Best Asset Classes Of 2018: Gold And Residential Real Estate

[ad_1]

If you had made bets on which of the key asset lessons would outperform in 2018, which might you might have chosen?

Stocks?

Bonds?

Real Estate?

Commodities?

Precious Metals?

I might wager that sentiment would have positioned shares in first place, actual property second, commodities third, bonds fourth, and valuable metals final just by the quantity of protection and hype that I’ve seen over the yr for every of these markets. But 2018 is clearly a transition yr for the stock and bond markets, which didn’t fare properly.

The Downers

Each of the key stock indices ended the yr down, together with the Dow, S&P 500, Nasdaq, and Russell 2000. Small caps ended down probably the most at 13%, whereas Nasdaq was down solely 5.3% on the yr.

Source: Yahoo Finance

Debt markets didn’t do properly in any respect. Here is the 12-month LIBOR, whose charges spiked up nearly a full p.c on the yr. If you’re a company entity holding hundreds of thousands or billions of {dollars} in variable fee debt, the development in rising LIBOR charges most positively is just not your pal.

Source: FRED

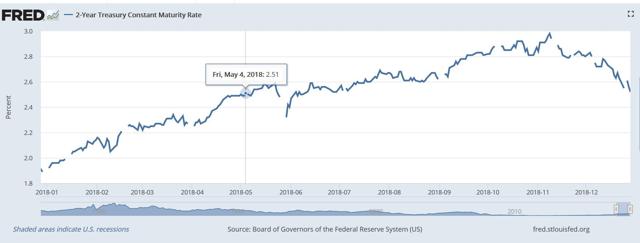

Here is the 2-year US Treasury, which spiked from 1.91 to 2.52. That is a 32% loss when you purchased on January 1 this yr and offered on December 31, 2018.

Source: FRED

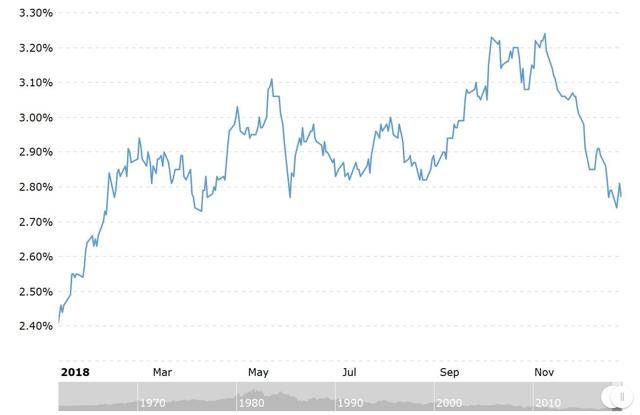

The 10-year treasury went from 2.4 to 2.77 p.c. That is a 15.4% loss when you purchased on January 1 and offered on December 31 this yr.

Source: Macro Trends

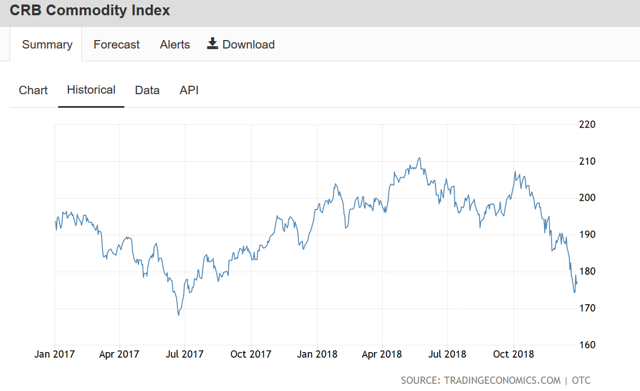

The CRB commodity index is down about 10% on the yr.

Source: Trading Economics

Here is an entire checklist of various commodities and their YTD efficiency. Notice that for a couple of particular exceptions, the elements are nearly all down for 2018.

| Commodity | 1-Month Change | 12-Month Change | Year-to-Date Change |

|---|---|---|---|

| Commodity Agricultural Raw Materials Index | -0.98 % | -0.61 % | -5.37 % |

| Commodity Beverage Price Index | 0.16 % | -5.15 % | -0.80 % |

| Commodity Price Index | |||

| Commodity Fuel (Energy) Index | -15.44 % | 6.89 % | -3.68 % |

| Commodity Food and Beverage Price Index | |||

| Commodity Food Price Index | -1.63 % | -4.82 % | -6.39 % |

| Commodity Industrial Inputs Price Index | |||

| Commodity Metals Price Index | -2.34 % | -7.14 % | -12.50 % |

| Commodity Non-Fuel Price Index | -1.32 % | -4.32 % | -6.85 % |

| Crude Oil (Petroleum), Price index | |||

| Coal, Australian Thermal Coal | -7.36 % | 4.23 % | -5.37 % |

| Coal, South African Export Price | -8.73 % | 0.21 % | -6.05 % |

| Crude Oil (Petroleum) | -18.78 % | 3.99 % | -5.90 % |

| Crude Oil (Petroleum); Dated Brent | -19.01 % | 4.16 % | -5.54 % |

| Crude Oil (Petroleum); Dubai Fateh | -17.54 % | 7.48 % | -1.38 % |

| Crude Oil (Petroleum); West Texas Intermediate | -19.90 % | 0.04 % | -10.99 % |

| Diesel | -12.22 % | 6.89 % | -1.25 % |

| Gasoline | -19.87 % | -11.20 % | -14.43 % |

| Heating Oil | -12.11 % | 11.52 % | 0.79 % |

| Indonesian Liquified Natural Gas | 0.00 % | 37.99 % | 24.84 % |

| Jet Fuel | -13.52 % | 10.51 % | -0.36 % |

| Natural Gas | 25.84 % | 38.46 % | 6.70 % |

| Propane | -22.31 % | -23.98 % | -17.59 % |

| RBOB Gasoline | -22.85 % | -5.28 % | -10.55 % |

| Russian Natural Gas | -5.92 % | 23.62 % | 24.17 % |

| Cocoa beans | 2.82 % | 2.82 % | 12.31 % |

| Coffee, Other Mild Arabicas | -0.33 % | -2.89 % | -1.31 % |

| Coffee, Robusta | -2.13 % | -8.46 % | -5.64 % |

| Tea | -2.48 % | -20.81 % | -20.27 % |

| Barley | 0.00 % | 10.18 % | -1.88 % |

| Canadian Wheat | |||

| Maize (NYSEARCA:CORN) | 0.27 % | 8.06 % | 3.11 % |

| Rice | -1.96 % | -0.25 % | -9.28 % |

| Soft Red Winter Wheat | 0.84 % | 20.03 % | 18.23 % |

| Sorghum | -0.90 % | -6.05 % | -11.73 % |

| Wheat | -4.65 % | 13.29 % | 5.93 % |

| Bananas | |||

| Oranges | -2.67 % | -15.12 % | -3.95 % |

| Beef | 2.33 % | -8.78 % | -8.14 % |

| Poultry (Chicken) | 0.00 % | 3.57 % | -1.93 % |

| Lamb | |||

| Swine (Pork) | |||

| Fish (Salmon) | |||

| Shrimp | 1.75 % | -4.19 % | -5.66 % |

| Sugar | -3.45 % | -15.15 % | -9.68 % |

| Sugar, European import worth | -2.63 % | -2.63 % | -7.50 % |

| Sugar, U.S. import worth | -1.79 % | -8.33 % | -6.78 % |

| Coconut Oil | -6.29 % | -49.38 % | -43.56 % |

| Fishmeal | -0.34 % | 6.52 % | -7.55 % |

| Olive Oil, Extra Virgin | |||

| Palm Kernel Oil | -10.79 % | -50.90 % | -43.92 % |

| Palm Oil | -8.56 % | -25.94 % | -23.27 % |

| Peanut Oil | 0.48 % | -4.12 % | 0.52 % |

| Groundnuts (Peanuts) | -3.27 % | -2.83 % | 3.70 % |

| Rapeseed Oil | -1.17 % | -12.71 % | -0.92 % |

| Soybean Meal | -2.13 % | 4.72 % | -2.20 % |

| Soybean Oil | -3.06 % | -17.75 % | -16.22 % |

| Soybeans | 1.68 % | -5.00 % | -3.95 % |

| Sunflower Oil | -1.66 % | -12.81 % | -11.63 % |

| Coarse Wool | |||

| Copra | |||

| Cotton | 0.00 % | 7.91 % | -4.98 % |

| Fine Wool | |||

| Hard Logs | -0.43 % | -0.43 % | -2.08 % |

| Hard Sawnwood | |||

| Hides | |||

| Plywood | -0.43 % | -0.43 % | -2.08 % |

| Rubber | -5.59 % | -14.01 % | -21.51 % |

| Soft Logs | |||

| Soft Sawnwood | |||

| Wood Pulp | 0.00 % | 0.00 % | 0.00 % |

| Aluminum | -4.50 % | -7.58 % | -12.27 % |

| Cold-rolled metal | |||

| Copper, Grade A cathode | -0.38 % | -9.24 % | -12.31 % |

| Gold | 0.43 % | -4.78 % | -8.31 % |

| Hot-Rolled Steel | |||

| Iron Ore | -0.20 % | 14.04 % | -4.03 % |

| Lead | -2.54 % | -21.30 % | -25.04 % |

| Nickel | -8.73 % | -6.12 % | -12.63 % |

| Rebar | |||

| Silver | -1.71 % | -15.49 % | -16.23 % |

| Steel Wire Rod | |||

| Tin | -0.30 % | -2.52 % | -7.89 % |

| Uranium | |||

| Zinc | -2.92 % | -19.62 % | -24.58 % |

| DAP Fertilizer | -2.51 % | 19.24 % | 13.82 % |

| Potassium Chloride | 0.00 % | 0.00 % | 0.00 % |

| Rock Phosphate | 1.37 % | 15.63 % | 15.63 % |

| Triple Superphosphate | -1.56 % | 28.47 % | 18.44 % |

| Urea | 13.19 % | 9.14 % | 39.14 % |

Source: Index Mundi

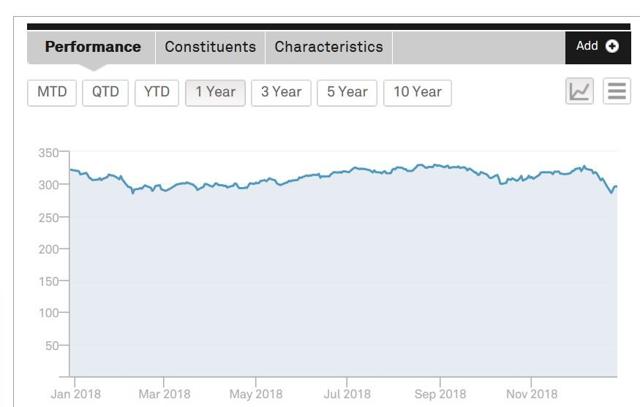

REIT investments total didn’t fare too properly in 2018, which, per the Dow Jones Real Estate Index, have been down 8.2% on the yr.

Source: S&P Dow Jones Indices

The Semi-Bright Spot With Weakening Fundamentals

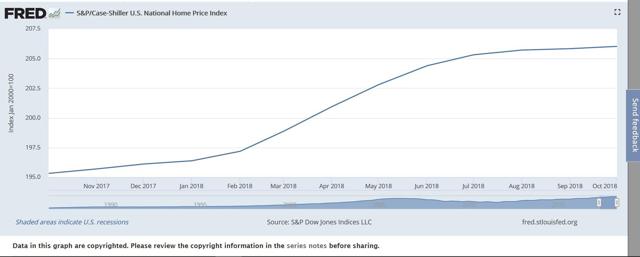

US residential actual property led the cost in 2018, up 4.9%, in accordance with Case-Shiller.

Source: FRED

However, indications are that retail inventories are rising and sales are down, so it seems the bull market in residential actual property could have come to an finish. The index above was comparatively flat for the final 6 months of the yr, additionally indicating a worth prime could also be in.

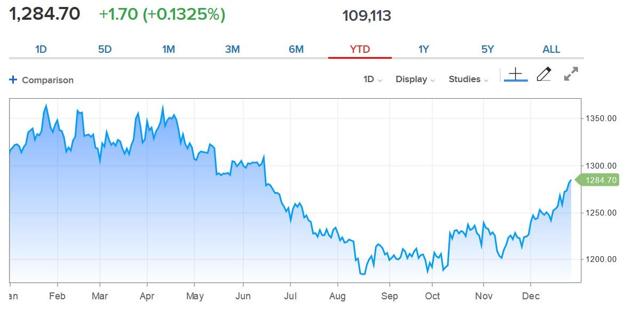

Gold is Alone in Ending 2018 in a Sustained Uptrend

Surprising to most is the truth that gold held its personal in 2018, ending down simply 1.6% for the yr.

(Source: CNBC)

Of these asset lessons, solely gold ended the yr in a stable uptrend, largely on issues of volatility within the stock markets and a weakening image for debt securities. If you might be involved concerning the different markets, gold could also be a superb piggy financial institution financial savings automobile for you in 2019.

Summary

Unless the bond markets stabilize and LIBOR charges come again down, the broad stock indices will proceed to undergo on expectations of decreased company earnings and better US funds deficits. These components favor a continued improve in gold worth in 2019.

Does the efficiency of the key asset lessons in 2018 shock you? If we had taken a Seeking Alpha investor survey on January 1, I wager it will present expectations almost exactly opposite to the results now we have had for 2018.

As a outcome, 2019 is shaping as much as be a really attention-grabbing yr for traders which have develop into reliant on the 30-year bond bull and the almost 10-year stock bull markets.

I predict gold and silver will shine in 2019 whereas the opposite main asset lessons see continued worth volatility.

Disclosure: I/now we have no positions in any shares talked about, and no plans to provoke any positions throughout the subsequent 72 hours. I wrote this text myself, and it expresses my very own opinions. I’m not receiving compensation for it. I’ve no enterprise relationship with any firm whose stock is talked about on this article.

Additional disclosure: I personal bodily gold.

[ad_2]