Braskem Shares Soar: Could This Be the Comeback Moment for the Debt-Laden Giant?

Did you catch what just happened with Braskem (NYSE:BAK)? The company’s stock jumped big time—13% in Brazil and 14% in the U.S.—and investors are suddenly buzzing. Why the excitement? Two major developments just hit the news. First, Braskem reached a $230 million settlement with the Brazilian state of Alagoas to resolve a years-long environmental case tied to a collapsed salt mine. That’s a huge legal cloud finally lifted. Second, there’s talk that its longtime controlling shareholder, Novonor, might be handing over the reins to IG4 Capital, a private equity firm. If that deal goes through, it could mean big changes for a company that’s been stuck in place for years. Braskem has struggled with heavy debt, industry headwinds, and governance challenges—but these moves have sparked hope that the tide could be turning. So what does this all mean? Let’s break down what’s driving this sudden optimism and whether this could be a fresh start for the small-cap chemical company.

Environmental Settlement Brings Closure & Clears Overhang

Braskem’s agreement with the state of Alagoas to pay 1.2 billion reais ($230 million) offers long-awaited clarity on one of its most pressing legacy issues—the geological collapse of a salt mine in Maceió that displaced thousands and triggered massive legal and financial uncertainty. For years, this incident weighed on investor confidence, leading to Braskem’s loss of investment-grade status and clouding its ability to access capital markets. The settlement, confirmed in a regulatory filing, provides full indemnity for related damages, eliminating the risk of future liabilities tied to this event. While the cash payout impacts Braskem’s liquidity, the strategic benefit of extinguishing this risk far outweighs the near-term cash drain, especially as the company has drawn down a $1 billion credit facility to bolster reserves. In Q3 2025, Braskem’s leverage reached 14.9x EBITDA and cash burn remained a concern, but removing the Alagoas uncertainty may stabilize risk premiums tied to the company’s debt. In essence, the settlement brings finality to a multi-year saga and simplifies the risk profile for potential buyers or investors. It also helps reposition Braskem as a cleaner bet in the environmental, social, and governance (ESG) domain—a critical factor in institutional allocation. As one Citi analyst noted, the agreement is a milestone because the Alagoas disaster was one of the last major overhangs preventing bullish sentiment from taking hold.

Shareholder Shift Could Unlock Strategic Direction & Capital Access

The potential sale of Novonor SA’s controlling stake in Braskem to IG4 Capital is being viewed by investors as a game-changing governance reset. Novonor, formerly Odebrecht, has been mired in scandal and debt ever since the Carwash corruption investigation rocked Brazil’s corporate sector. Its Braskem shares have been pledged as collateral to government-owned banks, limiting operational flexibility and spooking investors wary of political entanglements. The entrance of IG4 Capital, a private equity firm with restructuring chops, could be the catalyst Braskem needs to refocus its strategic direction, streamline governance, and potentially unlock fresh capital. The proposed transaction would see IG4 share control with Petrobras, another key shareholder, and would be supported by creditor banks that currently hold liens on Novonor’s stake. If finalized, this transfer would resolve a multi-year shareholder overhang, end M&A speculation, and open the door for capital injections, asset rationalizations, or divestitures—decisions Novonor has been unable to execute due to its creditor obligations. Importantly, a change in control might help Braskem reset relationships with rating agencies and institutional investors who have steered clear due to ownership risks. Although the terms have yet to be confirmed, the mere prospect of new leadership appears to be enough to boost sentiment in a stock that has largely underperformed due to headline risk and shareholder paralysis.

Financial Strain Remains an Anchor Despite Positive Headlines

Even with the good news, Braskem’s underlying financials reflect a company still in deep water. In Q3 2025, cash reserves fell to $1.3 billion from $1.7 billion in the prior quarter, and net debt climbed to $7.1 billion. This translated into a near-record leverage ratio of 14.9x EBITDA, up from 10.6x sequentially, driven by weaker petrochemical spreads, softer global demand, and ongoing cost pressures. While the company tapped into a $1 billion credit facility to manage liquidity, this is more of a short-term fix than a long-term solution. Management has acknowledged the need for financial optimization, but efforts to restructure debt or sell non-core assets remain at a preliminary stage. Braskem’s U.S. dollar bonds have also shown volatility, especially after a recent announcement in September about hiring financial advisors to explore options. From an operational standpoint, joint venture Braskem Idesa in Mexico has resumed production and is operating above capacity, which may improve segmental earnings in upcoming quarters. Still, the combination of high debt, weak free cash flow, and poor earnings quality leaves limited room for error. With trailing 12-month EV/EBITDA at 67.2x and Price/Sales at just 0.08x, Braskem trades like a distressed asset rather than a growth story. Investors are clearly betting on a turnaround, but the financials suggest any recovery will require aggressive balance sheet repair and possibly strategic divestitures to regain flexibility.

Global Petrochemicals Landscape Continues to Pressure Margins & Pricing

Outside of its internal troubles, Braskem is also grappling with a tough global operating environment for petrochemical producers. The oversupply in key products like polyethylene and polypropylene has kept international spreads under pressure, with Q3 2025 EBITDA coming in below consensus estimates. Despite modest volume recovery in some regions, weak demand in Europe and Asia has kept pricing power muted, while feedstock costs remain volatile. The company’s Q3 earnings call revealed that capacity utilization across many of its assets remains below historical norms, with some plants operating below breakeven levels. CEO Roberto Ramos noted that while Braskem Idesa in Mexico has turned a corner post-supply disruptions, overall industry dynamics remain unfavorable. The longer the margin compression persists, the harder it becomes for Braskem to generate the operating cash flow needed to service debt, reinvest, or return capital. The firm’s guidance did not indicate a sharp turnaround in market conditions, suggesting that investor bets are more about corporate action than a sector recovery. With limited visibility into when spreads will normalize and no signs of industry consolidation on the horizon, Braskem’s ability to weather macro headwinds depends heavily on internal cost control and capital discipline. The weak environment also complicates M&A discussions, as strategic buyers tend to be conservative during downcycles, further emphasizing the importance of resolving shareholder uncertainty.

Final Thoughts

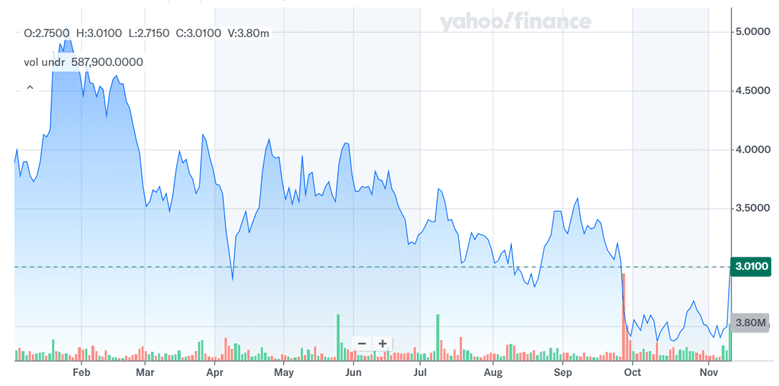

Source: Yahoo Finance

Braskem’s share price has seen a sharp jump in value and volume after the big news reflecting growing investor optimism. Right now, it feels like the company is at a crossroads. Investors are excited about the recent progress on two big fronts: settling the Alagoas mess and the possible handoff of control from Novonor to a more active owner like IG4 Capital. These are important steps that could bring stability and maybe even open up new paths for the company. But let’s not get ahead of ourselves. Braskem still has a heavy debt load, unpredictable earnings, and industry conditions that aren’t doing it any favors. Its stock might be rallying, but that doesn’t mean all its problems are fixed. In fact, based on current financial data, Braskem is trading at steep valuation multiples, like a 67x trailing EV/EBITDA and a super low Price/Sales of 0.08x—more in line with a company still in distress. This is why some investors are treating it more like a high-risk turnaround play than a growth story. There’s potential here, sure, but it’s going to take solid execution and maybe some tough decisions to really change the game.