Day One Just Made A Bold Bet On Mersana — Here’s What It Could Mean

Day One Biopharmaceuticals (NASDAQ:DAWN) is making headlines with its latest move—a definitive agreement to acquire Mersana Therapeutics for $25 per share in cash, plus a potential $30.25 per share in milestone-based contingent value rights (CVRs). The total deal size could climb to a hefty $285 million. Mersana, a clinical-stage biotech, brings with it a novel antibody-drug conjugate (ADC) program, emiltatug ledadotin (Emi-Le), targeting B7-H4, a surface protein expressed in several hard-to-treat tumors. This acquisition gives Day One a foot in the door to the ADC space, specifically aimed at rare cancers like adenoid cystic carcinoma (ACC), where no approved therapies currently exist. As Day One aims to build on the commercial momentum of its first approved drug, OJEMDA, the Mersana buy could mark a second act—adding diversification, scientific innovation, and market reach to this small-cap biotech’s growth strategy. But how exactly does this tie-up benefit Day One? Let us dive into the key synergies that could shape its future.

Expanding Clinical Pipeline & Rare Cancer Focus

One of the most immediate benefits for Day One is the strategic expansion of its clinical pipeline, particularly in rare oncology indications. With OJEMDA targeting pediatric low-grade gliomas, the addition of Emi-Le now puts Day One on track to build a rare disease oncology franchise. Emi-Le’s Phase I data in ACC, a tumor with just 1,300 annual U.S. cases and no approved targeted therapies, reported a 55.6% objective response rate among 9 evaluable ACC patients. This promising signal gives Day One a potential “first-to-market” and possibly “best-in-class” label in ACC if data holds up in larger studies. More importantly, the biology of ACC, especially its aggressive subtypes like ACC-1, aligns with Day One’s existing expertise in targeted oncology. Executives believe the registration path for Emi-Le could mimic OJEMDA’s fast-track journey, which bodes well for both development timeline efficiency and regulatory confidence. The rare disease positioning also comes with perks like reduced trial size requirements, potential orphan drug status, and premium pricing flexibility. As the Mersana transaction nears closure, Day One is expected to rapidly engage with regulators to determine the fastest approval path. Ultimately, the move solidifies Day One’s commitment to underserved cancers and aligns its pipeline with areas of high unmet clinical need, enhancing both its scientific mission and investor appeal.

Enhancing Scientific & Platform Synergies In ADCs

Mersana brings more than just a single drug—it brings ADC development expertise honed through years of preclinical and early-stage innovation. Emi-Le, its lead asset, utilizes Mersana’s proprietary Dolasynthen R-statin platform, which integrates a novel microtubule-inhibiting payload (SHPA) with a stable linker system. The target, B7-H4, is overexpressed in several cancers, including breast, endometrial, and ovarian, but most notably in ACC. This fits squarely within Day One’s emerging precision oncology focus. While Day One already has an internal ADC in development (DAY301 targeting PTK7), the Emi-Le program offers complementary technology with different linker and payload characteristics. The safety data so far shows low incidence of traditional ADC-related toxicities like neuropathy and ocular damage—issues that have plagued earlier generation ADCs. With over 141 patients treated in Phase I and manageable safety signals, Day One has a sizeable dataset to work with. Importantly, company executives emphasized that this was a product-focused deal rather than a full pipeline bet. Yet, the science and experience embedded in Emi-Le and Mersana’s development engine could accelerate Day One’s own ADC ambitions. The combined team could improve ADC trial designs, regulatory filings, and commercial positioning by leveraging both internal and acquired knowledge. In an industry increasingly bullish on ADCs as precision payloads, Day One’s move puts it in a better position to compete with mid-sized players and to align more closely with pharma’s strategic interests in oncology assets.

Strengthening Commercial Infrastructure & Revenue Outlook

Day One’s acquisition of Mersana is not just a pipeline expansion; it’s also a calculated step toward maximizing the commercial infrastructure already built around OJEMDA. With OJEMDA generating 2025 net product revenue guidance of $145–$150 million and a sales force geared toward rare pediatric indications, the company now has a platform it can scale with a second product. Emi-Le’s potential entry into the rare cancer treatment landscape fits neatly into this infrastructure. Since many rare diseases require similar commercialization models—targeted outreach, specialist engagement, and payer negotiation—Emi-Le does not force Day One to reinvent the wheel. More importantly, it allows the company to double-dip on its existing commercial footprint while improving overall asset efficiency. From a financial perspective, the deal was struck using only internal cash (with $451.6 million in cash on the books as of Q3 2025), meaning no shareholder dilution or debt financing was required. Additionally, the use of non-tradable CVRs to tie milestone payments to tangible clinical and commercial successes smartly aligns capital deployment with value creation. This structure minimizes near-term risk while preserving upside. Over time, as Emi-Le advances toward approval and potential launch, Day One’s top line could benefit from multiple revenue streams that help offset the natural plateauing of OJEMDA sales. In a market where biotech profitability is scrutinized, especially among small-caps, this type of disciplined portfolio scaling is critical to managing burn and justifying forward-looking valuations.

Managing Risk Through Strategic Deal Structure & Data Transparency

While biotech M&A often involves high upfront payments for unproven science, Day One has structured this deal with a keen eye on risk management. The $129 million upfront cost for Mersana is a relatively modest sum in the current biotech landscape, especially for a program that already showed 55% response rates in a rare cancer setting. The remainder of the total deal value—up to $285 million—is contingent on achieving specific clinical, regulatory, and commercial milestones. This CVR-based model ensures that Day One pays only if value is unlocked, protecting shareholders from overexposure to uncertain outcomes. Additionally, the company has had access to updated, yet undisclosed, data beyond the 9-patient ACC cohort shared at ASCO 2025. Management reiterated that their confidence in the acquisition is grounded in this larger, still-maturing dataset, which includes more ACC patients and ongoing dose optimization cohorts. Importantly, Day One has emphasized that the deal was driven by the strength of the Emi-Le clinical asset, not a broader bet on Mersana’s platform. That discipline is critical when evaluating assets from biotech companies with mixed track records. Furthermore, Day One’s team brings credibility in navigating rare disease registration—having executed a similar accelerated pathway for OJEMDA. Post-acquisition, Day One expects to discuss the regulatory roadmap with the FDA, including population targeting beyond ACC-1 into broader aggressive ACC subtypes. All of this points to a carefully staged transaction that could be derisked over time, assuming execution aligns with internal expectations and market conditions remain stable.

Final Thoughts

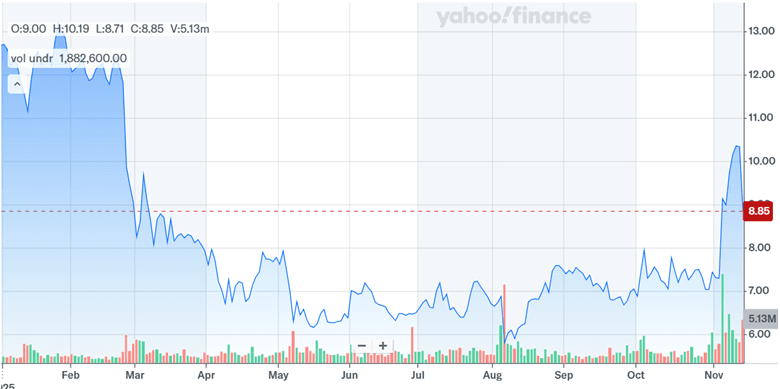

Source: Yahoo Finance

The acquisition of Mersana Therapeutics has resulted in a massive spike in Day One’s stock price and its volumes have also shot up in November 2025. Day One’s latest valuation metrics—such as a LTM P/S multiple of 6.8x and an LTM EV/Revenue of 3.44x—indicate that the market is already pricing in some level of future growth. Still, its LTM EV/EBITDA and EV/EBIT ratios remain negative, reflecting the company’s ongoing unprofitability and dependency on successful clinical outcomes to justify its current small-cap valuation. Whether this move transforms Day One into a more competitive oncology player or stretches its bandwidth too thin remains to be seen—but one thing is clear: the next chapter is going to be an important one.