Braemar Hotels & Resorts Explores Strategic Sale—Here’s What You Need To Know

Today, we are going to focus on a very interesting potential acquisition small-cap target in a rather intriguing luxury lodging REIT landscape – Braemar Hotels & Resorts (NYSE:BHR). The company has formally launched a process to explore a potential sale of the company after months of internal evaluation by a Special Committee which determined a sale could maximize shareholder value amidst growing investor activism and persistent undervaluation in public markets. The Dallas-based REIT owns a portfolio of high-end hotels managed under top-tier brands such as Ritz-Carlton, Four Seasons, Park Hyatt, and Hilton. With the U.S. hotel sector showing signs of recovery and luxury RevPAR outperforming, Braemar's board believes the timing is optimal. But can this small-cap REIT manage to grab the eyeballs of potential acquirers?

Unlocking Private Market Value

Braemar’s decision to initiate a sale process is largely driven by the persistent discount at which lodging REITs, particularly those with luxury exposure, trade in public markets. Despite owning some of the highest RevPAR-generating assets among its peers, Braemar’s valuation has failed to reflect the intrinsic real estate value of its portfolio. For instance, its LTM EV/EBITDA multiple of 13.18x and P/S ratio of just 0.26x as of August 27, 2025, contrast starkly with its asset quality. The public discount stands in contrast to the multiples luxury hotels can achieve in private transactions. Case in point: the recent agreement to sell the 369-room Marriott Seattle Waterfront at a trailing 12-month NOI cap rate of 8.1% suggests underlying real estate valuations far exceeding the REIT's trading metrics. Furthermore, precedent exists: Strategic Hotels & Resorts, a peer luxury REIT, also faced similar valuation pressures and activist investor friction before it was sold in an all-cash deal. Braemar’s Special Committee explicitly referenced this precedent in its announcement. The portfolio includes 14 wholly owned hotels and a 75% stake in the Capital Hilton, totaling 2,885 rooms, with a trailing 12-month NOI of $135.8 million. Additionally, the company owns excess development land valued at over $35 million and has positive net working capital of $68 million. This combination of stabilized high-margin assets and development optionality makes it well-suited for institutional buyers like sovereign funds, private equity firms, or hospitality conglomerates with access to lower-cost capital and longer investment horizons. The public-to-private arbitrage, alongside growing buyer interest in hospitality real estate, creates a compelling monetization opportunity.

Strong Portfolio Performance

Operationally, Braemar has continued to demonstrate resilience and top-tier performance despite macroeconomic uncertainties and capital expenditure burdens. For Q2 2025, comparable RevPAR grew 1.5% year-over-year to $318, marking the third consecutive quarter of RevPAR expansion. EBITDA margin improved slightly, and comparable hotel EBITDA rose 3.7% to $47.8 million. The resort portfolio, which includes 9 of the 15 properties, generated $25.7 million of EBITDA in the quarter, up 6.9% from the prior year, driven by properties like the Ritz-Carlton Lake Tahoe (+39% revenue) and Dorado Beach Reserve (+14% revenue). Urban hotels also posted growth, with the Clancy in San Francisco reporting a 14% revenue increase. On a trailing 12-month basis through June 30, 2025, the entire portfolio generated $135.8 million in NOI, reflecting healthy fundamentals in both leisure and group segments. Group bookings for full-year 2025 are pacing 8.6% ahead of last year, with 2026 pacing up 3.6%, indicating continued demand momentum. Importantly, Braemar’s high-end positioning and brand alignment allow it to command premium ADRs, which supports strong EBITDA conversion. Even while undergoing renovations at several properties—including Park Hyatt Beaver Creek and Hotel Yountville—the company managed to deliver quarter-over-quarter growth, underscoring operational depth. Ancillary revenue also played a key role, with food and beverage revenue rising 6.6% in the second quarter and group catering revenue up significantly at properties like Ritz-Carlton Lake Tahoe. These performance metrics provide a strong underpinning for a sale thesis, offering would-be buyers confidence in the portfolio’s near-term and long-term earnings power.

Governance Simplification

A key element in the sale thesis is the negotiated simplification of Braemar’s complex external management structure. Historically, Braemar has operated under an external advisory agreement with Ashford Inc., a structure that has often drawn criticism from investors for high fees and perceived conflicts of interest. In the context of the sale, Braemar and Ashford have agreed to a $480 million Company Sale Fee—significantly discounted relative to the $462 million termination fee calculated based on the most recent Net Earnings of $38.7 million. For reference, under the prior advisory agreement formulas, the termination fee would have exceeded $600 million due to performance growth and additional services rendered. The agreed fee also includes an upfront advance payment of $17 million to Ashford, and provides flexibility for buyers, including the option to cancel Master Agreements with affiliated entities (Premier and Remington) for an additional $25 million. These pre-agreed terms eliminate a major structural obstacle for potential buyers who would otherwise be deterred by the need to unwind or absorb complex advisory relationships. This not only streamlines the diligence process but enhances the marketability of the entire company. Governance complexity has historically been a gating issue in hospitality REIT M&A transactions, and this level of pre-emptive coordination may result in a broader buyer pool and faster execution timeline. Additionally, this reduces the perception of entrenchment risk and aligns incentives between shareholders and external managers, potentially leading to a cleaner transaction path.

Execution & Market Risk

While the strategic rationale for a sale is supported by asset quality and governance steps, execution and market risk remain key concerns. First, the $480 million Company Sale Fee payable to Ashford—although discounted—still represents a material transaction cost that will need to be factored into any bid valuation. Additionally, potential acquirers will need to assume or cancel two Master Agreements with Premier Project Management and Remington Lodging & Hospitality, at further cost, possibly deterring price-sensitive buyers. The company’s capital structure also adds complexity. As of June 30, 2025, Braemar reported approximately $1.172 billion in total indebtedness and $473 million in preferred equity with a liquidation preference, which must be satisfied before any distribution to common shareholders. Combined with 73.6 million fully diluted shares outstanding, any buyer must factor in substantial liabilities in pricing the equity. Moreover, interest rate volatility remains a risk: with 78% of Braemar’s debt effectively floating, rising rates could pressure future cash flows, especially as SOFR remains elevated. From a public markets perspective, Braemar trades at a trailing EV/EBITDA multiple of 13.18x and a P/S multiple of just 0.26x, but a forward TEV/EBITDA multiple of 11.83x suggests a slowdown in near-term EBITDA growth. These risks could result in either a protracted sale process or a valuation below the expectations of common equity holders. Lastly, while buyer interest in luxury hospitality remains robust, deal-making remains sensitive to macro conditions, including consumer travel patterns, global liquidity, and financing costs. There is no guarantee the process will result in a transaction.

Final Thoughts

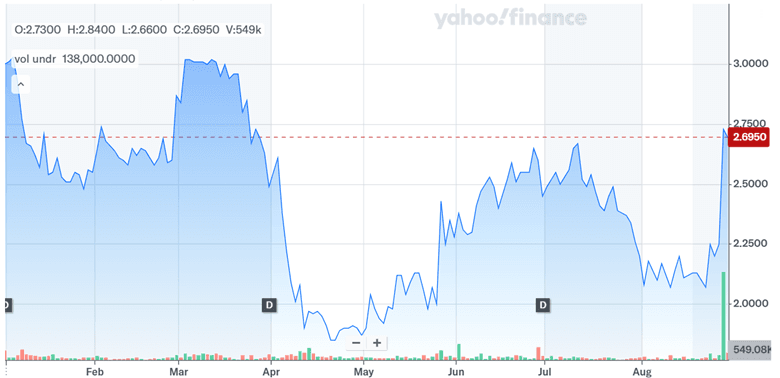

Source: Yahoo Finance

As we can see in the above chart, Braemar Hotels & Resorts’ strategic decision to explore a company sale resulted in a solid spike in the stock price and trading volumes as it did manage to grab the attention of Wall Street. The REIT has a portfolio of high-performing luxury properties generating $135.8 million in trailing NOI which is why, significant interest is likely from private market buyers seeking high-yield, trophy real estate assets. Operational performance, particularly in resorts and group bookings, remains strong, supporting the sale thesis. However, execution risks loom, including high transaction fees, a leveraged balance sheet, and uncertain macroeconomic headwinds that could affect buyer appetite or valuation levels. As of August 27, 2025, Braemar trades at a trailing TEV/EBITDA of 13.18x and an LTM P/S of 0.26x—levels that imply a valuation disconnect from its asset quality but may also cap upside in a sale if debt and fee obligations absorb significant equity value. Ultimately, the outcome of the process will depend on how buyers weigh real estate fundamentals against transaction friction and market volatility.