CRYO American CryoStem Corp Continues, but is it time to SELL?

[ad_1]

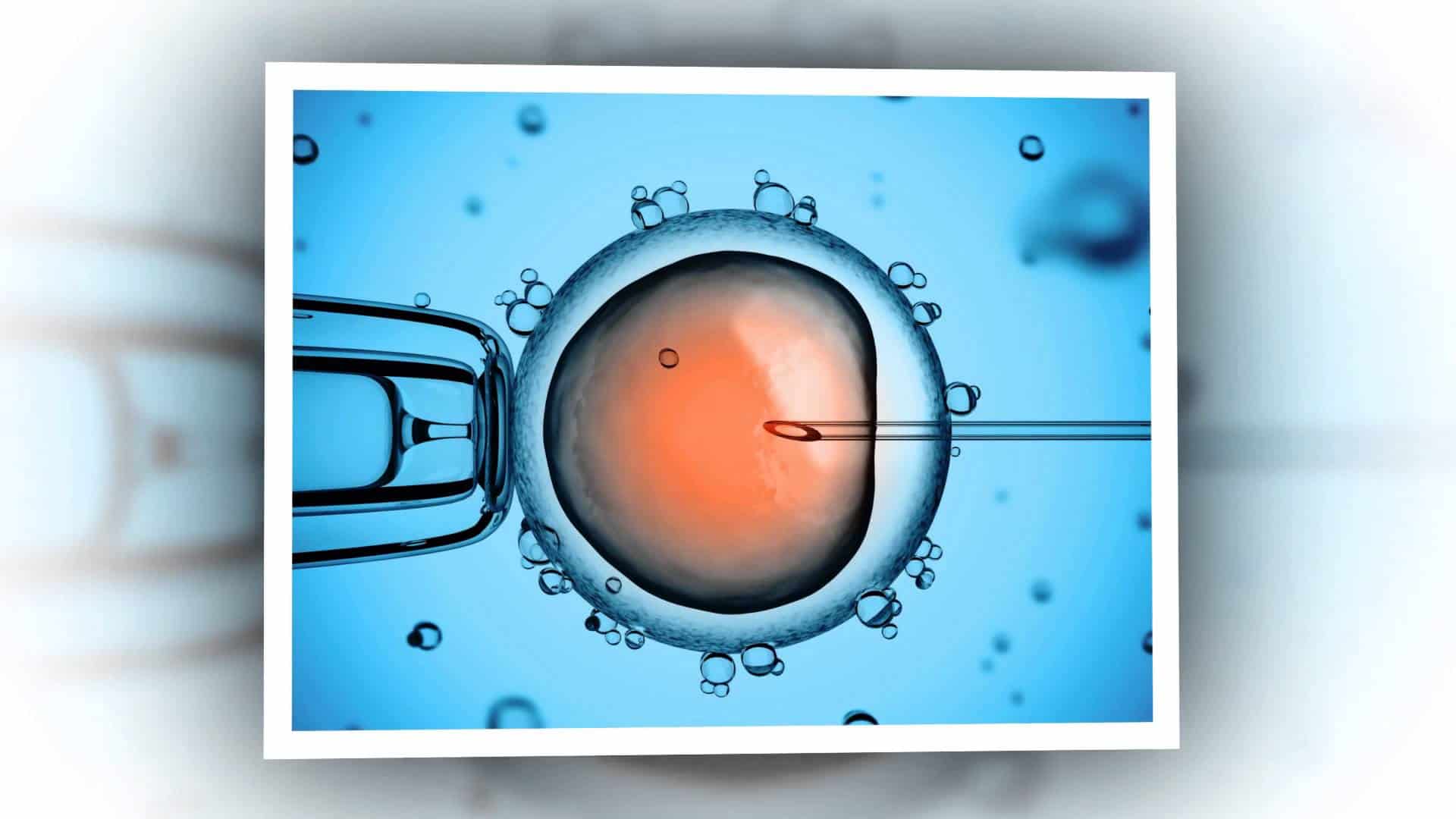

OTC:CRYO (American CryoStem Corporation), primarily based in Eatontown, NJ, with associate laboratories within the U.S., Japan and China, is a firm engaged in growing, bringing to market, standardizing and licensing applied sciences, supplies and companies geared at adipose tissue (aka physique fats) regenerative and personalised drugs. In this capability, CRYO is centered on analysis, evaluation, switch, storage, sterilization, viability and different companies within the over-arching adipose tissues subject. They additionally declare to have a strategic portfolio of mental property (IP) which they are saying will assist their pipeline of stem cell and functions and biologic merchandise. CRYO was based in 2008.

OTC:CRYO (American CryoStem Corporation), primarily based in Eatontown, NJ, with associate laboratories within the U.S., Japan and China, is a firm engaged in growing, bringing to market, standardizing and licensing applied sciences, supplies and companies geared at adipose tissue (aka physique fats) regenerative and personalised drugs. In this capability, CRYO is centered on analysis, evaluation, switch, storage, sterilization, viability and different companies within the over-arching adipose tissues subject. They additionally declare to have a strategic portfolio of mental property (IP) which they are saying will assist their pipeline of stem cell and functions and biologic merchandise. CRYO was based in 2008.

There’s been a spike in current exercise on CRYO and we’ll take a look at the short- and long-term implications in addition to strive to determine what’s truly behind the sudden upward trendline.

In 2016 CRYO appointed a Nobel Prize nominee and stem cell knowledgeable Vincent C. Giampapa, M.D. to its medical and scientific advisory board. Mr. Giampapa was nominated for the prize for his stem cell work in epigenetics, or the research of human cell operate with the aim of growing older higher. More not too long ago CRYO filed for patent safety for its premier progress medium, ACSelerate MAX™, in Europe, China, Hong Kong, Japan, Mexico, Thailand, Israel, Russia, India, Australia/New Zealand, Brazil, Canada, and Saudi Arabia. This product is a progress medium for stem cells. They additionally introduced the plan to proceed to broaden the licensing mannequin that the developed for ACSelerateMAX™ and apply it to their whole household of 14 progress and differentiation mediums in addition to its transportation and cryopreservation mediums lots of that are patented and others within the patent course of internationally.

So lengthy story brief, this firm is within the enterprise of stem cell remedies and therapies. What does that imply and the way does it evaluate to their friends? Well, they simply launched their 2017 Q3 earnings report and from what we are able to see, most indicators fare fairly properly for the long run. In abstract, revenues are up barely, YOY income progress is about 173%, earnings are constructive for the primary time in a number of cycles as is internet margin.

So lengthy story brief, this firm is within the enterprise of stem cell remedies and therapies. What does that imply and the way does it evaluate to their friends? Well, they simply launched their 2017 Q3 earnings report and from what we are able to see, most indicators fare fairly properly for the long run. In abstract, revenues are up barely, YOY income progress is about 173%, earnings are constructive for the primary time in a number of cycles as is internet margin.

Their friends embrace Brainstorm Cell Therapeutics, Inc. (BCLI), Verastem, Inc. (VSTM), Arrowhead Pharmaceuticals, Inc. (ARWR), Fate Therapeutics, Inc. (FATE) and Caladrius Biosciences, Inc. (CLBS) and all have reported for a similar Q3 interval. All instructed, CRYO seems to be in good condition in contrast to its friends (all data is out there to the general public) and is holding onto its market share. It doesn’t appear to be CRYO has sacrificed working capital for gross margins, which additionally improved, and signifies stability sheet solidity and good resolution making by company governance.

So, the place does it stand and the place is it going? For a lot of the final 12 months it has hovered between a low of $0.20 and $0.54 in June of 2017. At that time it started a takeoff and in August fluctuated between $0.53 and $0.75 earlier than spiking to $1.10 twice previously 2-week interval by way of a 75% improve in buying and selling quantity. As of now, it rests at $1.00. We really suppose that something is potential with this one and most indicators are constructive for the brief and mid-term worth of this stock. It seems to be barely undervalued and the market has seen. A 12 months in the past they retained an investor relations associate and that could be paying off in a couple of methods.

Keep a watch on this one. Even although it’s close to its all-time excessive, we predict that bodes even higher for the long run.

[ad_2]