited a DRIP plan which can enable shareholders to designate all or a portion of the money dividends on their shares of widespread stock for reinvestment in extra shares of the widespread stock. In addition, ADT accredited a share repurchase program which can allow ADT to repurchase as much as $150 million of widespread shares over the subsequent two years.

Moving extra into Commercial

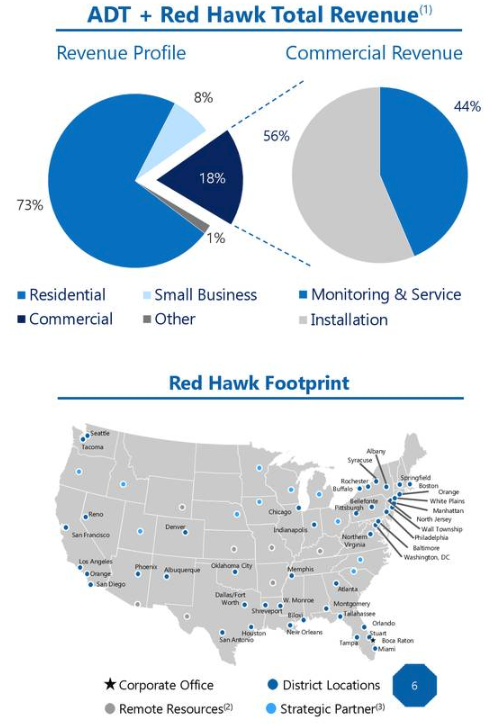

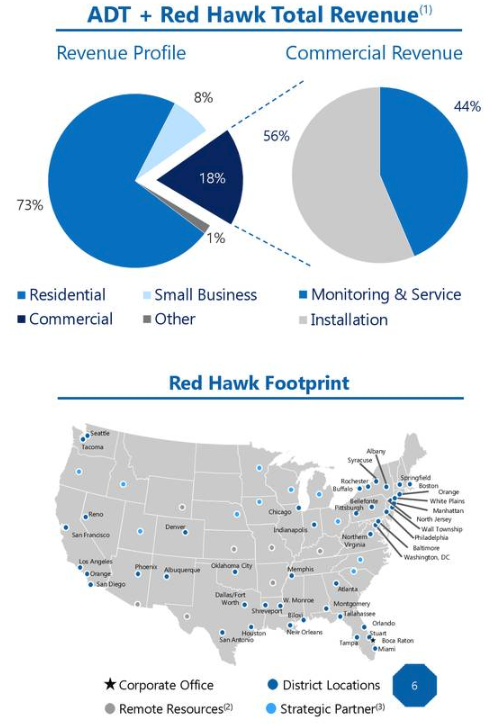

While the house safety enterprise has been the bread and butter for the corporate, the latest transfer into the Commercial enterprise units the corporate up for future development. The firm was once a bigger participant within the business safety market, however this enterprise phase was retained by Tyco and is now part of Johnson Controls after ADT Corporation was spun out in 2012. The December buy of Red Hawk Fire & Security was a powerful transfer into the area.

Source: This fall investor presentation

This firm is a pacesetter in business hearth, life safety, and safety companies. This acquisition will assist speed up ADT’s development within the business safety market and develop ADT’s product portfolio with the introduction of business hearth security associated options. In January 2019, ADT continued its business growth with the acquisition of Advanced Cabling Systems, one of many main know-how integration corporations within the mid-south. We anticipate additional strikes like this within the coming years as the corporate expands its footprint.

Take residence

Overall, the corporate is working to scale back debt whereas investing strategically in acquisitions to spice up the corporate’s footprint. We like the brand new buyback and dividend being paid. We assume the transfer to business will assist ADT transfer towards profitability within the coming years. The stock ought to observe swimsuit because the market reprices the identify increased. Let it are available in and contemplate a place.

Disclosure: SmallcapsDaily.com shouldn’t be receiving compensation for this text. We personal no shares of ADT. We haven’t any enterprise relationship with any firm whose stock is talked about on this article.